Leaderboard

Popular Content

Showing content with the highest reputation since 04/17/2024 in Posts

-

Hello all, We've had some (very few, but more than zero) issues where database tables have crashed during times of heavy load on the server. These load spikes are usually related to other sites that I'm responsible for that happen to share resources with the ATX Community. These haven't been significant issues, and in fact have been very easy to resolve when they arise, but it does cause brief downtime on the Forum. So, in the interest of constant improvement, I would like to move the ATX Community to its own server (VPS) with its own dedicated resources. There are other server configuration changes/challenges that I'll tackle at the same time. Because this is the only forum I maintain, I am less experienced with performance tuning for this software than, say, more standard website content management systems. All that to say, I am expecting it to be a slightly bumpy transition but with improved speed and stability in the long term. There might be as much as one or two days of downtime followed by intermittent hiccups until everything is smoothed out. I'm aiming for mid-May to get this work done, but there is no hurry on my end. If there are business reasons to put it off longer, please speak up! Thanks!14 points

-

So I had an issue with a client that I needed to talk with IRS about. Called the PPL expecting a 20-30 minute wait. I was shocked at how quick it was. The agent was on the line before I had my paperwork out of the file. Issue resolved in 10 minutes. I need to get a lottery ticket tonight. Tom Longview, TX9 points

-

Any time is ok with me for the conversion business-wise, but I may have withdrawal during the downtime. As always, thank you for taking care of us so well, Eric.8 points

-

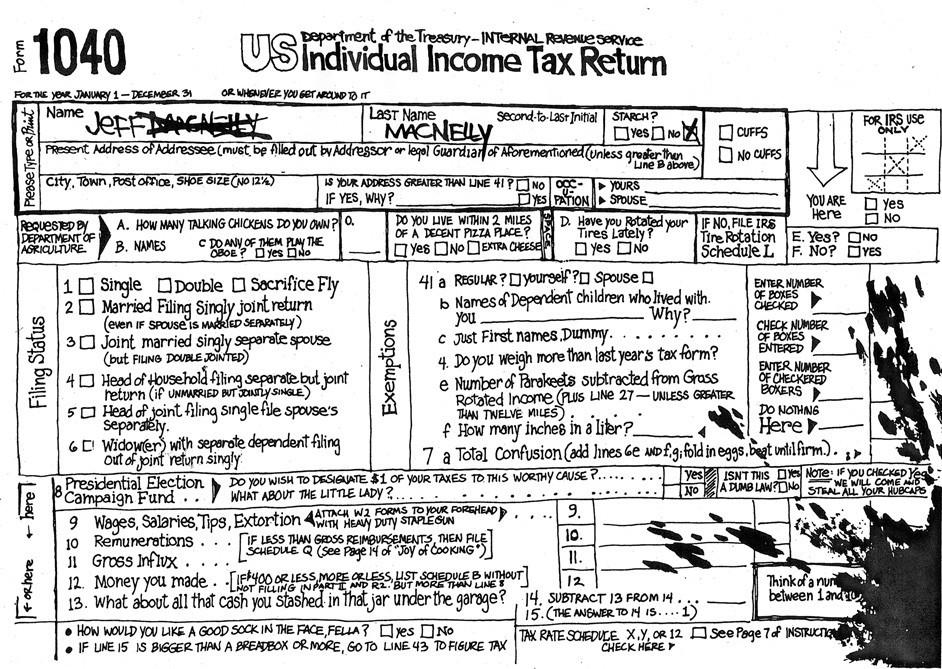

7 points

-

If you really want to learn a subject, learn it hands on and do your research. This is my fourth year of teaching another accountant that "accountant" does not equal "tax preparer". She has a certificate in accounting. I have one in tax preparation. I taught myself and gleaned knowledge from others along the way. This tax board, in particular, has been a major contributor. She is terrified of starting out on her own. I HAD to learn Partnerships because my husband was, and still is, one. There are areas that I don't step into. Take on only what you can handle or are willing to learn.6 points

-

I might add the following: If you really want to learn a subject, prepare to teach it to others.6 points

-

The loss on 8995 is NOT a deduction for FIT. It is strictly used to calculate QBI deduction. Any profit this year would need to be reduced by the 8995 loss before calculating any 199A deduction.6 points

-

Finally, I managed to have a snappy, to me, response to "How do I contact a live person?" "There is no one here who is dead, so every message you get from us is from a live person." --- This was from someone who has sent a dozen or more messages, over the last 24 hours, all with a reply address which is not valid, so I doubt they will ever see my reply.5 points

-

Sorry to hear about everyone's personal things going on during our busiest time. I guess I'm fairly fortunate. I went thru some things about 10 years ago but I'm an old bachelor and don't have a lot going on. I just hear from my siblings and the things they are going thru with children, grandchildren and all that. As someone said, life happens. But yes, the tax season is the tax season. I'm planning for three more years. Rent increases, othe costs increase. Whew. I'm afraid to start dipping into savings too soon so I'll keep at it for a few more years. I don't do too much after April 15 though. Fridays off, shorter hours the other days. Just the extensions gradually.5 points

-

I'm at a loss why someone would want to track this manually rather than on a spreadsheet, but some options: In Amazon search for trading log book for numerous options. If you use comb binding for tax returns, make your own. Google custom book binding for any number of companies that offer that service.4 points

-

I am having withdrawal ever since the 15th. I would like to see these extensions disappear. I am so totally disappointed in the IRS for various reasons; many of you can relate. I am disappointed in ATX for pouncing on us before tax season was even (over?). I have since been bombarded with emails and calls and snail mail from them. They choose to attack when our resistance is at its lowest. I only want to sleep. I am fine with whatever Eric does for us. It can surely only make our lives better and easier. Thanks again to Eric and all of you for what you do for me.4 points

-

Rule 1, umpires are always right. Rule 2, if umpire is wrong, see rule 1. But of course, the good ones work hard to never be wrong, and understand they will be wrong and have to rule the best they can with what they have at the moment. Good training for life. Sadly, the difference today is any perceived slight will follow you forever at any time. I have been asked about a call from 20 years ago while online at the grocery. Must have kept little Spike from making the show. My very first call in my very first game was an ejection. Little JR cursed at me. The grown up JR resides at state expense as a predator.4 points

-

A slight variation, but the same basic thought: “Experience - that most brutal of teachers. But you learn, my God do you learn.” - Anthony Hopkins as CS Lewis in “Shadowlands”4 points

-

It could be that the number is correct, but it is not passing the eVerify because of a small anomaly in the formatting of the name. Some variations don’t matter, but others won’t pass the “Name Control” requirements. For example, C.J. Smith Company becomes CJ Smith Company because it looks better on the letterhead. (or Smith and Jones Company becomes Smith & Jones Company over time). The possibilities for a problem with the Name Control are numerous. Some don’t matter while other seemingly innocuous ones will produce a reject.4 points

-

The loss on the 2022 F8995 line 16 gets carried forward to Line 3 on the 2023 F8995. The loss on line 16 of the 2023 F8995 gets carried forward to the 2024 F8995.4 points

-

I dropped back to 1040 to do my 1065, 1120S and 1040, plus my fiancee's 1040. Still cheaper than paying someone to do all of those or messing with some other software. But then I added 8 or 9 simple paid returns that more than pay for the software.4 points

-

The cats hated him at first, but the Alpha is getting closer to him. He only weighs 4.5 pounds and our smallest cat weighs 12. Yoda can't figure out why they are annoyed when he chases them or runs headlong into their side to try to get them to play. The cats are positive that he is beneath them. He really needs our son to bring back their two Great Pyrs again, because he has a blast with the youngest one. When we get moved out to Colorado, they will have fun. A Morkey is part Maltese and part Yorkie. He does have some poodle in him according to his DNA test. He does not shed and he is the faster than greased lightning.4 points

-

This was my last April 15th when I have to care about anyone else's return except my own! I just finished a bunch of extensions, but I still feel like a huge weight has been lifted. This has been the worst tax season ever. I didn't think that it could ever be worse than losing my Mom, but this last five months of having my husband so sick has been the pits. It was getting so hard to concentrate and get enough sleep. We got a new puppy, too for my husband. He turns out to be a Morkey, not a Poodle but I am happier with him anyway. I am also pretty sure that he will never know to go to the door to be let out. He is way too small, anyway. At least he is very good at using pads. Between a dog and 3 cats, it keeps me busy cleaning up. I just hope that we can find a condo that will allow 4 pets when we move. It was a sad and happy day. Lots of hugs and tears, and I will miss my clients. I got some beautiful bouquets, a customer made blankets for both my husband and me and gift cards to go eat. I did get a gift that I bet none of have ever received. My clients sent me an adjustable leg rest because they know that my leg is still a mess after my scope and that I will be getting a replacement. My client had just broken his leg very badly and was using this after his surgery. I have been blessed and still have a ton of work to do. I am hopeful that my husband will improve so that I can get a part time job out of the house in anything but taxes. Thanks so much for everything. See you all soon!4 points

-

"Being wrong is the only way I feel sure I've learned anything" Daniel Kahneman - Nobel Prize in Economics ( 1934 - 2024 )3 points

-

That means that the return has been selected for additional scrutiny by a live person. Until the return is actually assigned to to someone, you won't be able to find out much if anything.3 points

-

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are 7:00 a.m. - 7:00 p.m. local time, Monday through Friday. An assistor will ask you for identifying information and provide the number to you over the telephone, as long as you are a person who is authorized to receive it. Examples of an authorized person include, but are not limited to, a sole proprietor, a partner in a partnership, a corporate officer, a trustee of a trust, or an executor of an estate. If that number can't give her the EIN, I'd call the PPL and ask their opinion of what you should do. If an EIN was issued, they have a record of it.3 points

-

See attached link from the IRS https://www.irs.gov/businesses/small-businesses-self-employed/lost-or-misplaced-your-ein Your client will have to call3 points

-

Where is that $79 program for us tax practitioners ??? That is what I paid for it in 1991.3 points

-

A revocable living trust usually goes on the grantor's 1040. The exception is when the trust has an EIN and it is used on bank or brokerages accounts. The trust gets the 1099s and must file a 1041. You can elect Treas. Reg. § 1.671-4(a), which leaves the 1041 blank and provides a statement of income and expenses to be shown on the grantor's individual return. It essentially tells the IRS that these amounts are being reported by the grantor.3 points

-

After our retired racers started to pass, we were able to get our hands on two ~75/25% Greyhound/Whippets which were saved from the meat trade in a certain country. Some elders in that area still eat dog, and they have big markets where dogs are sold by the pound. Don't look this up online unless you are ready for what you will see. One of our greyhounds was a "Macau" dog, rescued at about 30lbs, with a good weight of 75. She lasted just under 2 years with us, likely because of being emaciated for two to five years while being "stored" in a back kennel at the Macau track. We call them our "littles" since they weigh 40-45 lbs. Much easier to pick up, especially when I think about picking them up 10 years from now. (Racing greyhounds are 60-100lbs in "retirement".) Most thankfully, our first racing Greyhound was an alpha female. She was able to train the littles into good house dogs in her final months, as a perfect purpose when her two prior house mates passed. There is something to be said about having an older dog break in the noobs. The littles spend most of my work days near me on fluffy dog ball/beds. There is something special about watching (and feeling) a free animal (such as a Greyhound) with the flexible spine, running (double suspension gait) at full song.3 points

-

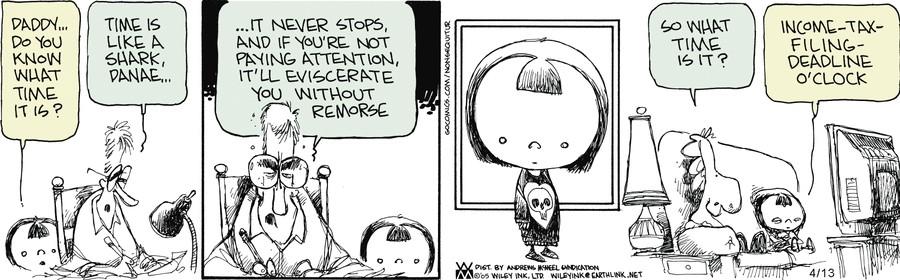

3 points

-

I definitely have a few in mind to fire. However, I'll wait until I've recovered a bit before making final determinations. Drake tracks time on a return (so I leave the client's return open when I'm doing anything with their documents) and one of the things I'll do is go back through 'em all and compare what I charged with what my time-billing fee would have been. Anyone whose time-bill is substantially more than the per-form charge is high on the list of candidate for firing.3 points

-

Part-year residents are generally taxed on income earned in the states they lived in in each part of the year. Check the two state websites. In the states I am familiar with, wages, interest, dividends, etc. are broken down by which state the taxpayer lived in when they were received--there is no credit for taxes paid to other states because each one only taxes the income received while t/p was a resident. If your client was truly a resident of WI when he sold property in KY, it will probably still belong on the WI return. Only if he was a full-year resident of WI would his income be taxed a WI rates with a credit for taxes paid to KY.2 points

-

Since property is in KY, it is taxable there. Since it was only one month after they moved, I'd look to see if they were WI resident at the time of sale. When did they change such things as drivers license, car plates, etc.2 points

-

Thanks. I will double check my material. I probably read it incorrectly. Appreciate you! Tom Longview, TX2 points

-

Both articles I read said it was half year, and I tend to assume ATX has it right. https://www.journalofaccountancy.com/issues/2022/nov/amortizing-r-e-expenditures-under-tcja.html2 points

-

Use Z-Amortization and 5-Amort-174-Rsch and exp and you'll get 5 year SL HY.2 points

-

Oh right, he meant after the program updates. I had that happen once mid-season but hasn't happened since then. I'm more tired than I realized.2 points

-

Been there, done that. Also known as IRS purgatory. IRS knows they have it but they don't know anything else. Tom Longview, TX2 points

-

Yes, it has been like that almost since the beginning of this season for me. When the program would open, I had no alerts or notifications in that bottom left corner of the manager screen, and I wasn't able to get program updates. I didn't realize this at first because I was only waiting for state approval of a certain form. Also, MS Edge browser window would open on top of the program every time, and I couldn't make the support person or her supervisor understand this. I have never used Edge, and the supervisor's suggestion was for me to try changing to Edge as my default browser, or try Chrome. I could NOT make either of them understand at all that something with my computer's environment was blocking communication from the program to Drake's server, that it was not a browser issue. Finally after about 6 calls the supervisor sent a message to a higher level support person. Very frustrating! We worked on it and thought it was solved with me changing settings in my AV, but the problem reappeared again in late Feb. I ended up changing to a different AV software completely but had only disabled the original one. That worked until I rebooted the computer and a portion related to the original AV's VPN was still enabled, and THAT was the issue.2 points

-

2 points

-

The benefit of the QBI is elusive indeed. At first glance, it sounds really great - a 20% reduction of profits available in addition to standard/itemized deductions. However, it has hoops to jump through. First of all, if there is EVER a loss, the loss must be applied IN FULL to the current benefit. However, if a positive result is ever squelched for any reason, the amount lost is NOT carried forward. Next, the 20% is applied to the taxable profit, or taxable income, WHICHEVER IS LESS. If any benefit is lost thereupon, it is lost forever. The 20% is a great thing for taxpayers with regular profits, and regular taxable incomes.2 points

-

2 points

-

2 points

-

Amazingly 20 minutes after e-mail she shows up all apologetic. Didn't give her the return, only the original documents.2 points

-

I'm fortunate enough to be at a point in my life where I don't need to be bringing in money from preparing returns. For the most part, I still enjoy it and the vast majority of my clients I look forward to seeing each year. Email sent and now I'm going to go dig in some dirt and plant some veggie seeds!2 points

-

I have always agreed with your statement. My threshold gets lower and lower every day. For instance, I have a hard line of end of relationship when a customer sends me something my granddaughter should not see. It is a matter of being professional/business-like, as well as liking to have her in play in the room when I am working.2 points

-

2 points

-

2 points

-

Might not matter where they still had their residence at the time. States vary, but over time more are taxing full-year income regardless of where earned. Then they adjust based on % earned in what state, or $ earned in each state, or they apportion by date. Home state will give credit for tax paid to another jurisdiction, usually up to the amount they tax on that same income. You'll need to research what KY and WI want for part-year resident reporting.1 point

-

Asking now before I start this return - before the board goes dark and I go into withdrawal symptoms..... Have any of you done the amortization of R&D costs on an 1120 return yet? I have one in my extended pile that I have been holding waiting for the Senate to act on the bill that is stalled. I have not even started the return yet, but I am curious if there are any issues with entering in ATX. I know it is a 5 year asset (but which one). I think it should be SL, but how do I keep ATX from taking mid-year? I am getting to this return in a couple of weeks and would appreciate any advice on how to enter in ATX Fixed Assets. Thanks - this is my first return with R&D costs. Tom Longview, TX1 point

-

1 point

-

1 point

-

1 point

-

That always annoyed me to no end, but I wonder if it's because many of us don't work the off season, and so might miss any notices sent later. Like others, I quit MAX 2 years ago. Last year it worked out to be about the same cost, but then I fired all my non-profits, and a bunch of 1040 clients. This year I'll fire more 1040s. Goal is to hold onto tax season but without extensions and without clients who stress me out, lol. This year the delay in so many K1s is kinda screwing that up, but as long as I have everything done and double checked, I'm ok with just plugging in the K1s later on.1 point