-

Posts

211 -

Joined

-

Last visited

-

Days Won

2

Profile Information

-

State

FL

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

You made my day @BulldogTom. Thanks for the smile.

-

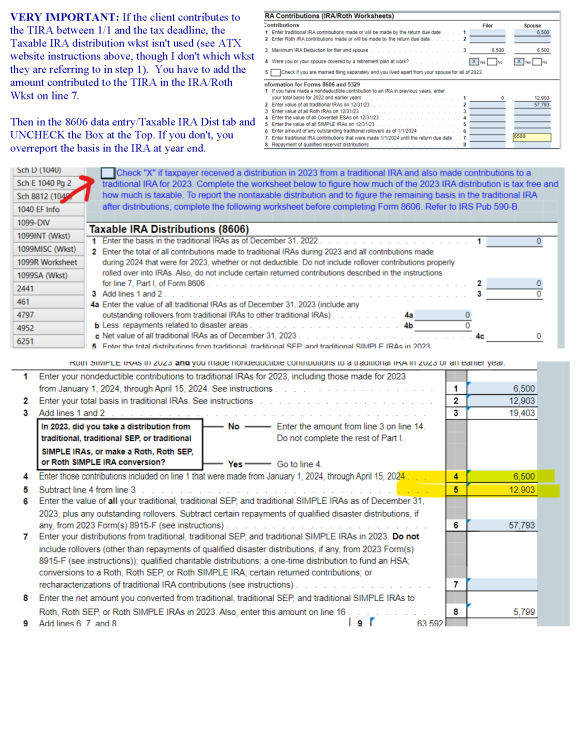

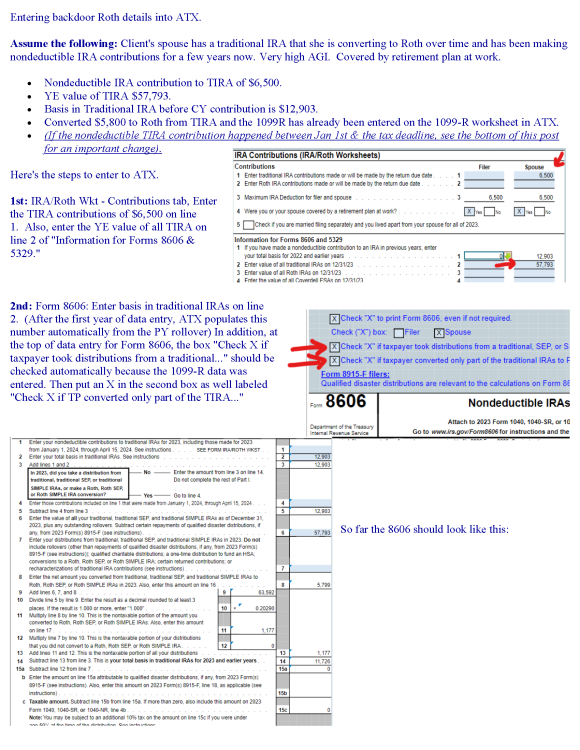

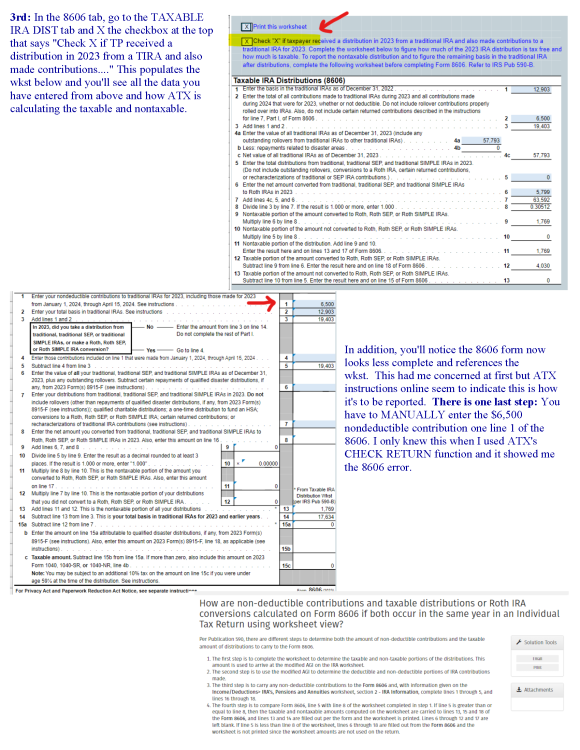

I prepare these cheats for myself so I don't have to always go through the torture of navigating ATX data entry. Maybe this helps anyone that needs to enter backdoor Roth details into ATX. PDF attached with the instructions I use for Backdoor Roth in ATX with Aggregation & PY Basis. Good luck and please, if someone sees an error, let me know! Hopefully this formatting is easier to read than the first post.

- 1 reply

-

- 2

-

-

-

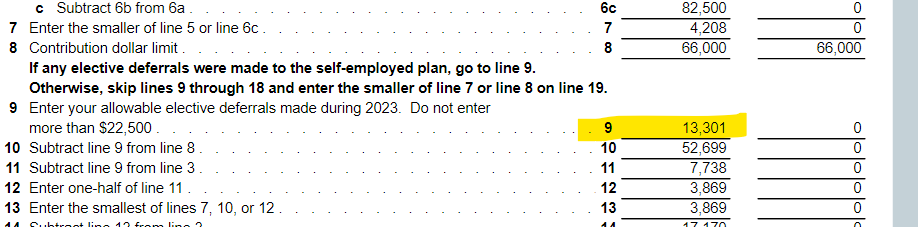

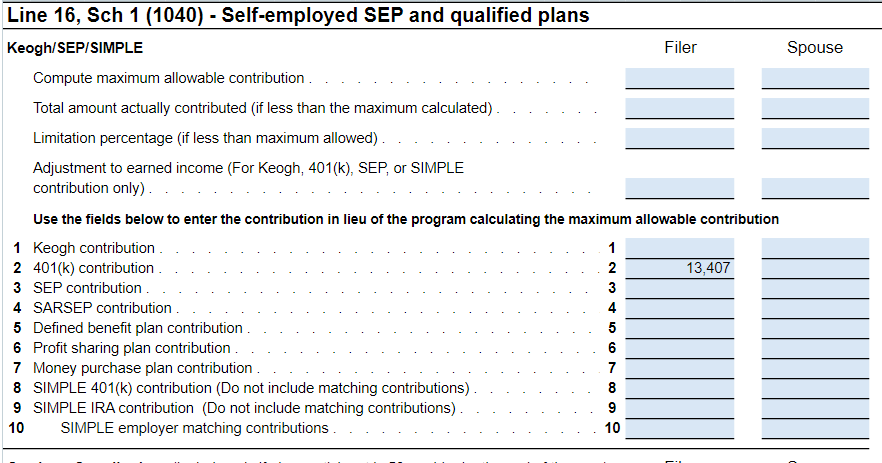

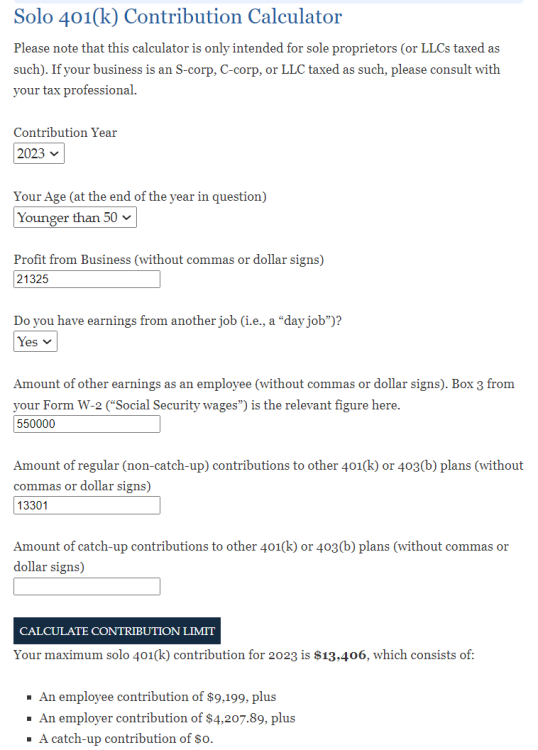

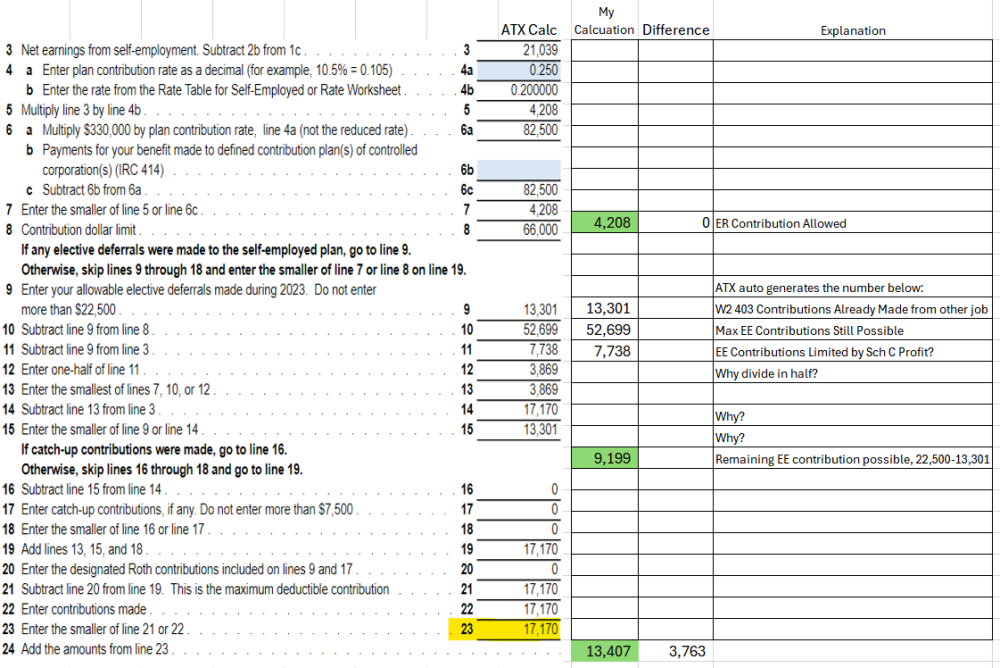

I believe this is accounted for in this area. ATX actually auto generates line 9 straight from the W2, box 12, Code D & E. But I tried putting in a ROTH 401k elective deferreal into the W2 data entry and it did NOT add to this amount so I'm even more baffled. Thanks @Abby Normal As you can see, this matches my own calculation. Given this is the line (Line 16, Sch 1) is where you're supposed to put the SOLO 401k contributions, this only way I can see inputting it correctly without an override is to manually do the math myself and add it here. If someone else figures it out, I'm all ears!

-

Interesting. So possibly they are just giving the REASON for the excess basis a name, but the crux of the information is excess basis limitations. That definitely makes more sense to me than a CF SEHI deduction. Thanks!

-

I was using this worksheet and could not get ATX's calculation to match mine own. Is the ATX worksheet not calculation a SOLO 401k? The "compute maximum allowable contribution" option #4 says 401k, not solo401k. OR maybe my calucations are wrong, though I've cross-referenced with a few solo 401k calculators online and they match my calculation. Here's a screenshot of ATX comparison to my calculation. The retirement option at the top is #4 (401k). Client doesn't qualify for catchup contributions.

-

Client's copy of last year's return filed by another CPA. On it, there's a statement associated with the 7203 (part III, line 45) that details the carryforward of self employed health insurance. I've never seen SEHI be carried forward. Anyone have any experience reporting this on a 7203 that could give me some insight? On a separate note, the company associated with the 7203 was closed in 2022, so is the CF of SEHI lost? If not, where in the world on the return could I take this deduction? TIA!

-

I'm using ATX and I was just curious if there' a central location to enter all Carryover data from the previous year. I have a new client and they have multiple carryover items, Passive loss, qbi, charity, etc. It would be nice if this could all be entered into one place and have specific carryover info linked to K-1s like they link 1099-NEC to Schedule Cs.

- 1 reply

-

- 1

-

-

G2R started following "Loans from Shareholders" category, S-corp and ERC, Amended Returns & CF Losses

-

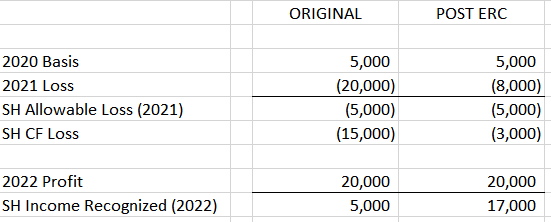

1120S Corporate return for 2021 showed a loss $20k. They didn't have the basis to take the full loss in 2021 so $15k was CF to 2022. In 2022, they show a profit of $20k so the CF loss is fully used in 2022. Then they file and receive the ERC for 2021 and receive $12k. ugh. Amending the 2021 1120S to include the ERC, doesn't change the SH personal return at all because the basis still limits the recognizable loss to $5k. However, it does change their 2022 personal return because there was less CF loss to absorb the 20k profit. I assume I have to amend the 2021 1120S to reflect the ERC. amend their 2022 personal return to reflect the CF loss adjustment. Is there any need to amend the 2021 personal return to reflect the change in the 7203 CF info?

-

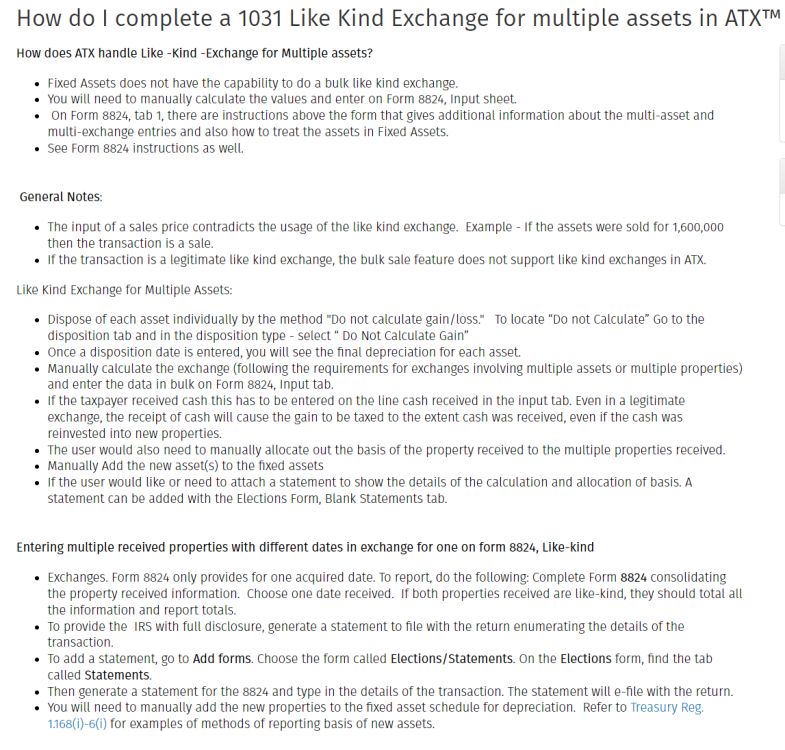

You can do a summary of the like-kind exchange and have the details listed in the BLANK Statements. That's the the CCH/ATX website says to do. Here's a link to the website instructions. I've screenshot them for you too. https://support.cch.com/kb/solution/000162166/how-do-i-complete-a-1031-like-kind-exchange-for-multiple-assets-in-atx

-

The first statement was referencing debt from shareholder that had supposedly grown through 2021, but no formal loan docs had ever been made. Owner didn't know it was necessary. So, as of Jan 1 2022, all previous loans from shareholders to the company would be reclassified as APIC. For 2022 books, the second statement referenced the possibility of open account debt as of Dec 31, 2022, that stays within the $25k limit. 2023 is looking rather profitable thus far so, he could pay off that debt by year end, not have the formal loan docs requirement and the reimbursements to him wouldn't be considered return of capital. Just throwing the idea out there for opinions.

-

Thank you everyone for the advice and professional experience. I really appreciate it. Curious thought. The amount listed as loans from shareholders is way over the $25k open account limit. Is there any value in reclassifying all of the loan to shareholder to APIC except for $25k? It will be paid off by end of this year.

-

I've made it clear what I expect of them moving forward. They are more than willing to obliged it seems, they have just never had an accountant educate them on what is truly needed to have proper records. They want to do it right so I'm doing my best to get them on the right course.

-

Same accountant for the last 20 years who didn't seem to mind all the comingling that was going on. No more comingling going forward. The 7203 on last year's personal return shows shows zero beginning balance, a $50k contribution (client's know nothing about this so I think this was just plugged in there), and a small positive ending value so the IRS has an ending basis in their records already if they are actually tracking the 7203. Nothing listed in the Debt Basis even if the loan from shareholders was accurate. Not sure how to correct this either. But based on the K-1s I have and all the comingling, they have been personally funding the losses for decades. I confirmed, title of the car, insurance and license are definitely in the owner's name, not the business. I do think your suggestion is exactly what happened. Along with ALL the other expenses the owner paid for the business with personal funds. No trial balance was ever done that I can find. Client provided a P&L only, that's what accountant used to prep the returns all 20 years. I have all 20 years of tax returns. The M-2s match the balance sheet R/E for each year. The previous accountant is deceased. To move forward: can/should I recategorize the loans to capital? how can I properly remove the vehicle from the books? It's not even 100% used for business, though they only took the generic 50% usage and depreciation deduction in the years since purchase.

-

New client, 20 years in business as an S-corp. 2021 ending M-2 shows a large loss. The one and only balance sheet I could find was the 2020 1120S which had a very large balance in "Loans from Shareholders." Client knows nothing about any loans outstanding, so no loan documents. They actually had all past K-1s. K-1s only list the income/losses each year. No distributions were reported. Losses were all taken on the personal return each year. No basis history was provided so I have to rebuild it as best I can. For me to get 2022 on the right path, would you simply reclassify the loan from shareholder to capital? Also, there's a truck on the books that the company doesn't own, yet was depreciated the last two years. Do I get it off the books as if it was converted to personal use in 2022? It was definitely used for the business, but no mileage logs were kept.

-

For those that do renew this early, have you found the discount is worth it?