Yrags

Members-

Posts

13 -

Joined

-

Last visited

Everything posted by Yrags

-

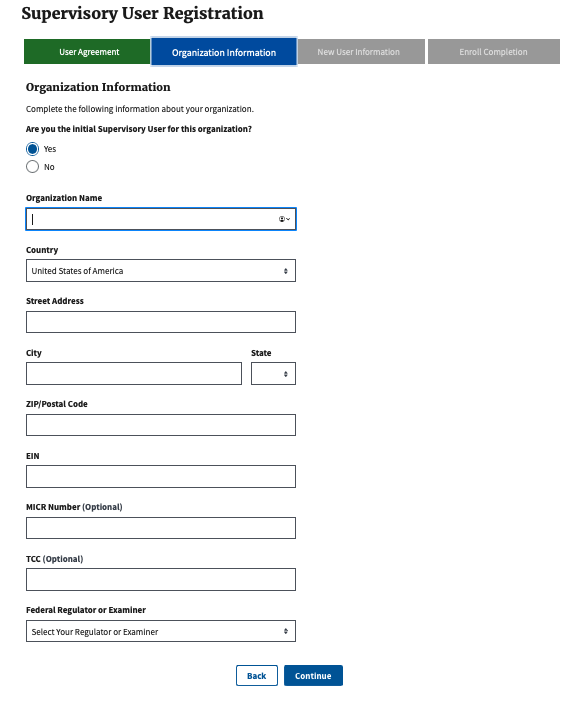

Hi, my client moved to a foreign country and transferred some of his funds there, so we have to file a 114. I have attempted to enroll with the BSA website as the preparer but the enrollment page requires an EIN to continue. It specifies an EIN. Thing is I am a sole proprietor with no employees and only have a PTIN (of course) and my SSN. Does anyone know whether this is an error and I can just use my SSN in place of the EIN or if there is another location I should be registering? The wording on the registration form discusses "organization" and "Supervisory User" which may just be generic indicators or something specific. Thanks.

-

Hi. I know there is a moratorium, but they will get to it when they get to it. Client had PPP in 2020 and did not file for ERC (in 2020 you could not have both, but the rules changed retroactively). Now you can file for 2020 but cannot use the same payroll for both ERC and PPP. Client cannot find paperwork to determine which and how much payroll was used for PPP; but rules state it must be at least 60% (in 2020). So for Qualified Wages in the worksheet, should I use 40% of the wages for the quarter (assuming no employee received more than $10,000 for the quarter)? This would be for Q3. For Q4, rules state that maximum qualified wages are $10,000 per employee per year (in 2020). If an employee receives $7000 in one quarter but I utilize 40% ($2,800), and was paid another $7000 in the next quarter, my question is do you count the actual wages towards the $10,000 maximum (in other words can only use $3000 x 40% in Q4) or figure that the qualified amount ($7000 x 40% or another $2800) for a total qualified amount of $5600 for the year? TIA. I know this is a pain in the neck. When client heard they would have to amend the 1065, all of the K1s, and all of the personal returns, they had second thoughts. Depends on the total amount of the credit for the year. The actual figures are higher.

-

So, back to this topic. I have a question about proper reporting. I also have mucho sales of inherited stock. I created a spreadsheet showing the reported basis and the basis as of the DOD. On Line (e) Basis, do I put the DOD value, or the reported (earlier) value, with a code in line (f) and an adjustment in (g)? If a code, which code? I can see using (B) Basis Shown is Incorrect, or (O) All Other Adjustments. I looked in the 8949 Instructions, and it's a little unclear, as it does mention doing either but does not mention specifically when inherited property. Thanks!

-

I guess I charge too little: probably close to $400-$450. If that "1 state" is Mass then $1000. (Mass is the most complicated state return I've ever done for a non-resident who made $6000 Mass income).

-

Thank you, and everyone. I assumed that the contribution was not deductible for the reasons mentioned, but wanted to make sure. The house was sold over a year after death, in an area with high home values and appreciation. It was not appraised at death so the gain has some flexibility, but there is definitely gain even with the expenses. I was also hoping that the $250,000 exclusion still applied to estates, but that was repealed over 10 years ago, lol.

-

I am preparing a decedent's estate (1041). For one of his retirement funds, he designated a charitable institution as the beneficiary. This is not noted in his will. The charity accepted the money (of course) and issued a thank you letter. There are capital gains due to a home sale in the estate. Can part of the contribution be used to offset the taxable income? I'm dubious, but it would be great if it could. Thanks in advance!

-

Separating sales of stock from 1099-B to final and estate tax returns

Yrags replied to Yrags's topic in General Chat

Thank you everyone. As for the dividends, I did actually enter them as per the dates paid rather than apportion them. -

Hi, A client died in 2021. From his consolidated 1099, there were numerous stock sales. Am I assuming correctly that for sales prior to his date of death, I enter only those on his final return, and for sales after death, I calculate the basis as of the date of death and enter those on the 1041, Sch D? Would they then all be short-term (acquired at date of death and sold before end of year)? And how does the IRS understand that some proceeds are left off of his return because they are placed on the estate return? Thanks.

-

Thank you. I did that and for me the submission ID never changed. I finally just transmitted it again and after it was rejected again was able to change the ID by recreating the efile. Pain in the neck but at least it finally worked. Thanks.

-

Did some research and see that it is not an uncommon error. Plus there are instructions and tips for recreating the Submission ID. HOWEVER, everything I have tried thus far, the Sub ID remains the same. Anybody have any ideas? Thanks.

-

Thank you. Wow, what a great tool. So it says that the reject error is that the Submission ID has the year 2020 when it should be 2021 (it's a 2019 return). I'm assuming Submission ID is also the E-file ID? I re-created the e-file but it looks like the year string in the ID is still "2020". How do I modify or fix that? Is there a way? Thanks.

-

I filed a 1041 and NYS Estate March 18. It is now April 11. The NYS return was accepted (after a rejection) 3/23. The Federal just says "Transmitted to EFC 3/18/21". This was 3 1/2 weeks ago. What's the deal? What can/should I do? TIA for any advice.

-

Hi, new to ATX. Client had paid Federal and NYS/NYC estimated taxes. I can jump to estimated tax worksheet from Line 65 on 1040 no prob. But when I jump to the NYS worksheet from line 75 on the IT-201 the state amounts are entered in a different 1040 worksheet and the city amounts are just written in separately. Problem is the 1040 worksheet is used to calculate the deductible amount on Schedule A, so I want to be able to enter the State and City amounts, but then back on the state worksheet it shows both amounts as the state amount. If this question is not too convoluted can anyone tell me how to enter the city amount separately from state so they both appear on Sch A AND on pg 4 of the IT-201 properly? Thanks. Just FYI I am doing a 2017 return so the state taxes are not limited. TIA.