M7047

Members-

Posts

66 -

Joined

-

Last visited

Profile Information

-

State

PA

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

M7047 started following Premium Tax Credit , MFS Refund , 1098T Taxable but not to state, help entering please and 4 others

-

Have a client that is filing separately. He wants a paper check. Will his wife have to sign that as well or will it only be in his name? Thanks!

-

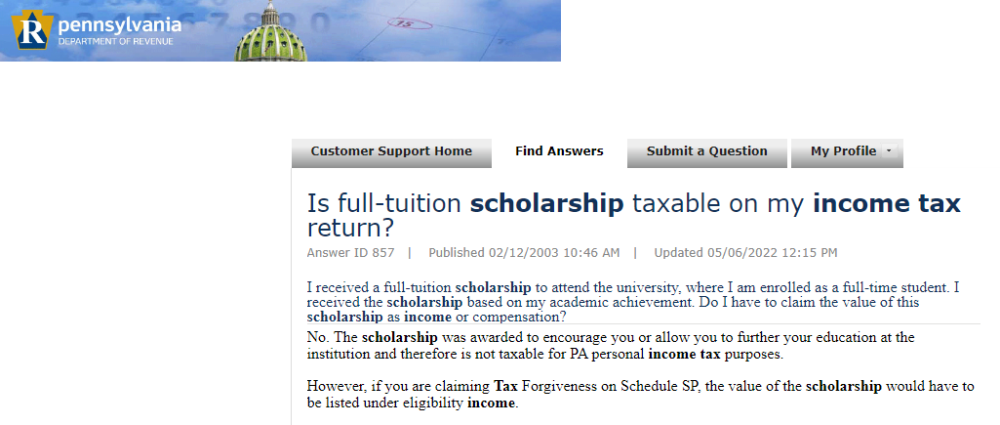

Client has taxable scholarships which I entered on the federal. They show up on Sch 1 line 8r. My question is how to eliminate that for PA. PA doesn't tax the excess, but the program is entering it as line 1a 9) Scholarships and fellowship grants not on a w2. Can I just override this amount? Thanks!

-

Thank you all. She says she does have proof that she paid more for it, just wasn't sure she could use it. Sounds like I can use the actual amount paid providing documentation exists.

-

Have a client who sold undeveloped land they bought in 1999. The deed says they paid $1 to save transfer taxes then. They obviously paid more for it than $1. Can they use the amount they actually paid or are they stuck using the $1 from the deed for capital gains?

-

How are they able to sell the original software cheaper? Why would you want to switch from Ultimate Tax to Sigma Tax? Did you have a problem with Ultimate? Sorry for all the questions, but I've never heard of such a thing. I'm a small business looking to cut costs without cutting off my nose in the process. Thanks!

-

What do you mean they are a reseller of Taxwise? Is it the taxwise program?

-

Mine are PA too. I thought it was weird that each received separate letters too.

-

Anyone else have married clients getting letters from the IRS separate from each other? I would have thought the would be joint letters since they filed MFJ. Each letter has half what the couple would owe as a penalty.

-

Change account for direct deposit after filing? PA state only

M7047 replied to jklcpa's topic in General Chat

If it's with the same bank and just a different account number the bank should reroute it for them. No need to do anything with the state. I don't think you can with PA anyway. I had clients that this happened with this year, and they received their refund just fine. -

Yeah, it may need that. Again though, they would still have to come up with over 4000.00 by the due date to make up for their part, and that would still be due Monday.

-

He's supposed to be doing that today. I'm just concerned with the due date being so close, if they have to make up the missed amounts on the return, they're not going to have it.

-

Have a client that had social security and medicare taxes withheld on only 2158.00 of their 59000.00 wages. Of course they didn't notice it throughout the year. Do I file 8919 on the difference and how do we make sure the company's part was taken care of?

-

They did. The problem lies with, the first half of the year their income was less and they qualified. Once he got a new job they didn't qualify. He notified them, but with the annualized income, it disqualifies them for the whole year. It's a shame there's no way to input they only received the help when needed and then stopped. They're going to be paying back what they got.

-

Client had the credit for the first half of the year and then got a better job. They notified the marketplace and stopped coverage immediately. Their insurance rep claims they can use the amount of income for the beginning of the year to still get the credit, I don't see anywhere that allows you to say which income was earned when, it's just annualized. Am I missing something?