tom777

Members-

Posts

54 -

Joined

-

Last visited

Everything posted by tom777

-

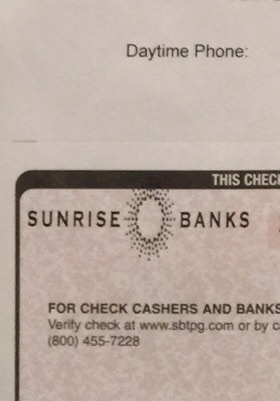

I am using Civista Bank, but when I printed the checks for my clients, the words "Sunrise Bank " on upper left corner of the check. I am using ATX. Has anyone got this issue ? Don't know what to do. I have more checks to print . Need help !

-

Most of my client returns were submited on 1/31/13 stiil waiting for Refund Checks. Some of them is single returns without EIC, 1 W-2. Checked on IRS web site , there were no information. I don't know if ATX submited my clients returns to IRS, all I can see all returns were accepted on Feb 1, 2013. I don't kown if those returns went to the Space.... More than 4 weeks already, still waiting checks. THIS IS BAD YEAR I EVER HAVE IN 15 YEARS doing tax business. Anyone has same issue ? I need help from ATX if ATX can check out every return that I submited on 1/31/13 ( BLACK DAY ). No phone or no email reply. That is why I post here. Tom

-

I mean simple return without EIC or 8867. They are waiting more than 23 days (accepted on 1-30.2013). They don't know where their returns are .

-

I have some clients ( Filed as single, simple return) but they are still waiting for refund ? Has anyone have same issues ? Now their tax returns was not found in IRS web site !

-

All returns with form 8812 got rejected but every thing is coorect. It just started rejected Since Sunday till now. I tried different way to efile : delete the return, start a new one; delete form and add form; This is so crazy !!!!!! I lost more than 10 lbs because of this software this year.

-

I think IRS did not care for people(retarding) who got income from Social Security, Railroad, Vetaran because these people is no longer pay tax for IRS and they are not important to IRS. That is why IRS will not allow for them to Efile their return.

-

Learning foreign language is not easy as English. Tom777

-

Have anyone tried this ? The software automatic calculate EIC for this client when her birthday is 1/1/1983 but when I change to 1/2/1983, she will not have EIC. She made $8700. I don't know it is right ? Need you help please. Tom777

-

I have a client with this form 1099-A Line 1: Date Line 2 : Balance of Principal outstanding : $ 61245 Line 4 : Fair Market value of Property : $ 74,000 Line 5 : Was borroer personally liable for repayment of the debt : Yes I think I should file the Sch D with the sale price as Market value $74000. Please correct me if I am wrong. Please advise ! Thanks for your help. Tom777

-

The more you complaint, the more problems you will have. If it is stinks, Why use it ?. Get another software and get another problems. I will never touch some thing which is stinks. Peace Tom777

-

The more you complaint, the more problems you will have. Peace . Tom777

-

I ussualy solve the problem by myself and I always post my problem on this post, then there was someone will help me because I don't have time to hold the phone line. Here is problem solve for your folder : click on Return Manager > Forms> Customizes Master Forms> then open form Client Letter, then click Tools > Delete , then delete 2 row above the word : Federal Tax returns for .... " I got this problem, then I fix by myself. If you have any problem, Post it on this board, someone will help you. I learned this software from everyone on this board. Peace. Tom777

-

I have no problem with software. I have used it for 10 years. I love it. I have to update software everyday. I think the software was good this year for now. RAL and ERC were smooth, better than last year ( That is worth $10 transmitted fee). I will never go to another software company because I don't want to learn their software. ATX is good. ATX is not for everyone. You have to use ATX a few years in order to fall in love their software. Now I am sticking with them.

-

What bank are you using ? That is so quick. Tom777

-

I got 2 accepted too. Good News!!!! Now I am begining to send more returns . Tom777

-

I sent a dummy return with ssn 111-11-111 and I got an accepted. yesterday, Idid sent 2 live returns, but it shows Validated by EFC today (Sat). Tom777

-

Download new version of EFile Info Form . You have to update your software everyday. Tom777

-

Agree with Bill ! I got 5 Rals, 7 ERC, 5 Efile, but I am still holding. Tom777

-

I have sent 2 live tax returns yesterday 1pm and 4pm. As today (Sat 11am), it is still show that Validated by EFC. Is this mean that my client returns did not send to IRS yet ? Anyone have same issues ? Please let me know. I am very concern ! Tom777

-

Tried to create efile without sch EIC with ssn 111-11-1111, and sent. It worked. We just wait for new version for sch EIC Tom777