-

Posts

25 -

Joined

-

Last visited

Everything posted by XP4ME

-

Click on 'My Information' and then 'Communities' and see if you get there...

-

The ATX community board is still there, but they pretty much hid it. https://support.atxinc.com/communities/index The alternative to the standard processing fee is that you pay for the software but you never get it. LOL

- 1 reply

-

- 4

-

-

-

So glad to read this thread...I thought it was just our clients! lol

-

True Pacun, but in the case where I deleted them there is zero chance of re-contribution. So just delete the 8915-E?

-

Just had it happen. Deleted both 8915-E and 8915-F. Hopefully that is the right thing?

-

Thank you Judy. I will double check, but I believe that disability is a prerequisite for the shared living program in Maine

-

I have requested the placement letter from the agency. Thank you for the input!

-

This is my third season doing taxes, so I'm never sure anything is obvious.

-

I reread the reply. You think the opposite in that the adult foster should NOT qualify taxpayer as HOH and for EIC, or you think that it is should not feel weird that they do qualify the taxpayer? lol

-

ATX software does allow for a disabled foster 'child' aged 50+ to be a qualifying child for EITC and HOH. I realize that just because the software allows it doesn't make it so, but it is sometimes an indication. Since this seems so fundamental you'd hope they have it right.

-

I love the tip of the day. Have done this several times just this week!

-

Thanks for your input. I keep rereading the relationship and age tests. I still don't see the flaw. Can you share line of thought? I'd really appreciate it!

-

Okay, so is this question so obvious that I should know the answer? I am definitely going with qualifying child but it seems weird.

-

Permanently disabled adult placed by agency with client receiving difficulty of care payments and disabled adult has lived with client more than 6 months. Meets foster child relationship because age is not relevant for disabled adult? Qualifying child for EITC and HOH?

-

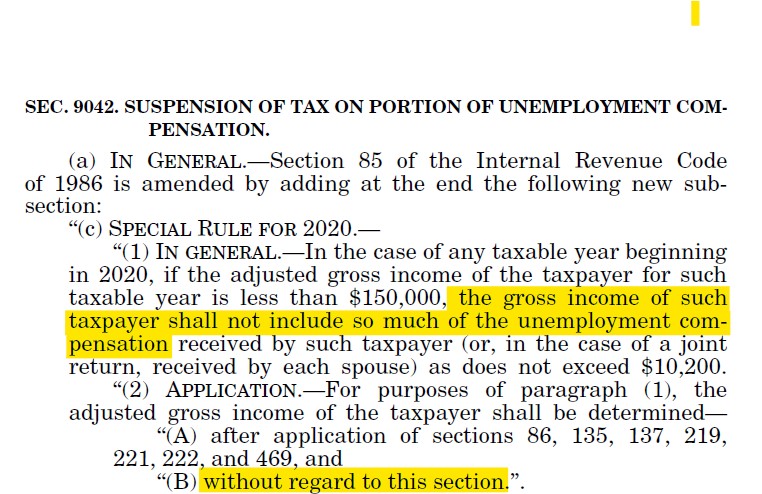

I read it as excluded from gross income if your AGI is below 150k. And your AGI is your AGI before they performed this magic stunt. That is why, per IRS instructions, putting the exclusion amount as a negative on line 8 of sch 1 can work.

-

-

And have you been able to e-file Maine returns yet? I got a bunch of rejects and now I get no acks at all. 6 days running...

-

I read somewhere and cannot find it again...the difference has to do with not letting the mortgage interest and property tax produce a loss for the sched C when taking the standard deduction.

-

I know what to do, I was just asking if anyone else had seen any of these. And I'm not willing to guarantee that there will be 'no issue' even when paper filing.

-

What did you pay last year for MAX because I'm pretty sure WE paid just about the price they are asking for renewal?

-

And just in the nick of time to be helpful for this tax season, how thoughtful of them.... Welcome back!? Surely they jest!