-

Posts

7,469 -

Joined

-

Last visited

-

Days Won

462

Posts posted by Catherine

-

-

I ended up sending a letter for my case. we're now past the "response date" of the letter and I started mine out stating that I've been trying to get through from about a week before the response date. If the IRS never answers the phone, they cannot then say the t/p is SOL because they did not respond in time.

-

1

1

-

-

Might not matter where they still had their residence at the time.

States vary, but over time more are taxing full-year income regardless of where earned. Then they adjust based on % earned in what state, or $ earned in each state, or they apportion by date. Home state will give credit for tax paid to another jurisdiction, usually up to the amount they tax on that same income.

You'll need to research what KY and WI want for part-year resident reporting.

-

2

2

-

-

An office support place like Staples or Kinkos, or a local stationer, can make those for you in whatever format you want. Talk to a local shop to see what format they want you to provide, and about options.

Hubby needed some specific type of scorebooks that were commercially available 30+ years ago but not for a long time. He took an old one to a local place, asked "can you make me more of these?" and they could not only make them, they gave him the choice of glue-bound or spiral-bound, paper color, page count per book, quantity, etc - all for what he considered to be a VERY reasonable price.

-

3

3

-

-

Thank you, @Eric, for everything you do for us.

Do you need any donations at this time to fund the new server? If so, please let us know!

-

3

3

-

-

Wow!

I've tried to call several times for a trust issue; letter response call number X and use ID number Y. No one has picked up, in an hour and a half, any time I've tried. Yesterday I got disconnected after 47 minutes; my shortest call yet. Very, very frustrating.

-

4

4

-

-

1 hour ago, BrewOne said:

When refunds do not match calculated amounts, correspondence will follow. Unfortunately for us, the money arrives before the explanation.

Not always! I've had a few over the years where no letter ever followed to explain discrepancies. The states tend to be worse about that than the IRS, but the IRS does it too. I'd call. Next week.

-

1

1

-

-

The forms may also insidiously end up being issued years afterwards, when the taxpayer is no longer insolvent. Then it can become taxable income.

-

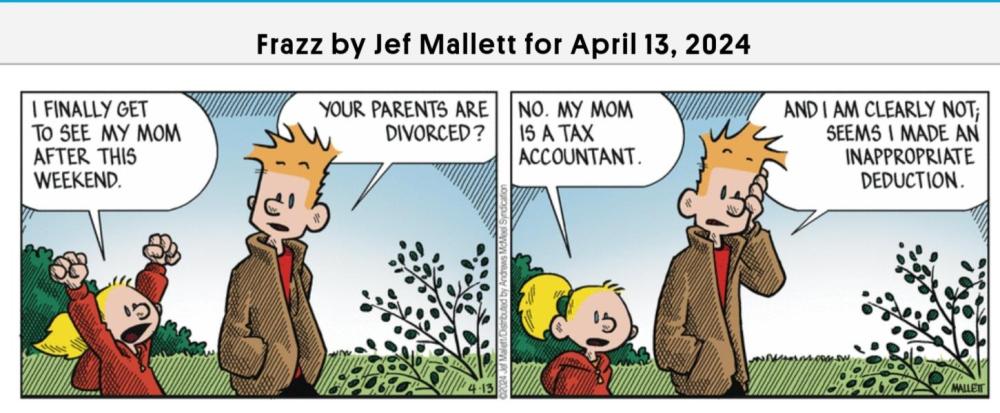

41 minutes ago, Gail in Virginia said:

I can't figure out how to share a copy of it, but the April 13 comic strip Frazz was very on-point if you can look it up. And if someone better at this than me can share it......

Here you go, Gail.

-

3

3

-

3

3

-

-

Maybe institute a per-call fee, so you try hard yourself before calling. Even a small fee of $1 to $5 per call would make a lot of folks look things up themselves first.

-

1

1

-

-

-

I definitely have a few in mind to fire. However, I'll wait until I've recovered a bit before making final determinations. Drake tracks time on a return (so I leave the client's return open when I'm doing anything with their documents) and one of the things I'll do is go back through 'em all and compare what I charged with what my time-billing fee would have been. Anyone whose time-bill is substantially more than the per-form charge is high on the list of candidate for firing.

-

7

7

-

-

On occasion I'll send an extension form with recommendations, or (for those internet-savvy) a link to Direct Pay. Up to them, though. I'm not their mommy and they're supposed to be grownups!

-

4

4

-

-

5 hours ago, BulldogTom said:

"What the hell happened, how the law tax law applies,

I cover these two in the upcoming webinar. Don't know about ATX any longer 'cuz I bailed in the 2012 filing season. I always learn more from case studies than the ivory-tower practice cases where all the numbers line up perfectly.

-

3

3

-

-

4 hours ago, Corduroy Frog said:

Will you be doing another live one later this year? A long distance for me, but I remember one year you made it down to Tennessee.

Will there be more than 2 CPEs?

This one is online and 2 CPEs. No plans at the moment to go somewhere live. Got a group that wants to invite me?

-

1

1

-

-

I also note is is very limited in time, and only for the day before the due date. They are also asking people only to call in with time-sensitive issues rather than general questions.

-

1

1

-

-

Yes, a very heartfelt thank you to Eric, the moderators, and every colleague who reads and posts here. Without you, I would be bereft of what small dregs of sanity remain to me.

-

10

10

-

-

When there is NO information on which to base anything - no papers at all, a client who varies year to year from owing v getting refunds - the worst that happens, that I see, is that the IRS invalidates the extension later. But they may not. If there ends up being a refund, you have extended the statute for collecting that refund an additional 6 months. I have a couple of clients who show up every 3 years, with 3 years' worth of documents in hand. I put in extensions, every year, just in case.

They know the risks (as they get told, by yours truly) and if they don't pay anything it's all on them. I figure it's worth a try, for minimal effort on my part.

-

3

3

-

-

14 hours ago, Lion EA said:

Was that in my handout?!

It was supposed to be!

-

1

1

-

-

9 hours ago, Margaret CPA in OH said:

however, as it seems at times I care more about the client than they do

Next lesson: we cannot allow ourselves to care more than the client does. Care about the quality of our work, yes! Care more than they about penalties for being late? Nope. And I at least have to re-learn this every couple of years.

-

4

4

-

-

8 hours ago, joanmcq said:

It could be fun if I can get up that early!

You'd get to see the (totally staged) photo of me hiding under my desk with a bottle of whiskey, when the full extent of the debacle becomes known...

-

1

1

-

3

3

-

-

Somewhere in the stack-o-stuff there is a breakdown of the per-condo improvement amounts, that I will dig out after 4/15.

Thanks, guys!

-

1

1

-

-

10 minutes ago, NECPA in NEBRASKA said:

It would be nice if people would ask for advice before they do something.

That is against the unwritten rules. No one may ask for tax advice before doing something. The more idiotic the step, the more strictly this is enforced.

-

2

2

-

5

5

-

-

Client has a condo that levied a "special assessment" against all owners to deal with capital improvements. But the paperwork says it's to pay the loan. My take is that the improvements are additional basis in the unit, and since the loan is not in the taxpayer's name it is therefore not deductible mortgage interest.

Thoughts?

As an aside, this client is already greatly limited by mortgage interest deduction limits in what can be deducted.

-

1

1

-

-

Double and triple check that you have the EIN listed correctly.

If it still demands a 1041, I'd say paper-file the thing and be done with it. Even include the e-file rejection 'reason' if you wish.

-

5

5

-

Words To Live By

in General Chat

Posted

Old college professor of mine said "You only start to understand thermodynamics about the third or fourth time you teach it."