-

Posts

4,262 -

Joined

-

Last visited

-

Days Won

167

Everything posted by BulldogTom

-

Do you guys charge extra fee for old returns

BulldogTom replied to schirallicpa's topic in General Chat

I do them at my current year rates. If I am doing prior year returns it is normally for a new client, and I want them for the long haul, not just this engagement. Tom Longview, TX -

Did you break out the wages on the W2 input screen on the bottom? Tom Longview, TX

-

I just did a quick internet search and I came to the same conclusion. ^^^^ Tom Longview, TX

-

How do you put a business that you run into a 401K? I am pretty sure that is a prohibited transaction....or is it? Tom Longview, TX

-

Love the Berkshire story. That is why Buffett is Buffett. On the flip side, I will never take a loan that does not allow pre-payment. I found this out the hard way on my first home purchase. I wanted to refinance and I had to pay a pre-payment penalty to the lender. Never again. Tom Longview, TX

-

Quickbooks Payments - who is responsible for 1099NEC

BulldogTom replied to BulldogTom's topic in General Chat

That is what I am thinking. I probably worded my question awkwardly. I think QBO as the payment processor should issue the 1099K, which would relieve the payor of the responsibility to produce a 1099NEC for the recipient. Is that how you see it? Tom Longview, TX -

@joanmcqIf you are getting the code 38 reject, go over to the efile page and look at the solution there. It worked for me. I don't trust myself to tell you the steps but it was simple to follow. Tom Longview, TX

-

Thank you all for this post. Had the issue, followed the above and the issue was resolved. Appreciate this board so much. Tom Longview, TX

-

Client paid contractor via Quickbooks payments (Contractor Payments for those of you who use QBO). Who is responsible to send the 1099 NEC to the contractor? I think it is QB since they are the payment processor. Just like Venmo or PayPal. Am I correct? Tom Longview, TX

-

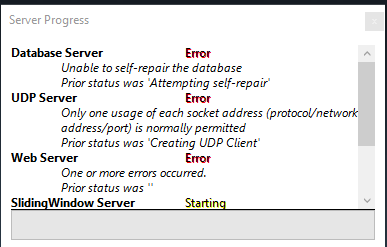

How to fix this - I know Abby had a post but I can't find it.

BulldogTom replied to BulldogTom's topic in General Chat

Turning off your anti-virus software is like walking outside naked....no one wants to do it and no one wants to see you do it. Turned off my antivirus and restarted my services and everything is fine. I guess if I only have to go through this every 3 years it won't kill me. Tom Longview, TX -

How to fix this - I know Abby had a post but I can't find it.

BulldogTom replied to BulldogTom's topic in General Chat

@Abby Normal Any chance you can give me a primer on how to stop and start the database? In my defense, it has been 3 years. Tom Longview, TX -

How to fix this - I know Abby had a post but I can't find it.

BulldogTom replied to BulldogTom's topic in General Chat

April 22, 2021 I had the exact same problem and made a nearly identical post. The error message is exactly the same. Thanks for helping out Judy. Tom Longview, TX -

@Abby Normal What is the process for fixing this error? I know you posted about it before and it worked for me but I can't find your post. Lucky, this is on my laptop. I fired it up because I am going out of town for a couple days and I wanted to bring it along. If I need to, I can uninstall and re-install. I have some time. Thanks

-

Sounds like a good client - or like you have decided they are a good client. Back to the original post. FMV of the items on the date contributed to the partnership is the Basis of the Fixed Assets. Depreciate under the normal rules for used equipment. Most conservative approach is to get an appraisal. If they want to be a little less conservative, use Garage Sale or Craigslist pricing for used items of similar value. If they insist on using the amounts they say they paid for them (and if you believe them), get them to write a letter to you signed and dated that says this is the value of the property they contributed to the partnership. It does not have to be confrontational, just explain that you are there to protect them from audit risk. and the riskiest way to go is take their word for the basis of the property. Tom Longview, TX

-

Just curious about the 2022 return. Any Sch C Painting work on that return? Seems that this guy was already a painter before he started this business. Was he calling it a hobby, side gig, hustle or some other term that on the street means "I get paid in cash and I don't have to tell anyone". The part about "paid cash" is I think what has all of us looking at it twice, because cash is so easy to put in your pocket instead of into your bank. Tom Longview, TX

-

Oh....I love that. Is that your own or is it a quote from someone else. I am stealing that line. Tom Longview, TX

-

I remember taking payments to the bank with the voucher. Then it was the call in to the IRS and we had a "cheat sheet" that told you what you were supposed to enter at each of the prompts. Ahhhhhh......the good ol' days Tom Longview, TX

-

My approach on rental deposits has always been that the amounts received are income (because the IRS says it is for cash basis taxpayers) and the return of deposits to the tenant at the end of the lease is an expense. I put it on the other expense section of the Sch E as "refunded deposits". That looks like your second option. Tom Longview, TX

-

Doesn't that fall under "legally placed in the home". I am doing this from memory, but I thought that was a specific line in the relationship tests. Tom Longview, TX

-

Whoa - not so fast.... You MAY have a LKE on your hands, but double check the rules were followed. Tom Longview, TX

-

Did the estate distribute the house to the heirs? "took possession" is theft if it is owned by the estate. Who is named on the title of the real estate? If it is the estate, then the estate is the only one who can sell the property. If the estate distributed the real estate, then the heirs owe the estate for the repairs the estate paid for. I would put a timeline together of the transactions, because this sounds like a cluster in the making. Tom Longview, TX

-

I urge all of you to check your AMT form on the 1116. That is where I had my issue. You have to enter the AMT carryover manually on that form. That may or may not be your issue, but it was for me. Tom Longview, TX

-

Reminds me of an article I read many years ago about a pregnant woman who was ticketed for driving in the car pool lane and went to court. The judge dismissed the ticket because he did not want to rule on when a child in the womb reached the status of a person under the law. Pregnant women should be able to drive in carpool lanes now in Georgia. Tom Longview, TX

-

Thank you all. Appreciate you. My clients think I am a hero... We are paper filing with the 14039 attached. Proof of dependency is also being attached to paper return (Birth Certs, Passports, College enrollment docs). It required a phone call to AXT support to find out which SS# was compromised. Taxpayers are taking steps to freeze credit, call banks, etc. Tom Longview, TX