Search the Community

Showing results for tags 'efile'.

-

Can a 2018 tax return still be efiled

-

Greetings, Last evening I rolled over a return from 2018, entered all data, checked return and selected e-file. The return showed up in my e-file folder. I did not e-file last night because I needed to verify this morning that the direct deposit was going to the same bank as last year. Once I spoke with my client I tried to e-file and got a message that none of the forms included with the return are eligible for e-file. So I deleted the e-file and went back to the return and tried again. Now it will not allow me to create an e-file. So I duplicated the return and tried again. No success. Now I deleted the 2019 file and again rolled over the 2018 file. I re-entered everything and it still gives the same message. So I now created a new file using a different name and only entered the w2 information and tried to efile. The same message appeared...."none of the forms included with the return are eligible for e-file". Help can anyone tell me what to do? Of course ATX is not open for telephone support or online support on Sat or Sun. Thanks in advance. Linda

-

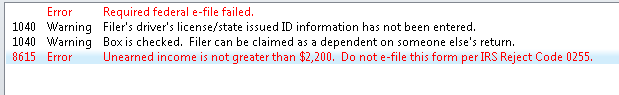

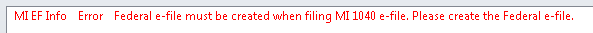

My client is a minor child with , unearned income of less than $2200. She does not need to file a federal return, however, she DOES need to file a Michigan return, and owes tax. What am I missing? If I select both the federal and state options in the Create Efile box, I get the following message: If I create the efile without the federal box selected, I get this message: I was wondering if I had to change the settings under Preparer Manager and Efile, but I think those are global settings. Any solutions appreciated.

-

IRS alert received on efiles that were accepted with messages. Error code IND-162. ATX says its an IRS Alert but no action is required. What is this? How come no other person in my office has received this on accepted returns

-

When I try to e-file a 4th Qtr 2019 PR Report I get this message. Anyone else experiencing this issue?

-

Have a client filing MFS. E-file error message says "SpouseClaimAsDependent" is not checked, then the Spouse SSN must not be the same as a Dependent SSN on another return. I get this message regardless of whether the "Box" is checked or not. ATX help desk I MUST Paper-file this return. This is Ridiculous! Spouse e-filed her ow return, she is no one's dependent. Is this an ATX Problem or a True IRS E-file problem? Must I paper-file this tax returns? Please advise, and Thanks.

-

My client's e-file has been rejected "because taxpayer's identity protection personal identification number (IP PIN) must match the e-File database." It is a year 2017 tax return and I entered client's pin only at one spot under "filers' Information" on Form 1040. Is there another spot where I need to enter it or what am I doing wrong? please help. Thanks.

-

I am requesting that ATX make the E-file of Oregon Form 41 (Fiduciary Income Tax Return) available. I am tired of explaining to my clients why they are able to E-file the Federal Form 1041, but must paper file the Oregon Form 41. Oregon has made E-fling of this return available for several years now and ATX is behind the times.

-

I just got a notice from a client who got a larger refund on her 1040 and the notice is saying because of a missed HSA deduction. Upon reviewing the 8889 it computed no additional deduction which is correct however an incorrect number on line 3, $8,900, double what it should be creates a balance on line 12 that should have moved to line 13 and then to 1040. The instructions clearly say a self only coverage over age 55 is $4,450 but $8,900 somehow comes over? I just got off the phone with ATX and they are not up yet so they cannot help. I am surprised the IRS computers allowed a number greater than her age allows to be used. If you get any calls about increased refunds and the person has an HSA, go right to that first.

-

I have a weird situation. 1120S is accepted & IL's tax says transmitted to EFC since past 6 days with acknowledgement of acceptance. When I called ATX tech support today he says it is stuck & suggested me to duplicate tax return, re-transmit both Fed & state of course fed will be rejected & state will be accepted. I duplicated & then deleted for some reason I was feeling uncomfortable about this. I am sure there should be some way out not just re-submit already accepted tax return. Does anyone else went through or has some suggestions how to get over this.

-

On all my returns I get a error stating that I have to create a fed e-file before i can e-file Mi. I have created the fed e-file correct fed e-file so there is nothing to fix.

-

How long does it take to get acceptance. I transmitted my first for the season yesterday but no acceptance yet.

-

The 2018 w2/1099 e-filing produces a separate AR.zip file for the client in addition to the .zip file to upload to SSA. This cannot be submitted to the SSA (as I tried and it rejected). In years past I have only sent the SSA the one zip file for the client with the understanding that the IRS sends the State of Arkansas the information and we weren't required to send paper forms to AR. But with the addition of this AR.zip file I am wondering if the procedure will be the same or do we have to make sure AR gets copies ourselves?

-

Hi everyone- I am looking for a copy of New York State 1998 S Corp Tax software for a one time use by my accountant; I was recently served Notice by the State that I haven't filed a variety of years including 1998 (I assume lost somewhere in Albany); I have paper copies of the others in question ; can anyone help? Not sure what platform is possible either, but can solve that later thank you David Johnson [email protected]

-

Hi All, Is anyone having an issue with the software giving you an error even after you input your CTEC number in steps 1-3 on the FTB EITC Due Diligence section? This is driving me bananas! I don't see a place to input on my firm setup, I have the number in front of me, and I am still getting an error that I know will prevent an efile!

-

I transmitted 4 returns yesterday morning. Three have Fed and OH Acceptance...but one still shows "Transmitted to EFC"....not even "Transmitted to Agency" yet....Other returns that I have transmitted since then (yesterday afternoon and last evening) have IRS Acceptance as well....but the one return still shows only transmitted to EFC. I am not one to panic about getting ACKs this time of year, but I'm getting nervous about this one...in part, because it is my personal return.....I wish someone at ATX would check into it and advise.

-

TAXPAYER RECEIVED REJECTION ERROR IND-517 INDICATING A DEPENDENT'S SSN (SON) WAS USED ON A FEDERAL RETURN WHERE THE DEPENDENT CLAIMED A DEPENDENCY DEDUCTION. NO DEPENDENCY EXEMPTION/DEDUCTION WAS CLAIMED ON THE SON'S RETURN AS FILED (LINE 6a WAS NOT CHECKED). THE SON'S FEDERAL RETURN HAS ALREADY BEEN ACCEPTED. HOW CAN THE REJECTION CODE BE CORRECTED ON THE FEDERAL RETURN WHERE THE DEPENDENT EXEMPTION IS CORRECTLY BEING TAKEN?

-

So, I somehow created a duplicate application in September 2015 when I applied for my EFIN which caused me to have to delete both and start from scratch in November. I overnighted my fingerprint cards on Dec 17, 2015. As of last week, I saw that my EFIN status was valid/active so I submitted my first efile return. The next morning I discovered the return was rejected due to an invalid EFIN. I contacted the e-help line and was told that even though the status showed active, my application was still pending and "sitting on someone's desk". At this point, I have no way to eFile client returns, but a stack of returns which were already prepared. Is it legal for me to walk my clients through an online tax software and have them submit the returns themselves? In addition to this, my bank product relationships were already established and approved. Is it possible to still request bank products (ie, allowing them to pay with their refund through a refund transfer) if they e-file their own returns A.) through the bank product provider or B.) by doing a refund transfer directly to my practice?

-

I notice this year's payroll program requires a Reporting Agent Control Number. Would this be the first characters of the Reporting Agents name (line 9 form 8655)?

-

On Friday, July 24, 2015 I efiled a 2012 1040 for a client. The "Transmitted" status remains. I don't understand why a 10-day delay in processing by IRS. Any ideas. I was told IRS would accept 2012, so I assume that is not the problem. Thanks.

-

JOINT FILERS TOOK FIRST-TIME HOMEBUYERS CREDIT IN 2008. SOLD HOUSE IN 2014 TO AN UNRELATED PARTY AT A LOSS IN EXCESS OF THE BALANCE OWED ON THE CREDIT. WHAT DO I NEED TO DO TO FIX THE RETURN WHICH KEEPS GETTING REJECTED FOR THE STATED REASON "E-FILE DATA BASE INDICATES A 1ST TIME HOME BUYER INSTALLMENT PAYMENT IS DUE FROM SPOUSE. I'M OF THE BELIEF THAT THERE IS RELIEF FROM THE BALANCE OF THE CREDIT OWING TO THE LOSS ON THE SALE.

-

I've used ATX for years. I e-file several family members returns for no compensation. Since NYS is a mandatory efile state, I use my ERO to efile, but I don't enter anything in the Paid Preparer section - since I am not being paid. This year (for the first time) I am getting an error. It says: "NY will reject any return that does not have a Preparer Name and SSN/PTIN. If the Paid Preparer is also the ERO, enter the SSN or PTIN on the 'Preparer Manager' on 'Preparers' tab." Is there anyway around this?

-

Wanting to change from sole prop to S-Corp, what is the process that has to be done with e-file center? I already have EIN for S-corp. I am ERO and have been for eleven years, if that makes any difference. I called the help desk and talked to a lady, but she confused me more than she helped me. Thanks.

-

When I try to e-file Form 4868 for a partially completed tax return, I get an error message saying locked amount must be checked. The client is not making a payment as the return is not complete and the amount with the extension is incorrect. ATX will only allow one box to be checked so I cannot have all zeros on the 4868 and Lock Amount checked at the same time. How do I e-file the 4868?