BKG

-

Posts

10 -

Joined

-

Last visited

Posts posted by BKG

-

-

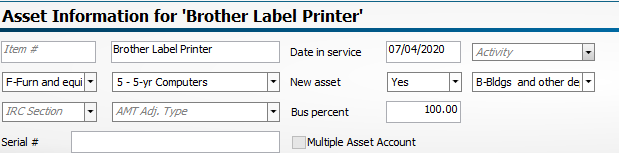

I am trying to file form 1065X. Client forgot to take depreciation last year. So I am amending prior year tax return to claim the depreciation. The "Activity" field in the fixed assets input area is grayed out and I cannot link it to the form 1065X. Help anybody? Thanks.

Quote

Quote -

-

Yes they are taking forever to release those forms this year. Clients are getting anxious.

-

They were issued another PIN for year 2018 tax return and I am guessing that the IRS have updated that PIN in their database and deleted the old pin for year 2017? I am quoting directly from the 2018 IRS letter that issued the PIN. It states "You'll need to use this IP PIN when filing any forms 1040 during the calendar year beginning in January." So I guessed any form 1040 filed during the year 2019 regardless of the "tax year" it belongs to. I e-filed again using the 2018 PIN for filing the year 2017 tax return.

-

My client's e-file has been rejected "because taxpayer's identity protection personal identification number (IP PIN) must match the e-File database." It is a year 2017 tax return and I entered client's pin only at one spot under "filers' Information" on Form 1040. Is there another spot where I need to enter it or what am I doing wrong? please help. Thanks.

-

Did anybody have problem getting form 540-X from ATX 2018? The only amendment form i see there is CA Sch X.

thank you

-

On 5/26/2019 at 7:47 AM, BulldogTom said:

When I have this situation, I enter the return as filed in ATX, and then do the amended. I name the original return "client prepared".

Tom

Modesto, CAThank you

-

I have a new client who needs to have 1040X and 540X filed for both federal and California State. Do I need to first input the data in Forms 1040 and 540 and then carry it over? Or is there a way to input directly to forms 1040X and 540X? I am using ATX and there is no form 540-X coming up. Please help. Thanks.

-

I have a new client who has NOL from a Sole Proprietorship. If I just want to display the carryover loss from previous year and not take the deduction for it (because the client is expecting to have loss this year as well) where do I display that info? I am using ATX. Thanks.

E-file not picking up the amount paid with originally e-filed return

in E-File

Posted · Edited by BKG

forgot important detail

Does anyone know how to link the amended efile form for a California business return to Form 100X?

The amended efile form is not picking up the payment made with originally filed Form 100. It keeps telling me that there is payment due when in fact there is a refund due shown on Form 100X.