Leaderboard

Popular Content

Showing content with the highest reputation since 03/27/2024 in all areas

-

Hello all, We've had some (very few, but more than zero) issues where database tables have crashed during times of heavy load on the server. These load spikes are usually related to other sites that I'm responsible for that happen to share resources with the ATX Community. These haven't been significant issues, and in fact have been very easy to resolve when they arise, but it does cause brief downtime on the Forum. So, in the interest of constant improvement, I would like to move the ATX Community to its own server (VPS) with its own dedicated resources. There are other server configuration changes/challenges that I'll tackle at the same time. Because this is the only forum I maintain, I am less experienced with performance tuning for this software than, say, more standard website content management systems. All that to say, I am expecting it to be a slightly bumpy transition but with improved speed and stability in the long term. There might be as much as one or two days of downtime followed by intermittent hiccups until everything is smoothed out. I'm aiming for mid-May to get this work done, but there is no hurry on my end. If there are business reasons to put it off longer, please speak up! Thanks!15 points

-

13 points

-

Anyone looking for a couple of CPE hours in late April, I'm presenting online. https://www.bigmarker.com/tax-practice-pro-inc1/When-1040s-Go-Wrong-Navigating-a-Tax-Train-Wreck @Lion EA saw the first presentation of this, live, last September.11 points

-

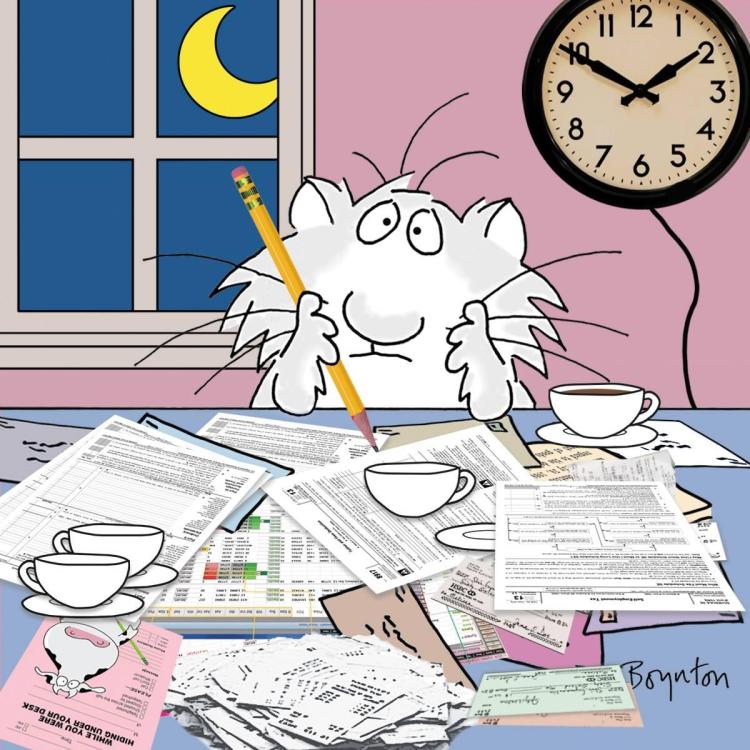

Thanks to Eric and to all of you. I am starting to double guess myself and waking up in panic mode. Not Good! Without you, I would be lost, even with all the research material that I have. Please donate to keep this board alive and always appreciate all of the knowledge and comradery found here. Happy Summer to everyone.11 points

-

I don't know what I would do without all of you and a couple of groups that I belong to on FB. I am hesitant to ask questions of some groups, but this bunch of awesome people are willing to help and be kind. All of my cronies here are dead, retired or just said that they had had enough. I hope that it's OK if I hang around here for awhile after I retire. I am just letting my permit go inactive, in case I get desperate and have to work for somebody else in Colorado.11 points

-

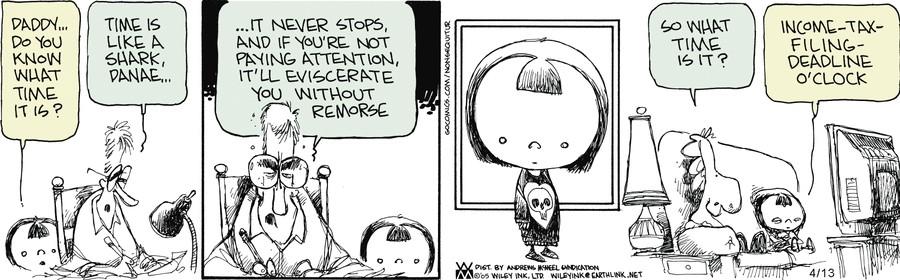

Almost over people !!! Take a couple weeks off then finish the stragglers we filed extensions for. Its been a trying year that has dragged on forever !!! Been saying for years we need to cut back, but this year solidifies we need to. Tired and wore out as I imagine we all are. Hope everyone has a fantastic summer !!10 points

-

This was my last April 15th when I have to care about anyone else's return except my own! I just finished a bunch of extensions, but I still feel like a huge weight has been lifted. This has been the worst tax season ever. I didn't think that it could ever be worse than losing my Mom, but this last five months of having my husband so sick has been the pits. It was getting so hard to concentrate and get enough sleep. We got a new puppy, too for my husband. He turns out to be a Morkey, not a Poodle but I am happier with him anyway. I am also pretty sure that he will never know to go to the door to be let out. He is way too small, anyway. At least he is very good at using pads. Between a dog and 3 cats, it keeps me busy cleaning up. I just hope that we can find a condo that will allow 4 pets when we move. It was a sad and happy day. Lots of hugs and tears, and I will miss my clients. I got some beautiful bouquets, a customer made blankets for both my husband and me and gift cards to go eat. I did get a gift that I bet none of have ever received. My clients sent me an adjustable leg rest because they know that my leg is still a mess after my scope and that I will be getting a replacement. My client had just broken his leg very badly and was using this after his surgery. I have been blessed and still have a ton of work to do. I am hopeful that my husband will improve so that I can get a part time job out of the house in anything but taxes. Thanks so much for everything. See you all soon!10 points

-

I have the utmost respect for everyone here and I thank you for sharing your day to day and making me feel less alone. Sincerely. My plan was for this to be my last year but I looked at the numbers and I think I have to do at least one more. Here's hoping I'm just exhausted and maybe I can call it a day? Congratulations to those who are done. My best to those who will continue.10 points

-

I will be working all day today and tomorrow. Then on to the extensions. This has been a whirlwind year. A client is bringing homemade soup for tomorrow. Then I can say that we have been given everything from soup to nuts. Friday it was two quarts of homemade maple syrup. You just have to love these clients who appreciate what you do for them and we really try to do the best job possible. Off to work I go.10 points

-

Yes, a very heartfelt thank you to Eric, the moderators, and every colleague who reads and posts here. Without you, I would be bereft of what small dregs of sanity remain to me.10 points

-

Certain people do come to mind and then they turn to dust. Breaking things after an aggravating day can be very satisfying.10 points

-

Amazingly 20 minutes after e-mail she shows up all apologetic. Didn't give her the return, only the original documents.10 points

-

I'm fortunate enough to be at a point in my life where I don't need to be bringing in money from preparing returns. For the most part, I still enjoy it and the vast majority of my clients I look forward to seeing each year. Email sent and now I'm going to go dig in some dirt and plant some veggie seeds!10 points

-

For me, this site is a place to learn, get answers, vent or commiserate, or just take a break during the day. It continues to be an invaluable resource that's been a part of my daily routine for 17 years. Eric has taken care of us from the site's inception, mostly unseen, and his work is ongoing. Soon he will migrate the forum to a new host and is waiting for us to get through the 15th before doing so. I've made a donation today and hope others here will consider that as well.10 points

-

yesterday Catherine White EA was the presenter for Tax Practice Pro, a c.e. provider. Her presentation was a case study of what happens when a client changes tax professional, and issues with prior years are discovered by the new tax pro. Kudos to Catherine on a well developed and perfectly presented class.9 points

-

So I had an issue with a client that I needed to talk with IRS about. Called the PPL expecting a 20-30 minute wait. I was shocked at how quick it was. The agent was on the line before I had my paperwork out of the file. Issue resolved in 10 minutes. I need to get a lottery ticket tonight. Tom Longview, TX9 points

-

The cats hated him at first, but the Alpha is getting closer to him. He only weighs 4.5 pounds and our smallest cat weighs 12. Yoda can't figure out why they are annoyed when he chases them or runs headlong into their side to try to get them to play. The cats are positive that he is beneath them. He really needs our son to bring back their two Great Pyrs again, because he has a blast with the youngest one. When we get moved out to Colorado, they will have fun. A Morkey is part Maltese and part Yorkie. He does have some poodle in him according to his DNA test. He does not shed and he is the faster than greased lightning.9 points

-

Yes! I definitely agree. Especially for those of us who work solo. Thank you!!9 points

-

Cigarette smoke and couldn't wait to get them out of my office. The firm I worked for early in my career had a seafood market, and the stench from its papers was nauseating. The owners knew it too because they and the kids would shower and change clothes after work. AIr out as best you can, keep the docs sealed up and in a separate area until ready to work on them, and get the work done sooner than later. Maybe you could put a box of baking soda or some odor absorber/neutralizer in a bag with the papers.9 points

-

Any time is ok with me for the conversion business-wise, but I may have withdrawal during the downtime. As always, thank you for taking care of us so well, Eric.8 points

-

I'm in for a short time today but probably won't get much done. Got an email from a lost client. He's four years behind. Ha. Says he wants to catch up. Ok but he'll have to get his info to me. His son has been coming in regularly. We'll see. I jogged this morning. Feels good to get back to it after a few months off.8 points

-

8 points

-

I'm done. This morning I filed the extension for my ultimate procratinator, and other than the extended returns, I am waiting on one to pickup (SO unexpectedly hospitalized day she was scheduled to see me) and one couple that have had the returns for almost a week and must return the 8879 to me. Tomorow I am participating in a charity event in the early morning and then will be shooting at the clay pigeons. That's been ongoing as weather permitted and really helped keep my sanity this year. Plus, it's fun.8 points

-

You are so right! I had about a dozen that I out right fired, about 10 more that I doubled the price and they went elsewhere and a couple more that paid the PIA fee. The stress these clients caused was not worth the money.8 points

-

I'm essentially done other than one that is a total PITA. They dropped off info late March. I sent email of a couple basic items missing. Various emails over the last 2 weeks to get the info. Sent email that they were done Tues, and she replied she will pick up today. Did not answer my return email as to what time today. I sent another this morning saying they need to be picked up by 1 pm. At 1:05 I'll be sending another email with password protected file of their original documents telling them they need to go somewhere else. They have 1 dependent that graduated HS in 2023 and another in college. Guessing at least one of them filed their own returns without indicating they were being claimed by someone else. Same crap happened last year and needed to prepare a revised return for them on 4/18 because kid claimed herself. I can be very nice until I feel taken advantage of. When I reach that point, look out!8 points

-

I've had a policy for years - and my annual tax letter states in bold - that any return not ready for signatures and e-filing as of April 1st *will* be put on extension. My cutoff is March 15th, but the poison pill in it is that I have to have all the documents and information in-house by that date. People rush to get me docs on March 14th & 15th - but it's never, ever, complete, so they have not made the cutoff. Manage your clients, or they'll manage you into premature gray hair and high blood pressure.8 points

-

I have to decided to limit my involvement to informing my clients of their obligation to report I am not giving any advice or answering any questions. BOI has nothing to do with providing accounting. payroll or tax services.7 points

-

7 points

-

7 points

-

I definitely have a few in mind to fire. However, I'll wait until I've recovered a bit before making final determinations. Drake tracks time on a return (so I leave the client's return open when I'm doing anything with their documents) and one of the things I'll do is go back through 'em all and compare what I charged with what my time-billing fee would have been. Anyone whose time-bill is substantially more than the per-form charge is high on the list of candidate for firing.7 points

-

I had a (former) client who I hadn't heard from in 4 years text me at 6:00 pm Friday asking me to do a trust and individual return. This was the normal pattern when they were my clients. I told them I was "pretty much" retired and to call Block Advisors. Just remembered--one summer I sent them a warning they were about to hit the 60 day mark (minimum penalties kick in). They contacted me on day 61.7 points

-

If I have nothing, I just use last year's tax as a guesstimate for this year. I automate that in ATX by linking the prior year tax from the comparison form to the 4868. It's better than zero.7 points

-

The person who set it up made a lot of money. Apparently enough to "incentivize" brokers.7 points

-

That is against the unwritten rules. No one may ask for tax advice before doing something. The more idiotic the step, the more strictly this is enforced.7 points

-

7 points

-

has worked fine with the few clients I've tried it. And as you mention, they have been older clients; younger ones I've pointed them towards Direct Pay. Just had another instance of client's check going missing--the 1040-ES arrived but not the 1040-V. Even though elderly, I think he is savvy enough with the computer to use direct pay going forward. We have a serious problem in my area with stolen checks, including those dropped off inside the Post Office.7 points

-

Here we go again: Bubba: "Hey, bought a brand new pickup truck!! $100,000. All for business. I parked it outside so you can see it." Preparer (after glancing out the window and seeing two fishing rods sticking out the window). "That's great Bubba!! We'll see what we can do with your mileage log." Bubba: "Whaddya mean mileage log?? I want'chu to write off this whole thing." Preparer: "They won't let us do that. Only a limited amount of depreciation per year. Not only that, but if you take actual cost, you STILL need a mileage log." Bubba: "Only a limited amount of depreciation? I'll never get $100,000 depreciated out before the thing is ready for the junk yard. I don't need a mileage log either. It's 100% for business. I tole you that." Preparer: Mileage log?? Where do you drive? Bubba: "Everywhere in my business. Just got back from Myrtle Beach last week and my wife wants to see the Alamo in June." Preparer: "I'm sorry Bubba. I don't think I can help you." Bubba: "Well I'm sorry too. I can find someone to do what I want them to do. I'm gonna take my honkin' new truck to Slick Sam over in Yonder County and he'll fix me up." Ever happen to you??7 points

-

At a seminar an IRS agent once told us that the only vehicle IRS believes is 100% business use is a cement mixer.7 points

-

I might add the following: If you really want to learn a subject, prepare to teach it to others.6 points

-

8 pm! Just filed the last extension and there are many. This day is SO over. Had to pause for one more senseless phone call. I am going to bed. Have been in this chair for 12 solid hours. We didn't even stop to eat. Good night all. Things will look better tomorrow. I am also rethinking giving up and shooting for one more year. What? Have we all lost our minds?6 points

-

6 points

-

I had a pretty good start to the season, but then lost a week to tech crap in March, and this past week to a bad back. So I'm trying to remind myself why I thought it was a good idea to keep doing taxes a few more years. But I just prepared a partial list of folks I'm going to fire, I'll go through and finish the list this week. Then I just have to write the letter to them. Then only 2 clients I still have payroll returns for, that's a relief to have that so low! Next year, none!!6 points

-

I did see that happen one time (over 20 years ago). I hadn’t prepared the extension or the return, but was asked to look over an audit report. The original extension request showed zeros on all lines. The actual tax liability was significant - $15 k or so. The taxpayer was self-employed and clearly should have know there would be tax due. The audit only turned up a nominal amount of additional tax - maybe $1k or so. But the auditor added full FTF penalties, stating that a reasonable estimate of the tax liability was absent from the 4868 and thus it was invalid. That’s the only time I’ve ever seen that happen, so I conclude there’s no attention paid to the numbers in the 4868 unless there’s an audit. But then they have a slam-dunk case for invalidating the extension retroactively if the extension shows all zeros. That’s why I agree with the approach to estimate the projected tax liability high, even if there’s only a token payment (or no payment) submitted with the 4868. It’s perfectly fine to lowball the payment (or even not submit a payment), but don’t lowball the expected liability.6 points

-

No. It is different for a corporation and not at all the same as how a partner handles UPE. Corporation would need to set up an accountable plan and reimburse the shareholder. An example of where this is used is personal auto used for business purpose, shareholder keeps mileage log and submits a report to the corp for reimbursement. Corp reimburses at the allowed federal rate. There are other accountable plans that have more specific tax law rules such as medical reimbursement plans or when to reimburse shareholder paid disability insurance premiums. If there is carelessness or intentional comingling of expenses paid from the corp accounts, you may want to have a discussion with your client about not using the corp's checkbook as his/her own.6 points

-

All you can do is file a zero-information federal extension. Gives him 6 months on the SOL to claim any refund, if he finally gets his docs to you next year. We are not their mommies and can't make them do anything. Nor can we allow ourselves to care more about their own taxes than they do. If he has late penalties and interest it's not your fault and there's nothing you could have done to fix it.6 points

-

Years ago, I used direct debit, and the IRS took the money twice. One phone call and they immediately acknowledged, but it took them 10 weeks to refund the 'double dip'. LONG ago, and I'm certain it's fixed, but I've never used it since. I have an instruction sheet with instructions for direct pay for Fed and State, and I pay a client who is retired to come in 4 times a year and phone all my clients who have estimated payments reminding them of the same. Clients love it, and it's a 'touch' in the off season time. I print vouchers when I do the tax return for folks who want to send checks, and we keep a spreadsheet of 'estimated payment' clients. My son is getting ready to go to college, and he says he's going to take over my business someday. When that happens (or when he changes his mind and I sell my business), he can move the estimated payment system into this century ... my retired client might be tired of making the phone calls by then ;).6 points

-

My hair skipped grey and went directly white (sans color). But then again, I have hair, so no complaints - other than the cost of a cut. I say it is from kids, they stole the energy I used to have, as well as my hair color . For me, the "days" are the W2 deadline date, and every quarterly deadline date. But, as someone told me so long ago, there is NO such thing as an accounting emergency. No ambulances come, no specialists are on call, etc.6 points

-

This type of client doesn’t bother me. It’s those who was to bring it in an expect to have it completed bly Apr 15! who would irritate me. That’s why I set a cutoff date (usually somewhere around March 15-20). Anything coming in after that date automatically get an extension. Some of those returns still get finished, but there are no guarantees. Strict adherence to that type of policy turns April 15 into just another ordinary day.6 points

-

I always liked the ones who said they’re too busy to keep a log and “if I’m audited I’ll just give the auditor my box full of gas & repair receipts and let them figure it out.” I’d always tell them “The auditor will just hand the box right back to you and inform you that you don’t have a deduction.”6 points

-

Simply viewing an email will not infect your computer. However, clicking on links or opening attachments can. Even when I get an email from a a company I do business with, I don't click on the links. I go to their website and login.6 points