Leaderboard

Popular Content

Showing content with the highest reputation since 10/28/2010 in all areas

-

A handful of extensions have been filed and 3 returns waiting on signatures in order to efile, and those will be in today. It's been a harrowing couple of weeks trying to get caught back up after losing days of time because of husband being hospitalized for a few days mid-March and then working day and night on about 3-4 hrs of sleep a night since then. I'll be around here to help where I'm able over these next few days, and of course the rest of the year. I want to express my sincere appreciation to every member that selflessly contributes to help others on here. I learn a lot from reading all the posts and seeing the ways that you all approach some issues differently than I would. You all are amazing and are what makes this such a great site! For me, it is also a needed distraction at times too. Thank you all for another great season.20 points

-

... I became a landscaper. And I have the farmer's tan to prove it! We hired a crew for the front yard. We did the side door ourselves. The backyard is still a work in progress leftover from last fall. A little hardscaping is next (walkways, patio, etc.). Our life will involve a lot of watering over the summer, but we're as happy as we are tired. There will be a rose trellis on the right side and some evergreen bushes on the left. Our side door. A flagstone walkway from the driveway to the front door that follows the curve of the bed goes here.19 points

-

New couple came in today to pickup their finished returns and I noticed that the woman had tears in her eyes as she sat down. So I thought, gee, this return isn't anything to be emotional over, but whatever. The first thing the woman asked was where I got my beaded necklace and said it was one of her mother's. It turned out that her mother used to make original bead and stonework pieces and did restringing repairs also. This woman's mother made the necklace that was of her own original design about 30 years ago when I purchased it and the matching earrings. I then told *my* mom this story and she was with me that day and remembers the purchase too! It is the oddest thing that I chose this exact day because I haven't worn it in about 20 years, and this morning I felt compelled to wear the piece with a particular sweater I had in mind, and not a new sweater either. These were happy tears for this woman and made her day knowing that mom's work is still out there for others to enjoy. It's an interesting business we are in, and one never knows who will walk through our office door and into our lives. Whatever the reason for this, I have a happy client and a new friend. Happy Tuesday, everyone!19 points

-

Well forty seasons now done. Some of these clients showed up as young adults, had children whose children now have children. Not in my wildest dreams when I accepted my Uncle August's suggestion to take over his small tax business when he quit it would go on this long. It has been a challenging and rewarding time. I have had countless laughs with clients and sad times when as with this year three of them passed on after more than thirty years. I have been much appreciated and sometimes less so. I have not been perfect but I rather doubt the perfect taxman has yet to walk this earth. And now you are doubtless thinking I am going to hang it up and bring in my rocking chair. Well I ain't ! I'll be back again next year.18 points

-

Baby granddaughter started walking yesterday, at just-turned-10-months old!18 points

-

I've been around for a few years but I'm Irish and stubborn so have rarely asked for help. I'm also a one woman band here so rarely chime in because (I apologize in advance) I read daily to learn yet have little time to help. Unfair to all of you that I take yet I don't give. I learn something new every day from each and every one of you. I've done taxes since 1987. I remember peeling the label off and sticking it to the blue form at the kitchen table. I went computerized with a software called Pencil Pushers and I loved it but it went away. Then I turned to Lacerte. Too expensive so I switched to ATX which led me here. The debacle of 2011 sent me back to Lacerte but I'm grateful my short time using ATX introduced me to this incredible group of people. I lost my partner in 2018. Not my business partner but the man I simply adored so 2019 season was a shit show. Sorry if I'm not supposed to say shit. I work from home. Every single day people came in and asked "where's Eric?" I had to say "dead." 2020 was business as usual until it wasn't. 2021 has been the worst I've seen in 33 years. No one in my office. Meeting in the driveway. I won't even list the insanity of the government because I've been here daily. I know you know. I guess this post is to simply say thank you for getting me through another year. Thank you for sharing your knowledge. Your struggles. Most of the time you were helping others but you were also making me feel less alone. Going forward? I'm probably downsizing because I'm old and I'm tired and I'm furious to have done such hard work for so many years only to have them make my life and my job harder. I wish all of you a week on the beach with your family. Or the mountains. Or wherever. Most of all - I thank you. From an old woman in upstate NY who's been doing taxes way too long and still trying to do her best. My sincerest thanks18 points

-

Husband texted me that he was running late and I answered with what was supposed to be "ok, thanks for letting me know" that I sent as "ok, thanks for loving me now." Then I started to send "geez, I should proofread before sending" which started to convert to "Cheese Arthur profit..." which started me laughing so hard that I had tears running. It was at that exact moment that a representative from the state's division of revenue returned my call. All I can say is that poor woman must think I'm totally nuts, and that it's a good thing I don't text much with my clients.18 points

-

Long time client. Has a rental, royalties, detailed schedule A, 2106 etc. Because they are friends, we always gave them a discount. Last year, their son talked them into going to Liberty so he could get a $50 referral payment. They also got a very heavily discounted return. Like only $17. But the bill would have been over $550 without the discount. So this year they want to come back. Sure, send me over your 2013 return. Roll the return from my software and put in the numbers from last year so I can roll the return again. Guess what, they don't match up? Why? Well, the rental has NO DEPRECIATION on the 2013 return. I keep looking at the schedule E and I don't see the depreciation. So that $17 return that got your son $50 cost you $1400 in Federal and State Taxes paid in 2013. Now I get to do the amended and the 2014. I bet they never leave again. And there will not be a discount this year. Tom Newark, CA18 points

-

Cordelia Rose arrived on the 19th. 7 lbs 10 oz, 19" They asked us to stay quiet until they got home and settled, so I've had both hands over my mouth at all times for four days now! And I just had to share with all my dear friends here.17 points

-

I've signed a sales agreement for my practice. I have high respect for the guy who's buying my business and I'm thrilled that what I started 27 years ago will continue to grow and prosper, and that my employees will have a great new boss and continued employment. (is everyone singing that Who song in their heads right now?) This coming tax season should be my last full-time one where I work 70 hours and 7 days a week. I still need/want to work part-time for several years to come, perhaps at the wine bar in the town where I live. They've been struggling to find reliable employees who won't steal from them or screw up their inventory. Excited for the next chapter of my life and for being less stressed. I can't believe it all worked out exactly as I always hoped. I'm not much of a planner but I've always been lucky as can be. Don't worry. I'm not leaving this forum. You all (y'all) are like family to me!17 points

-

Well, today I sold my practice to a very capable young man! I have taken down my shingle and have entered retirement. I just wanted to stop in and say so long for now and to express the deepest sense of gratitude for each and everyone of you and the sense of comradiry we have had here. It is with the most sincere part of me that I say I wish the each of you the very best of luck and success in the days and years to come. May the Lord of all creation be your ever guiding light! And until we meet again.................17 points

-

So I check with my doctor the other day to find out what's ailing me. He said I had IT'SAD, Income Tax Season Affective Disorder. This malady was first recognized by Dr. Walter N. Cluer of the renowned ATX Institute or the Amsterdam Taxpreparers Xfile Institute in the Netherlands. Some of the indications are, Fear of missing something if you don't visit this board daily. Grief, when opening a tax package and seeing a crumpled, sticky, coffee and spaghetti sauce (or blood) stained documents. Headache, from breathing the odor of tax documents that smell like a pack of Marlboros. Sadness, when receiving a long fax with 50 pages of a year end brokerage statement with instructions. Anger, when realizing you are out of fax ink and machine keeps beeping. I'm sure many of you have other symptoms. I asked if there was a remedy and he said "No bunky, just therapy from a support group". I hope everyone here gets the help they need if they are affected, and it is good to know we have a great support group right here. Thanks to all, I feel better already. Don't let the April fools get you down, they all just realized what date is fast approaching.17 points

-

Hello all, We've had some (very few, but more than zero) issues where database tables have crashed during times of heavy load on the server. These load spikes are usually related to other sites that I'm responsible for that happen to share resources with the ATX Community. These haven't been significant issues, and in fact have been very easy to resolve when they arise, but it does cause brief downtime on the Forum. So, in the interest of constant improvement, I would like to move the ATX Community to its own server (VPS) with its own dedicated resources. There are other server configuration changes/challenges that I'll tackle at the same time. Because this is the only forum I maintain, I am less experienced with performance tuning for this software than, say, more standard website content management systems. All that to say, I am expecting it to be a slightly bumpy transition but with improved speed and stability in the long term. There might be as much as one or two days of downtime followed by intermittent hiccups until everything is smoothed out. I'm aiming for mid-May to get this work done, but there is no hurry on my end. If there are business reasons to put it off longer, please speak up! Thanks!16 points

-

Well, I just received my final acceptance from the IRS for my last return on extension. I am officially retired. I started preparing taxes in the '80s with H&R Block, bought a franchise in 1991 then sold it in 1997 after doubling the business. Started doing some returns for friends and investment clients using ATX (with the bunny hop) making only house calls. I joined this community after ATX dropped the previous version. I am thankful for the advice and assistance I have received from various members over the years. I will continue to lurk on the forum in the future. Good Bye and thanks to all. Joel16 points

-

Baby granddaughter at just over 8 months old, has her first little toofie. So exciting!16 points

-

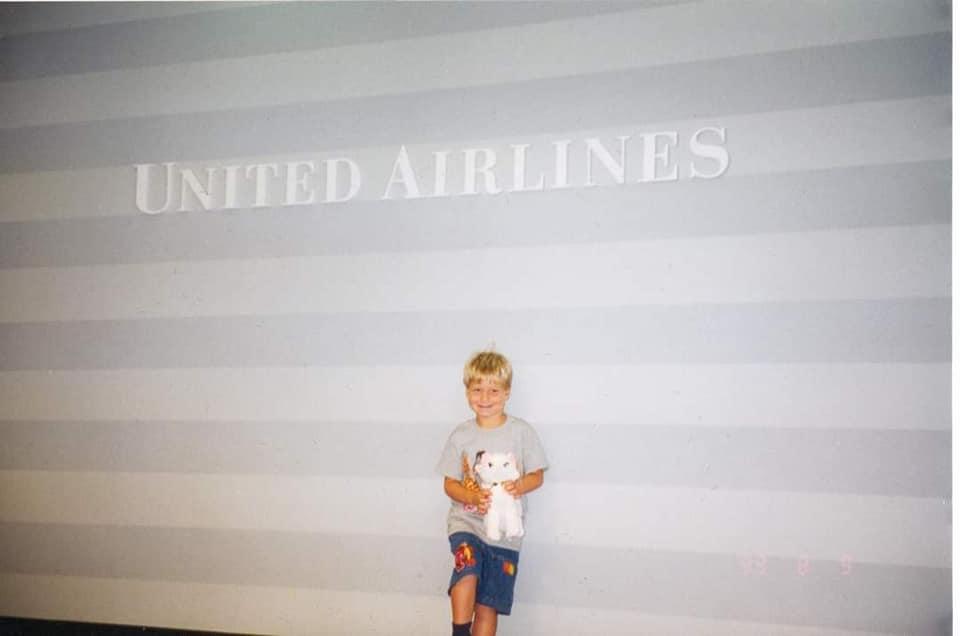

Andrew was hired by United and started training January 4. It was hard for him to leave SkyWest, but this has been his dream job since he was little. He will be flying 737s out of LAX until a spot opens in Denver. We are super happy for him. I am looking forward to more fun trips to places that I have never seen.16 points

-

Hey, Everybody, we're all good. Lots of hail but the tornadoes missed us! Thanks for checking!16 points

-

Fifteen years is a long time, but 9/11 is remembered vividly by all of us as the most profound and defining day in America's history. We lost nearly three thousand heroes that day, civilians and first responders alike. As a former firefighter in NYC, I know why 343 firefighters and 60 police officers were killed. There is a segment of a bible proverb in every firehouse, "Greater Love Hath No Man" (than this, that a man lay down his life for his friends). Those first responders ascending the towers' staircases knew what their fate might be. But they still tried to get as many people out as possible. That's the job, that's what we do. September 11th is called Patriot Day, a day of Service and Remembrance. A fitting dedication to honor all those lost on that awful day. First responders around the world do their job with unwavering dedication, continuing the legacies of those lost. We will be doing the same as we remember and serve those in need. Please say a prayer for all those who have become sick from 9/11 related diseases. 120 NYC firefighters have died since, and many others are battling for their lives.16 points

-

16 points

-

16 points

-

...wishing the ATX Community a happy 7th birthday. This site was created April 10, 2007.16 points

-

Yes, lots of letters are coming to my clients because in spite of my spending countless hours explaining why I needed their exact stimulus payments, many got them wrong. In other news, I did sell my business! YAY! I will continue to work for the buyers for at least 4 years. I will be transitioning from TaxWise to Ultra Tax. Praying for an easy learning curve. I'm so happy to be an employee and not a business owner. One more step toward retirement. And yes, you will still see me here!15 points

-

New client with five rentals. NOT a real estate professional. Came to me because HER LENDER told her that her 2013 and 2014 tax returns were not prepared correctly. Boy, that is the understatement of my short, illustrious career. Preparer put the rentals on Sch C, charitable donations on Sch C, made up 14,685 business miles, completely omitted depreciation (but the mileage made up for it). Lo and behold, we have EIC! The rentals are in a trailer park. Taxpayer lives in the last trailer in the row. There is NO travel. WTH? I also looked at what the preparer before this inept person did in 2012. She used Sch E. Good call there. However, two rentals, that had been depreciated for 16 years, were sold. Not a peep about accumulated depreciation on Form 4797. Taxpayer had gains of 32,000. Tax return comes out that she made 1,200. Where is IRS? These errors are GLARING. Stuff like this kills good tax preparers. In general, people here are not well off. They go to the preparer they can best afford. They either think all preparers know what they're doing, or they don't care if it's correct. This 2013 and 2014 preparer charged $150. It's worth nothing. She is making twice as much as me per hour and producing crap. How is a good preparer going to compete with these bad preparers if nobody is minding the store? I realize that many of you have all the business you want and/or have clients that will never leave you, no matter what. It's not like that in Rural, TN. C'mon, IRS, help a girl out.15 points

-

So glad it’s over! This morning as every year I leave MA at midnight to spend a few days with Mom in NYC after being away for nearly 3 months. She’ll be 99 in a few weeks and all she wants to do is play dominoes, Bingo and drink my homemade wine with no sulfites. A tradition I hope goes on for as long as I am in this business. Photo is not long ago.14 points

-

14 points

-

14 points

-

14 points

-

Shout out to my girl RitaB for hosting such a wonderful event. I have considered her a friend online for years, but now she is like a sister. She put on a fabulous lunch for us all and we just had a marvelous time hanging out. Love you Rita....you are the best. In case it does not get mentioned, Possi is the best joke teller of the group. She does accents and dialects for all her characters. Abby is not far behind, he is very fun. Abby is also brilliant and has a wonderful spouse. Margaret can cook! Catherine is sharp as a tack and competitive as all get out. Jack is just like he is online. Edsel is a soft spoken southern gentleman. Gail is very sweet and funny. The back forty has a lot of flowers in it. Seems to be well tended and fertilized. Seriously, the view from Rita's house never gets old. I just kept walking outside to look out over the back 40. Beautiful country to look at. And most important....BulldogTom and Catherine are the undefeated cornhole champions. Thanks again RitaB for hosting. Tom Modesto, CA14 points

-

My assistant and I went for a doubles massage. My neighbor brought us a little bottle of champagne, so we had some bubbly before going. This gal, Cynthia, has become like a daughter to me. With no job and no plans for a career, I took her under my wing last year. She was even better this year. I'm helping her study for her EA (even though I have no plans for my own) so she can plan her future in taxes. Personally, this has been the most peaceful, joy-filled, and productive tax season in my life. Thank you for all your assistance, all your laughs, and for being my extended office. This is my safe place, right here. What a difference this site makes in my business and my spirit. Saturday, I begin HORSEBACK RIDING LESSONS. Yes, 62 this month, and I'm finally able to fulfill a dream of mine. I am going to a Christian camp so that if I fall off the horse and "wake up dead," they know how to pray me UP! AMEN? I'm a very blessed woman! Thanks, and God Bless y'all.14 points

-

Since no one responded to the thread for the week of 3/24-3/30, I hope you all like my decision to make @Eric an Honorary Aficionado for putting up with us (probably mostly me bugging him at times), and I'm also awarding him a crown of golden laurels for keeping this forum up and running for the last 11 years. Thank you, Eric! If anyone that has benefitted from this forum has not yet donated to Eric, please consider doing that to help keep the site up and running. If you consider the time another member here may have saved you by providing answers not easily found in other reference materials or sites, or if this site has helped make your season a little easier or more profitable, I think you'll agree that a donation isn't too much to ask.14 points

-

Preparation is - done! Extensions are - done! I am - DONE!!!!!!!!!! Will work on some quarterly payroll reports tomorrow and Thursday while putting out minor fires that pop up - and then we we are out of here for four relaxing days!14 points

-

HUGE bald eagle flew at low altitude over my car and then landed in front of me (I was going slowly to start with, and stopped). First time I've seen one live and in person. This was in Lexington MA, barely a 1/2 mile from a major interstate highway. Wow. Just wow.14 points

-

Ah yes, "the hipster underwear taxpayer strategy". Happens to me at least once a year. Taxpayer slips in a flattering (size), popular, functional and colorful 3 pak, trying to gain your generosity in calculating their tax liability. IRS knows all about it and they have sent out briefs on the subject to warn us to not get boxed in by this ploy.14 points

-

Long-time client (and family friend) was in an "unfortunate" marriage for several years. Her spouse earned cash (under the table) and had not filed taxes in 5+ years and was not going to start just because he got married...so I have had to file client's returns MFS even though jointly was better because husband did not want his name ona a return and refused to sign a MFJ return. Client finally divorced the guy (unfortunately not final until January 2016). Client demands to file HOH (daughter lives with her) instead of MFS. The problem is that client already told me in several previous conversations that she did not move out until Sept. 2015....so did NOT live apart last 6 months of the year. After reading some IRS literature I sent, client is now telling me to file HOH under assumption that they did NOT live together last 6 months. I told her I could not file that way, as much as I may want to, because I had reasonable belief that it was false. Client cried Client shouted Client is no longer client but I will sleep well knowing I did not file a false return. I figure she'll find another preparer this year...to whom she will know what not to say...and she will probably be back to me next year. This job.....14 points

-

Ok, you started it! Granddude pics for your viewing pleasure. 3 of the current 4 with one on the way in July.14 points

-

14 points

-

14 points

-

I am retiring from practice, gray hairs and all. I hope I can still drop in and chat with ya all, from time to time. Thirty seven years is long enough I think. Although I will still have to prepare mine,.. going back to pencil....NO SOFTWARE Giving away all my office furniture and equipment to charity today, hope they can use it or sell it. All in all it has been a rewarding career. I may miss it for a time, but I guess all things come to an end. My best wishes to every one of you pro's. Elrod14 points

-

7 years ago today, my high school sweetheart and wife of 17 years passed away. Some of you were with me in spirit then (on old ATX forum) and offered words of encouragement. Thank you. Life is a crazy-magical thing....the door closed on that part of my life....and another opened just a few months later....affording me the opportunity to spend the 2nd half of my life with a grade-school sweetheart. During this time of year that is so filled with tax returns and clients....a take a little time to remember and be thankful. The motto I've learned to live by: "Shit happens...get over it...live happy"14 points

-

Client decides to jump on board the direct marketing bandwagon and start a "business" selling hand bags/purses (through Thirty-One). I sit down with her and explain the whole idea of business vs. hobby and explain to her what expenses might be deductible if we do approach it as a business...to assist in reducing the affect of her $1,000 1099-MISC income. She admits that there is no area of her home used exclusively for this activity, so no OIH...thus I inform her that she cannot deduct mileage...even if it was business-related...which was in itself questionable. I also inform her that her cell phone is not deductible since (among other reasons) she does not have another home phone...just her cell. She seems to understand and leaves me with her papers with a positive attitude...understandably since her product cost and other legitimate expenses would reduce her "profit" to only approx. $300.00....not having much affect if any on her usual refund. However, this evening, she e-mails me that she has been talking to other people she knows that do such "businesses" and they have been deducting such expenses for years...and that if I cannot deduct those things, she wants her papers back...below is my response...first time in my 16 years that this has happened. She is a nice young lady, but so be it...I do not have time for that crap. I understand completely. I pride myself on preparing returns according to IRS regulations in a manner that would hold up under IRS audit. A person can claim anything on their tax returns and not suffer any negative consequences…until they are audited….and there are no shortage of preparers willing to claim those deductions in order to attract or retain clients. While the chances of you being the unlucky one is really small, I will not lower my standards or risk my professional reputation by putting my name on a return that I consider questionable. I will be home tomorrow evening after 7:00pm, and other evenings this week after 6:00pm. I will have your papers ready.14 points

-

13 points

-

My younger daughter and her husband today gave their toddler girl a baby brother. The handsome little bruiser clocked in at just a hair over NINE pounds. Mama and son are doing well.13 points

-

Horrible year personally but the work was OK. Everything is worked on and out. I try to aim for around the 10th or 12th to get most done and give myself a cushion of time. I have one client meeting today for pickup, and then I'm waiting on signature forms for the rest. I will have only 3 extensions, all for one client for his personal and 2 little partnerships. I took yesterday off! I've been taking care of mom full-time for the last 5 years with increasing demands the last year or so. Now at 96+ yrs old, early dementia and was still living at home until a fall in late March. She was unhurt, but it landed her in rehab. Three days in she, I, and my husband all got a nasty GI virus circulating in that facility. I was completely down for a few days and feeling sick most of a week. Then a second hospital trip with her last weekend and another night with no sleep because rehab made a bad call on when in actuality she had lower rib and hip pain radiating. After all night in the ER told me to give her some extra strength Tylenol and that transport would be another 6-7 wait. No way! I drove home for her van and took her back to rehab myself at 4-something in the morning! In the next few weeks I have to find permanent placement for her somewhere and begin to clean out the family home that she has lived in for more than 70 years. Because of mom's needs, I haven't taken any new clients in these last 5 years and most of my business clients got old, retired, and/or sold their businesses. My workload is much lighter than it should be now when I should have been building my practice and couldn't. That is some of the reason I've had some extra time in the past few years to answer lots of questions here, away from the office and the internet to fill up time. Husband is doing well with fighting the bladder cancer, the prostate cancer is treated and gone, and other issues were fixed in '21 that were heart ablation and AAA repair. When a SIL passed suddenly last June, I started walking with my brother in the very early morning and have gotten more fit again. I'd walk anywhere from 3-5 miles every morning until the time changed and everything fell apart with mom. I wanted to walk last week but in the turmoil I ended up with a twisted or sprained ankle that I'm babying at the moment. I don't know how that happened but it's getting better. Also thanks to two brothers, my husband and I have taken up shooting sporting clays, or some may still call them clay pigeons. They are all excellent marksmen, so I have lots to learn and catch up on. I love the outdoors and all kinds of activities, and this is the latest and one I never dreamed of trying. I bought a shotgun of my own. We took advantage of yesterday's beautiful weather, went shooting, and got away from all the pressure for the afternoon. I'm slowly improving and was pleased with my progress on a more difficult and new-to-us course. If you made it through all of that, thanks for reading!13 points

-

13 points

-

Whose woods these are I think I know, His house is in the vilage though; He will not see me stopping here To watch his woods fill up with snow. My little horse must think it queer To stop without a farmhouse near Between the woods and frozen lake The darkest evening of the year. He gives his harness bells a shake To ask if there is some mistake. The only other sound's the sweep Of easy wind and downy flake. The woods are lovely, dark and deep, But I have promises to keep, And miles to go before I sleep, And miles to go before I sleep. Stopping by Woods on a Snowy Evening - Robert Frost (1874-1963)13 points

-

I've never said, "If you have to ask, you can't afford me." but I'd like to do that once before I fully retire.13 points

-

MERRY CHRISTMAS to all! We just bought our Christmas Tree from the market. One of our better clients She deals with good people and even said if we gave it plenty of light and water she would even and come and take it away for us come February! So nicely shaped and just the right amount of fill, etc. Kind of strange quills - I did not get the type. What a great deal and nice young lady she is!! First year in this endeavor, hope she does well. /s13 points

-

I am right with you JB. You have to have some comfort in know you did the right thing. It's not even worth mentioning the consequences you could face had to succumbed to the client's desires. Good Job!!! All I know is that for every client that I have lost for what ever reason, at least two or three takes their place. Go figure. I fired a client last summer that was almost at the top of my PITA list. They opened the door by asking me the tax consequences of selling a building and have the buyer pay them partial cash and the rest with a check to avoid paying capital gains on the sale and if they absolutely had to report it. This opportunity was a blessing to say nope and now you breached our agreement and I can no longer provide you service as I cannot be part of anything that suggests tax fraud. I was told to forget everything I had just heard. Nope no can do, engagement ended. Man am I glad and I have already gained another S-Corp to take their place. So, stand up for what is right, you can't go wrong.13 points

-

I really try not to judge...I can't know all of the sad/gory details of clients' lives and don't want to. However, when a client quits her two part-time jobs at the same time in 2014 because she has hit what she terms "the EIC sweet spot"...sits on her butt the remainder of the year being lazy (her words), chooses not to get insurance (even though subsidy would pay for almost all of it). gets sick and wants sympathy for not having health coverage and instead having big medical bills....then complains to me because her EIC and refund are not higher and how "that damn hospital" won't cut her a break on the bills. Her rent is subsidized through a county agency. She gets WIC (food stamp/card) and child support. Is mentally and physically able to work, but just chooses not to. Bitches to me for 10 minutes about how the government does nothing for her her refund is almost 25 times what she paid in. I need scotch13 points

-

Edit: I moved this so that we may all wish Jack our sincere congratulations, and so that it won't hijack another topic. It's a little misleading that the forum list shows Jack started his own thread of congrats. lol That was not the case. I should have used the "merge" function instead of "move". ~ Judy HEY!! I resemble that!! Passed all 3 EA exams last week. Just waiting on the official paperwork from the IRS. All of this talk about regulating preparers, and the ability to properly represent clients before the IRS are the reasons I stuck with it and won.13 points

.jpg.789f867d3b973abc8fc99dc3a5ce1eaa.jpg)

.jpg.5968a982a3fc3c4787f9842daab95ecb.jpg)

.jpg.799afa21cc12950b99f81732b0ddcb47.jpg)

.jpg.2a794d7e2eddec845158703293a25710.jpg)