Leaderboard

Popular Content

Showing content with the highest reputation since 06/20/2025 in all areas

-

I definitely would be forced to retire. I hope that everyone remembers Eric before you spend all of your profits. Also, a special Thank You to Judy for her pristine Moderation and all of the rest of you who reach out so generously to help those of us in need. I couldn't do this without all of you.11 points

-

No, the losses in year of death are handled like any other year. Any capital losses that are unused (those that would carryfwd if the person lived) are lost. They die with the decedent.8 points

-

No matter how many people they hire, it won't improve significantly until they invest in new infrastructure. I had to be transferred three times, over two hours, to reach the person who could access the platform needed to fix the issue. Once I got to the right person, it took 10 minutes to resolve the issue.5 points

-

Treat these as distributions to shareholders, unless you can convince them to repay the business.4 points

-

4 points

-

If the investment account was joint and originally funded jointly, half of the carryover losses belong to the surviving spouse and can be used on his or her future returns. The deceased spouse's half is lost forever after the final return. Many of us still have clients who lost a fortune in the 2008 market crash, pulled out of the market altogether, and will have to live to be 200 to use up the losses at $3k per year. That $3k limit has been around since 1978 and never adjusted for inflation.4 points

-

That's correct. What this means is that the final 1040 can show up to a $3,000 loss (just like usual) and any remaining loss carryover is lost. The planning opportunity mentioned is where a surviving spouse can sell capital assets having a gain in that year of death so that the otherwise unused losses would offset those gains. Example: your client is allowed $3K of losses allowed in the current year and $25K losses unused that are going to be lost. The taxpayer (prior to death) or surviving spouse any time during that year, if filing MFJ, could have sold other capital assets having GAINS up to that $25K with no additional tax effect. If single, that client could have done that in prior years or in the final year prior to death to use up the losses so that they aren't lost. For a single taxpayer where someone has a POA and is aware of the situation, that person could so initiate such a sale of capital asset prior to the taxpayer's death.4 points

-

Honestly for the last several years, my experience once I have reached an IRS employee has been satisfactory. Does it take too long to get someone on the phone ? Yes it does. Does it take too long for them to find an answer or to change something in one of their programs? Yes it does. However given the old systems they are still working with that don't share information, I think they are doing the best that they can under difficult circumstances.4 points

-

G2R Thanks for sharing this disaster with us. It certainly puts a different perspective on whether or not to use IP Pins3 points

-

Umm, I thought the purpose of all this was to eliminate waste. Isn't paying people not to work somewhat wasteful? Just a short time ago we were elated that IRS finally got funding to increase staff so phone wait and processing times would decrease and audits would increase in areas we knew needed auditing. TAS was the place we went to when all else failed. Taxpayers are really going to feel this. They won't be able to get questions answered or problems solved, all the while knowing that others are cheating and getting away with it.3 points

-

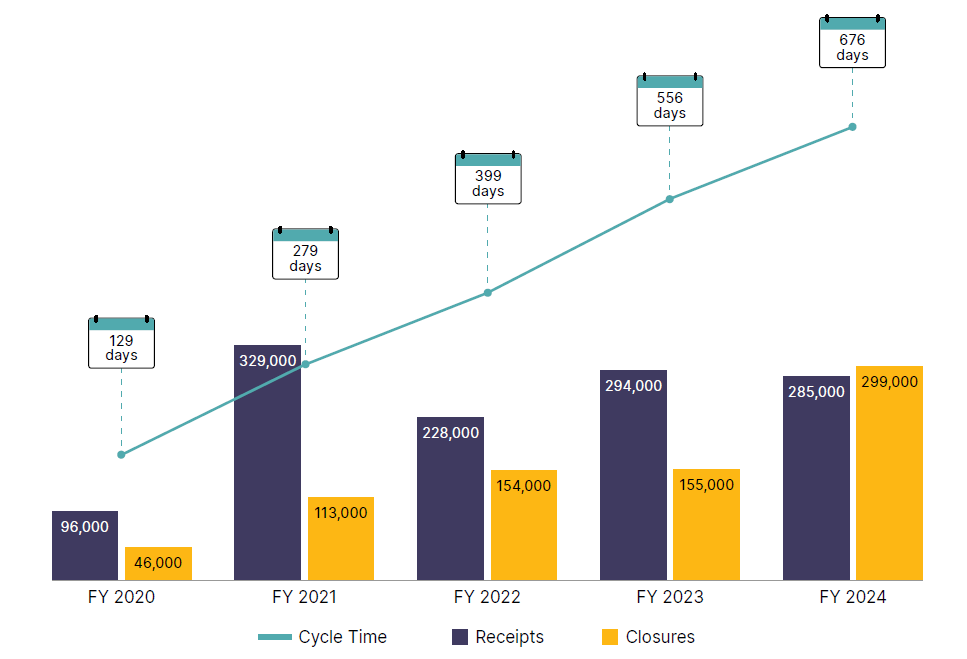

Copied from the Tax Advocate's Mid Year Report to Congress: "One longstanding filing season challenge that remains unresolved is lengthy delays in resolving identity theft cases. There are two categories of identity theft cases. One involves returns that IRS return processing filters flag as potential identity theft; the IRS flagged about 2.1 million such returns. In these cases, the IRS sent a letter to taxpayers notifying them they had to authenticate their identities before receiving their refunds. The IRS typically takes several months to resolve these cases. In the second category of identity theft cases, a thief has stolen a taxpayer’s identity and filed a tax return using the taxpayer’s name and Social Security number. These taxpayers are victims and may also be experiencing the effects of identity theft beyond the context of their tax returns. Their cases are referred to the IRS’s Identity Theft Victim Assistance (IDTVA) unit for resolution. As of the end of the filing season, the IRS had about: 387,000 IDTVA cases in inventory, and the cases were taking an average of about 20 months to resolve. “These delays disproportionately affect vulnerable populations dependent on their refunds to meet basic living expenses,” the report says. In fiscal year (FY) 2023, 69% of affected taxpayers had adjusted gross incomes at or below 250% of the Federal Poverty Level." Sometimes my mind really struggles to understand this stuff2 points

-

It was Joe McCarthy. He was indeed great. I think he said his wife took the deferred resignation, also, but I'm not sure I remember. She prosecuted the Son of Boss or one of those schemes. They're both wicked smart and probably saved well for retirement or have already found consulting jobs. I hope they go into tax teaching.2 points

-

On 16 April I heard from our CT Stakeholder Liaison that he'd accepted Deferred Resignation and expected to be put on administrative leave shortly while being paid through September. By 9 May I heard from new Stakeholder Liaisons in NY (2) and NJ who are covering the northeast. I think CT's Liaison (who was great, by the way!!) was gone by 30 April. Probably the same end-date for the former NY and NJ Liaison's.2 points

-

I'm sure that someone who uses Drake will confirm that Drake is just sending a PDF via some secure method. Personally, I don't know why every tax pro doesn't print a PDF of every return and every other document they produce, for safekeeping, quick access and backup. I use a secure email service (sendinc.com) to exchange documents with clients. I can set the email to self destruct after as little as 1 day up to 365 days or never. I usually do 30 days. It's a very inexpensive service and most clients can use it easily. All they need to do is create an account with their email and a password of their choosing.2 points

-

https://www.thetaxadviser.com/newsletters/2020/mar/married-taxpayers-jointly-owned-business/ @DANRVANThis is a second article from The Tax Advisor that disagrees with your interpretation by saying that MMLLCs are state entities that do not qualify to make the 761(f) election, and that goes on to make the separate point of an exception to those in community property states. I would still tell the OP to file a 1065. In Argosy, the court didn't need to consider that it was an LLC or not because there were previous filings as a partnership. ----------------- As to your H-W rentals in your state and the audit you mentioned, not all auditors are that good. Are these in LLCs? Even if not, did you make a 761(f) election for them? Do you check for material participation of EACH party each year without attribution of the participation of each to the other? Also from the same Tax Advisor article:2 points

-

I worded that very poorly. I revocable trust can have biz prop that is QJV, but it can't be in an LLC, rather it must be operated in an unincorporated entity. So in your case, QJV would be off the table on 2 scores: because the rental is in an LLC and because the client is in a non-community property state. Sorry for the confusion.2 points

-

Send him to IRS DirectPay so he can get a payment confirmation: https://www.irs.gov/payments2 points

-

Here's Joe's letter to us in the NY/CT-ATP: Dear Tom and Rita, Due to significant staffing reductions at the IRS in general and in Stakeholder Liaison in particular, I have decided to leave the IRS under a deferred resignation program. You might have heard this program referred to in the press as “the fork in the road”. This means that while I will still technically be an IRS employee until the end of September I will soon be placed on administrative leave and be unable to perform any of my official job duties. Before I leave the IRS, I just wanted to let you know that it has been my absolute pleasure to work with you over the years. As I always say … working with tax practitioners is (and always has been) the very best part of my job! I am looking forward to the next phase of my life and I wish you all the best in the future. Also, due to the significant staffing reductions, I am not sure who if anyone will be taking my place. If you wish to contact Stakeholder Liaison in the future I suggest you use the contact information in the following link: https://www.irs.gov/businesses/small-businesses-self-employed/stakeholder-liaison-local-contacts Feel free to share this information with your members. Most sincerely, Joe McCarthy CPA IRS Senior Stakeholder Liaison 150 Court Street, 5th Floor New Haven, CT 06510 203.415.10151 point

-

Was that still Joe McCarthy? He was indeed great, very helpful and so funny that no one fell asleep during his portion of a seminar. He once told those "who have never been in an IRS return processing" campus, they really do take all the staples out and have papers scattered over the floor, which is why they request the same docs three or four times. His wife was an IRS agent. If she still was, maybe she's been downsized too. Tough to have both breadwinners in a family unemployed. And it's the IRS's and our loss to have so much expertise dismissed.1 point

-

1 point

-

That's all correct and you don't need to do anything else. There is the question of basis in the S corp and whether any of those distributions are taxable, so be sure to do the basis calc on the K1.1 point

-

And I would not issue any 1099 from the corp to the LLC, because you're creating hobby income and paying tax twice on the same income. Just leave it on the K1 as ordinary income and in the basis worksheets as distributions to shareholders.1 point

-

1 point

-

Exactly, for tax purposes the creation and involvement of the LLC is just a smokescreen for their dancing hobby, which is not a business!1 point

-

1 point

-

Trust was setup years ago. LLC was just setup last year and owns the rental. I got the EIN letter from the client, they state 1065 as the expected form filing.1 point

-

Also see this article in The Tax Advisor: https://www.thetaxadviser.com/issues/2019/apr/llc-spouses-partnership-joint-venture/1 point

-

@DANRVAN Dan, IRS information page on QJVs says it can't be held in a state-recognized entity such as an LLC. Are these IRS pages incorrect? This rental the OP asked about is in an LLC owned by the rev trust. According to the original post, this is in a NONcommunity property state. Do you still think it goes on Sch E and not on 1065?1 point

-

1 point

-

"Designates a person on the taxpayer's tax form to discuss that specific tax return and tax year with the IRS." My understanding is that this only allows you to discuss what's on the form submitted. It doesn't authorize the IRS to share any information with you or for you to represent the taxpayer. I don't believe that responding to a notice received by your client is covered by being a third party designee.1 point

-

Two weeks ago I called the IRS in regards to a notice my client received which I have third party designee, guess what I had to conference call my client to discuss the notice. First in all the years of doing business, the payroll report was filed in April 2025 so it was not expired.1 point

-

I thought an LLC was an unincorporated entity because it's a partnership.1 point

-

Revocable trust is a grantor trust and is generally ignored for tax return reporting unless it has an EIN and requires a separate 1041 for income to pass through. As you said, QJV is off the table because you are dealing with a non-community property state. Trusts are precluded from holding business property that elects to be QJV anyway. With all of that in mind and being a revocable trust, then the LLC reporting falls to state law. If this had been a SMLLC, then it would certainly be reported on 1040 Sch E. Because it is a MMLLC, then you would look to state law which probably says that the multi-member LLC (even H-W) would default to a partnership unless the LLC had the ability and elected to be taxed as a corporation. In your client's case, it sounds like this should be on a 1065 using form 8825 with the husband and wife each receiving a K-1 from the partnership.1 point

-

People can physically go to the bank to make withdrawals and deposits. No passwords or online banking required. Just an ID, and sometimes, not even that.1 point

-

https://www.irs.gov/newsroom/irs-statement-on-delay-in-processing-some-electronic-payments Even their notice is delayed1 point

-

Sounds like Drake (and ATX also) are not the problem, but the IRS itself won't allow direct withdrawal after April 15, even if they have extended the due date. Doesn't make sense. I think my client wants to pay on October 15th, so I'll just send him a voucher and he can send in a check any time he wants. Thanks to all -1 point

-

It used to be the an individual could get an FEIN. That way, no LLC needs to be formed with whatever state fees are due at formation &/or annually to SoS &/or DRS.1 point

-

Oops, posted too soon. I've take the discount for all the years prior but now use only 1040 package so it's only $140 or so. With back surgery Monday and moving in June, I'm not sure whether I will continue. My healing process will determine. When I used MAX for many years, it was worth it to pay early as the amount was more significant. And then one year someone posted that they got the discount in the fall after all. Maybe begging and pleading was involved - or bribery, who knows? I am passing this time. YMMV1 point

-

I am one of the cases. We originally filed the return September 2022 -- In January 2023 after still not receiving the refund, we learned there was ID theft. Elderly client who unfortunately passed away during all this. The fraudulant return was flagged, and luckily, not paid out. When the legitimate return was filed, the process of ID verification begin. We had to go through ID verification 7 times before it finally stuck. (well hopefully, the refund has still not produced) Originally in June 2023 we were told it could take up to 430 days. In August 2024, we were then told maybe 640 days. Called last week (you know, 2 years and 9 months after filing the original return we filed) and were told ID verification is confirmed, but it has yet to be assigned to a case worker. So, about 1,000 days later ... we are hoping the National TP Assistance will help us.0 points

-

Copied from the TIGTA Report "FY 2023, cases worked by TAS generally met its acceptance criteria and taxpayers’ issues were fully addressed. However, we found TAS case advocates did not timely contact taxpayers or their representatives in 103 (63%) of the 163 closed cases we sampled. The initial and subsequent contact delays for these cases totaled an average of 146 calendar days late." "The National Taxpayer Advocate stated that TAS case advocacy is facing three challenges: rising case volume, new staff, and outdated systems." Well, this is really discouraging0 points

-

And the burden of TAS failures and IRS administrative bungling falls upon the taxpayer.0 points

-

It's sure not going to get any better. From the TA Mid-year report to Congress The TAS itself has been reduced by 25 percent. BTW, my understanding is that those who took the offer are actually leaving at the end of this month, though they will "remain on rolls" and get paid through Sept. 30.0 points

-

According to the Federal News Network after this years layoffs/deferred resignation confusion, the new budget for the coming year proposes to hire 11,000 new call center employees in order to maintain current levels of phone service https://federalnewsnetwork.com/workforce/2025/06/nearly-25-of-irs-tech-workers-are-gone-forcing-agency-to-reset-and-reassess/ I really wonder, "Are there any adults in charge of this train wreck sliding downhill0 points