TexTaxToo

Members-

Posts

295 -

Joined

-

Last visited

-

Days Won

16

-

More details here: https://www.kff.org/policy-watch/how-will-the-2025-budget-reconciliation-affect-the-aca-medicaid-and-the-uninsured-rate/

-

Descendent Return with Court Appointed Personal Rep Attachement

TexTaxToo replied to b#tax's topic in General Chat

The software should handle it, but: The recommended name is: PersonalRepresentativeCourtCertificate.pdf with a description of: Personal Representative Court Certificate https://www.irs.gov/tax-professionals/tax-year-2024-modernized-e-file-schema-and-business-rules-for-individual-tax-returns-and-extensions -

-

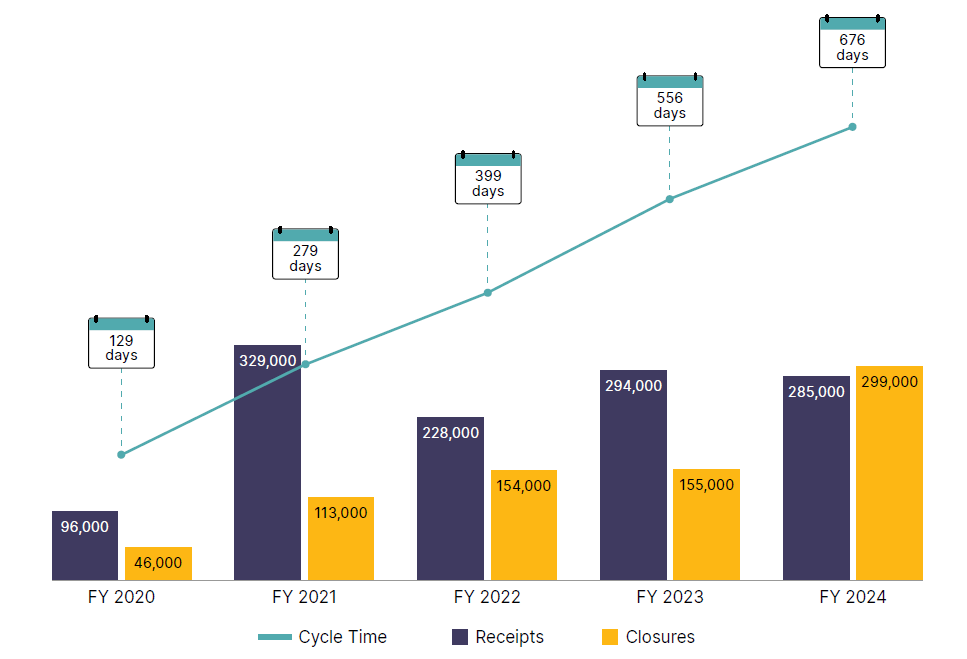

It's sure not going to get any better. From the TA Mid-year report to Congress The TAS itself has been reduced by 25 percent. BTW, my understanding is that those who took the offer are actually leaving at the end of this month, though they will "remain on rolls" and get paid through Sept. 30.

-

The MeF (efile) system will not allow future direct debits to be scheduled after April 15 when efiling a return. The IRS does not modify it for postponements due to disaster declarations. I believe the taxpayer can still schedule future payments using Direct Pay or EFTPS at https://www.irs.gov/payments

-

There have been a lot of disasters which postponed the deadline to November, but certainly not for everyone (so far https://www.irs.gov/newsroom/tax-relief-in-disaster-situations

-

Since Room & Board is not a qualified expense, a scholarship for Room & Board is taxable to the student. Any amount used for tuition and other qualified expenses is not taxable.

-

Here's my guess at what is meant: Total income other than SS: 44671 Gross SS: 16860 Taxable SS: 13736 AGI (as originally stated): 58407 MAGI for Form 8962: 61531 (this assumes no tax-exempt interest/dividends) Without the year of marriage calculation, this would require a repayment of $3150 With the year of marriage calculation, the monthly contribution is $63 and repayment is $704 Form 8962 is filled out as follows with everything else blank: 1. 2 2a,3. 61531 4. 19720 (assuming other 48 states is checked) 5. 312% 7. 0.0630 8a. 3876 8b. 323 9. Yes 10. No Lines 12-22: 1256 1193 63 1130 1130 1194 24. 12430 25. 13134 26. 0 27. 704 28. 3150 29. 704 36. 1 63 01 11 ----------------------------------------------------------- If you need worksheet III for the spouse: 1. 1 2. 30766 3. 14580 4. 211% 5. 0.0244 6. 751 7. 63 8. 01 9. 11

-

Pub 550

-

Have you reviewed the Proxy statement regarding tax matters for the merger: https://www.sec.gov/Archives/edgar/data/1732845/000110465924053001/tm243828-20_defm14a.htm#tMUFI

-

You must make taxable a part of the scholarship that was or could be used for tuition, in addition to the amount in excess of tuition. For example, if tuition was $24,000 and unrestricted scholarships were $40,000 ($16k in excess of tuition which was used for room and board). If you make $20,000 of the scholarship taxable to pay nonqualified expenses, that leaves $20,000 to apply to the tuition, and that leaves $4,000 of tuition available for the credit. The scholarship terms must allow that $20,000 to be used for nonqualified expenses and it would be taxable to the student. And pay attention to Slippery Pencil re. kiddie tax and getting an accurate statement of account - was the scholarship actually used for qualified expenses in another year, or was it for room and board in the current year.

-

Hmm. Pub 4012 is the guide for VITA/TCE. It says:

-

Note that this type of "theft" is not subject to the 10% of AGI+$100 reduction for casualty losses and should flow to line 16 of Schedule A (not line 15).

-

Rev. Proc. 2024-31 explains the QM PIN requirements. Manufacturers must label units with the QM PIN, or otherwise provide it to purchasers. They must at least quarterly provide the IRS with lists of the QM PINs they have issued which qualify. So the IRS will know which are legitimate. I think it is unlikely that there will be a generally available lookup tool, as there would be too much opportunity for fraud (someone could look up numbers until they got a match and use it on a return). "The IRS urges QMs not to place a product’s PIN on the exterior packaging of the product," presumably for the same reason. I wonder if there will be a new reject code "The QM PIN entered on the return has previously been entered on another return".

-

Judy, I disagree. Worksheets I and III should have 1 for the alternative family size (and that may be his problem), but Form 8962 should have 2. The example on page 44 of Pub 974 makes this clear. The example has one spouse with no dependents and one spouse with two dependents: Then on the worksheets: