-

Posts

2,834 -

Joined

-

Last visited

-

Days Won

29

Posts posted by Terry D EA

-

-

I have used QB in the past. For the most part it is not beginner friendly. But.. if the payroll is setup correctly and not too complicated with fringe benefits; etc. It does do a fairly decent job. PR tax payments can be setup for automatic EFTPS deposits, state deposits; etc. I agree with Medlin though, to start they should use a service.

-

1

1

-

-

It seems there are some previous post regarding Robinhood Securities and I apologize if I am beating a dead horse here. I do understand the transactions and do know where they go; etc. My client just brought in 52 pages of these transactions. If I read the top of the 8949 correctly, we can enter these transactions as a summary????? For me to enter each individual and group transactions will take about 2 weeks solid work. I don't think this guy can afford that. Yeah, I would love the final bill but really????

Proceeds of one summary is $385,093.75 - By the transaction dates, these are day trader transactions. BTW- he lost his butt on this.

-

I stand corrected on NC. NC always uses the Fed taxable income as a starting point. With that said, the exempt unemployment from Federal is also exempt from NC.

-

NC has not announced any changes yet and quite honestly, I don't expect them to. They always tax unemployment. The Drake update also corrected already filed taxes returns with unemployment compensation. There a fix in the works to correct this and we probably won't know until the IRS releases the guidance on how to amend those returns.

-

4 hours ago, cbslee said:

Their SE and taxable income is based on their share of the PTS Annual Income.

Their monthly draws( distributions ) don't determine their taxable income.

Because a partnership is a pass thru entity, aren't guaranteed payments subject to SE tax? Distributions, would seem to be a distribution of capital as the OP states?? The extra loads would definitely be guaranteed payments. It sounds like what the OP said the distribution title was used to avoid the SE tax. Too bad the agreement isn't more specific.

-

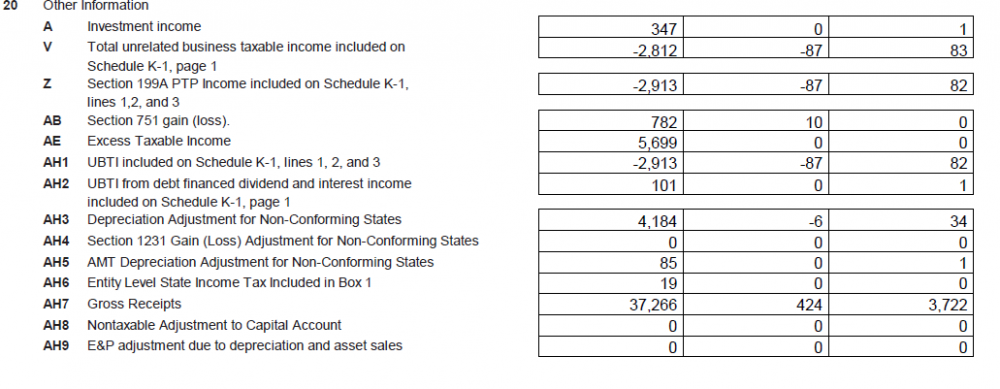

I do have that detail and it does tell me where to enter parts of it. For example, the 782 gain is supposed to go on form 4797 section II. I can't find the input for that. I did see on the partner's basis worksheet where an entry for 4797 part II but in Drake it was labeled a bit differently which throws me off a bit. There is no explanation for the gross receipts of 37,266. The AH3 depreciation adjustment for non-conforming states. Client is in Texas. I guess I'll check to see if Texas requires anything. I'm glad we're still waiting on another K-1 for this guy. Gives me some time.

-

-

I don't split anything nor do I make any decisions. It is up to the taxpayer and their dependent who gets what. I don't have time to list where this is in the Pubs but I do know you are only listing what both parties agreed on. You are affecting each persons refund or balance due by the percentage(s) each party agrees on. Sorry I can't explain it any better right now.

-

Tom,

The square appointments is easy to setup and is also easy to manage. During the setup, I set the hours that I am normally open for business. Also included in the setup are the services I offer and the time normally allotted for that particular service. I list whether it is a drop off, review and pickup, individual return, consultation, etc. None of my business clients use it nor any rental enterprise partnerships that I have. But, for individuals it works great. I can also block out a time when I'm not available for anything personal. Example; I have to go to my daughter's in Delaware one weekend. This will only be a two day trip over a weekend so I am only closing for one day. I don't take walk-ins only appointments and this works great. Client's can also pay through the square appointments. I don't use that feature cause I never know exactly what they are bringing me. Hope this helps.

'

-

1

1

-

-

I haven't used ATX for years so I can't answer. Drake does have a scheduling program. I don't use that either. I schedule all of my appointments through Square appointment. I have a booking button on my facebook page and plan on putting it on my new webpage. I don't have a secretary to schedule appointments and this helps so much. It also connects with my google calendar. With this said, Drake might do all of that, but I have not had time to try it. Square is free as well. JMHO

-

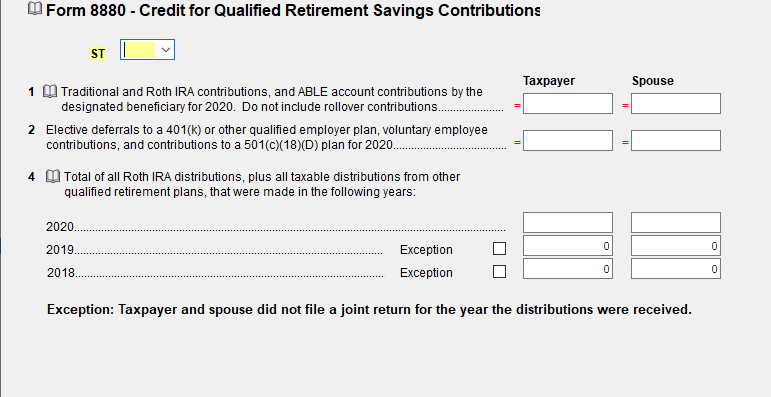

If this is the input you are asking about, The only information you have to input is the items on line 4 if any. The contributions made by the employer is input to this form from the W-2.

-

1

1

-

-

Yep, I totally agree. I have a self-employed author that files a Sch C each year.

-

So deeply sorry for Rita's loss. Prayers of comfort for her and her family.

-

1

1

-

-

Judy,

Thanks so much for the info. I will review the links in your last message. I just learned from the partner that he did not transfer four properties but only transferred two into the partnership. The reason the transfer of the remaining two properties did not take place, they are mortgaged and the bank wouldn't allow it. So all properties this partner has moved were paid for so no worries on the affect on the basis or gain recognition.

The same partner has created an additional LLC for asset protection as recommended by his attorney. Those properties are also clear. Even though this LLC is a disregarded entity, I will still track his basis in the LLC.

-

Here is an excellent article regarding transfer of partnership interest. I know some folks here don't like clicking on links but this is too much to copy and paste.

Transfer of Partnership Interest, Tax, Sales, Disguised sales and terminations

-

I agree with no step up in basis. Maybe the words "step up" were used in the wrong context. Here is what I found so far which answers the majority of my question

26 U.S. Code § 723.Basis of property contributed to partnership

U.S. Code

The basis of property contributed to a partnership by a partner shall be the adjusted basis of such property to the contributing partner at the time of the contribution increased by the amount (if any) of gain recognized under section 721(b) to the contributing partner at such time.

721(b) is relating to intangibles, not applicable in this case.

The only way I see the partner(s) will realize any taxable gain on the transfers is if any of the contributed properties are sold. I am sure, in this case, the other partner is aware of this.

-

Client has four rental properties that have been claimed on Sch E. Transferred the properties into an already established LLC that is a partnership. Deeds and mortgages all transferred legally. For depreciation purposes, is the LLC basis for depreciation the contributing partner's remaining basis? All of the income, expenses, etc. are split between the personal return and the 1065 based on the date of transfer for the partner who is contributing the properties. I know this affects his basis in the partnership as well. I'm just drawing a mind blank right now on the depreciation issue. Thinking through this, if the LLC could step up the basis, wouldn't that mean a taxable gain to the partner contributing the property?

-

Well I know a lot of teachers in certain states do not have unions. In NC teachers do not. We have the NCAE which is useless and is not a bargaining unit for teachers. You confirmed my thoughts exactly.

-

I have not found anything on this subject yet. I have a few teachers and others that have been working from home due to the pandemic. If this deduction were available, wouldn't be under form 2106? That form is only available for certain folks to use. I don't see any other way this could be done. Thoughts???

-

I also checked Pub 970. The exact wording cbslee posted is correct and very straight forward.

-

Client has been claiming the AOC for education for the previous four years, started a consulting business in 2020 as a single member LLC. Now wants to deduct the education expenses incurred in 2020 as a business expense instead of utilizing the Life Time Learning credit or tuition and fees deduction because their income level is too high for the education credits. I have never been asked this question before. My first response was no because the education expenses were not continuing Ed or necessary CEU's to maintain a current status. According to the client, the education applies to their current credentialing.

I have prepared this client's taxes for several years and this has never come up in the past. Business expenses were given to me from receipts they were pulling up on their phone. I couldn't see the receipts and some of the expenses seemed unreasonable. At times, it appeared figures were being pulled out of the atmosphere. I advised that all expenses have to be reasonable and allowable expenses and that you just can't create an expense. I also advised that because I now became suspicious of the legitimacy of the expenses, I was ready to terminate the agreement and send them packing. Not quite that harsh but you get the point. At this point I was shown some receipts. I included all of this in statements with the due diligence because there is a dependent child involved and CTC. I still say no regarding deducting the education expenses as a business expense.

-

I am a teacher by day. I can tell you that the majority of us spend far more than 250.00 per year. Many of us have purchased equipment necessary to work from home during the pandemic and for that reason alone have spent more the 250.0. Needless to say, the limit on that deduction is a joke and really makes little difference in the refund or amount to pay. While I love my teaching job, it is a thankless job at the same time. I could go on and on about this but wouldn't do anyone any good.

-

5

5

-

-

Again, I totally disagree. I did indeed have the parents permission to allocate the way I did. I did not state that which is why you took it that way. In my case the dependent got the letter and not the parents and the letter did not indicate his was not a dependent. I don't see how getting the letter automatically removes the dependency as you state.

-

I agree with Lion we need more information here. The mother can claim the son up to age 24 if he attends college full time. The original OP stated the son attended part time which I agree will knock her out of claiming him as a dependent which negates the HOH as well. By your figures of the son's income, it appears he should file on his own. I always do this both ways and compare it to the parents return both ways and determine the best scenario for everyone.

-

3

3

-

Form 8949 Robinhood Securities

in General Chat

Posted

Good reading material. There are wash sales but they are identified as disallowed.

Thanks,