giogis245

-

Posts

79 -

Joined

-

Last visited

Posts posted by giogis245

-

-

Client bought 2 investment properties in 2022, they renovated them completely, between the 2 units they spent $50K in new furances, kitchens, floorings, lighting, paint, bathrooms in material and labor. Their contractor buys the materials and they just make a check out to the contractor for material and labor then send him a 1099. Just seems like such a big number, can they really write off all of it?

-

Thank you so much!

-

She has a SSN and doesn't know why she received this, she withdrew her retirement money, payer is Empower Trust Company, withdrew $6k paid in $1,600 to federal. Where do I enter this on a 1040?

-

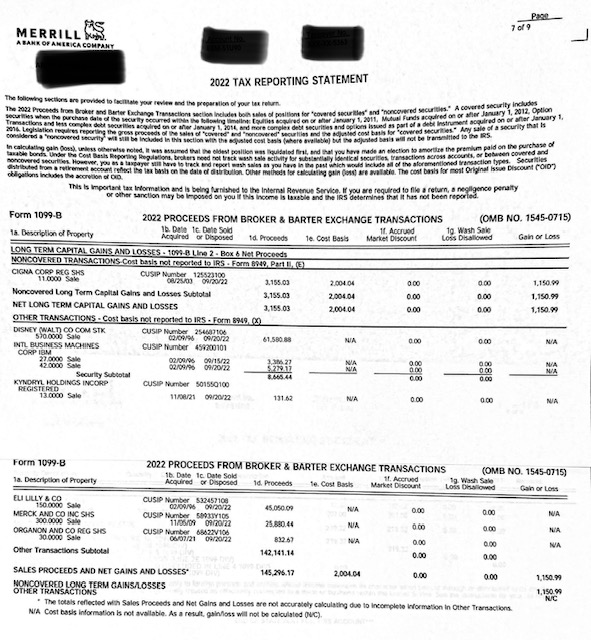

Thank you! Do I include form 8949 or nothing at all since based on this, client does not pay capital gain taxes.

-

1

1

-

-

Hello, we're on the final stretch! I have a client who came in with this form, she inherited stock from her grandpa. He passed in July of 2022, she withdrew the money in Aug 2022, her Merrill Lynch stock broker told her she would not have to pay taxes. I've never had a situation like this, so your help is greatly appreciated!

-

It's been a long week (and it's only Tuesday) and I cannot think straight. TP bought house 3/6/20 and sold it 11/15/21, do I have to report on 8949 and pay taxes on the proceeds? He bought a piece of land and thinks they can write off that purchase, which I have told them they have not as they plan to build a new house. Can you please shed some light.

-

Based on what I found, not but just want to make sure. Thank you so much for your help!

-

Client received 2 1099-A's for timeshares he had, do I enter the Balance/Fair Market Value (same amounts) as income on other income?

-

I have not had a single ITIN taxpayer client receive it either...

-

I am constantly looking for updates on this. I do not think they are but the news is saying yes and clients are going desperate.

-

I made a mistake and put Roth but it is a traditional IRA.

-

Taxpayer asked me if he can put in an amount into this Roth IRA now (2021) and I take a deduction on 2020 taxes? He says he's done it for years, it reduces his income now. W2 says nothing!

-

Ok looks like I have to do some reading tonight. Thanks much!

-

Basis $469,183

Cost: $505,785

Wash sale loss disallowed: $48,268

Net gain: $11,673

do these numbers make sense

-

Client brought in his Robinhood securities, do I only enter 1099DIV info which includes the ordinary dividends? Do I need to enter summary of proceeds, gains and losses?

-

Thank you for this question as I have this question and so glad it was asked already. I want to get clarity though, the taxpayer can get 26% of total cost correct, how do I carry forward the credits if not all used?

-

We called ATX as we have a few clients who want to file without waiting and they said UP TO 2 WEEKS to update.

-

2

2

-

1

1

-

-

I am not sure about this so coming here for guidance. I have a 19 year old who made 12K, he has a dependent of herself who is a few months old. She says she's independent and she provides more than 50% of her own support. Can she claim the AOTC?

-

Parents have the health insurance marketplace, they are listed as insured as well as their college daughter. Last year the daughter's refund was delayed because she received a letter from the IRS stating that she needs to claim form 8962 from the 1095A, so we filled out the form 8962 for daughter, she got her money. This year I am not sure what I should do now, should I include form 8962 on daughter? I have never "allocated" and not sure how to go about it...

-

Son made $15K

-

She pays for her and his household expenses but he went to school half time, he wants to file himself and claim stimulus as he went to school PT.

-

Hi All, there's a family of 4, husband and wife and 2 college students kids who have the insurance. Last year both college kids were claimed by their parents and they also filed their returns. I input 1095-C market place health insurance info only on the parents and both kids received a letter from the IRS stating that they needed to include the information from form 1095-C as well. Does this sound correct? This year upon entering the information, they owe a crazy amount of money as repayment if I include the info on the kids return, I am not sure what to do.

-

She says that she was told that she can keep filing a 1040 and include the income in Schedule C, is that correct? Or does she have to file a company return that flows to her personal? She does not pay herself a salary.

-

I am having a brain fart and not sure if I need to enter anything? They lived in house for 4 years qualify to not pay taxes on proceeds.

Health Insurance for business owners

in General Chat

Posted

Can it be a business expense on their business return or must it go on personal? if it's on personal, can it go on adjustments to income line 17 or does it have to go on Schedule A?