KATHERINE

-

Posts

140 -

Joined

-

Last visited

Posts posted by KATHERINE

-

-

Hi, if happens to my client, I will amend and file jointly or MFS. because married is married in US or not. especially will involve with USCIS. if we do it wrong, and delaying in their process, they might blame us. Thank you!

-

2

2

-

-

sorry to mention, I am in NY and client is also in NY. NY wont allow any over payment from PTET to be carried to next tax period. so, when file PTET, any overpayment will be returned as refund. Thank you!

-

Hi dear team here,

May I have a question on PTET deduction? I dont remember where I got the idea that the deduction on Fed on PTET is the lesser of the payment made or the liability is. but, there are people said only go with payment made. can any one provide me some exact what IRS said on this?

Thank you so much!

Kate

-

1 hour ago, Lion EA said:

I think it can get into how the property was held, also. But, I can't give you any details about the different ways a couple can title property might or might not make it community property in CA. You might need to talk with the family's lawyer about that specific legal title.

yes, Lion. I did some research for this situation. If they were living in CA, and then moved to a common state, they should redesign the structure to make sure it will remain as community property. It is so complicated to me.

Thank you!

Kate

-

1

1

-

-

1 hour ago, BulldogTom said:

I don't think so. But it is possible.

Domicile at the time of purchase is the controlling factor (at least that is how I understand it). If your couple were both domiciled in CA at the time they made the purchase of the property, then the property would be community property and carry that designation even if they subsequently moved to a separate property state. If they were domiciled in NY (not a community property state) when the purchase was made, then the step up would only be for the half of the property owned by the decedent spouse and the living spouse would continue with their own basis.

Double check this because I am commenting from memory and not research.

Tom

Longview, TXHi Tom,

They never lived in CA. So, I will take it as normally we do because she is still alive and only his half transferred to his estate.

Thank you so much!

Kate

-

1

1

-

-

Hi dear friends,

I have another question again: if NYS resident dies and jointly own real estate property in CA. someone said can step up basis for the 100% value of the house to FMV instead of half. Is that true?

Thank you!

Kate

-

On 10/9/2023 at 11:58 AM, Randall said:

I copied the info for a client to explain the rules for RE professional. And told him to keep good records, time sheets, etc. This was in 2021 for preparation of 2022.

Yes. Actually, NYS is kind of strict on these hours., good record is imporant. some other people confused too, and thought once the 469, then those will all be counted too. Now, I think each activities needs test separately (except the hours), basically, involves management as landlord. thank you so much!

-

Thank you every one! I am clear on this now. I will not take those small K1 which I knew for sure he is not involve at all. Because the even choose election to combine all activities to decide, but the ones to take consideration has to be material (except hours) first. so those are not qualify. Thank you so much!

-

1

1

-

-

36 minutes ago, KATHERINE said:

Hi friends,

I have a question regarding the professional status: the client received a lot k1s. some from he is one of the major partners, like 10%-50%, some marked as limited and some marked as generals., and I knew he is part of the management. Then there a lot which he has 0.008%-1%, which he was marked as limited partners. We decided he could be qualified for professional treatment. I will mark the ones I knew he part of the management and K1 % is kid of big as professional. How about those from outside, which is very small % and outside marked him limited partner? Is income from these small ownership K1 also get professional treatment which exempt from investment tax?

Thank you so much for any comments or thoughts.

Sincerely,

Kate

Hi friends, I knew limited partner normally should be material, should be not treated even active, so should not be qualified for this treatment at all. since someone internally argue with me and I cannot make myself clear to tell them, if so small% and outside already marked limited, we cannot take those k1s and apply the professional treatment, I need find something solid. sorry to interrupt when everyone is so busy already.

-

Hi friends,

I have a question regarding the professional status: the client received a lot k1s. some from he is one of the major partners, like 10%-50%, some marked as limited and some marked as generals., and I knew he is part of the management. Then there a lot which he has 0.008%-1%, which he was marked as limited partners. We decided he could be qualified for professional treatment. I will mark the ones I knew he part of the management and K1 % is kid of big as professional. How about those from outside, which is very small % and outside marked him limited partner? Is income from these small ownership K1 also get professional treatment which exempt from investment tax?

Thank you so much for any comments or thoughts.

Sincerely,

Kate

-

39 minutes ago, cbslee said:

"How Do I Change Ownership of Replacement Property After a 1031 Exchange?

If that is your intention, it would be wise not to act straightaway. It’s generally advisable to hold onto the replacement property for several years before changing ownership. If you get rid of it quickly, the IRS may assume that you didn’t acquire it with the intention of holding."

Frankly, the way these exchanges were handled raises some serious questions !

Thank you, Cbslee! The issue in this case is not usage. They will hold replacement as investment. My issue is: where to report the rental activities from the replacement property (new property). In the old LLC , or the new LLC. (both LLC has same individuals as owners). Since all documents regarding the replacements property is under the new LLC name. and New LLC was formed as multi-member LLC (same individuals as old LLC). I saw IRS allows partnership to do 1031. Thank you!

-

1 minute ago, Lion EA said:

I haven't had to report a 1031 exchange, only academic experience. But I thought one requirement for a 1031 exchange is that the replacement property needs to be titled the same as the exchanged property. Is that incorrect, or is there an exception if the LLC members are the same in both the replacement LLC and the exchange LLC?

I would probably grab an NATP self-study course to guide me through the tax return reporting. Hopefully, preparers with practical exchange experience reply to your post.

Thank you, Lion. yes, hope someone can give some advice. Normally, I did exchange in 1040, which is only matter of a calculation. (software will calculate, but I will verify). Now, I saw both reporting ways are existing if the it is multiple member LLC. I preferred the old accountant's way because the balance sheet and depreciation schedule will be clean. also, if they do exchange again later on exchanged property, a separated reporting will be more clean in future. otherwise, the depreciation and balance sheet will so messy.

-

Hi dear friends, The old LLC (the XX GROUP LLC) holds multiple units. they sold two units in 2022 and replace it (1031) with IL property. The the IL property is under a new LLC (YY home LLC) and new LLC is a multiple member LLC. The EIN letter suggested to file 1065. The replacement property is recorded new LLC as owner on all documents. Both old and new LLC have two same equal members (brothers 50% and 50%). This is the second exchange they did. the first one was in 2021, this is the second (2022) . the first one(completed in 2021): the previous account report the its new replacement property under ZZ LLC (the new one set for hold the replacement) and ZZ LLC filed its own 1065 in 2021. Now, My question is: should I report the new property under old LLC (XX GROUP) and treat the new (YY HOME LLC ) as disregarded entity ; Or follow the old accountant on how he did with the prior exchange, and report all activities under new LLC (YY home LLC). Please advice. Thank you!

-

You can do it yourself. Use the 1099TAX.com (the online software) to prepare 941X. I forgot whether it comes with worksheet, because it is long time ago. Thank you!

-

14 hours ago, Sara EA said:

I find it very difficult to work with emailed docs (especially when they send piecemeal so you have to go back through ten emails to be sure you got everything--a portal would help here). It's not a big problem when they just have a couple of W2s and mortgage 1099, but when you start getting multiple brokerages or eight 1099Rs, I really have to print them out to put them in reasonable order. When I am done with a return, I manually add up all the W2 income, bank interest, withholding, etc. and check it against the return, then put a check mark on the original doc. I find it impossible to run this check on 25 helter-skelter docs. How do others work with emailed docs? Don't get me started on phone pictures of docs. Our client letter states in all caps NO PHONE PHOTOS. Never can read them, often can't print them or send to electronic file cabinet.

Sara, try Verifyle. A friend here recommended, I convinced clients to use it and both sides feel paperwork are more organized. As the host, you can always remove the outdated doc so client wont get confused from multiple drafts. The only thing I would like them to improve is, if they can put a sign on each unread message from client on the dashboard to remind us to check. currently, the message is sorted by date only, and they will send message reminder, which is not good enough when you get busy. May someone has other suggest, but you could try if you didnot find any solutions yet. Thank you!

-

3

3

-

-

Hi Catherine, you already did a good job and could file it, may be someday, he can appreciate your good heart and pay it. At least, he will remember he owe you a favor. I did a lot like this, and eventually, I got paid. Of cause, I lost money too but that is the risk. The job is done, so wont cost extra to file it now. Hope he is not a unfair person. Cheers.

-

1

1

-

-

Ok I tried, it is harder for people have accent. The voice mail will say three words and ask us to repeat, if not match, then they will hung up. Em....Hope they can improve their questions. and they are fast. I think for someone with hearing issue will be even harder.

-

3 hours ago, GLGACCT said:

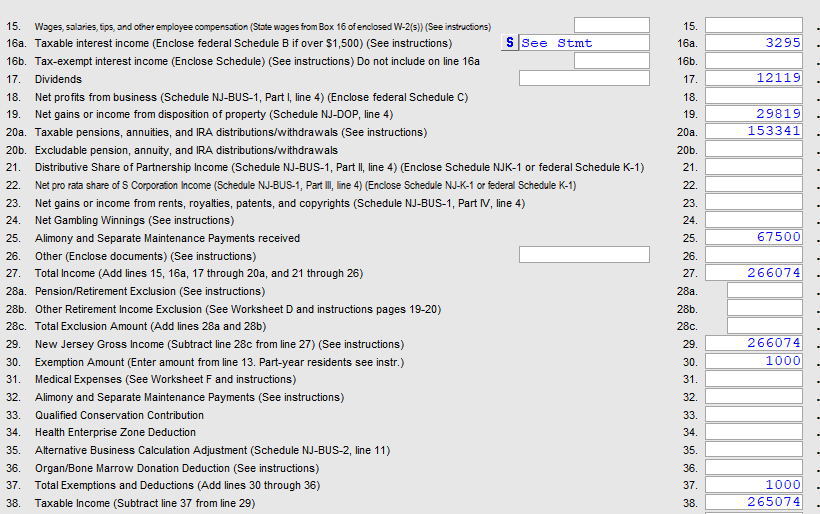

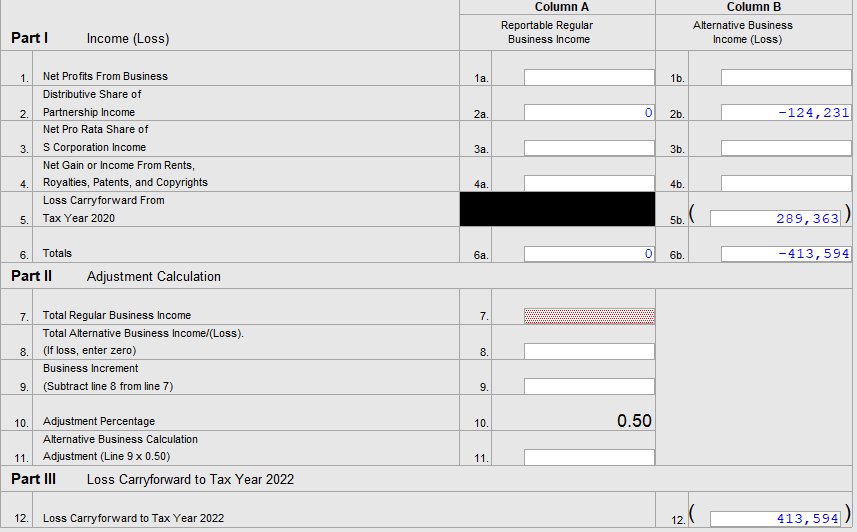

It is my understanding, that NJ does not allow you to take the loss, but rather carry it over to future years to offset the income. If you had income, column A would be filled in on NJ-BUS 2 and appear on line 21 of the NJ-1040. Then lines 7-11 on NJ-Bus 2 would also be filled in offsetting the carry over loss but be reduced by the adjustment percentage on line 10 and appear on line 35 of the NJ-1040 as a reduction.

Also, in NJ if you are paying taxes to other states, you do get a credit as well see NJ Sch NJ-COJ/NJ-DOP.

I tried to fill out Bus-2 manfully, it did not create a negative number to NJ1040. seems, NJ resident have net loss from outside NJ K1, NJ doesnot allow use that loss to offset NJ income to reach the NJ taxable income. Thank you!

-

6 minutes ago, Lion EA said:

CT gives credit for taxes paid to another state on the same income that CT's taxing. If the other state has NO income, did NOT tax any income due to a loss, then there is NO credit on the CT return. CT, the home state, is NOT taxing that loss. Maybe NJ is similar. Start by reading the NJ instructions.

Hi dear Lion,

That is the thing. I am in NY, we are doing like this: if paid tax to the K1 source state, we will give credit; if source state K1 is negative, we WILL allow a loss because NY tax worldwide income too, if a loss, they will allow to take the loss subject some restriction. NY return starts from FED AGI with some adj , but the loss from other state is not an add back item. now, I feel NJ will tax on positive K1 from other states, but not allow negative K1 to reduce income. so, CT is the same, if CT resident only has one K1 which is a NY K1 with a loss, that NY K1 cannot reduce his CT gross income? is that true?

Thank you so much!

Kate

-

Hi GlGA,

Thank you for your response. The 1040 doesnot take negative number from BUS1, and Bus 2's negative also not allow shown as negative in NJ1040. so, if a NJ resident have negative K1 from other states, cannot reduce income, I am not sure?

-

Hi dear friends here,

Found something strange, the client has multiple K1s from VA, which ends a net of negative. Seems NJ does not allow me to reduce her income from this net loss of K1. Is that correct?

I checked with instruction, it said box 4 of NJ Bus-1 goes to box 21, but only positive number goes. Where shall I post the loss from K1 to reduce my NJ income?

Thank you all.

Kate

-

On 9/19/2022 at 2:58 PM, schirallicpa said:

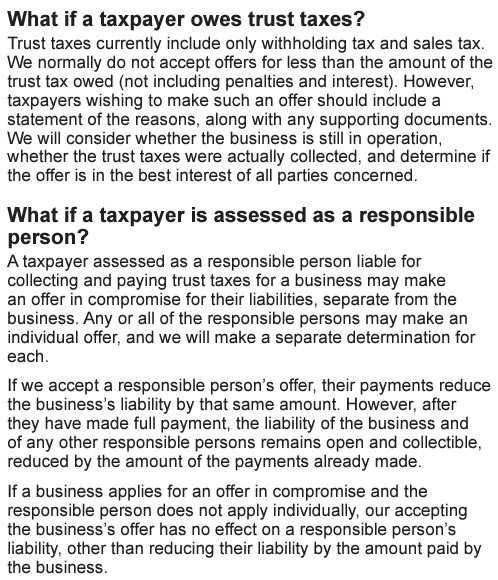

Has anyone in this group dealt with NYS with an OIC? My conundrum is this: NYS sales tax that was associated with a defunct business is attached to an individual. The forms imply that a separate DTF4 and DTF5 be filed if a business is involved. The business doesn't exist anymore. I'm not sure if I understand why I need both submissions since the sales tax is being pursued at the individual level. The person who hired me says she was told she needed to file the business OIC.

Does anyone have experience with this?

so, I think you need to file two separate OIC. The business one offers $1, because the business is closed, and the business cannot afford any amount, then the responsible person offer whatever amount realistic. Thank you!

-

1

1

-

-

Hi TAXIT, in NY, anyone who is more than 59.5 years old can exclude up to $20K per person annually from retirement. So, since 11 was included into box 1 of W2 and categorized as taxable income, if the taxpayer is more than 59.5, then, should allow him to exclude up to $20K. so, your software is correct. Thank you! --Kate

-

Ok, I am curious the outcome at the end. I feel that client just messed up and want to get someone to blame. We were told not to take a fee nor apply for client because they have to deal with their bank or lender directly. We are so nice to provide those online lender name list to client because local bankers seem not know the thing themselves. It is client responsibility to follow up those online application, we were providing doc. Now, how come that client missed it and blame accountant? only if they have engagement letter said accountant will do it from begining to end. otherwise, how can he sue them only because he thought the accountant told something to him. How can he prove his case against the accountant? Bad thing is: the accountant will spend time and money for nothing.

PTET

in General Chat

Posted

Thank you for your response. In NY, when the LLC file PTET in the following year for previous closing year (in 2024 to file 2023 PTET), it will be calculate like this: NYS PTET income (fed income with some state adj), applies 6.85%, get PTET tax due (assume all parnters are PTET partners). If the partnership's estimated payments exceeds the calculated PTET due, the overpayment will be returned (not allowed to carry) to the partnership. Now, I thought IRS will only allow the lesser of amount paid or amount liable in 2023 fed F1065. but I saw other people will deduct whole amount and said when the refund comes, they will take as income (or reduction of future PTET tax expenses). I prefer to keep the PTET credit and IRS dedcution the same, so the overpayment amount I would post as prepaid assets on balance without deduct it. The reason I think this way, I thought I read some thing but cannot find it anymore.

Thank you!