weaverdoan

Members-

Posts

19 -

Joined

-

Last visited

Everything posted by weaverdoan

-

Thanks so much XP4ME! I'm in now.

-

Yes, that is the link I'm using, but it is blank. After signed in, it took me back to main page below. I must have done something wrong.

-

Hi everyone, Did ATX closed the ATX Community Discussion Center? I have not been able to get in. Thanks,

-

Texas Franchise e-File status still showing "Transmitted to EFC"

weaverdoan replied to weaverdoan's topic in E-File

I finally have all of my Texas Franchise tax accepted. It took them like four days. -

Texas Franchise e-File status still showing "Transmitted to EFC"

weaverdoan posted a topic in E-File

Hi everyone, This is very strange. I e-filed one Texas Franchise tax return two days ago, and the status still showing "Transmitted to EFC". Is there a way I can resubmit it again? Thanks, -

S-Corp with no activity in the last 10 years

weaverdoan replied to weaverdoan's topic in General Chat

Thanks so much cbslee. I didn't think about closing the EIN. -

Hello everyone, I have a new client who told me for the last 10 years he filed form 1020-S with no activities. Does he need to file his corporate tax return (actually LLC elected S-Corp) if he has no activity? He doesn't think he will have any activity in the future, but he wants to keep the LLC name that he registered. Therefore, he is OK with keep on filing it on a yearly basis. Thanks so much for your help

-

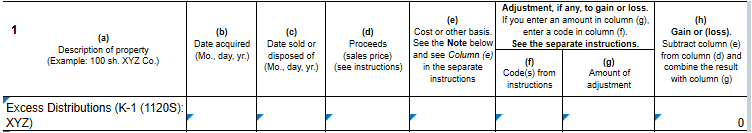

Thank you Slippery Pencil! I will to use "various" as ATX software will give me an error if I use code "M" in column (f) and leave the dates blank.

-

Sorry for another follow question. What dates should I use for date acquired and sold on form 8949? If I leave the blank, ATX gives me errors of dates required. Can I use "Various" for both dates?

-

Awesome! I wish I knew about this earlier Thanks again for your help!

-

Hi cbslee, Do you attached forms 1099-B to the return? Thanks,

-

Hi Abby Normal, Thank you for your response. I have a follow up question. "I almost never use those lines because I like to see the totals on the 8949 Details tab. In the case of multiple brokerages, I would enter totals by brokerage by code" If you enter total by brokerage on 8949, do you require to attached forms 1099-B to the return? My understand is for the Covered transactions that qualify for direct reporting on Schedule D do not require to attach forms 1099-B Thanks again for all you help

-

Hi everyone, I have a question about Schedule D line 1a and 8a. I understand I can report on line 1a (short-term) or line 8a (long-term) the aggregate totals from “Covered” transactions on form 1099-B that show basis was reported to the IRS and the basis doesn't show any adjustments in box 1f or 1g. The question I have is if I have more than one form 1099-B, can I aggregate the total from all forms 1099-B? Thanks so much for your help.

-

Hi everyone, My client tax return was accepted on October 9, 2021 and it still shows "Your tax return is still being processed" on IRS refund status website. My client did not received any letter from the IRS to indicate there were anything wrong with the return. I don't know what to do to help my client. Any suggestion would be greatly appreciated. Thanks in advance for all your help.