-

Posts

3,389 -

Joined

-

Last visited

-

Days Won

315

Posts posted by RitaB

-

-

2 hours ago, Sara EA said:

Does anyone here question a client when they submit some huge figure like $30k for meals or 62k in mileage, especially if their gross doesn't seem to warrant such expenditures?

I do.

I do.

-

4

4

-

-

On 7/22/2020 at 9:17 AM, ILLMAS said:

How do you respond to this:

Very close to filing deadline

”Here is my information and I would to file before the deadline to avoid having to pay fines and penalties”

You: you have tax returns you received in May still in queue to be prepare.

Taxpayer Karen, you can avoid interest and penalties [maybe not entirely if you've not paid quarterly] by paying what you owe now, before July 15, and here's a Form 1040-ES. I will get you an extension today, and prepare your return as soon as I am able. I will complete your return even before my own, provided I have everything needed to prepare yours. I understand you don't know what you owe; I don't know what I owe either. That's why I estimate as closely as possible, and pay in quarterly what I think is a little too much.

-

5

5

-

-

Or they will be coming for you, and it was nice knowing you. Enjoy your stay at the crossbar motel.

Just kidding. I forgot to file a 4868, remembered at the crack of 9:00 am Thursday the 16th. I had read that IRS computers had some problems on Wednesday, so I thought what’s the worst that can happen if I send it today? It was accepted.

If I have to go away for a while, y’all know why.

-

2

2

-

2

2

-

-

27 minutes ago, Possi said:

@RitaBI love you so hard. LOL

Well, I love you, too, and I didn't get the engagement with the tire kicker, which was the best part. I'm a terrible story teller.

-

4

4

-

4

4

-

-

I had one come in unannounced in March telling me his friend TimeSuck sent him, informing me it's a real simple return, and what would you charge blah, blah, blah. Ok. Let's think about this. You have been referred by a friend, you pop in like I'm the walmarts with 23 registers, two of which are manned, and you are really going to kick my tires? I looked it over and quoted an extra 100 for being rude and dropping TheWrongName.

No regrets.

-

8

8

-

5

5

-

-

54 minutes ago, Possi said:

Last year, @RitaB and I had a blast in Roanoke at the NATP forum. We didn't learn a whole lot, but MAN IT WAS FUN! We even got snowed in and watched the worst movie EVER in the universe. The Crown Salted Caramel was good though, so we got over the movie real fast.

Oops, did I say too much?

This year, I'll be taking online CE. I have a lot of free credits hanging from TTB.

I am still mad about Ryan Reynolds being in a box underground for two hours and not making it out alive. Who comes up with this stuff?? Why, Donna, why??

-

4

4

-

-

18 hours ago, Christian said:

I see exactly what you mean. I may simply pass on this one. I don't read that there are any expenses which reduce the full HA from SE tax. I think the former taxperson made significant errors in this regard. She somehow deducted unreimbursed employee expenses from the HA whereas these would apply only to income such as fees and other incidental income reportable on Schedule C. She is showing a leftover NOL from the income taxed on the SE with no Schedule C attached to the return. I am going to get the client to bring me her 2015 and 2016 returns to see if I can make sense of what she did but regretably I doubt I will succeed.

Since the exodus of Form 2106, clergy reduce SE tax on Line 2 of Sch SE, per Instructions to Sch SE. Right click on Line 2, there's a worksheet where you can enter business expenses, if any.

-

3

3

-

1

1

-

-

18 hours ago, Christian said:

Margaret has pretty much cleared the clouds on this one. I'm going to print the entire disussion and place it in the client file.The client provided utility bills for her home and this along with the FRV will likely just about exempt the HA from any tax. Many thanks to all as I was in the weeds on this one. ( I am sure there are some that feel I stay in the weeds.)

Did you mean "income tax" or "any tax"? The HA is subject to SE tax (unless she filed the 4361 that some do).

-

1

1

-

-

On 6/10/2020 at 9:02 PM, scottmcfly said:

I worry too Tom. I keep files close to home. Am I paranoid? Who is asking?

Why do italics make this sooooo much better??? I'm crying.

Also, Marty McFly is my favorite. Just saying.

-

1

1

-

5

5

-

-

On 5/28/2020 at 5:33 PM, Christian said:

Separate books and records must be maintained to reflect income and expenses for each rental real estate enterprise.

At least 250 or more hours of rental services must be performed by the taxpayer or other individuals (i.e., plumbers, landscapers, contractors, property managers) per year with respect to the rental enterprise. The activities that count towards the 250-hour requirement include landlord-related duties such as repairs and

maintenance, collecting rent, reviewing tenant applications, spending time with tenants, etc.The taxpayer must maintain contemporaneous records of relevant items, including time reports, logs, or similar documents. This requirement applies to tax years beginning after December 31, 2018. Relevant items for recordkeeping include hours of all services performed, description of all services performed, dates on which such services were performed, and who performed the services.

This will basically disqualify the two guys I have in mind as they would never maintain these records. This is pretty much what I had expected. The record keeping requirements would likely kill their deduction as they would never comply.

The safe harbor is a way to qualify, but not meeting the safe harbor does not disqualify.

-

15 hours ago, peggysioux5 said:

Taxpayer received a 1099-Misc from Union for working on a committee of Union. Would other tax preparers determine that self-employment tax needs to be calculated? He did say he will continue to be on committee ongoing so not a one-time thing but he is not looking to make a profit and it is not a business.

Peggy Sioux

Based on your post, I would, yes. I tend to go with "work" being subject to self-employment tax, even if it's a one-time event. I believe "other income" is, well, income from something other than work, like a prize or debt cancellation. Lots of tax pros better than me would never subject income to SE tax for a one-time activity, like that week of hanging vinyl siding for the general contractor, but this is not that. Shoot, the real experts think practically nothing is subject to SE tax, Schedule SE should be seen less frequently than a Unicom, and I should just hang it up.

I would of course ask him to provide legitimate expenses. I assume he has some if he's not looking to make a profit. Or do you mean he would do this work even if not compensated? I guess my answer is the same, either way.

-

3

3

-

-

Thanks to all of you for the comments. I am dragging. I know I am so very fortunate because I work alone, don't prepare returns with clients in front of me, and I've not missed a single day of work. Stopped working Saturdays a month early. But Holy Crow, I feel like I can't get anything done. I had five of my October PITA clients who became April PITA clients, and you know it's like pulling teeth to get them wrapped up. Bless their hearts; I don't know who ties their shoes for them. Add one million EIP calls and hey-my-return-was-filed-in-February-but-I've-not-received-my-refund calls. At least my folks are overwhelmingly pleasant, and I know some just want me to tell them we're gonna be fine. So thankful for the extension from April 15 to July 15. I sure needed it.

-

6

6

-

-

On the problem with incorrect EIP payments and PPP disbursements, I don’t know that we can say IRS and SBA and lenders don’t share some blame. Probably enough to go around.

And my payroll client whose business has been booming this whole time was encouraged by his tax pro buddy to apply for PPP funds. Yep, I’d say it’s not all Congress this go round.

-

1

1

-

-

17 hours ago, giogis245 said:

How I wish I could just say that, not my problem and get over it haha.

Since you and I cannot really do that and keep clients, you might try running an article or two for your client. I've found one that seems clear for this purpose: https://www.thepennyhoarder.com/taxes/child-coronavirus-stimulus/

Also, the number given in the letter IRS sent out, Notice 1444: 1-800-919-9835

I just got off the phone with a caller, who's not even a client, and I gave her that number. She was so appreciative and said, "Now I know why my brother brags on you all the time." So, her brother is a client. Yeah, I know, but I was glad I tried to help her.

-

4

4

-

1

1

-

-

14 hours ago, Janitor Bob said:

Can anybody advise how to enter this in the 2019 software?

Greg (and MarkM from 2017), since the taxpayer took control of the funds, the issuer has no choice but to use Code 7 (or Code 1 if early withdrawal, as in MarkM's case). I believe you'll need to enter an explanation within the 1099-R entry. There's a tab down at the bottom named "Rollover Explanation." I had to use it twice on 2019 returns. I entered detailed information regarding dates and names of both investment companies involved. I also keep copies of the proof that my client deposited the funds within the 60 days, because I figure odds are good that they'll get a letter despite the explanation.

-

2

2

-

-

14 hours ago, Janitor Bob said:

client withdrew $105,000 from one IRA then (10 days later) made a rollove contribution of te same amount to a different IRA. The 5498 shows the rollover contribution, but since 1099-R has code of "7", the software includes it as taxable. How do I enter the rollover in ATX?

Greg, since the client took control of the funds, the issuer has no choice but to use Code 7. I believe you'll need to enter an explanation within the 1099-R entry. There's a tab down at the bottom named "Rollover Explanation." I had to use it twice on 2019 returns. I entered detailed information regarding dates and names of both investment companies involved. I also keep copies of the proof that my client deposited the funds within the 60 days, because I figure odds are good that they'll get a letter despite the explanation.

-

2

2

-

-

1 hour ago, Randall said:

I agree but there is one situation that irks me. Ministers' housing allowance. The amount used to pay a mortgage is non-taxable and the amount paid for mortgage interest (and real estate tax) is also deductible. Sort of a double tax advantage for the same dollar. May not be as applicable now with the higher standard deductions but still annoying to me.

I agree, this is absolutely an allowed double dip. Also, I have a minister whose family received APTC (100% of premiums for five paid by the taxpayers) and Retirement Savers Credit because 17,500 of his income was excluded as HA. I don't blame the pastor. He's a very nice guy, does not appear to hate paying Caesar the small [to me] amount he owes, is not impoverished, and his wife is able to stay home with the kids. This is the wrong thread, but we were on cricket mode, so I'll pile on.

-

2

2

-

1

1

-

-

This makes sense. I can only see two logical ways of dealing with the forgiven amounts (grant) designed to keep your employees tied to your business while receipts are down:

1) Include the grant as income and deduct the expenses paid by it.

2) Exclude the grant from income and don't deduct the expenses paid by it.

Business is business. And, yes, if you received a grant while your gross receipts did not suffer as much as the grant amount, your net income is higher. And your tax bill is higher. Your business made money. Surely we can explain this just as we educate the ones who call asking if they should take a raise at work.

If not, they can return the money to save the tax.

-

3

3

-

-

2 hours ago, Catherine said:

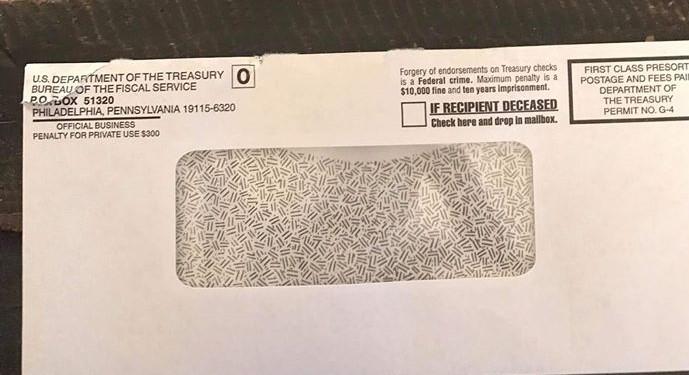

I just love that your example envelope has been opened and the check removed!

"Experience is something you (and my clients) don't get until just after you need it." - Steven Wright

-

1

1

-

-

1 hour ago, Gail in Virginia said:

Sometimes I fail to listen to those thought bubbles and these

stupidcalls take up way more of my day than they should.Yes! The first one that called me after consulting the They Said I Heard Tax Club with the question about whether their return (refund) would be affected 2020 - Oh, my soul.

I don't even remember how he asked the question now, but wow, I tried way too hard to answer it. He finally said, "I don't understand," to which I replied, "I know you don't."

-

2

2

-

2

2

-

-

On 4/19/2020 at 10:53 AM, Abby Normal said:

I've only had two calls about stimulus payments and both were from wealthier retired clients, whose income stream is secure... <sigh>

Phone rings yesterday. I pick up. I know, don't ask me why, but I did. What can I say? I don't have caller ID, and sometimes it's google, and I can just slam it back down.

Retiree Caller: You know that stimulus payment?

Me: (Thought Bubble: Just yes or no, Rita, yes or no.) Yes.

RC: Is it taxable?

Me: (TB: Don't adlib, Rita, yes or no.) No.

RC: Is the interest [income it will earn in the bank CD I'm putting it in] taxable?

Me: (TB: WTH do you think?? Are you kidding me right now?? Yes or no, yes or no, yes or no...focus...) Yes.

God is working in my life, y'all.

-

1

1

-

7

7

-

-

-

38 minutes ago, cbslee said:

Christian,

Based on your posts, you already knew what you were going to do, so why even ask the question(s)?

He wanted to know how the audit lottery would go.

-

2

2

-

-

26 minutes ago, Abby Normal said:

I would also explain math to him. You spend 50k to save 20k in taxes, you are 30k poorer. Keep the cash and try to earn money instead. Or just give it to charity for the deduction and do some good in the world!

He's spending 50,000 because he enjoys what he's buying. Just like the guy with the swimming pool would still install it, and ask his tax pro after he filled it up. If only elements of personal pleasure was addressed by the nine factors...

-

2

2

-

Help with IRS adjustment

in General Chat

Posted

I like to say, "If you drive at 60 mph, and work seven days a week, you're driving 2 hours and 45 minutes a day for your work. Imagine how much money you'd make if you found a job where you didn't have this excessive travel burden." If they don't recheck their log, I'm with Terry, it's a catch and release.