Matthew in the PNW

-

Posts

63 -

Joined

-

Last visited

Posts posted by Matthew in the PNW

-

-

2 hours ago, Abby Normal said:

I wish. I've submitted an enhancement request for a feature to collapse the icon ribbon and encourage everyone who doesn't use it much to do the same. That's precious screen space I'd like to have, but I doubt ATX has any interest in programming a 'hide' button for the ribbon, like most other software has.

And this year it's even worse because they've added more crap I don't need or use and pushed the few icons I do use off the screen, when I'm not running ATX maximized.

I couldn't find the link in the support center. You don't have it off the top of your mind do you?

-

-

Thanks as always Abby! I'll submit an enhancement request too. Adobe does this same thing

-

Does anyone know how to remove the tool icons bar?

-

Oh also, is there a way to remove the visual toolbar? It's just a repeat of the bar above it, and takes up unnecessary monitor space.

-

I found the forward shortcut key combo! Ctrl+Shift+F

Within the help menu, it's under user interface > toolbars section. Don't ask me why it's not listed in the shortcuts page.

My only sadness now is that I don't have more buttons on my mouse!

I'm not sure if the sticky links to this convo, or if it needs to be updated.

-

One thing seems clear... The IRS doesn't seem to prioritize the 8949 reporting, probably because every preparer is doing something different.

Next year it'll probably be at the top of their list

-

1

1

-

-

Thanks Judy, that's understandable since everyone has a job to do. I do appreciate you pointing me to the right place though! I've noticed you always try to be as thorough and detailed as possible. When I bring it up to my employer, I won't be using old memories from 6 years ago

8949 Pg 3 - Box A (TIP)

If you don't need to make any adjustments to the basis or type of gain or (loss) reported to you on Form 1099-B (or substitute statement) or to your gain or (loss) for any transactions for which basis has been reported to the IRS (normally reported on Form 8949 with box A checked), you don't have to include those transactions on Form 8949. Instead, you can report summary information for those transactions directly on Schedule D. For more information, see Exception 1, later.

Exception 1. Form 8949 isn't required for certain transactions. You may be able to aggregate those transactions and report them directly on either line 1a (for short-term transactions) or line 8a (for long-term transactions) of Schedule D. This option applies only to transactions (other than sales of collectibles) for which:

• You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and doesn't show any adjustments in box 1f or 1g;

-

Thanks Lion!

-

I tried searching online and in the forum here first but didn't see it address WITH a reference to the authority.

When reporting ST/LT (Code A/D) Stock sales with a Wash reported, do you need to attach the statement and note code MW (alphabetically) to indicate multiple stocks with wash?

I thought my previous employer did attach the wash sales, but my current one is thinking otherwise. Granted, the previous employer was back in 13 when the changes were pushed down.

The strongest argument I've seen is that Code W puts it on the 8949 which should be the itemized sales, not grouped ones. The solution to this as referenced below was to subtract the wash sales out of the Code A/D totals and list them separately on 8949 and let the remaining ones stay on Sch D....How the IRS could track that I have no idea. I'm also NEVER put code M for grouped securities, so I suspect the IRS doesn't care whatsoever.

This was some discussion per Tax Pro Talk

QuoteCalGalCPA

I just pull out the one wash sale and report that separately. Then everything else can go in the normal spot so you don't have to list each one. You should be able to attach in a PDF attachment as well. I use Lacerte and there are several different links to Sch D and 8949.

Kendrick

Yes, if you are entering one stock sale with a wash sale component, you are fine. But if you are putting the sum of several pages of, say, covered short-term sales in, and out of all of those sales there is one with a wash sale component, and you scroll down and put the miniscule amount into your software, yes, on the 8949 you will see your sum totals, with the miniscule little wash sale component, and a W. But then your sum totals are on Form 8949. The only time, from what I can tell, that you can put sum totals on Form 8949 is if you attach schedules supporting the sum totals, either by PDF or by sending a Form 8453 to Austin TX with the supporting schedules.

I still like the idea of CalGal separating the wash sales separately, then subtracting those proceeds amounts and basis amounts from the sum totals and putting these revised sum totals in as "basis reported" amounts - no Form 8949 except for the separately listed wash sales.

But wanting to do it right, until I am convinced otherwise, I will probably continue to put the sum totals of those several pages of stock sales with the one wash sale amount and a code M on the Form 8949, and check the "schedule attached" box (Lacerte), and then make photocopies of all the pages and send them with a Form 8453 to Austin TX.This is per the 8949 Instructions

QuoteColumn (e)—Cost or Other Basis

The basis of property you buy is usually its cost, including the purchase price and any costs of purchase, such as commissions. You may not be able to use the actual cost as the basis if you inherited the property, got it as a gift, or received it in a tax-free exchange or involuntary conversion or in connection with a “wash sale.” If you don't use the actual cost, attach an explanation of your basis.The 8453 instructions don't say anything.

-

Good perspective! Being new parents working from home most of this year, I can attest it's nice that my in-laws are happy to visit and babysit but very respectful of our space. I'd say we spend more time with them because of their respect than the alternative!

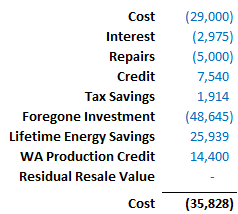

I'm a little lost on the investment piece since they have to pay the money for the solar panel investment somehow. The return on investment is what kills it for me. Everyone finds value in different places though... such as my fishing and camping hobby. Let's not talk about that though

-

1

1

-

-

On 6/24/2020 at 7:04 AM, Lion EA said:

This has all been very helpful.

Both of them work, so their tax liability is enough to use up the solar credit in one year. Their system will cost under $29,000, and the kids calculated their 2020 credit at under $7,000. They do have one child and the CTC. He hasn't been at daycare very much this year, but will return by July, so a small CCC. I ran a pro forma return.

My challenge now is to help him reduce his w/h so they get more now instead of a huge refund next year. Although, with current interest rates and short-term investment opportunities, maybe it doesn't matter!

Solar Panels are a fail in almost every context I looked at, though Businesses can turn them into only a small fail in JUST the right scenario.

Washington also offers a state incentive (reduced or eliminated if system is over 12kwh and is a reduced incentive amount the longer you put off installation) that pays per watt.

Washington also encourages but doesn't require the utilities to refund the production.... what isn't told to you, is they credit your account, which does not roll over in February (the months you actually need to use it).

If you figure the following in, it doesn't look that great. My numbers might not be great, but it doesn't make sense to me. If they can put it on a Sch C business where you use the electricity produced during the day and can take Bonus, it improves slightly... but not by much. I tried telling an engineer this once. Of course they knew better.

Interest on the loan taken to get the panels installed (2 year repayment at 4.5%)

Repairs for a warrantied product where the installing business no longer exists to replace

Foregone investment (if they put $30k into the market for 20 years at an average rate of return of 6%)

-

The general chat on here seems to align with what I was thinking.

On 2/3/2020 at 6:45 PM, Terry D said:Sorry but I can't help you with ATX. However, in Drake, you enter the total qualified expenses, then enter the scholarship (drake is education assistance), then the balance would go to the credit. With the AOTC, you can only claim up to $2500.00. So in your case, 5950.00- 2223.00 = 3727.00. The AOTC should be 2500.00, part credit to reduce taxes and part refundable. 40% refundable up to 1000.00. The remaining 60% is to reduce tax liability to zero. A lot of times the client spends significantly more than what can be recouped from the credit. As in the past, I believe you can only take one of the credits. Either AOTC, LLLC, or tuition and fees but not two at the same time. If your client qualifies for the AOTC, then that will always return the best result.

I'm not sure how you go to that credit. 3,727 in edu expenses... (2000*100%) + (1727*25%) = 2,432

On 1/29/2020 at 2:36 PM, EricF said:You can choose to make some or all of the scholarship taxable to the student. This would leave the tuition available for the parents to take the full AOTC. The scholarship income is considered earned income that can increase her standard deduction and result in zero taxable income.

Isn't it treated as earned income for purposes of determining the standard deduction but unearned income with respect to caluclating the tax. Do the trust tax rates come into play?

One problem is the article references §1.117-6(h) which I couldn’t find (it goes from 1.117-5 to 1.118-1).

Another is it say the standard deduction (relief?) applies to 2018 and I’m doing 2019 I assume the PUB clears this part up though?

On 2/4/2020 at 7:19 AM, EricF said:Christian,

In ATX, go to the 1040 ExExp worksheet, Scholarship Worksheet tab. The default is to show the scholarship as nontaxable on Line 7a. You can enter a different number you want to be tax-free on that line, and it will show the balance as taxable.

Thanks Christian!

If you can apply the scholarship to room and board as taxable income, couldn't you manage to find enough qualified expenses for the full $2,500?

400*12=4,800

6,400-4,800 = 1,600

1,600 /3 = 533 in books and supplies

That leaves over $4,00 in tuition if the books cost that much

-

3 hours ago, WITAXLADY said:

I was just going to ask the exact same question!! as the 2016 and no election to carry forward...

Thank you!

I'm not I helped, (blind leading the blind scenario) but you are certainly welcome if that was at me

-

I'm not sure if it's as complicated as I thought, or if I made it so complicated nobody's willing to touch the mess I made above

Any thoughts are appreciated

-

1

1

-

-

Another irony is that if you have a surprise meeting with a client and pull up the app on your taskbar to close out of the current TR to open theirs, ATX keeps showing all of your clients while you log in.

-

Side note to the log-ins. ATX didn't have user input when they applied this requirement. When you are in a TR and need to log in due to inactivity, but have forgotten your password... do not lock yourself out. When the admin resets your account, you have to restart ATX, which requires closing without saving (from what I saw).

-

20 minutes ago, Medlin Software said:

While I do not prepare for money, I would prep for the recipient only if I could believe they are running a business. A business license or other business document would do the trick. When I was younger, I would likely have looked the other way.

I have a similar battle every year about now. S Corp's wanting to fudge a W2 and W3 to reflect the >2% shareholder/employee insurance. While it is true, the W2 and W3 need to reflect the amount to maintain tax benefits, the amount is also wages, taxable on constructive receipt, and should be proportioned to every paycheck. Most face the issue only at tax time, when their preparer tells them their W2 is not correct, and then fail to believe it when they are told it is also taxable wages. The "extra" complication is the person who is usually handling the payroll is also the shareholder/employee, and has a tough time separating the issue to the employer and employee perspectives.

This is a separate issue, but the health insurance can be paid of out pocket by the shareholder and reimbursed by the company. At least that how it was the last time I read up on it.

-

6 minutes ago, Gail in Virginia said:

I think that we all agree this is most likely an employee/employer situation, but that was not the question in the OP. At least, not as I read it. I think the question is whether or not these reps can take the QBI deduction since they are being giving a 1099 and treated as self employed. And while I would hesitate to prepare the return for the "employer" in this instance because I don't think he/she is obeying the law regarding employment taxes, etc., I would prepare a return for the people getting the 1099's and I would most likely take the QBI unless there is some other factor that would preclude it (income too high, SSTB, something else) because those employees do not really get to choose their status.

If a 1099 is issued incorrectly isn't the responsibility on the recipient to reach out to the issuer to fix it?

-

On 2/4/2020 at 3:27 AM, Randall said:

What is a client answers yes. Is there something else we have to do?

If cryptocurrency is sold, then there would be gains to be reported on 8949 to pass to Sch D as I remember it. In the last CPE I took discussing this they argued your kids would technically have this if they played world of warcraft.

Oh the pits the IRS keeps digging. At some point we'll all just join the vanlife movement and turbotax will be the only option

-

4

4

-

-

I would say employee is the safe route to go, but you might look at these avenues before defaulting to the easy route.

Does the employer have control of when that day off is taken, or how many are taken? Is PTO offered? Is there a minimum hours worked expectation?

How is the pay structured? Is it billed for hours worked as a service, or as fees earned for sales.... or is just for hours "on the clock"?

-

On 8/1/2019 at 1:29 PM, Abby Normal said:

I just realized that I didn't have notification checked for this thread!

Thank you everyone.

One secret code I just learned this year is F9 to recalculate.

A next form code would be great. I often use Ctrl+o to bring up a list of open forms to move between forms. It's especially useful to jump to 1040 (or first form) or fixed assets because Ctrl+o followed by up arrow and enter takes you to fixed assets, and Ctrl+o, enter takes you the first form.

Now that's SLICK!!!

Having a mouse with forward/back buttons on the side works for forward and back in ATX.

I love this option too. I have my page left on the wheel set to go back and was hoping the page right could be coded to forward

I use Alt+p to bring up the list of pages in a form. Hitting up arrow takes you to the last page, just like in the Ctrl+o list. I call this the mobius strip feature.

I can't arrow up in Ctrl + O but can in Alt + P so that's being added to my bag of tricks too!!!

The user manual has most of the shortcuts.

One of the main selling points for me in ATX the ability to move quickly among the hundreds of pages in a tax return.

This is my list of ATX shortcuts on a stiky note on my screen:

Yeah, I'll just copy and paste that to word in size 6 font! You're the man!!!

BTW- what is recalculate for? Doesn't the software typically recalculate after you jump out of the box? Or is it for times when there's no other box to jump to without leaving the form entirely?

ATX Shortcuts

(Ctrl+)

E Error check

F Add forms

I Itemized List

O Open forms List

P Print

R Restore field

S Save

T Add note

Z Undo(Alt+)

P Pages of form

E,E Create efile

R,R Print pageF3 Form Instructions

F9 Recalculate -

We picked up some returns recently. As a result, I have a few 1040X's to do this year to carry back NOL's. In reading the 1040X and 1045 instructions, as well as Pub 536, I am interpreting that I file the 1040X for the carryback year since the 1045 was not timely submitted (or at all). With the 1040X I will also attach the 1045 Sch A and Sch B (though not the actual 1045 to avoid confusing the IRS agents and getting an automatic rejection).

2016 (w/NOL) was filed - no election made

2017 (w/NOL) was filed - no election made

I am a bit confused on the reporting piece of this however. It appears that in the year of the NOL we prepare the 1045 Sch A and B. In the instructions they all seem to say to attach Sch A to the 1040X and Sch B too if the carryback is then carried forward. What is unclear is what year the Sch B is prepared in. Interpreting the instructions strictly I would say one for each year of NOL (year of NOL and years of carryback/carryforward). I haven't found anything online backing this up or refuting it.

To complicate matters, there was an NOL in 2016 and 2017 (no forego election for either).

The complicated way (Read as, no IRS agent will ever understand this)

It appears I would do the following per instructions

2014 - Carryback 2016 NOL and use a portion. Attach 2016 Sch A/B showing use and carryforward

2015 - Carryforward 2016 NOL and carryback 2017 NOL. Use a portion of the 2016 NOL. Attach 2016 Sch A/B showing use and carryforward. Attach 2017 Sch A/B showing carryforward (No use).

2016 - It was already filed. I was assuming no changes to original, however the original did not include on line 21 the carryforward of 2017's NOL.

- I obviously wouldn't want to double count the 2016 NOL, but should it be amended to include the 2017 NOL carryforward from 2015?

- Also, if I need to amend for the 2017 NOL carryforward, would it stand to reason that I actually SHOULD cary the 2016 NOL to the 2016 1040X on line 21, and somehow now double count it?

- Am I including the 2017 1045 Sch A/B, or should two new Sch B's be prepared in 2016 for 2016 and 2017 carryforwards respectively (that would put me up to 3 total if counting the original Sch B for the initial carryback)?

2017 It was already filed. - It's getting fun now right!?! I was assuming no changes to original, however the original did not include on line 21 the carryforward oof 2016 and 2017.

- I obviously wouldn't want to double count the 2017 NOL, but should it be amended to include the 2016 NOL carryforward from 2014-2016 on Ln 21?

- Also, if the 2017 NOL carryforward SHOULD have been included, how would I keep from double counting this with the actual 2017 NOL?

- Am I including the 2017 1045 Sch A/B, or should two new Sch B's be prepared in 2017 for 2016 and 2017 carryforwards respectively (that would put me up to 4 total if counting the original Sch B for the initial 2016 and 2017 carryback, and then the two for the two carryforwards)?

2018 - File a standard return, and carry the unused 2017 NOL's forward to ln 21

- Attach 2 1045 Sch B's for the original 16/17 NOL's and then 2 additional ones for the 2018 carryforwards of those remaining NOL's

The less complicated way (Read as, It might give the IRS a reason to reject the returns)

I would like to

Amend 2014 and use a portion of the 2016 NOL. Report 2016 NOL on Ln 21. Attach the 2016 1045 Sch A/B. Carry forward through 2018.

Amend 2015 and use a portion of the 2016 NOL. Report 2016 & 2017 NOL on Ln 21. Attach the 2016 (Same one used in 2014) & 2017 1045 Sch A/B. Carry forward through 2018.

2016/2017, just use the software to create the 1045 sch A/B. No additional filing required.

2018 File original return. Show 2016 remaining NOL and 2017 Unused NOL on Ln 21 as a total number only (They won't use it in 2018 due to income level). Keep an internal schedule showing remaining NOL available for carryforward.

Side not, Pub 536 seems to say if you have a Sch F operator running at a loss, and with an overall NOL on 1040, you must allocate the Sch F loss as a carry back up to the lesser of the Sch F loss or NOL per 1040. This is the default treatment UNLESS you remember to make the election to forego the carryback. Does anyone see this differently?

Sorry for the HUGE question. I spent a ton of time on this barely chargeable project already and am at the point I just have to close my eyes and pick the most logical option. I'm hoping one of you will have a better understanding of this ridiculously complex process.

-

I was hoping to find a shortcut for the following actions but I didn't see an option in the ATX Shortcuts document. If anyone knows, I would sure appreciate it.

- Next form (to switch to the next form in the left hand display i.e., 1065 to Sch B to Sch K-1

- Forward (there is a Control + B for back)

Also, I saw that I could change my view preferences to zoom out to 80% on a 27" monitor to view most forms in full screen mode, but I was wondering if there was a full screen option.

Thank you in advance!

ATX Client Letter Formatting

in General Chat

Posted

Is there a way to have the 2020 Client Letter override the 2019 Client Letter when we roll over the clients? We have updated the letter for a slight formatting change, but we would have to manually delete all of the rolled over ATX client letters and then add in the newly formatted ones within ATX in order for this to work. We had to do this a couple years ago when we changed our logo and it was a PITA.