M7047

-

Posts

66 -

Joined

-

Last visited

Posts posted by M7047

-

-

Have a client that is filing separately. He wants a paper check. Will his wife have to sign that as well or will it only be in his name?

Thanks!

-

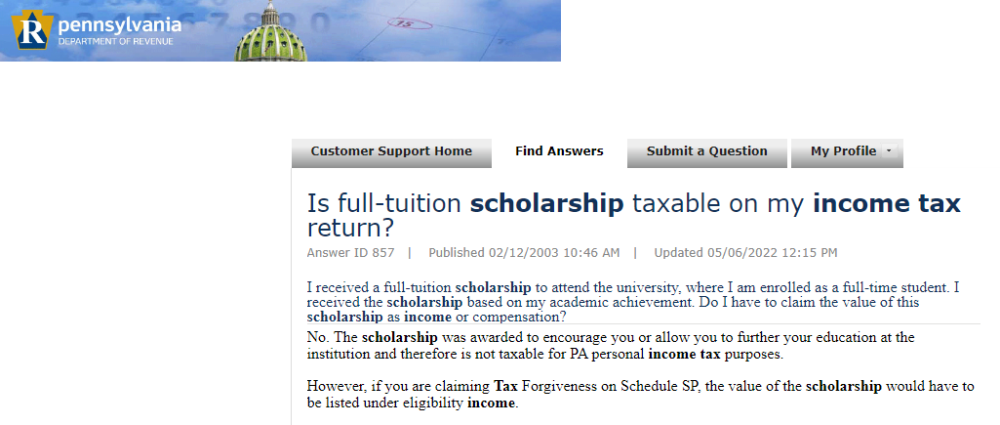

Client has taxable scholarships which I entered on the federal. They show up on Sch 1 line 8r. My question is how to eliminate that for PA. PA doesn't tax the excess, but the program is entering it as line 1a 9) Scholarships and fellowship grants not on a w2. Can I just override this amount?

Thanks!

-

Thank you all. She says she does have proof that she paid more for it, just wasn't sure she could use it. Sounds like I can use the actual amount paid providing documentation exists.

-

3

3

-

-

Have a client who sold undeveloped land they bought in 1999. The deed says they paid $1 to save transfer taxes then. They obviously paid more for it than $1. Can they use the amount they actually paid or are they stuck using the $1 from the deed for capital gains?

-

On 5/5/2022 at 7:12 PM, b#tax said:

Anyone have any experience using Sigma Tax Pro which claim they are a reseller of both Taxwise and Drake?

How are they able to sell the original software cheaper? Why would you want to switch from Ultimate Tax to Sigma Tax? Did you have a problem with Ultimate? Sorry for all the questions, but I've never heard of such a thing. I'm a small business looking to cut costs without cutting off my nose in the process.

Thanks!

-

On 5/3/2023 at 10:12 AM, b#tax said:

Just a helpful update, I moved from Taxwise to Ultimate Tax Software, who is a reseller of Taxwise and saved a bundle. Tax season was great and much easier to get ahold of live support, which only used for two issues. Still have the limitations of Taxwise which are slow to roll out updates for states. Now I need to find a PPR software that supports k-2, k-3 and AAR filing for a correction on a partnership return to finish off the year.

What do you mean they are a reseller of Taxwise? Is it the taxwise program?

-

8 minutes ago, Yardley CPA said:

I had a Pennsylvania MFJ couple receive letters separately, showing the amounts "each of them owed". Our letter to the IRS rectified the matter and there ultimately was no penalty but did find it strange they received two letters instead of one.

Mine are PA too. I thought it was weird that each received separate letters too.

-

Anyone else have married clients getting letters from the IRS separate from each other? I would have thought the would be joint letters since they filed MFJ. Each letter has half what the couple would owe as a penalty.

-

On 4/21/2023 at 11:31 AM, jklcpa said:

Affects PA state return only.

Client called and said her checking account was hacked into and recommended opening a new account to change account number. Anyone know if it is possible to change the account for DD after the fact, or how long PA is taking to issue refunds? Returns were filed on 4/11, so not long ago.If it's with the same bank and just a different account number the bank should reroute it for them. No need to do anything with the state. I don't think you can with PA anyway. I had clients that this happened with this year, and they received their refund just fine.

-

2 minutes ago, Lion EA said:

Extensions are our friends!

Yeah, it may need that. Again though, they would still have to come up with over 4000.00 by the due date to make up for their part, and that would still be due Monday.

-

3 minutes ago, cbslee said:

I would think the first step is for the client to get an explanation from their payroll department .

He's supposed to be doing that today. I'm just concerned with the due date being so close, if they have to make up the missed amounts on the return, they're not going to have it.

-

Have a client that had social security and medicare taxes withheld on only 2158.00 of their 59000.00 wages. Of course they didn't notice it throughout the year. Do I file 8919 on the difference and how do we make sure the company's part was taken care of?

-

33 minutes ago, cbslee said:

The taxpayer is required to notify the Marketplace of any change in circumstances.

They did. The problem lies with, the first half of the year their income was less and they qualified. Once he got a new job they didn't qualify. He notified them, but with the annualized income, it disqualifies them for the whole year.

It's a shame there's no way to input they only received the help when needed and then stopped. They're going to be paying back what they got.

-

Client had the credit for the first half of the year and then got a better job. They notified the marketplace and stopped coverage immediately. Their insurance rep claims they can use the amount of income for the beginning of the year to still get the credit, I don't see anywhere that allows you to say which income was earned when, it's just annualized. Am I missing something?

-

Client had windows installed in 2022, but they were financed for free and nothing is paid on them yet. Does the credit belong in 2022 when they were installed or can they wait and take the larger credit in 2023 when they actually pay for them?

-

11 minutes ago, cbslee said:

Is the superseded return going to reduce their refund causing them to repay part of their refund?

No. There wont be any change in the refund.

-

25 minutes ago, cbslee said:

I have had this problem 2 or 3 times when the student filed their own tax return and claimed themselves.

There is nothing you can do until the superseded students tax return is processed which might take months.

unless you want to try paper filing the parents return with an attached copy of the student's superseded return which will also take many months.

Is it considered processed once the student receives their refund?

-

I have a family and a son of theirs. While playing with who should claim the student, I accidently forgot to uncheck the box for the student to not claim himself and filed it that way. When I efiled them the parents were rejected as they correctly have the student on it but the IRS had already accepted the students one claiming himself. I amended the students to not claim himself and it was accepted on the 24th. I recreated the parents and tried again today and it's still being rejected for the same reason.

I thought waiting a couple of days after the amended student one was accepted would fix the problem. Any thought on how to get theirs accepted now? Thanks!

-

33 minutes ago, jklcpa said:

I agree that the tax portion of the refund is nontaxable since they used the standard deduction, and also agree with mcbreck to report the $396 as interest income.

I was thinking that the 396 should be interest, just wasn't sure if it would flag anything since they never received a 1099.

Thanks everyone.

-

1

1

-

-

It was from their mortgage Co. They issued them a check. This is the letter they received.

Nothing was ever deducted, as they can't itemize. Thanks

17 minutes ago, Max W said:Please elaborate a little more on this. How were the use of funds lost? Who issued the check? Was it an insurancepayment? Were the lost funds reported as a deduction?

-

Have a client that received money for "Lost use of funds" and being told it would be reported to the IRS as required by law.

They never received anything other than the letter. Would I just place the amount like it was an interest payment or would that confuse things, since there was no 1099?

-

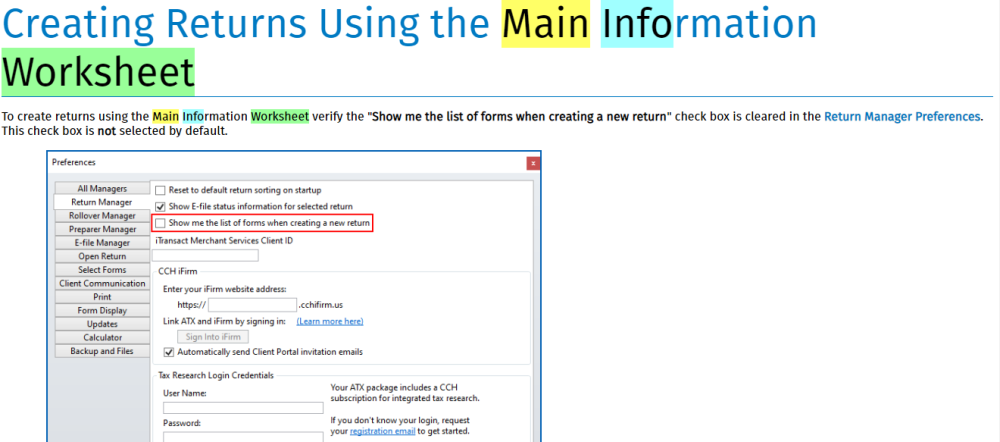

Spoke with ATX technical support today. She says this isn't an option this year, the removed it. I asked her to pass on to the powers that be that this was a really dumb move on their part and is wasting our time.

-

4

4

-

1

1

-

-

-

32 minutes ago, TAXMAN said:

I too would like to customize the main form. Anybody figure it out yet?

Ugh...not yet. I know I did in the past and it was a real time saver. I thought I was missing something.

MFS Refund

in General Chat

Posted

Thanks a lot!