M7047

-

Posts

66 -

Joined

-

Last visited

Posts posted by M7047

-

-

38 minutes ago, Catherine said:

I have a slew of QB updates that I never installed. Now I never will! Thanks for the warning.

How do you stop them. I'm going to get a newer version and don't want to fall into that trap either.

-

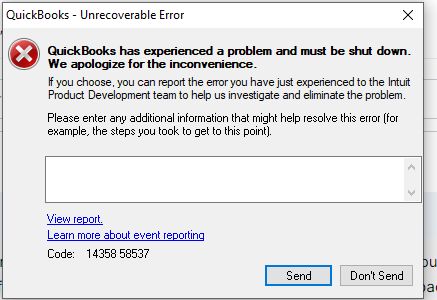

@Dennis. I truly appreciate you taking the time to give me input, but I can't open anything on this stupid program. It never gets to that point. I've tried to open backup files from a hard drive but it wont open those either. As soon as I try to open quickbooks, this is the message I get and it never goes beyond it to try anything else. UAC was down to never.

-

3 hours ago, BulldogTom said:

I still use QB 2003 desktop on my Win10 computer. I have the install key so every time I change computers I can re-install without QB knowing about it. I turn off the internet when I install, turn off automatic updates within QB, and then turn the internet back on. Never checks for updates, never changes anything about how it works. I don't use it for payroll, just my own bookkeeping. No hiccups. Never an issue. Intuit can bite me, I am not paying for a new version every year that does nothing more for me.

Tom

Longview, TXUgh, I thought this was brilliant. I have a 2009 version with the license key. I tried doing what you suggested, but even with the internet off, I still get this message once I try to open it. I've even tried to run compatibility with windows 7 and still nothing. Tried looking up the code and it's just basically telling you it's not compatible with windows 10. Funny thing, I had this working on windows 10 but had to get a new hard drive, and now it wont cooperate...:(

-

Hello,

I'm looking for software to enter "after the fact" receipts for a few clients. Need to also be able to get P/L statements. Don't need payroll. I've been using quickbooks and like their checkbook entry, but they're getting out of hand price wise. Also want a desktop version not online, as our internet can be out some days. Anyone have any recommendations?

-

4 hours ago, Gail in Virginia said:

I did not share fees because I am inclined to think that what I charge in rural Virginia would be a far cry from what you charge in the suburbs of Philadelphia. I price by the form, and a basic 1040 with a w2 and no itemized deductions or earned income credit would be $85. Most returns are not basic any more, so prices typically start at $100 and go up from there. A family with each spouse working, and two children (no EIC, but with CTC), and standard deduction, savings interest and no investments to report would probably run around $125. I find it difficult to articulate the price of a tax return, but a $200 or $300 return is not uncommon. Some of the returns that I see from other preparers make my prices look high for this area but I am okay with that. I have been trying to inch my prices up, and did do a more major increase this year since Virginia has raised their minimum wage and my cost for someone to help with filing, copying and answering the phone went up accordingly.

I'm in very rural PA (as in I have no visible neighbors) and my pricing is similar to yours. Obviously I would love to get more for a basic return, but given where my office is and there are two other accountants in "town" with similar pricing, I just cant.

-

4

4

-

-

On 4/22/2022 at 11:52 AM, Yardley CPA said:

I'm not sure where you are getting your information? I was an ATX user back to the days of Saber. Their cost, like almost every other technology company, have risen through the years. For me it became cost prohibitive. I switched to ProSeries for this past season. I locked in their Choice 200 rate which provides me up up to 200 federal returns (all business and personal). It includes every state as well, advanced calculations and unlimited use of their portal. The cost for that package easily saved me $600 or more compared to what I would have paid for ATX MAX and their portal. Granted, I'm limited to a total of 200 federal clients, but that is not an issue for me.

I'm not suggesting ATX is inferior, I enjoyed using the program. With that said, ProSeries has saved me time and has added efficiencies that have helped me and my clients.

I was looking at the ProSeries Choice 200 as an alternative to ATX. I understand this is for new customers only. Could you tell me what are they telling you about renewal? I'm looking at alternatives as ATX is getting out of hand, but I don't want to be looking again next year.

-

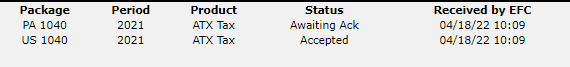

I've had multiple returns stuck at "transmitted to agency" for the state return. The federal are accepted. Are these considered filed on time?

-

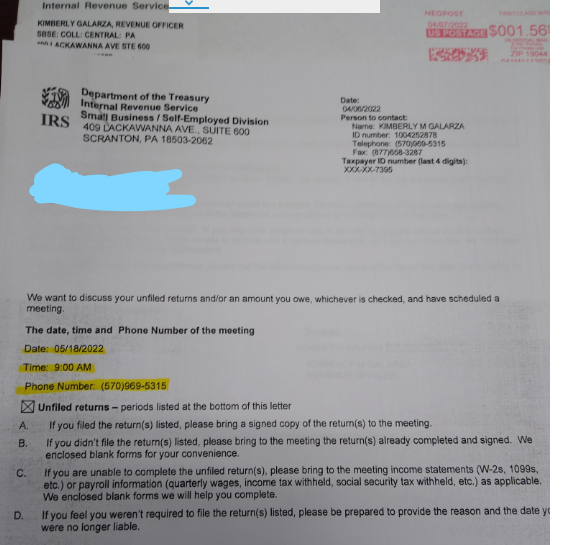

She claims she doesn't know whose number that is.

I am an accountant, but not a CPA or an EA

I thought this was fishy too. The weird thing is they want her to call them at that time.

What happens if she doesn't call them....

-

New Client received this letter from the IRS. It has her name and address correct, but that's not the last four of her social security number. The second page has 2 years listed that had no filed returns(because she only had social security those years). Our concern is, is this legit when they don't even have the correct social on it. Does she call and say that's not my number and then scammers have her real number? I'm so leary of fraud anymore. Has anyone else seen where they set up a time for you to call them? Anything I've seen had everything done back and forth in writing. Advice?

New Client received this letter from the IRS. It has her name and address correct, but that's not the last four of her social security number. The second page has 2 years listed that had no filed returns(because she only had social security those years). Our concern is, is this legit when they don't even have the correct social on it. Does she call and say that's not my number and then scammers have her real number? I'm so leary of fraud anymore. Has anyone else seen where they set up a time for you to call them? Anything I've seen had everything done back and forth in writing. Advice?

-

17 minutes ago, BulldogTom said:

Unless the pension file did not get uploaded into the IRS computers correctly and there is a mismatch between the return and what they have?

Tom

Longview, TXThat makes sense. Thanks!

-

I can do that. I just thought it was weird they were asking for that when they would have received the federal copy of the 1099 and should also have social security on file. It seemed weird they would ask for info they should have already, when they are understaffed.

-

1

1

-

-

Has anyone had a client get a letter from the IRS that asked for proof of withholding.? The only income they have is a pension and social security. Both have federal taxes withheld, but wouldn't the IRS already have the amount on their end?

-

23 hours ago, DANRVAN said:

I don't have a cut and try answer here, but believe there is confusion over what it means to have a home office and deduct mileage.

With a home office established as your principal place of business, you are allowed mileage for any business travel away from there. The key here is that your home is your place of business.

However, I don't believe there is any written authority that says you must have a home office in order to deduct mileage form your home.

Consider the case of an log truck driver owner/operator who leaves his home at 4 am to go pickup his first load of logs in the woods 30 miles away. I would not consider that commuting and prorate his depreciation, diesel...etc. Those are ordinary and necessary business expenses that start at the first turn of the key in the morning.

While I do not have any authoritative cites to back this up, in reality, the principal place of business for the log truck and full time "uber/whatever" driver is behind their respective steering wheels; and while there are differences between the two cases there are certainly similar fact patterns.

I do not have any uber driver type of clients but would dig in deeper if I did.

I can see what you're saying here. Makes you want to use the whole mileage, but I would still be inclined to forgo a home office deduction. I've been digging but there doesn't seem to be any case giving a definitive answer.

-

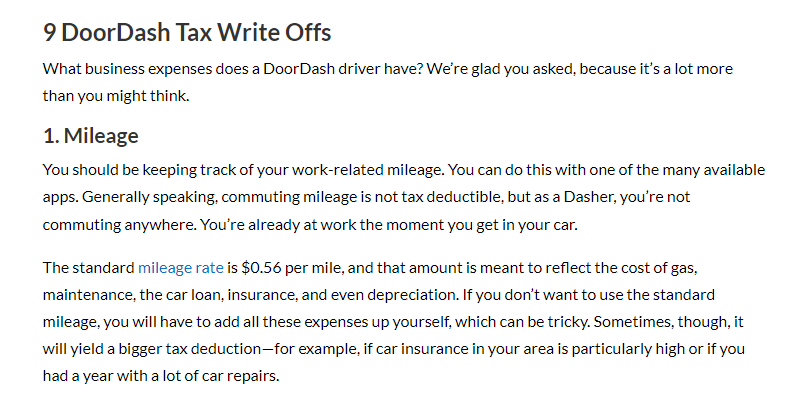

Thanks guys. I was inclined to ignore the commuting miles to first and from last pickup until I read this (attached) from a "tax advisor" and started second guessing myself. I had already told her no commuting mileage and I'm not venturing into a home office with her when all she's doing is answering her phone there.

-

2

2

-

-

This is her only job. It's a rural area so she doesn't go anywhere unless she gets a notification from the app. Once she accepts the job, she leaves home and goes to pickup/deliver whatever. She doesnt really have an office, she's just using her phone to get notices.

-

1

1

-

-

I understand that the client can use the standard mileage rate when working for these companies. My question is, does that start when they leave home or when they pick up the food/ passenger? I have read a lot and am getting both versions of this depending on who wrote the article. Some consider the mileage to the pickup as commuting others say the diver has no permanent place of work, so mileage to the pickup counts. Thoughts...

-

I've been thinking of switching software, the price for ATX Max is just getting out of hand for my business size and that 95.00 processing fee to download software is beyond ridiculous! . I have about 160 paid returns and a couple of partnerships.

Does anyone have experience with other software and care to offer pros and cons? I have an email from Drake and I understand a lot of people like them once they get on to their system. Any others...

-

17 minutes ago, Abby Normal said:

I would not use fixed assets to do this. In fixed assets, use the disposal code of removed for personal use.

Then go to 8949 and enter like any other sale of residence, just enter the total depreciation claimed and pay tax on only the depreciation.

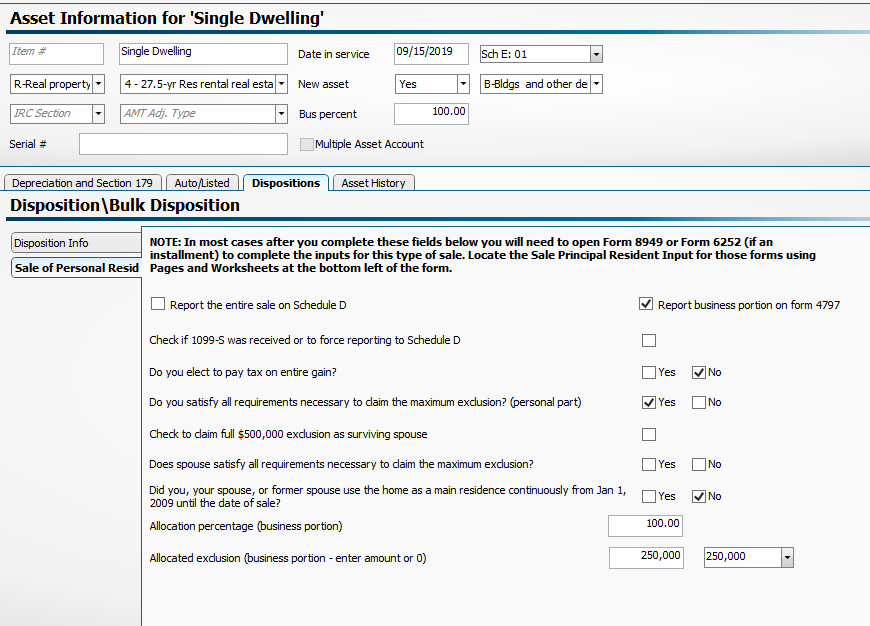

Thank You so much! I was using Fixed assets to remove it from Dep Sch.

-

14 hours ago, grandmabee said:

Did you fill out the sale of personal residence tabs in sch. 8949? it walks you thru it.

I filled out the sale of personal residence on the fixed asset tab. Why would I use 8949, wouldn't that put it on here twice?

-

8 minutes ago, Pacun said:

To qualify for the exclusion they have to own and have lived in house for two years in the past 5 years. You have entered less than 2 years.

That's the date it became a rental. She's owned it since 2011.

-

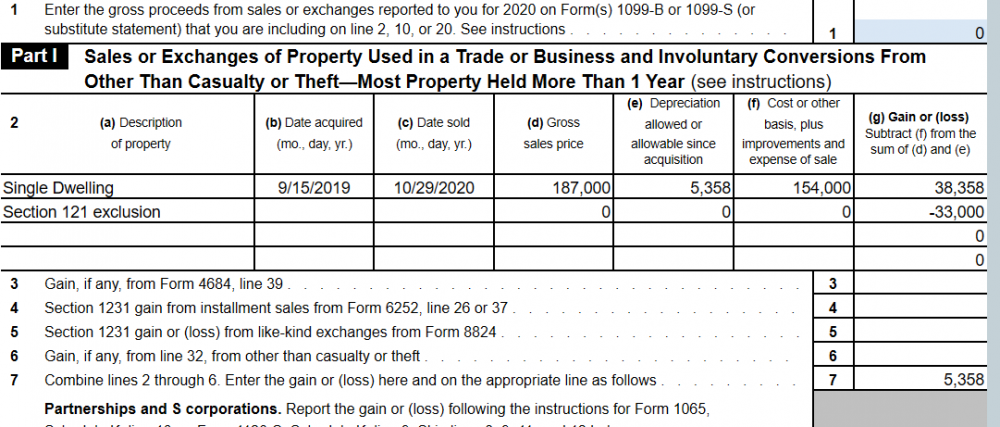

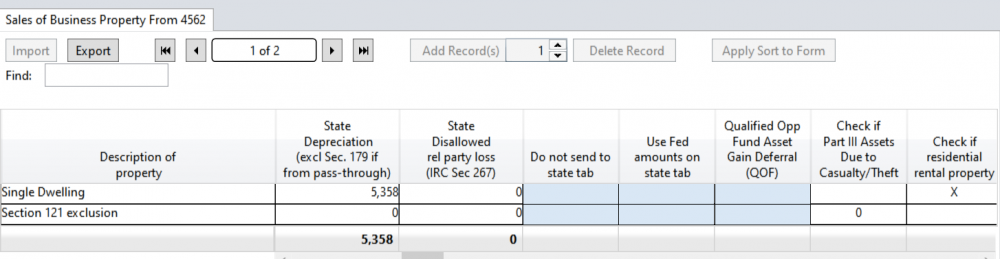

This is what I have for the 4797-it flows from here to the schedule D onto the 1040. They do qualify for the exclusion BTW.

Even though the state info is there on the detail tab, I can't get the info to flow to the state return...

My PA Sch D is blank and I cant get any of the info there. What am I missing?

Thanks!!

-

Why, when the whole gain is under 250,000?

Wouldn't you figure the gain/loss first and go from there . I mean, if you have to factor the depreciation into the basis aren't you already recapturing it...

-

This was part of another post that must be considered closed.

If client has home that they turned into rental property, used it 2 out of the 5 and then sold it, does he have to recapture the depreciation if the total gain is under 250,000? In other words, if you reduce your basis by the amount of depreciation used and still have a gain, can you exclude it all if that gain was under 250,000??

Ex house value 150,000 used depreciation of 10,000 so basis is now 140,000. Sales price is 190,000 making a gain of 50,000.

Can they just exclude all that gain and not report anything?

"Generally, the law allows an annual depreciation deduction on your rental property and you must reduce the basis of the property by the amount of your depreciation deductions. If you don't claim some or all of the depreciation deductions allowable under the law, you must still reduce the basis of the property by the amount allowable before determining your gain on the sale of the property.

The gain attributable to the depreciation may be subject to the 25% unrecaptured Section 1250 gain tax rate. Additionally, taxable gain on the sale may be subject to a 3.8% Net Investment Income Tax. For more information, see Questions and Answers on the Net Investment Income Tax. Refer to Publication 523, Selling Your Home and Form 4797, Sales of Business Property for specifics on how to calculate and report the amount of gain."

-

If he used it 2 out of the 5 and then sold it, does he have to recapture the depreciation if the total gain is under 250,000?

"Generally, the law allows an annual depreciation deduction on your rental property and you must reduce the basis of the property by the amount of your depreciation deductions. If you don't claim some or all of the depreciation deductions allowable under the law, you must still reduce the basis of the property by the amount allowable before determining your gain on the sale of the property.

The gain attributable to the depreciation may be subject to the 25% unrecaptured Section 1250 gain tax rate. Additionally, taxable gain on the sale may be subject to a 3.8% Net Investment Income Tax. For more information, see Questions and Answers on the Net Investment Income Tax. Refer to Publication 523, Selling Your Home and Form 4797, Sales of Business Property for specifics on how to calculate and report the amount of gain."

-

2

2

-

Why can't I Customize "Main Info" Master

in General Chat

Posted

In the past I could customize items on the main info worksheet. This year I can't even select it, it's grayed out. Anyone have any ideas as to how to change that? It shows up as a generic form in my rolled over returns or if I try to create a new return. I just can't customize it.