-

Posts

6,633 -

Joined

-

Days Won

327

Posts posted by jklcpa

-

-

1 hour ago, Lion EA said:

What is substantial control? For example, husband owns 80%, wife 20%, adult son 0% but VP of marketing, and high school daughter 0% but VP of finance. Both H & W are the producers of the local TV shows as well as being the on-air talent. Does only husband report? Or, some combination of 2, 3, or all 4? Would it matter if the responsibilities stayed the same, but the "kids" didn't have VP titles? Is there a difference between the kid that's over 18 and the kid that under 18? I guess I have to go read the details at the website!

Thanx, Lynn, for your post. That's what I'll send my clients, with the website in large font, bolded, and highlighted.

That's covered on the FinCEN site's BOI page of FAQs. See section D.

-

29 minutes ago, Catherine said:

As long as they are in a Workspace thread with both people, you set up the two signers. It goes to #1, automatically to #2, then back to you once signed.

I wasn't asking if the preparer must send two emails. Based on what Margaret said here:

3 hours ago, Margaret CPA in OH said:When the first signer is finished, an email is sent to the next one.

...what I meant was, for example, must each party signing the 8879 have his or her own separate email address.

-

2

2

-

-

Does a form requring 2 signatures need to have two separate emails?

-

1

1

-

-

6 hours ago, mcbreck said:

I would call Sigma.

I am wondering that as well.

Also, do you have access to the Drake forum?

-

1

1

-

-

Any time is ok with me for the conversion business-wise, but I may have withdrawal during the downtime.

As always, thank you for taking care of us so well, Eric.

-

7

7

-

1

1

-

-

-

-

1 hour ago, mcbreck said:

Just in the past few days I've noticed I can no longer load Drake / Sync while connected to my VPN. Anyone else notice this? Maybe it's just my VPN.

Yes, it has been like that almost since the beginning of this season for me. When the program would open, I had no alerts or notifications in that bottom left corner of the manager screen, and I wasn't able to get program updates. I didn't realize this at first because I was only waiting for state approval of a certain form.

Also, MS Edge browser window would open on top of the program every time, and I couldn't make the support person or her supervisor understand this. I have never used Edge, and the supervisor's suggestion was for me to try changing to Edge as my default browser, or try Chrome. I could NOT make either of them understand at all that something with my computer's environment was blocking communication from the program to Drake's server, that it was not a browser issue. Finally after about 6 calls the supervisor sent a message to a higher level support person. Very frustrating!

We worked on it and thought it was solved with me changing settings in my AV, but the problem reappeared again in late Feb. I ended up changing to a different AV software completely but had only disabled the original one. That worked until I rebooted the computer and a portion related to the original AV's VPN was still enabled, and THAT was the issue.

-

3

3

-

1

1

-

-

I haven't had anything from Drake yet. Tax Book's offer came in the mail today.

-

14 hours ago, NECPA in NEBRASKA said:

A Morkey is part Maltese and part Yorkie. He does have some poodle in him according to his DNA test. He does not shed and he is the faster than greased lightning.

He's a cute little fluffball.

-

3

3

-

-

Yes, please see the instructions to preparing 1099-C and "Who Must File" and the large bold heading under that labeled "Exceptions".

It seems that the form's issuance depends on the type of bankruptcy and whether the debt was for business or investment, or if it was for personal use.

-

2

2

-

-

27 minutes ago, Slippery Pencil said:

Sure he can. I know plenty of kids who graduated w/ an Associates Degree from the local community college the same time they graduated HS.

Thanks. That's good to know, and so it would be up to Christian to find out the specifics for this student.

-

2

2

-

-

Christian, you may be correct.

With the AOC, the student must be a degree candidate, and he can't be a candidate for a degree without graduating from HS. Most colleges and universities will not even enroll the student in the degree program without first completing the secondary education.

The LLC, on the other hand, can be taken by an eligible student taking course(s) that are part of a degree program, but it does not require that the student be a degree candidate.

-

1

1

-

-

Student has to be a degree candidate, and since he hasn't graduated high school yet that would knock him out. No?

Even if qualifying, AOC can only be claimed for 4 years. Maybe the parents don't want to claim in a year where the credit would be small.

-

4

4

-

-

-

I'm done and done in. Last night I dug a hole on the edge of my foot to remove an already inflamed deepish splinter and went off this morning to the 5K charity event with a bunion pad and bandage. I completed only half of that, and then the sporting clays went about the same, like I was a raw beginner again.

I had an awful season this year. My Mom passed at the end of Feb, and the I got the flu-a in early to mid March and missed many days. I actually sent 3 returns and a trust away because of it. There were a few days that I don't even remember in March when I started back working and was still very sick.

Glad this season is over. If you made it this far, thanks for listening to me whining.

-

4

4

-

9

9

-

1

1

-

-

5 hours ago, NECPA in NEBRASKA said:

I hope that it's OK if I hang around here for awhile after I retire.

Yes, absolutely we want you to stay with us.

-

8

8

-

-

Have you included the nonresident/part-year ratio schedule in the return? That ratio from the schedule would be applied to the overall MT tax on all income so that the tax is reduced to the same ratio that the MT income represents of the total income.

-

2

2

-

-

4 minutes ago, Lion EA said:

Can you personalize each clay pigeon?!

Certain people do come to mind and then they turn to dust.

Breaking things after an aggravating day can be very satisfying.

-

8

8

-

2

2

-

-

There is a fillable version available from irs.gov here: https://www.irs.gov/pub/irs-pdf/f8978.pdf

and the instructions: https://www.irs.gov/instructions/i8978

Good luck!

-

2

2

-

-

I have no experience with this and don't use ATX but googled and found that ATX does not list this form as part of the ATX packages.

https://support.atxinc.com/taxna/software-system-requirements/atx-forms

-

1

1

-

-

I'm done. This morning I filed the extension for my ultimate procratinator, and other than the extended returns, I am waiting on one to pickup (SO unexpectedly hospitalized day she was scheduled to see me) and one couple that have had the returns for almost a week and must return the 8879 to me.

Tomorow I am participating in a charity event in the early morning and then will be shooting at the clay pigeons. That's been ongoing as weather permitted and really helped keep my sanity this year. Plus, it's fun.

-

8

8

-

-

7 hours ago, Sara EA said:

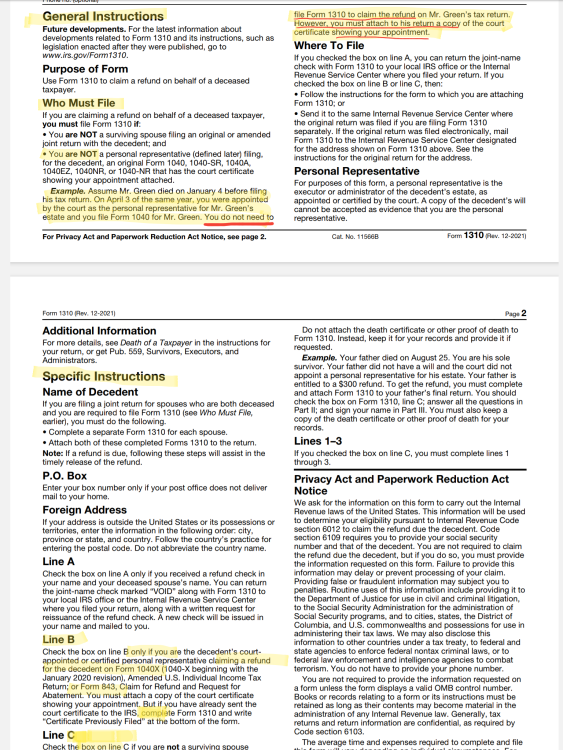

What are you reading? Form 1310, Part 1, Line B is where you check the box that you are the personal rep. It says nothing about amended returns.

TexTaxToo's quote is directly from the 1310's instructions.

I don't know why this is so hard either. If Yardley's client (the son) has a Short Certificate, which if in his state would be the only official legal appointment LIKE IS HERE IN DE, then the form 1310 is NOT REQUIRED.

-

2

2

-

1

1

-

-

7 minutes ago, joanmcq said:

ST or LT or does it depend on how long he has had the investment

Yes, this is correct. It depends on how long the investment has been held.

-

1

1

-

Upcoming server move for the ATX Community

in General Chat

Posted

The site does have the option to stay logged in, and stays that way until the user clears browsing history unless leaving cookies intact. I'm logged in almost all the time.

The site also has the ability for a user to log in anonymously too and stay that way.