michaelmars

-

Posts

2,272 -

Joined

-

Last visited

-

Days Won

34

Posts posted by michaelmars

-

-

Can you share this article. I was just researching a similar situation.

-

is she an S corp for asset protection purposes?

-

1

1

-

-

-

Remember, shutting down cards can adversely affect your credit score because you are now using a greater percentage of available credit. Better to just keep it in a draw and use it every 5-6 months for a small charge to keep it active. BTW B of A is one of the easiest banks to get a line increase on and offers great -0- percentage offers. I put all my balances that build in the off season onto an interest free BoA card and pay it off each tax season. Never incur interest charges this way.

-

3

3

-

-

is it possible he did a refi and this is closing costs and not an actual improvement?

-

no problem with proseries or lacerte today

-

1

1

-

-

Put $1 from your left pocket to your right pocket and now you are a paid preparer. Don't forget to declare the $1 income next year.

-

You can't amend from joint to mfs. You can only amend going the other way

-

about 1600 out of 2000 are on extension - we do too much real estate to deal with the aggregation rules and interest limitations that the software isn't handling correctly

-

1

1

-

-

2019-07 safe harbor election needs to be attached to the return

-

why would the past matter? once it goes into the estate it gets a new basis based on market value and depreciation starts over. i would not do a 3115

-

from a tax point of view, partnership distributions don't have to be equal as with an S corp

-

2

2

-

-

HE CAN pay himself a management fee which gets deducted on E and picked up on C, or better yet on a S corp with payroll.

-

25 but you will have to paper file

-

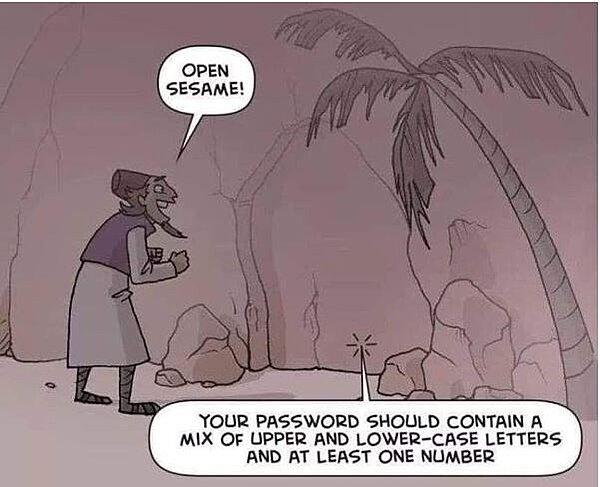

a while back, after much frustration i changed my Oxford insurance password to "thisisb*s*f*koxford" all spelled out. Well one day my secretary had to deal with them on an issue and they asked her for the password verbally. Boy was she embarrassed to say it over the phone.

-

1

1

-

9

9

-

-

Haven't been able to print with proseries all season, they post the usual bs response that its our computers. Its a 32bit issue, I have 64 bit, so then its a 64bit issue but with a different fix than the 32bit fix they posted. You all know the drill, its your system, its your anti-virus, its another program causing it. Then they log into mine and say, wow you could run nasa with your equipment. Now finally 3/9 they state that they tracked the issue as a microsoft issue and microsoft will have an update 3/19. Luckily i have been able to print to pdf and then print.

Bottom line, all software is having issues this year and customer service is just "cover out butts" service.

By the way, even lacerte which i also use isn't calculating the 8990 which is holding up all of our real estate returns. I think we sent out about 50 of our 2000 returns. Biggest issue will be a very busy summer and lack of cash flow now.

-

3

3

-

-

if not done in advance, i always get a cost seg in year of sale just to gain this rate spread.

-

2

2

-

-

I WOULD split it and do the 3115, they come out ahead assuming max bracket. depr is deducted at ordinary rates and recaptured at cap gain rates.

-

3

3

-

-

Sounds like joint ownership since the property would have to have been titled in a "partnership name" to go that route. btw flipping is ordinary income subject to se tax

-

-

2

2

-

-

Just finished, 12 ptp's [6 sold], 8 rental properties, refi consolidated mortgage with 5 properties. Yahoo, just one simple return for tomorrow and about 35 to review from staff.

-

4

4

-

1

1

-

-

i don't use atx anymore but wasn't there a line to put it on instead of opening a 2nd k-1. i use 3 other softwares and they all have this. a place to enter 13W items.

-

On 10/1/2018 at 7:49 PM, cbslee said:

You are required to inform your client of their obligation to file the amendments and the resulting tax consequences.

The sticky wicket is " Will your client pay you to prepare the amendments?"

They could choose to wait and see if they receive any correspondence from the IRS.

However that doesn't change the fact that you need to prepare the amendments, whether or not they decide to wait and see.

They could also choose not to file the amendments, because you can't force them to file.

A real life "Catch 22!"

On 10/1/2018 at 7:49 PM, cbslee said:why would you prepare amendments unless the client hires you to and pays you to? You are only obligated to explain the need for an amendment not prepare one. Maybe he will have his barber prepare it for him.

-

1

1

-

-

Can't use cash withdrawals to justify an expense since the cash could have been used in Atlantic City. Cash payments are ok as long as you have receipts for the expense.

-

1

1

-

estate and business ? please

in General Chat

Posted

i can't get to that page even with registering, can you post the article?