-

Posts

211 -

Joined

-

Last visited

-

Days Won

2

Posts posted by G2R

-

-

Finally got someone on the phone. They instructed I delete my EFIN number, save. Then reentered it. It fixed the problem.

-

1

1

-

-

Did you ever get a solution for this. I too and getting this 77 error code, "You have transmitted an EFile using a transmission relationship that is not valid in the EFC Client Database."

-

I use OneDrive expiring links. I upload the documents I need to send with a link that expires in 3 days. They can download from there anything I'm sending. Since the link expires, I don't have to worry about a hacker getting their info from these links and my inbox and theirs remains "personal-info-free."

-

2

2

-

-

My client is an engineer and owns his own S-Corp. He got his bachelor's degree from a smaller school, has been working in the field for a couple years now and wants to get his PE license. However, the school he got his bachelor's degree from doesn't qualify him to sit for the PE license since it didn't have the right accreditation. So he has to take many of these classes again from an accredited school to qualify for the PE license.

My question is this. I think if he were getting his bachelor's degree only, the education expenses wouldn't qualify as a business deduction because the IRS views a bachelor's degree as "training for a new profession" regardless if you're already in the profession. But an MBA in the field WOULD qualify as education expenses of the S-Corp because they "maintain & improve skills in your current profession."

So here's the tricky part. Since my client already has the bachelor's degree, and he's only taking some of the undergraduate classes to qualify for the PE license, you think that's enough separation to qualify for the "maintain & improve skills in your current profession" and take the deduction through the business? Or am I really reaching here?

-

Just got a notice about this from PayPal. They are no longer refunding ANY of the PayPal fees when refunds are processed. This is gonna piss off of people. Many of my clients will probably skim right over this unaware. Just in case you've also got clients that utilize PayPal, you might want to let them know too.

-

2

2

-

-

12 hours ago, mircpa said:

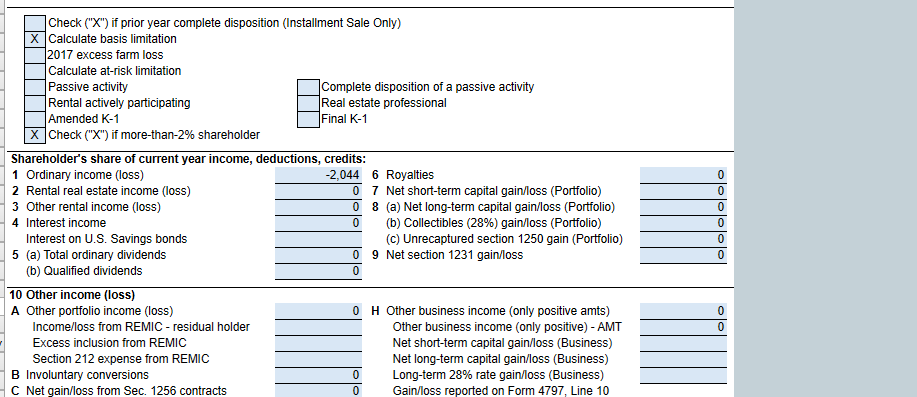

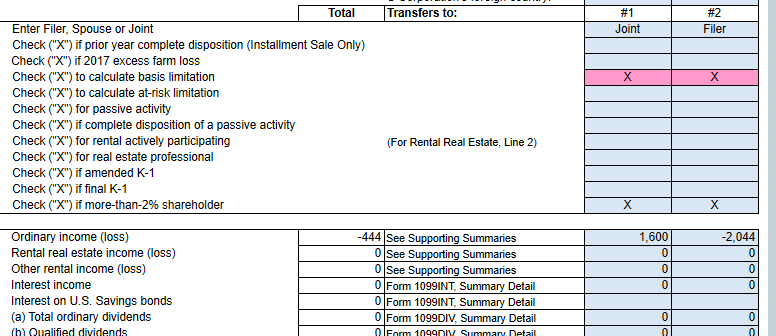

Losses shown on Line 1 of K1 gets entered on K1 input screen of individual tax return & put check mark on calculate basis limitation & if you go further down on same input screen you would see basis limitation worksheet.

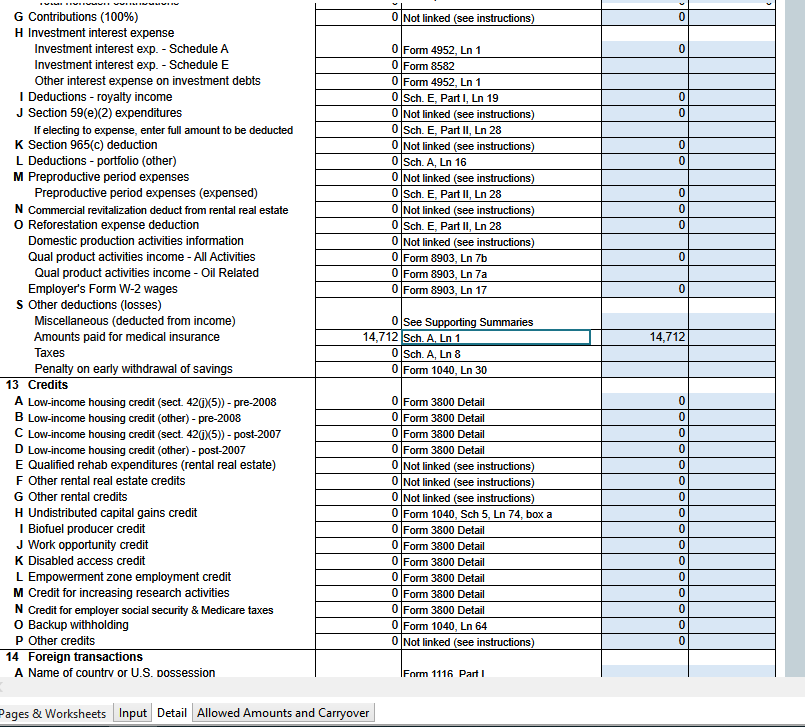

This is what I've already done so thank you for confirming it. My belief that I was still somehow overriding it was based on the DETAIL tab of the 1120S K-1 data entry. When I check mark the "calculate basis limitation" box on the K-1 1120S K-1 INPUT tab:

I then get the pink "override" boxes automatically filled in on the DETAIL tab.

Not sure why ATX would do that since it makes you think you've done something wrong, but things flow through nicely and line up with my paper copy so I'm happy. Thanks for all the insight everything.

-

Oh, I still don't see how to enter this information into ATX without overriding a box. Any clue how to get the new Schedule 2, page 2, line 28 box to be check-marked in the first place?

-

19 hours ago, Richcpaman said:

IF this is your only S-Corp, then I congratulate you on paying attention.

19 hours ago, Catherine said:Oh they might! We've seen questions from the IRS about claiming losses when we don't have the basis worksheet (only when someone else is doing the 1120-S). They want to know there is basis before they allow.

Interesting. I have filed other S-Corp owner returns, but this is the first with a loss so it piqued my interest.

I can see them sending letters for lack of basis reporting if a loss if reported or stock disposal, but I wonder how much enforcement there will be for distributions only as I would think most S-Corp shareholders have distributions.19 hours ago, Richcpaman said:The rules changed in the past two years and now we are required to provide a basis worksheet with every K-1.

It's my understanding that reporting the basis information is only required if a shareholder reports a loss, receives a distribution, disposes of stock, or receives a loan repayment from the S corporation.

-

2

2

-

-

Was reading an article from Kiplinger regarding expanded cases when on Schedule E, Page 2, Line 28, the box labeled "check if basis comp required" is checked. I'm about to file my only S Corp return this year that has a loss to report and I can't see how ATX even utilizes this box unless I override. Even in the K-1 Detail Anyone ever check this box without an override and if so, how?

And while we're discussing it, how many are actually doing the basis computation and including it with the return when their reporting a loss? I've spoken to other accountants who looked at me like I had three heads when I mentioned it. -

3 hours ago, Abby Normal said:

Yes, that's how I do it.

2 or 3 times, I've had the catch-22 where deducting SEHI qualifies you for a PTC, but then the PTC lowers the SEHI so much that it disqualifies you for the PTC. I just split the difference and call it a day. Never gotten any IRS notices over this.

You honestly, genuinely and sincerely just made my day

-

5

5

-

-

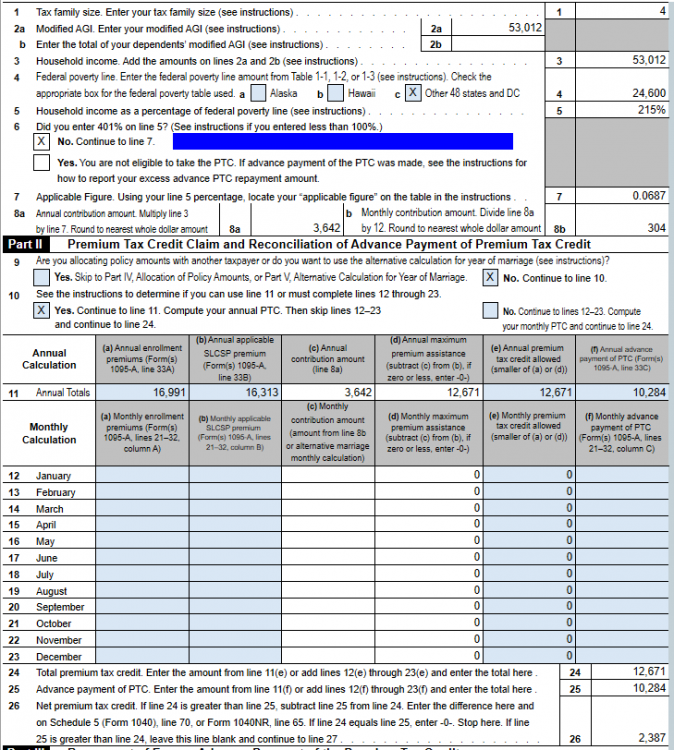

Resurrecting this beast as I'm really trying hard to do this RIGHT, and it genuinely feels impossible using the 974 as a guide. I'd honestly LOVE to see an IRS auditor explain this whole thing. I'd bet many can't. Regardless I've got a CRAZY method and I'm hoping one of you can logically talk me out of it.

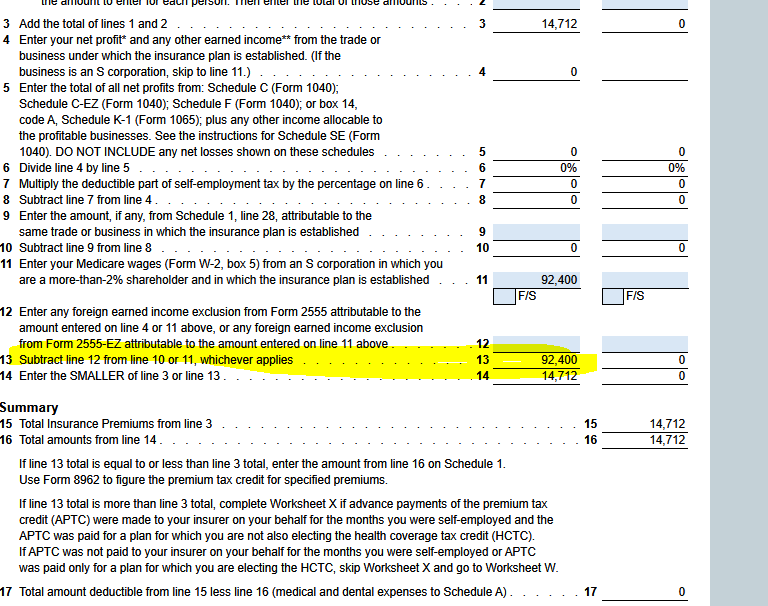

I'm using ATX. I've already completed the SE Health Ins. worksheet, Worksheet W & Worksheet X and form 8962. The only thing blank on W is the very bottom where it asks for the simplified or iterative method results.

THEN, I took total premiums listed on 1095A (ie $16k) minus premium tax credit listed on 8962, line 24 ($13k) = $3k. So I then reduce my SE Health insurance deduction by $3k. Let's assume I was deducting $7k in premiums originally, so now it only says $4k. I go back to 8962, see what the newly calculated premium tax credit says and continue to adjust the SE Health insurance number up and/or down until I get a summation of SE Health insurance and Premium tax credit that's most closely totals the total premiums.

Is this crazy? Is this in effect the Iterative calculation?

-

Resurrecting this beast as I'm really trying hard to do this RIGHT, and it genuinely feels impossible using the 974 as a guide. I'd honestly LOVE to see an IRS auditor explain this whole thing. I'd bet many can't. Regardless I've got a CRAZY method and I'm hoping one of you can logically talk me out of it.

I'm using ATX. I've already completed the SE Health Ins. worksheet, Worksheet W & Worksheet X and form 8962. The only thing blank on W is the very bottom where it asks for the simplified or iterative method results.

THEN, I took total premiums listed on 1095A (ie $16k) minus premium tax credit listed on 8962, line 24 ($13k) = $3k. So I then reduce my SE Health insurance deduction by $3k. Let's assume I was deducting $7k in premiums originally, so now it only says $4k. I go back to 8962, see what the newly calculated premium tax credit says and continue to adjust the SE Health insurance number up and/or down until I get a summation of SE Health insurance and Premium tax credit that's most closely totals the total premiums.

Is this crazy? Is this in effect the Iterative calculation?

-

Ugh, I did a search in the forum for this before I posted and came up dry. Guess my searching skill need work. Thansk Pacun.

-

And I found it. Never mind. For anyone looking, it's under the "over 65, blind, deaf, etc." boxes.

-

1

1

-

-

Rolled over a client's return from last year where his mother claimed his exemption. His mother cannot claim him this year, but the box at the top for "Someone can be claimed as a dependent" is checked and for the love of me, I cannot find out how to remove this. HELP!

-

This is what I thought too, however, after researching it and I think because it doesn't qualify as a 2nd home (they didn't stay in it the minimum of 15 days necessary to qualify as a 2nd home), then that rule doesn't apply.

https://www.redweek.com/resources/articles/tax-aspects-renting-timeshare

-

Client owns a 3 week timeshare. Uses it for 11 days personally, rents it out for 10 days. Got a 1099 for the rental income. Just want to confirm.

- The timeshare doesn't qualify as a 2nd home because they didn't personally use it for 15 days correct?

- I report it on Sch E, but losses are limited to rental income. After that they are disallowed, correct?

- Do I have to split the association fees and other expenses between personal and rental? Meaning, only (10/21 or 48%) of expenses are deductible on Sch E?

- Are the disallowed losses carried forward or permanently disallowed?

-

Did you complete this line?

-

1

1

-

-

This data entry is very tricky indeed. I always have to pull away the cobwebs from last year to remember how I did it before.

After I've enter everything I think should be enough, the business name never shows up in the "choose the business under which the plan is established" list. Then, on the K-1 schedule data entry, in the DETAIL tab, Box 12, letter S, "amounts paid for medical insurance," when I enter the SE health insurance amount again here, this seems to illuminate the business name in the Line 29, Sch 1 worksheet of the 1040.

-

I didn't even know about this feature. Been doing it the old fashion pen-and-paper way! Thanks for the tip!

-

2

2

-

-

On the 1120S page, click on the pages & worksheets tab on the bottom, jump to the line 17d page worksheet, scroll to the bottom and start with line "V."

-

I'm stunned by the number of NEW clients I get that were incorporated by other lawyers, accountants, etc and did not have the articles of incorp, by laws, minutes, or stock certificates issued. None of this was completed. Some clients have no idea where the corporate book is? Some were just given articles of incorp and blank by laws, minutes, stock certificates and did not provide guidance or insistence that this be completed BEFORE the company opened (let alone before the first tax return was filed.)

So my question is.

- Do you request to see the corporate (black) book when interviewing a new corporate client?

- Do you verify the corporate details against what's on past corporate returns filed by another accountant?

- When, or if, you incorporate a client, do you just send them off to legal zoom or a lawyer and leave it up to them the corp in order? Do you ever check the book for accuracy?

My terror on this subject comes from a story father (also an accountant) told me that happened years ago. New client comes in, says he's being audited. My dad reviews the bookkeeping and financials for him, requests to see the black book, but the client forgot it. On the day of the audit, the auditor requests to see the black book. New client says, "Oh, I've got that this time Bob!" Hands it to the auditor, (so my dad never got to review it) and low and behold, the lawyer screwed up the paperwork with incorrect dates and names, and worse, the stocks certificates were blank. The auditor denied the incorporation & S election based on the book being wrong. My dad said, the penalties and fees put the guy out of business.

Has the IRS relaxed these rules over the years?

-

16 minutes ago, Lion EA said:

FYI: NY W-2s (and CT and other states) are required to have the federal wages listed for NY. That's the starting point for the NY return. Then you complete the worksheet to allocate for part-year situations.

Interesting, I didn't know this. Thanks!

-

1

1

-

-

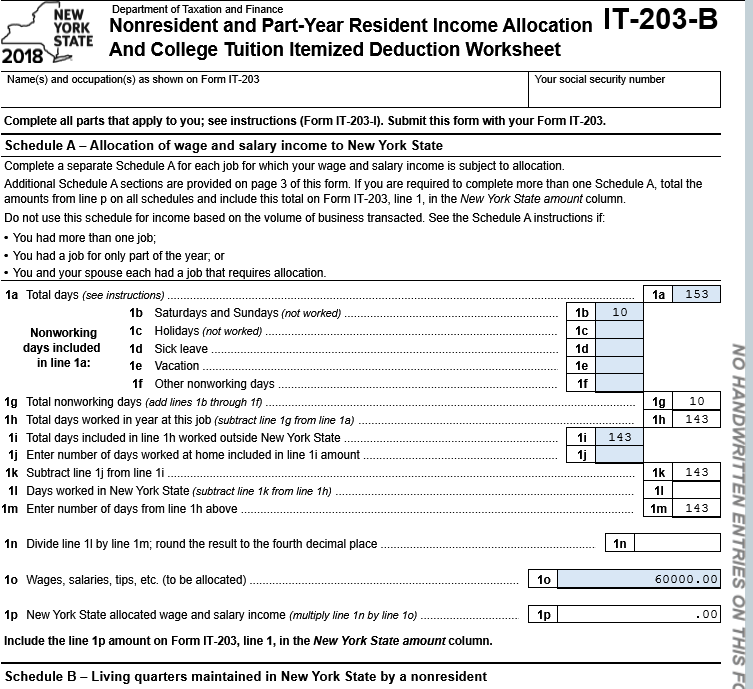

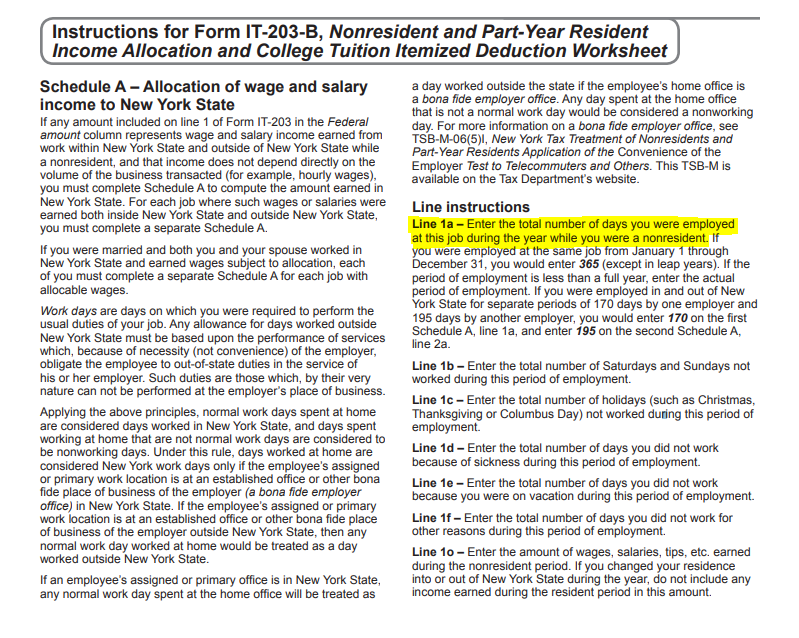

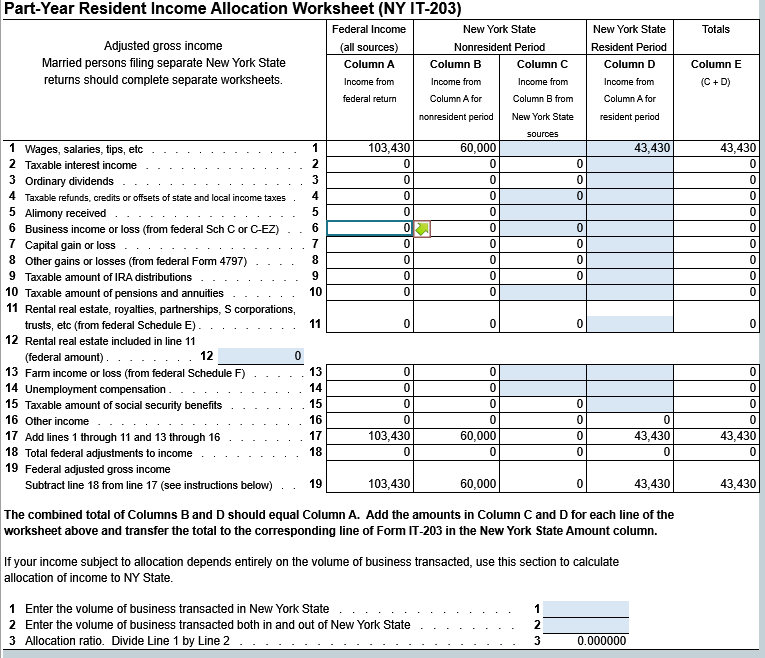

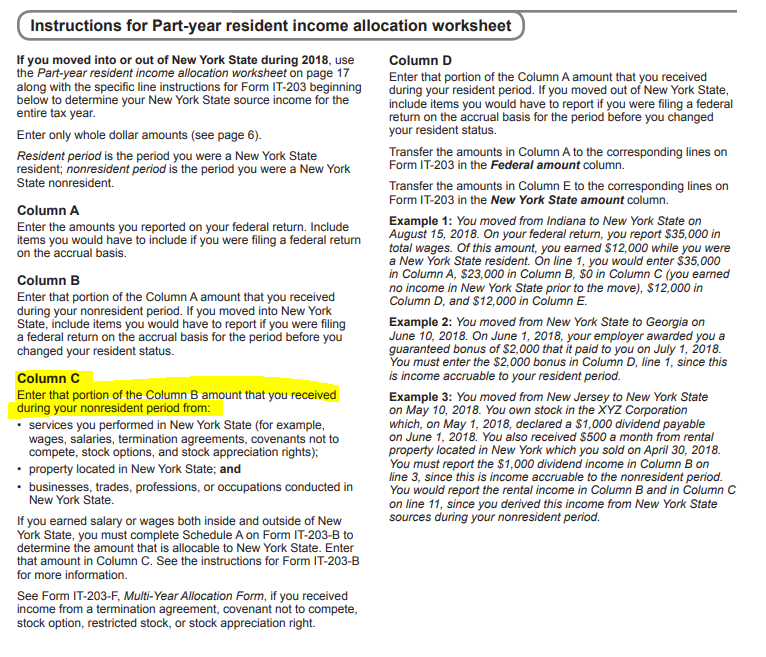

I think I see where you went astray. The instructions say for the IT-203B to enter NYS income info for when you were a nonresident of NY. You've entered the entire year and backed out the IL time. I think it should be entered like this (I'm just assuming $60k earned while in IL). You manually enter the IL wages on line 1o of the IT-203-B worksheet, then manually DELETE the Column C wages ATX flows to the Part-year Resident Income Worksheet for the NY IT-203

-

1

1

-

emailing PDFs to clients to review

in General Chat

Posted

Sorry for the late reply Margaret. Originally I was asking clients to upload to various Clouds they may have that I also have; One Drive, Dropbox, Google, etc. But this year, I'm trying out SignRequest. So far, it seems easy. The only annoying thing is that it's a separate email to the client, rather than part of my original email with the return information. We'll see how my clients respond to it.

As for encrypting docs upload to OneDrive. No I don't encrypt them. Once the engagement with the client is completed, I delete their info from my drive completely.