-

Posts

233 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

I am one of the cases. We originally filed the return September 2022 -- In January 2023 after still not receiving the refund, we learned there was ID theft. Elderly client who unfortunately passed away during all this. The fraudulant return was flagged, and luckily, not paid out. When the legitimate return was filed, the process of ID verification begin. We had to go through ID verification 7 times before it finally stuck. (well hopefully, the refund has still not produced) Originally in June 2023 we were told it could take up to 430 days. In August 2024, we were then told maybe 640 days. Called last week (you know, 2 years and 9 months after filing the original return we filed) and were told ID verification is confirmed, but it has yet to be assigned to a case worker. So, about 1,000 days later ... we are hoping the National TP Assistance will help us.

-

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

Trust was setup years ago. LLC was just setup last year and owns the rental. I got the EIN letter from the client, they state 1065 as the expected form filing. -

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

I learn something new everyday. Thanks! -

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

Great point. They are still looking for it. The did all this last year, and did not mention it to me till Tuesday. The LLC has one owner, the revoc trust. The revoc trust's grantors are a married couple. This is where my uncertainty stemmed from. If I look at the LLC ownership 1st (and only), there's a single owner (the rev trust) so ... it's a SMLLC. But as @Lee B pointed out, drilling down deeper, the trust is disregarded bc it's revocable, so then the grantors of the trust are LLC owners. Married couple, thus two people, common law state so MMLLC. Thank you everyone for your input. -

As the title says Married Couple's Revocable Trust Owns "Rental Property LLC" in a Common Law State. (So, No Community Property State, No QJV) Ignoring the trust part for a second, couple is then required to file 1165 partnership rtn because they are a multi member LLC. But there's always a monkey wrench that makes me go . Is the TRUST considered a single entity, so then the LLC is considered a disregarded entity and can forego the 1165, filing Schedule E direcly on the married couple's 1040? My gut says no, but maybe there's a legal element in play that someone's seen before?

-

Exactly why I wish ATX would create a one-stop-shop location for all CF/CO -- Wolters Kluwer, if you're listening, this would be a really great addition and help alittle in justifying the large increase in software costs we get every year!

-

Did you complete a IT 360.1? Also, be sure on page one of IT-201, question E & F correctly with days and months.

-

Just in case the developers at ATX monitor this forum.... Is there a reason the Tax Summary Carryover Summary doesn't detail QBI Carryforwards? I routinely check the 8995 for any QBI CF, but I can see how this is easily missed if it's a new client and/or if the data isn't rolled over the next year (new tax software). Or if there's a netting of QBI CF, then at least have a *** note on the CF summary that says, "QBI CF present." Something of an alert for this and the other CF info that was present in a previous year. Just my two cents.

- 1 reply

-

- 1

-

-

'Keep me authenticated' check box added to ATX Tax!

G2R replied to Abby Normal's topic in General Chat

This was a GLORIOUS discovery. Thank you!! -

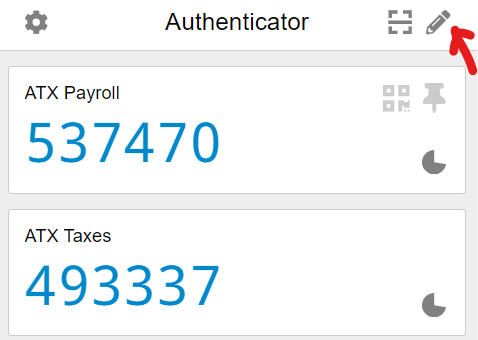

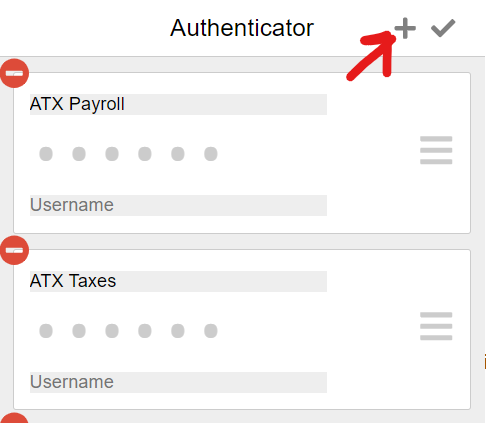

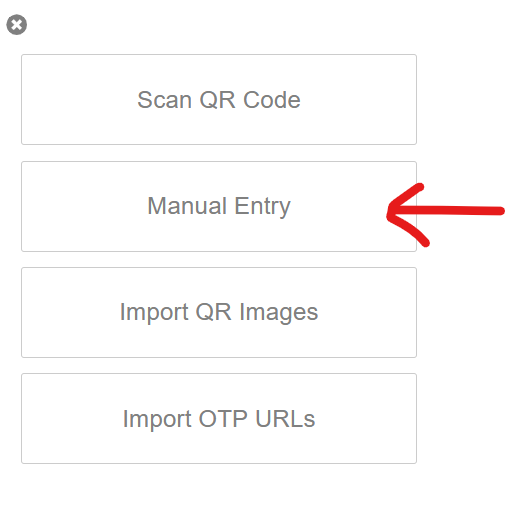

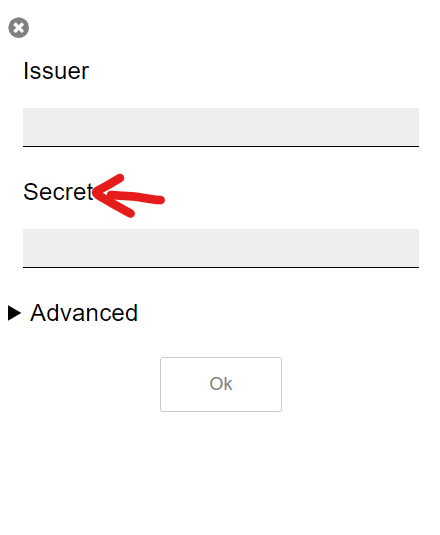

I reached out to ATX. The guy said 95% of his calls since October were complaints about this. Nothing they can do at this point unless rules change. He did advise of a browser based authenticator if cell phone wasn't an option. I tried it and it worked so it'll be a bit easier to explain to my low-tech/no-tech dad. I downloaded the Authenticator.cc browser extension in Chrome. Hope this helps.

-

Not sure how much this might help, but Google being the unasked-for big brother they are often tracks people's location history. If he has a smartphone, he might be able to track each time he went to a rental property to address an issue inside his Google Maps timeline. In addition, email and phone records are also usually stored in the phone and or via the cell phone/telephone records. It's a labor intensive process for the client, but if it's req to avoid a major tax implication, it is what it is.

-

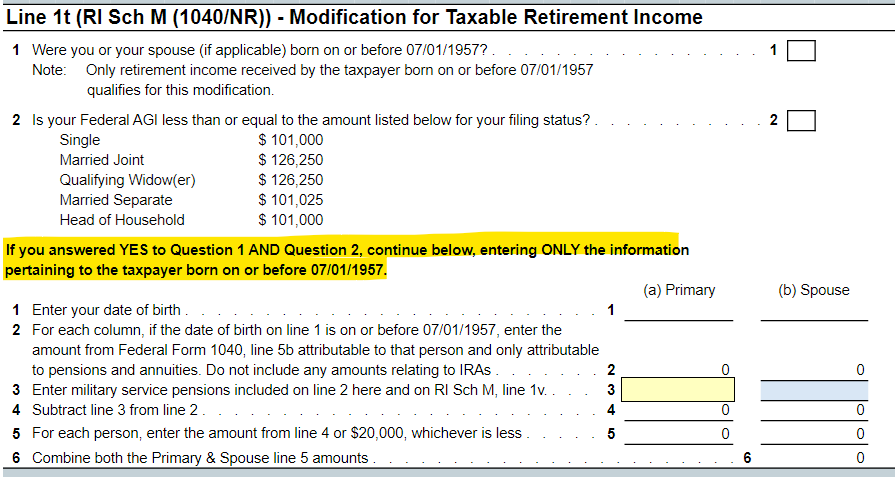

I got a reply from ATX regarding this issue. In case this comes up for anyone in the future. ATX resolution: Additional Note: Not only did the Line 3 instructions throw me off as ATX reports in the resolution, but it was the ABOVE 2 questions being NO, and the highlighted above stmt that said "If you answered YES to Questions 1 AND Question 2, continue below, entering ONLY the information pertaining to the taxpayer born on or before 07/01/1957." Personally, I don't think interpretation of the worksheet instructions are the problem, I think ATX instructions are just flat wrong. Had I followed them, the client would have owed $4500 more in RI taxes. ATX gets alot right federally and catches things I've missed time to time, but on a state taxation level, I find I have to be much more digilent about the return's accuracy on specialty items.

- 1 reply

-

- 3

-

-

@jklcpa You're a genius! Yes there is! For anyone looking for this in the future, the rabbit hole map is: 1120S, pg 4, 17d (yes the greyed out field) and JUMP to Linked Field which takes you to: Line 17d, Sch K (1120S) - Other Items & Amts. Scroll to AC, and click the JUMP to Linked Field which takes you to: Line 13 (1120S) - Interest Expense. Depending on how you answer the schedule B question, the "IRS Sec 448 Gross Receipts Test equation is explained. For the record, it's the preceeding three year average fo gross receipts OR the CY gross receipts. Thank you @jklcpa !!

-

Thank you @jklcpa. I also saw that information at one point in my research. Unfortunately when I manually apply this method to a return I've done in ATX, what I calculate and what ATX calculate sis completely different. I cannot find where ATX explains themselves.

-

Anyone know how ATX calculates the 1120S, Box 17, Code AC (Gross receipts for section 448(c)). I've tried to figure out what ATX is doing and for the life of me, cannot determine their method. TIA

-

Any RI tax preparations that are familiar with the data entry in ATX for military retired pay? I have a client that received miitary retired pay and starting with 2023 tax year, Rhode Island no longer taxes military retired pay. I believe I found the correct section to enter the reduction on the RI personal return, however ATX is throwing me off with their data entry screen information. My particular client was born after 1957, but I'm pretty sure they still qualify for the exclusion based on Rhode Island publication on the matter. Any chance someone's been down this road and can point me in the right location to enter this into ATX, or confirm ATX's data entry info is out of date? FYI, I do have a case open with ATX to get their take on the matter too. ATX Data Entry Screen: Rhode Island Publication:

-

They are trying to catchup from a year that was far too lopsided. I have explained the need to even it out, but cash flow has prevented them from retifying the issue all in one shot. Dad is the one being shortchanged by the son. He's knows he's losing value each day they don't even it out.

-

Thanks @Abby Normal. Year after year, I have reminded them of this, and the potential fallout should they not follow these rules. You can lead a horse to water .....

-

I found a mistake on the K-1s for a corporate return I filed. The distribution amount listed in box 16, code D is wrong for each shareholder is incorrect. The sum of the two numbers is correct and matches page 3's amount on the 1120S, but the actual amount of each shareholder's individual distribution is incorrect. Would you amend only to correct the amounts in Part III, Box 16D amount? Or just give the shareholder's the corrected K-1 amounts so they can file their personal returns with accurate information?

-

I'm in the never ending merry-go-round with the IRS. Client had a fraudulant 2020 return filed mere days after she passed away. We didn't know at the time, but when we went to file the returns 2020 & 2021 rtn (yes, 2020 was late) in Sept 2022, obviously it was discovered a few months later when the refunds weren't issued. I have been through ID verification 7 times for the 2020 & 2021 returns. I finally got the 2021 refund, but 2020 (the return that actually had fraud) still, 1.5 years later is in limbo. Strangely I got another letter that they needed me to ID verify 2021 again and soon after a copy of the cleint's tax transcript for 2020 that said I requested it, but I didn't. Of course, I have called the ID verification number at least 50 times, and it says, you "due to high call volume, we cannot take your call at this time." Adding insult to injury, the main IRS reps cannot field any calls regarding the still outstanding 2020 refund until I ID verification, for the 8th time, has been completed. And the true cherry on top. They said processing after ID verification is taking upwards of 650 days!! (This is much worse than the 430 days number I got 6 months ago.) WTH. I don't even know who to go to for help. Can't the gov't be held accountable in some way for this nightmare of disorganization. It has got to be criminal the way the IRS is being managed these days.

-

You made my day @BulldogTom. Thanks for the smile.

-

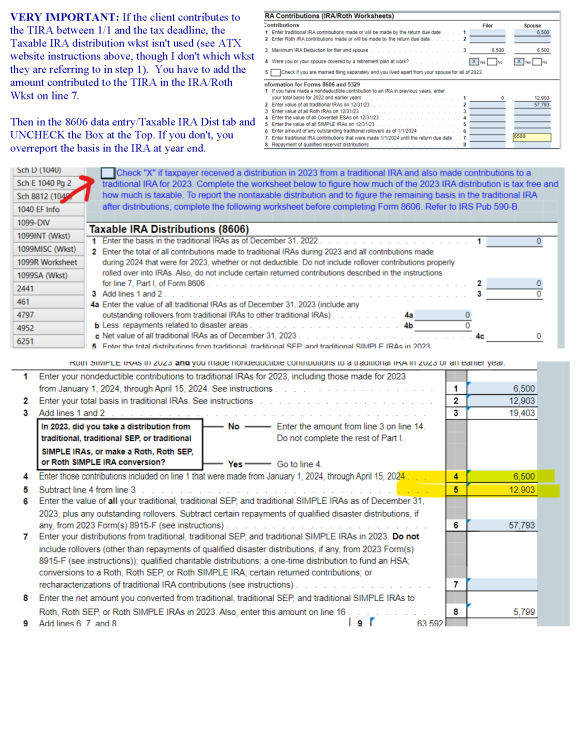

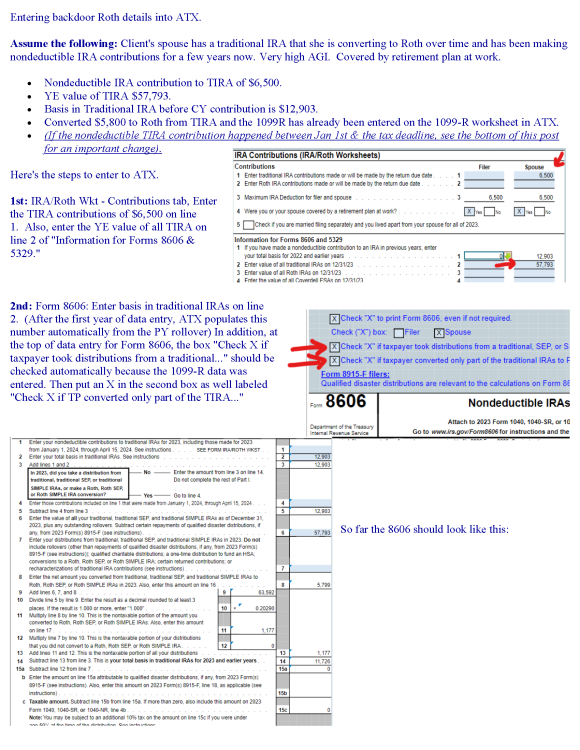

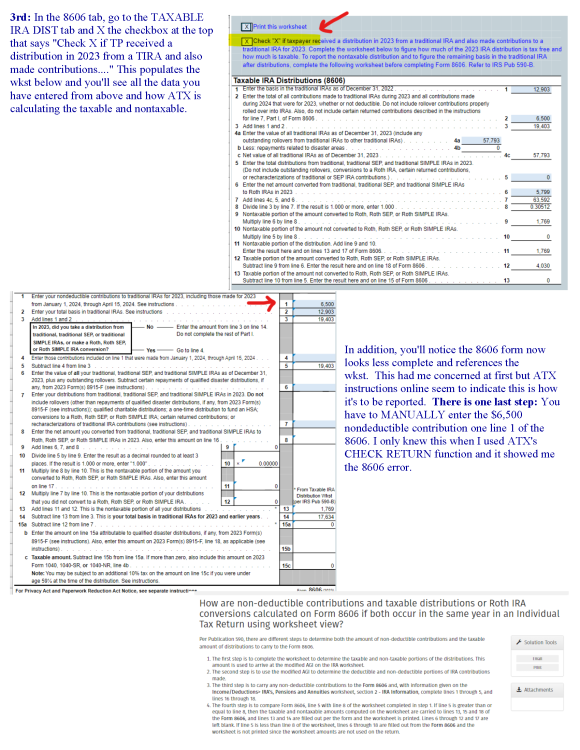

I prepare these cheats for myself so I don't have to always go through the torture of navigating ATX data entry. Maybe this helps anyone that needs to enter backdoor Roth details into ATX. PDF attached with the instructions I use for Backdoor Roth in ATX with Aggregation & PY Basis. Good luck and please, if someone sees an error, let me know! Hopefully this formatting is easier to read than the first post.

- 1 reply

-

- 2

-

-

-

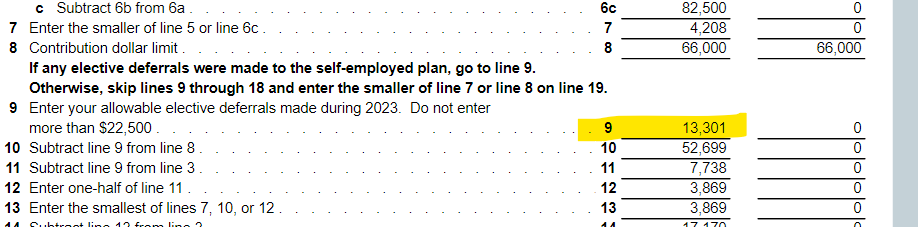

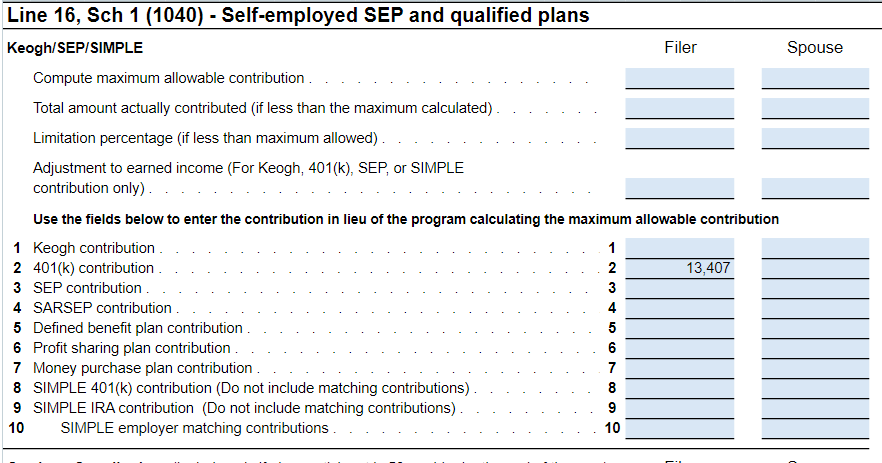

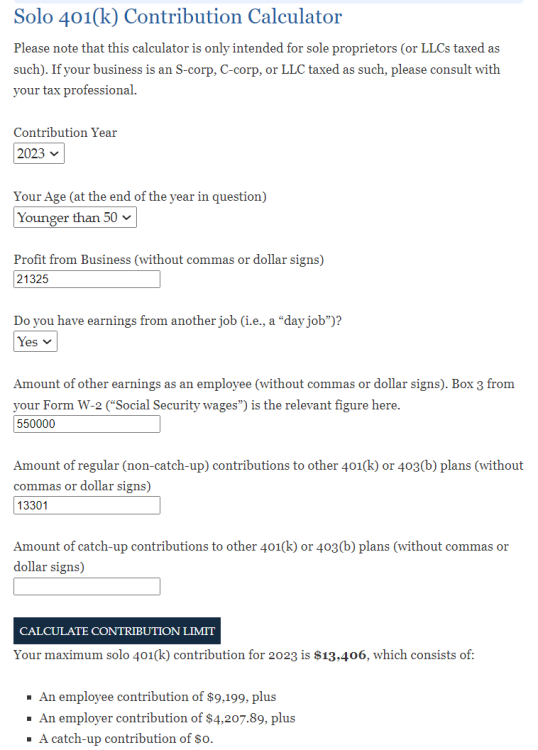

I believe this is accounted for in this area. ATX actually auto generates line 9 straight from the W2, box 12, Code D & E. But I tried putting in a ROTH 401k elective deferreal into the W2 data entry and it did NOT add to this amount so I'm even more baffled. Thanks @Abby Normal As you can see, this matches my own calculation. Given this is the line (Line 16, Sch 1) is where you're supposed to put the SOLO 401k contributions, this only way I can see inputting it correctly without an override is to manually do the math myself and add it here. If someone else figures it out, I'm all ears!