-

Posts

228 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

I'm doing a side by side analysis of my NY clients and how it affects them. It seems to be a great deal. Even with the lower QBID deduction, the fact that it lowers AGI, those on the borderline of phaseouts will reap the benefits. I'm still a bit shaky on the NY personal return effects. I read that they get a credit on the NY return, but is that credit AFTER the tax is added back on maybe the IT-225?

-

Hi! Does anyone know of a good website or webclass that might provide a sample of this strategy actually executed?

-

Thanks everyone! The $1 suggestion worked and saved me the hassle of paper filing!

-

ATX won't let me efile a tax return that has income items, but the entire 1040 is blank due to basis and passive loss limitations. Do you still paper file this so the IRS has a log of the activity & carryforwards that happened on the other forms (ie, Sch E pg 1 & 2)? Also, is it a benefit to paper file just so the statute of limitations commences?

-

Yes Gail, that's exactly what I was saying. Thanks for confirming it too!

-

Thank you for the reply @Lion EA & @Gail in Virginia -- Originally I was told the LLC was a C-Corp and I'd never seen an S-corp own a C-corp so I was curious how reporting that information would work. I finally got a copy of the actual K-1, and it's an LLC taxed as a partnership, NOT a C-Corp like they said. But for future reference, if the S-Corp DID own a portion of a C-Corp, I assume the dividends would simply be reported through the 1120S K-1 right?

-

Anyone know the answer to this?

-

My client's company (Sub-S) invested in another company (LLC, taxed as corp) in 2020. For 2020, a K-1 was issued from the LLC to the Sub-S for the 2020 profits, however dividends were not issued until 2021. Am I correct that the 1120S for 2020 will not show any tax implications, but in 2021, the Sub-S will show dividend income to my client on his 1120S K-1?

-

I was just reading about this this weekend after NYS sent out an email last week about it. It's on my list of to-dos so thanks for bringing it up here. I can see the obvious tax savings in their efforts to work around SALT, but I'm just worried that NYS will get all too comfortable getting this tax income and eventually make it a permanent thing. NYC doesn't recognize the S-election so a further state tax is tough to explain to clients that don't grasp over tax strategy very well. (Sigh) @TaxCPANY I tried to click the link above and it's broken.

-

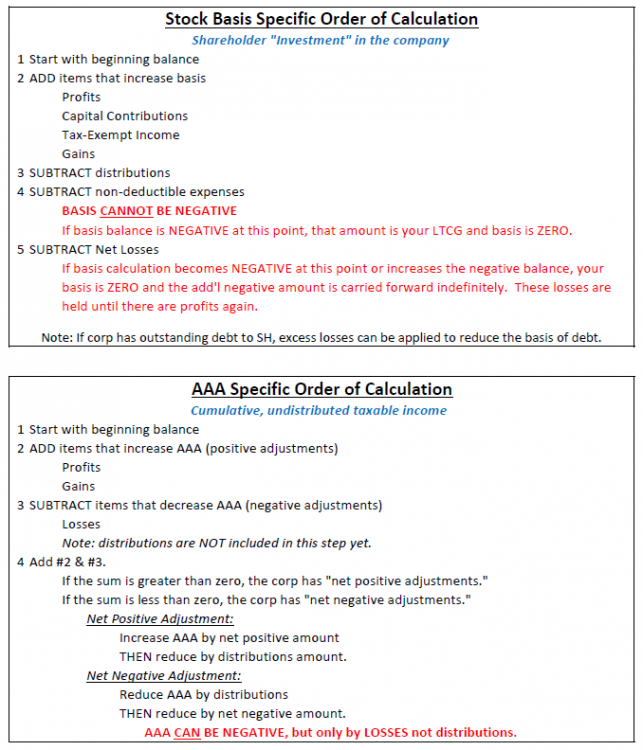

Resurrecting this topic to emphasize how much this thread has meant to me as an accountant. The knowledge here completely changed my understanding of AAA/basis/RE etc. It couldn't have come at a better time given the losses many of my Sub-S clients experienced in 2020, basis reporting requirements, and throw in PPP loan forgiveness reporting and basis challenges and I'm just so grateful to have labored through learning this stuff. I now have the attached picture below taped to the wall of my office so it's information continues to be reinforced in my head. I hope it helps someone else that maybe struggles grasping what I found to be a complicated, difficult concept. I tried to keep the summary info simple and limited to what my own clients normally encounter so it's not a complete textbook of the concept, but if anything below seems wrong, please let me know.

-

Primary Residence with Improvements turned Turned Rental, Depreciation Mess

G2R replied to G2R's topic in General Chat

Hi everyone! I can't thank you enough for all the help with this. I was able to get through the 3115 (insert proud smile) and now I'm working on the tax implications of their state taxes. Any NY preparers ever dealt with NY or RI regarding this form? I read that California requires approval before a change in accounting method but I haven't found any rules regarding NY or RI. btw, @Lion EA thank you for recommending that self study course. It was well worth the price. -

Primary Residence with Improvements turned Turned Rental, Depreciation Mess

G2R replied to G2R's topic in General Chat

Thank you everyone for the advice and encouragement! I really, really appreciate it. -

Primary Residence with Improvements turned Turned Rental, Depreciation Mess

G2R replied to G2R's topic in General Chat

I've never used that form, but read about it multiple times on this forum. Ugh, @Abby Normal every time you answer one of my posts I have to actually LEARN a whole new section of the code. Skeleton in the Closet: Would filing this form make the IRS go back and review what depreciation they actually took? Because if so, the Pandora's box that might open could be a disaster. -

New client looking to sell their rental. Over 20 years ago, the property was their primary residence for a short time. They put in over $100k in improvements during that time, then converted it to rental. So basis, $100k purchase price, $100k improvements. They only used their purchase price as the basis for depreciation and failed to include any of the capital improvements (Land value wasn't a blip on the radar). The depreciation taken over the years is a disaster of mistakes. Regardless of the depreciation they took, I still calculate the depreciation as it should have been calculated and report the gain and depreciation recapture off the correct calculations despite the fact they didn't get the benefit of the depreciation deductions. Here's my dilemma. As crazy as this sounds, it make more sense for her to ignore the improvements all together so the bulk of the gain gets the favorable capital gains rate rather than the depreciation recapture rate? Selling price is north of $600k so were looking at big gains here and their in a very large tax bracket already. Is there another tax strategy out there maybe that might help and do I/can I ignore all the improvements they made?

-

Has anyone seen confirmation that owners are eligible for ERC? A bunch of my S-Corps are single owner corps and I haven't seen any guidance from the IRS that owners are definitely eligible. Only that relatives of owners are not. As I'm filing Q1 941s (and looking over 2020's previously filed 941s that were PPP borrowers) it's a lot of potential money for most of them.

-

Wow, that's sounds AWFUL. During questionably the worst tax season EVER, I can only imagine your stress level.

-

Just wanted to do a follow up to this. I've now been using TaxDome for nearly two months and it becomes more and more apparent how valuable it is. I love the internal messaging I have with clients, signature features, document approval, email sync. Clients seem to find it VERY easy to use. They have a cell phone app too so getting client documents scanned and sent to me has been a MUCH, MUCH faster turnover. I only had two clients that had issues and it's because they are business and personal clients and they didn't know how to toggle between accounts. Other than that, it's been VERY smooth sailing. In addition, I abandoned my DocuSign subscription in place of TaxDome's signature option. I like that I can decide which forms I need KBA and which I don't. I've probably only used 20% of a capability and I'm still this happy. I find I'm not scrabbling around nearly as much trying to find documents from client's in the 20 different communication vehicles I was using before. Instead, I put a link to the client portal on my website and point everyone there for document transfers. And clients are abiding by that most of the time. When they send me sensitive stuff via email (like their SS# ) I kindly remind them to please use the portal. I haven't had one client object. They constantly do updates based on user feedback. All in all, I am very happy with it and for $600 for the year, I really think it's a steal. I do recommend learning to use it when you actually have a little down time to do it. It was a bit overwhelming to navigate at first while knee deep in tax season. Hope the review helps!

-

Taxpayer reached out to the guy that gave her the money and today he replied, "I should have given you a 1099-NEC, but I didn't. You owe the SE tax." Now I'm wondering if I have an argument for filing it on a Sch C, and claiming QBID.

-

Well she lives in NY sooo.... her taxes are worse than VA. :( I've explained her options and she's decided on the conservative route, she's filing as if she got a 1099-NEC. Thanks everyone for the input.

-

I agree, I think it's a big red flag. I have documented my own discussions with my client and asked she forward all written communication she had with the guy to detail the history of the payment and also detail her timeline of assistance for him. All points you've made are spot on. It's why I'm struggling so much with the reporting. I doubt a gift return was filed. I struggle with my client being liable for all FICA when she didn't have a profit seeking motive or business structure of any kind. Clearly the guy did something wrong, but what is her obligation to correct it at her own expense (paying both ER & EE FICA)?

-

Have you actually met all your clients in person?

G2R replied to Yardley CPA's topic in General Chat

I joke that 1/3 of my clients could walk by on the street and I'd have no clue. Aside from copies of their Driver's Licenses for some state return filers, I have no idea what they look like. I haven't actually seen a client in my office in 2 years. Covid protocols nixed those couple old-schoolers than liked to come in person so now I'm totally remote. -

I set up a question on my tax organizer that asks how much they got for EIP1 in April/May of 2020 & EIP2 in Dec2020/Jan 2021. Having the dates there as a reference seemed to help most remember to go back and check their bank statements for the amounts.

-

Given the abundance of "we forgive you, you don't have to pay back the error" approaches Congress continues to pass in our tax code, does anyone think that the CTC advance payments will likely be forgiven anyway come 2022 tax season? I mean it's like a carbon copy of the APTC, and I've got a number of clients who are getting away with murder in that area. Just my Saturday morning thoughts...

-

Weird situation (what else is new these days.) Client worked for a company. Covid hits and the company goes under. She is laid off. The company hires another company to wind down the company's affairs and collect whatever outstanding invoices they could from customers. My client offers to help in the collections. There is no discussion of pay, no employment or contractor agreement at all. She'd worked for company a long time and just wanted to help where she could after a sad ending to the company. She never expected to be paid anything. (Hand to God, she's a good, honest person. There's nothing nefarious going on.) After three months of helping, the guy in charge says, thank you so much for everything you did, we couldn't have done it without you. As a thank you, here's $50k! Fast forward to this tax season, as she's collecting her tax stuff, she calls the guy and asks if he's suppose to issue her a 1099. He says, "I'm not filing one, don't worry about it." So, what do I do? She sort of worked for him, but sort of didn't. Gift? Other income? NEC subject to SE tax?