-

Posts

233 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

Input field is at the bottom of the K-1 input under the Basis Limitation section. It still needs to be attached as a PDF before efiling.

-

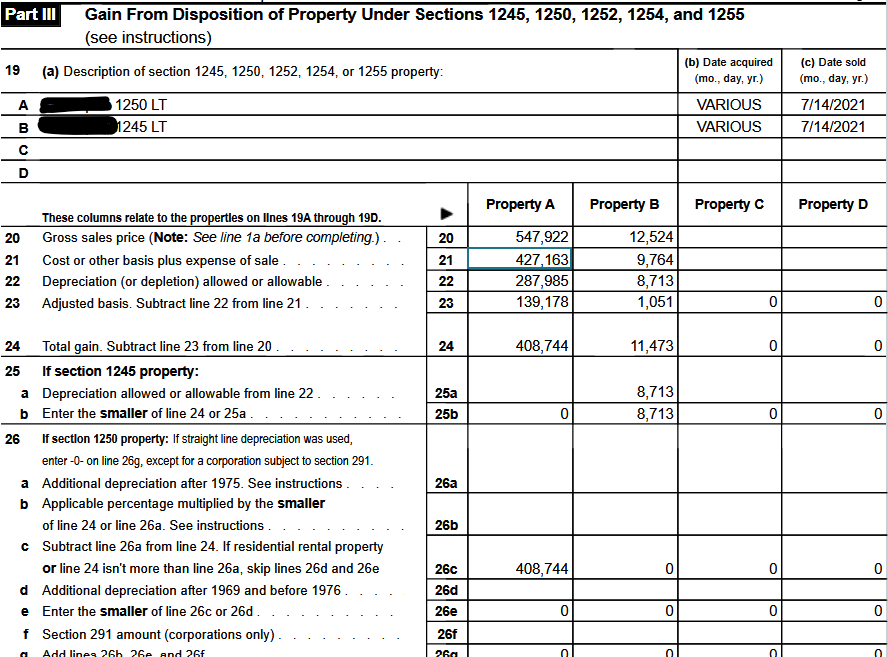

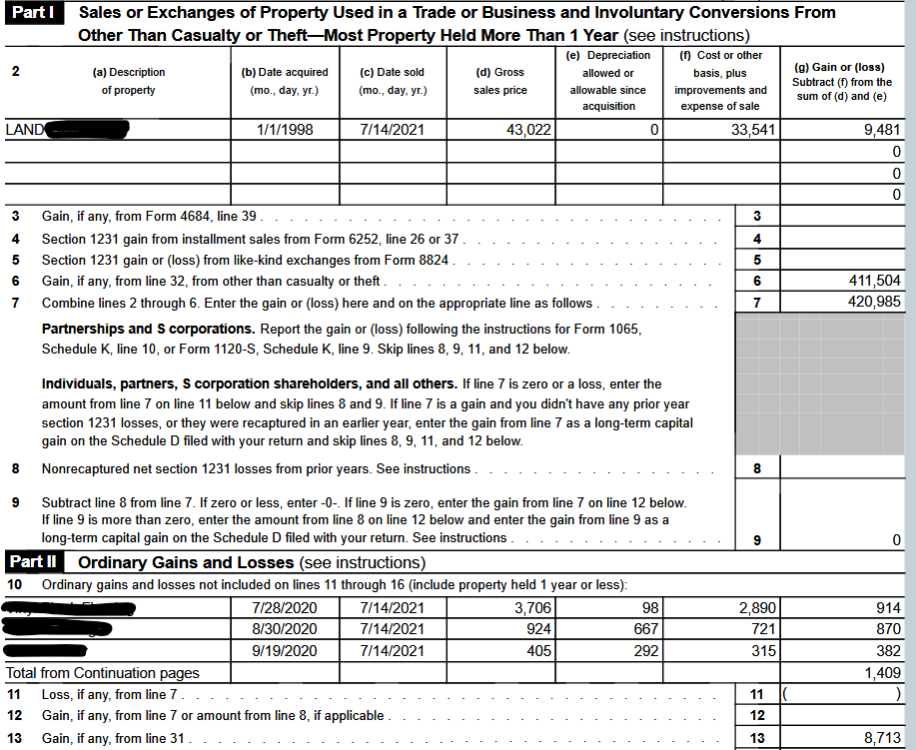

I'm reporting a sale like this now and just want to confirm my method. I have created a spreadsheet that breaks down the 1250 vs. 1245 vs Land, further breaking them down into Long-Term and Short-Term assets. I then did bulk sales for each of these sub-asset accounts in ATX. I divvied out the Sale price and selling expenses based on the cost basis percentage. ie if land cost was $20k and the building were $80k, land would get 20% of the sale price and selling expenses. Building would get 80%. Lastly the unamortized Refi Costs are immediately deducted on the Sch E current year activity. Here's what the 4797 look like: I think I've got this right, but ATX is a bit daunting it how it requires this data entry so I just want to double check my work. Is this how ATX data entry should be done in this situation?

-

I completely agree. I apologize for leaving it out, but honestly, didn't even know what power of appointment was till it the lawyer explained it to me. I too found this confusing and contradictory. I asked the lawyer about this and he said, during her lifetime, the 7% clause was in effect, however the power of appointment language in the trust says that upon her death, she can will the properties to whomever she wanted. This language effectively transfers the ownership of the properties (for estate purposes) to her. Meaning it's includable in her estate and qualifies for stepped up basis because she is legal owner, not the husband's trust. It's an interesting situation that I learned a great deal from. Again, thank you everyone for your comments. I hope this thread helps others in the future.

-

Luckily no. Here's an update for anyone that comes across this in the future. Spoke to the lawyer, they pointed me to the section of the trust that showed the wife had power of appointment for the properties. For estate tax purposes, this means she is the owner of the properties so they must be included in her estate regardless of the deed because at any point in time, she had the power to transfer the properties into her name. The lawyer confirmed this as well. Thank you @Sara EA! So in conclusion: For tax filing purposes, the deed in the husband's trust name meant a 1041 for the husband's trust was required each year. If the properties had been transferred to the wife's name, the trust would be dissolved. For estate tax purposes, the properties are includable in the wife's estate because of the power of appointment clause in the husband's trust. Thank you everyone for all your help and insight. I really, really appreciate it!

-

Husband set up a revocable trust with rental property in it. He died long ago and the trust became irrevocable. Wife was the sole beneficiary & trustee. She dies last year. Property is still in trust name and a trust return for the husband's trust has been filed every year to present. Trust docs say that if wife dies, then their 2 children are the beneficiaries. Does the transition from revocable to irrevocable status eliminate the secondary beneficiaries and property is now own by the wife's estate upon her death (regardless of the deed still listing the husband's trust), or is the irrevocable trust still alive and the 2 children are now beneficiaries and should receive K-1s until the property is transferred to their names? Note: the 2 children are also the beneficiaries of the wife's estate. Given the wife's estate must include these properties in her estate tax return, it seems logical that option #1 is the answer, but the property still being in the husband's trust name is tripping me up. And if it's #2, I don't see how ATX let's me split the income to the now 3 different beneficiaries without overriding. It only allows percentages. TIA!

-

Thank you Catherine. I appreciate that.

-

Thank you @Gail in Virginia -- that makes a lot of sense.

-

My grandmother passed away last year. I was named the executor of her estate. Because of COVID , she wasn't able to see anyone to get her tax returns filed for 2019 to present, including a trust that she is/was the trustee. I now have to file those back years on her behalf, including the trust return. My question is, do I file them and list her name as the trustee and sign POA (of which I was at the time). Or do I list myself as the trustee since I'm now the current trustee, regardless of not being the trustee during the 2019 or 2020 years? TIA!

-

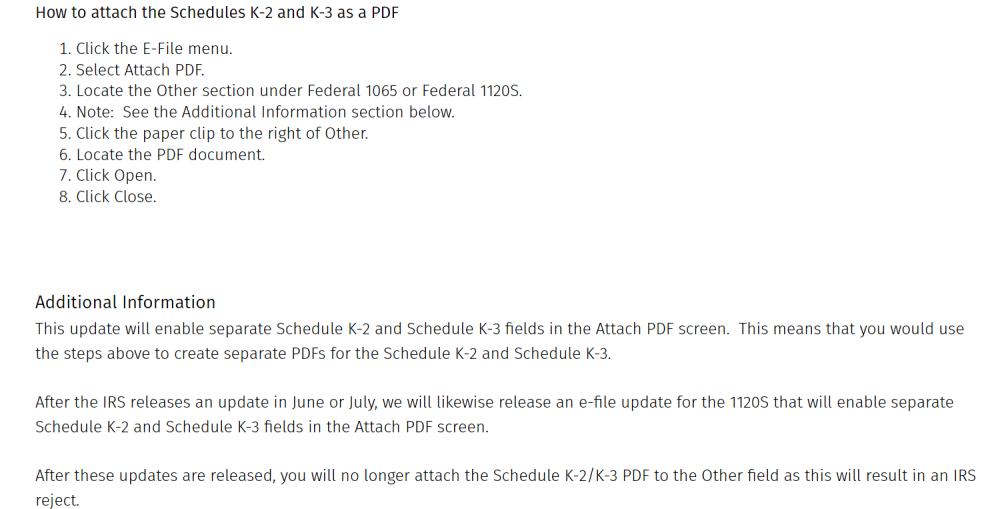

Yes, ATX. As in delete the form and reinstall these forms? If so, that's more daunting a task that usual given the K2 data doesn't autofill to K3 for each shareholder.

-

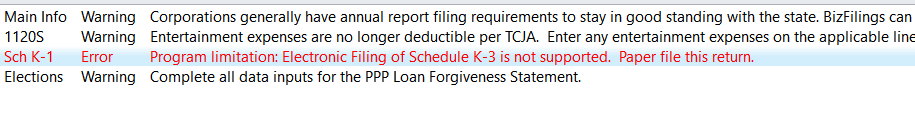

I just went to file my client's return and this new error is popping up on the Checks. I just checked this return on Friday and I don't recall seeing this error message. I really do NOT want to paper file this return. I'm tempted to just add the K-3s as PDFs and still efile. Any suggestions? The ATX help site says to attached as a PDF... https://support.cch.com/kb/solution/000139480/000139480

-

Well, it's not good news. I found the ATX instructions for these forms. Not what I was hoping to read. Posting here for anyone who might in the future be looking for a better solution. https://support.cch.com/kb/solution/000139480/000139480

-

My one client that has international activity.... I've entered the data into ATX, including the international activity on the K-2 . Unfortunately the K-3 is still blank. None of the K-2 info is populating on the K-3 and there's only one K-3 even listed. (Unlike the K-1 where I can toggle between each shareholder's K-1 schedule.) There are 4 shareholders so I assumed 4 K-3s would generate to be included with the K-1 data. Is there a button I must select for the K-2 data to generate the K-3 numbers based on Shareholder ownership?

-

This is what I ended up doing. Thanks for the replies everyone. Yes, I tried this. It didn't change anything. Thanks for your input.

-

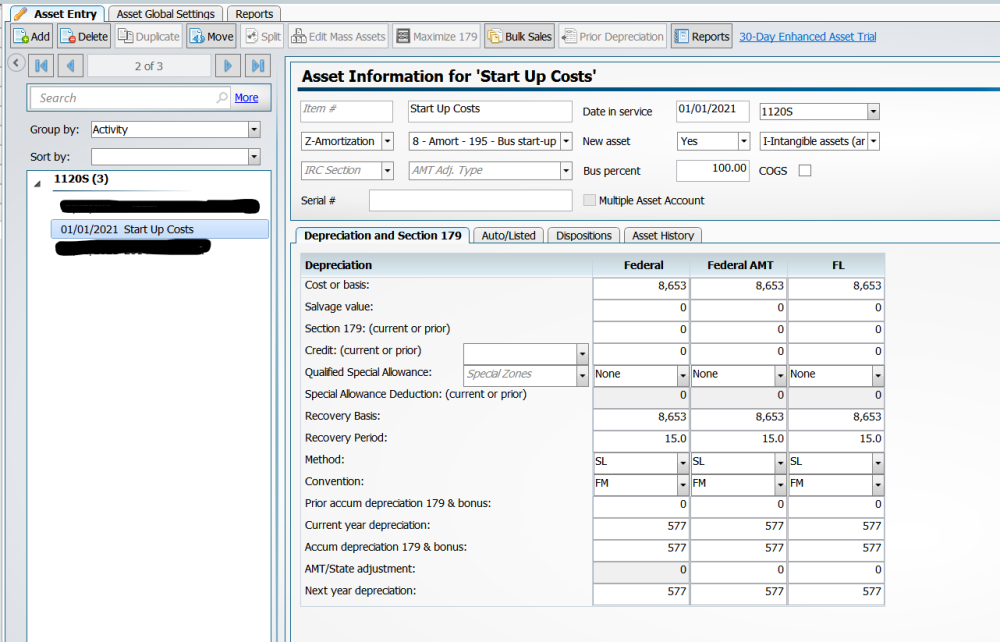

Hello! I've entered approx. $8k in startup costs for a client into ATX. I cannot figure out how to get ATX to allow the $5k deduction. Anyone know how?

-

Unfortunately this isn't going to happen. Bitter infighting amongst the SHs. Long, sad story. But thanks for the suggestion. This is what I was hoping wasn't the case. I didn't realize an actual cash transfer was a requirement. Thank you for your insight @DANRVAN.

-

What a great read. Thank you @cbslee. I appreciate it! I found a number of articles regarding the uneven distribution discussions and definitely gained a tweak perspective on them. The loan idea came about for two reasons. The left out SH would earn something on the cash he wasn't given like the rest. The amount of time that uneven distributions existed would be shortened. That's why I'm hoping it's not a violation of any existing rules. So far, I haven't found anything that says it is.

-

1120S has four shareholders. All were also officers of the company. Reasonable compensation was paid to all four. Three of the shareholders took it upon themselves to take large distributions in the previous year leaving one of the shareholders out. I've let them know this violates the S-corp rules and puts the S-corp status in jeopardy. The company currently doesn't have any remaining cash to pay the 4th SH his distribution. Can they draft a loan agreement between the company and the SH, with proper interest, for the distribution that should have occurred? And if so, can the distribution be recorded at the time the loan is drafted?

-

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

G2R replied to G2R's topic in General Chat

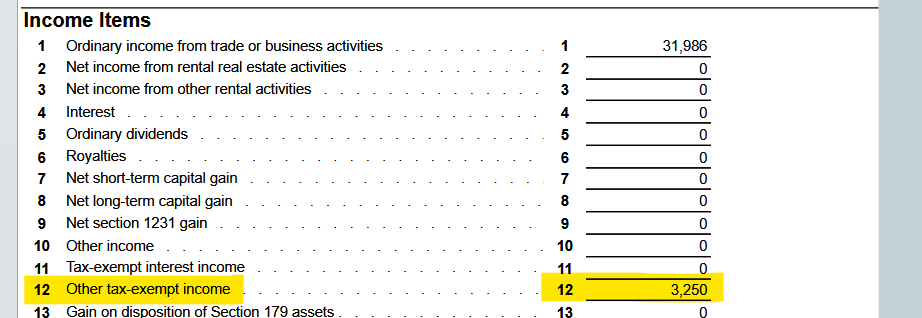

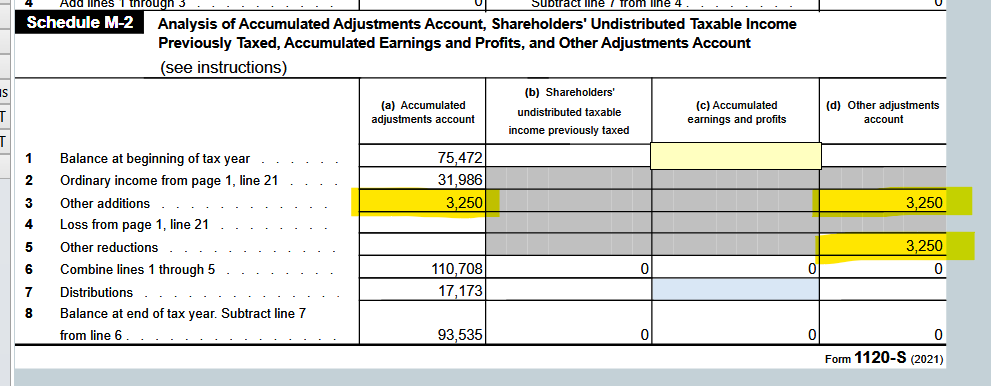

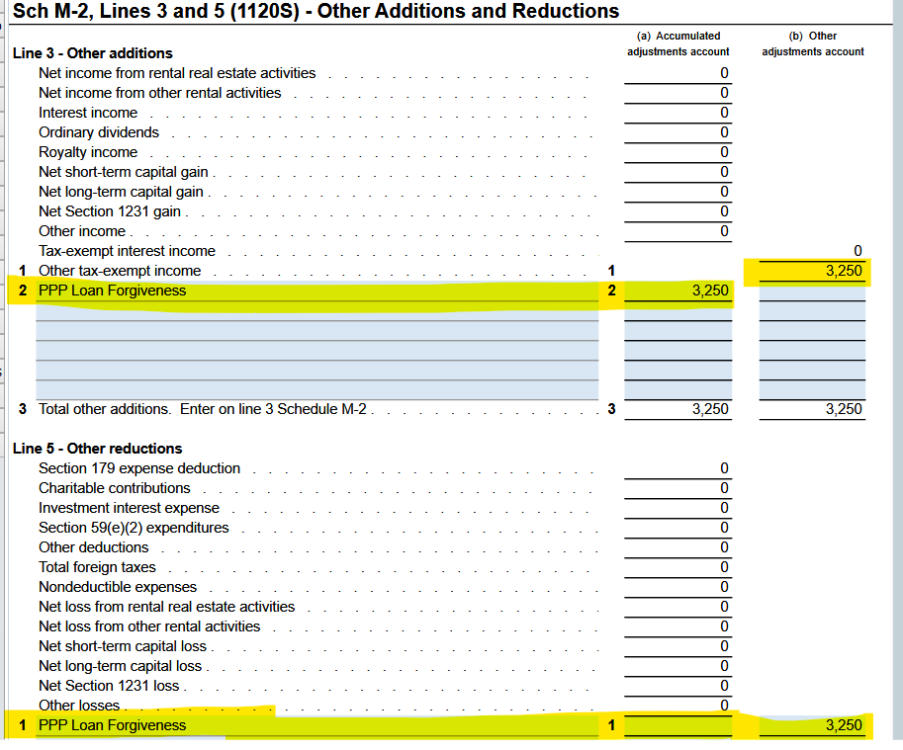

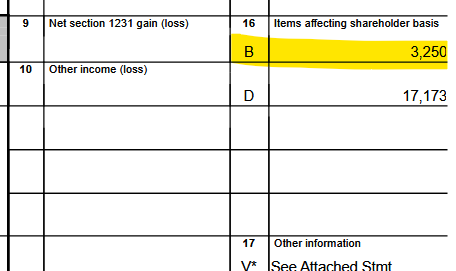

This is how mine flows thru. Hope it helps. Keep in mind, in my example below, the expenses paid for by PPP loan funds were expensed in 2020, while the forgiveness was given in 2021 so line 3 of the M-2 AAA column includes this fact. In my example the PPP amount was $3250. Also, to answer your question, I do not have K-1, box 12 data related to PPP. K-1 Basis stmt: M-2: see below for how I entered these data points. To get M-2 to populate: K-1: -

I've been using TaxDome which is an entire online portal that offers e-signature with KBA ($1/signer), and so far it's been a breeze and my clients haven't had any real issues. It offers the audit trail download too. I haven't even begun to use the pipelines yet, but many have said they made a huge difference in the office workflow. Summer project for me is learning them. I use CamScanner. It takes the picture and converts it into a VERY CLEAR digital copy and offers PDF, JPEG, etc.

-

Yes, I have to add back the pre tax items the NJ doesn't allow to be excluded from taxable wages. Some of those items that need to be added back are EE paid health insurance premiums, vision, dental, etc. I'm looking to confirm that when I add those items back to wages for NJ purposes only, they are also now eligible items for medical deduction on line 31 of the NJ-1040.

-

The employer doesn't acknowledge the employee's NJ residency at all.

-

Client lives in NJ, works in NY. Employer does NOT provide a NJ wage detail on the W-2 so I have to calculate myself. It's my understanding that NJ only allows 401k to be deducted from wages But on the NJ-1040 I see a medical expense deduction for 125 Plans. Limited research suggests I can take the premiums my client paid for health, vision etc and deduct the amount over 2% of NJ AGI on the front page of the 1040. (Luckily they gave me the 12/31 paystub so I know they portion). Any NJ preparers that can confirm this? Previous preparer didn't do this so self-doubt makes me hesitate.

-

Thanks! That's where I ended up putting it and it flowed through perfectly! Thanks again for your reply.