Medlin Software, Dennis

-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Posts posted by Medlin Software, Dennis

-

-

Try a different protector. They do wear out. Also, use a quality protector, maybe not a power strip for "$9.99" (if that is the case).

The power "wart". It is generally an AC/DC converter, going from AC to what seems now to usually be 19v DC. DC is likely better for the equipment, and probably mirrors (close enough) what the battery pack provides as nominal voltage. Also makes it VERY easy to support US and EUR power sources without altering the actual product. In many cases, they provide a simple wall adapter as the wart can manage the different incoming power.

For instance, in our RV, I added a TV. Since I want to be able to run it off battery, and I know how the power wart functions, I cut off the wart, and wired the TV directly into a step up converter. Did the same for a dehumidifier which runs when we are home. The benefit is the items run off the 12v system, so battery, but if plugged into AC or running the gen, they still run.

To go off the ledge, since the ladies in our family like to use their hair irons and dryers, even when not plugged in, and their pod coffee maker, I upgraded to LFP batteries and installed a quality inverter. so they can power up even when we have no AC connection and cannot run the generator. Of course, these things are built in to high dollar RV's, but we don;t have a long enough space at home to keep one of those monsters.

-

1

1

-

-

18 hours ago, mcb39 said:

6 years old but in top condition.

Probable failed/damaged battery; thermal runaway (can think of it as being like a short). Tech is much better now than a design which is likely 7+ years old.

-

1

1

-

1

1

-

-

16 hours ago, Abby Normal said:

Could be true for some android phones depending on their batt chemistry and bms. The last time I used an android daily, there was an app which limited max charge to 80% so there was no issue with leaving connected even for old chemistry. (Nothing against android at all. I elected to change because it is very difficult to get a truly unlocked android and set it up for two line / two carrier use.)

-

1

1

-

-

My experience is batt failure when using a knock off replacement, or early lion batts. On both cases, it was likely thermal runaway, which is the internal bms failing to prevent overheating. Charger and power incoming should never cause an issue with the batt as the bms should be the batt manager.

I looked into building my own system for our rv, same as people also do for off grid. The key was always the bms. For prebuilt batts, the off grid experts (who post tear downs) always key on the bms. The cells themselves are only made in a couple of places and the concern is first or second quality, and volt matching. (CATL is the biggest and arguably best tech at present.)

For a laptop, secondary monitoring is tougher. But, the surface line has charge limits, with the current being the new norm of 80%. This setting is before the bms as far as I know so it serves as a second safety

-

2

2

-

-

24 minutes ago, Abby Normal said:

New types of batteries are coming, but in the mean time:

- Don't leave batteries charging overnight or all the time.

- Never charge your battery to 100%. Keep it between 15%-85%.

- Get a cooler for your laptop.

- If your laptop battery is easily removable, only put your laptop battery in when you travel.

I haven't had a laptop in a long time, so I'm not aware of any changes that have been made recently.

Tech and chemical makeup is evolving fast.

1. Not always true. Surface machines, for example, have a mode which is designed for constant plug in. It is a hardware/software setting which stops power from reaching the BMS at certain levels (such as 5-% or 80%). It was originally called Kiosk Mode. Same thing for anyone using a battery backup - they do not get turned off.

2. LFP batteries can and should be regularly 100% charged. At least a couple times a month is best for the BMS. There is little degradation to be saved bu the old 20-80% "rule" and the BMS cannot stay accurately calibrated if not at 100% on a regular basis.

3. Always true. Not so much a physical cooling pad or fan, but use the software settings to actively cool and/or passive cool with a lower CPU load.

4. To me, silly. Why? The advantage of a laptop is to have a built in battery backup. Degradation is most current batteries is as much calendar as it is usage.

Where I am coming from is someone who uses portable computers exclusively. Also rely on LFP batts for our RV. Our Tesla also has the LFP formula. LFO is the easiest on the user, just charge as often as desired, and use it. Not all batts are LFP, so you do need to know what the chemistry of your batts are, and act accordingly (Tesla has many non LFP models, which should follow the 20-80% "rule"). Companies like Battleborn (RV and similar battery supplier) are a GREAT resource.

Our RV has LFP batts, which are always kept at 100% when parked. It is our "lifeboat". After roughly 18 months from manufacturer, they have lost less than 3% capacity, which can be contributed to calendar effect. Granted, I have the ability to keep them at the ideal voltage through an external BMS, but it can be safely done (the always at 100%).

-

1

1

-

Such as a web site with an email or chat link creating nexus. The key is the profit possible, cost of investigating, and odds of collection. It seems like it is the same as a low dollar warrant. Unless big enough, they will not try to extradite. But if the process is automated (ala spam) there is a fair chance enough will choose to pay to make it profitable.

-

2

2

-

-

Just using common sense, a term like "joint and several responsibility" comes to mind. Separate letters also make it easier for the collector to claim both parties knew (less chance of successfully claiming innocence). IOW, follow the money, the collector wants to preserve best chance of getting paid, and is not sure who has the deepest pockets.

-

6

6

-

-

Remember, is is not the people of the tax jurisdiction making the rules. It is the folks whose livelihoods depends on being parochial and complicated. This, no common form, and the caee of some, forcing use of certain products which likely pay fees to the agency involved.

-

13 minutes ago, mcb39 said:

It is an internal hardware issue. Either they figure out a workaround or a lot of people will close up shop and just continue to use their current OS for personal computing.

Not sure a 500 purchase every half decade is a reason to close. Can find cheaper on sale. The big issue, hardware, is very likely security related (secure boot and the like) and candidly, likely means the current computer is not as safe as something more reasonably current.

TPM hardware was available at least a decade ago IIRC.

-

I paper file my ca return (second year ptet) because the consumer level software I use does not have this form. No real issue, other than a longer wait for a small refund. I would rather efile of course, but the benefit of the ptet is worth it, and I did not even look for a different offering which has the form for efile.

however, if I were paying for prep, I would likely expect efile, especially if I had not planned correctly and was getting a significant refund.

-

1

1

-

-

Just now, Lion EA said:

Really good point about Office. I'm perfectly happy with my old MS Office Home & Business 2019. I'm a sole proprietor and spend money on tax prep, but the peripherals like Office I don't use often enough to renew every year or go to their new subscription/monthly plan. Boo. Well, I'll be talking to my outside tech guy about my OS 10 desktop and how long I can keep it as my primary biz computer, how long it's safe for tax prep, anyway.

I have been using open office for many years, and was a user of "as-easy-as" before that.

W10 is no longer safe to use after the end of support data mentioned in the OP. Why? No more security updates. Those here manage data which must be kept secure, and after the above date, no one can consider W10 secure, period. If your machine runs W10, it should runs W11 as well. Whether or not your machine is secure is another matter (hardware security, software security, physical security).

-

1

1

-

-

Tom, could be, I have no idea. For me, I cannot continue to provide reasonable support for my own software, after a few years. Since it is accounting/payroll software, it should be kept current. But, I get folks who write and ask for support for decades old versions, which I have not used myself in decades. I even get requests for help with my DOS based versions from the 80's and 90's. While I have yet to simply say no, my policy is no support unless a current version (meaning within a year or two old). Just imagine, digging up an old version for me to reinstall, some time to get familiar again, then deal with whatever the issue is. No one would pay for my time to do so, even if I offered paid support.

Those who have care of PII of others, this is a non issue. Common sense and liability means you cannot afford to use an outdated OS, fail to keep current, etc. For most here, a PII case would be end of business, and maybe bankruptcy (depending on insurance coverage). The IRS has something to say in their rules for those who are subject to IRS rules.

Whether or not your existing hardware is reasonably safe is a more personal decision. Anything reasonably modern can run W11, and likely W12. The issue is whether or not the machine has the current security stuff (bitlocker, secure boot, etc.). MS is likely done with major Windows changes - since they merged all users into essentially what was their former NT path (all the "users" stuff).

-

Until the EOS date, sticking with 10 is a valid option. After the EOS date, it is negligent (and likely indefensible) for those managing data for others to keep using 10.

-

Always good to monitor EOS dates. Win 10 to 11 is the first one I am good saying to just update rather than buying a new box with the new os preinstalled.

But, I still go on a 3 year new box cycle, so my backup/old box is no more than 6 years old.

Box is a loose term. I swapped to surface pro tablets as they are good portable, stationary, and can be well secured.

-

There are many ways to account for the desired amount. The obvious are a second phone line, amount of upgraded internet, etc. For the harder to disseminate items, something similar to how home daycare providers calculate seems reasonable.

Works well for me, especially with a relatively small pct of sq ft I use. Easy as well as I am already tracking home costs for another purpose.

-

Not shocked it is a mess or changed. With the lower w2 efile threshold , the number using efile (for instance) will exponentially change this TY.

I have not tried logging in yet. Waiting until Sept.

-

1

1

-

-

Annual inspection would clear parking on my street, if we had such a thing.

Sometimes an HOA sounds better than worse.

-

2

2

-

-

Thankfully my wife shops online almost daily. Meaning I get almost daily notices something is in our cluster box. Our old cluster box was not as secure and was pried open a couple of years ago. There were some w2 forms lost by our neighbors. So check your incoming daily as well. For outgoing important, go the post office and hand it to a clerk. Mine has a drop cart anyone can reach, but I don’t use it as anyone can reach it…

We also have a P.O. Box we use for incoming items which we don’t want to lose. Home cluster is now for junk and packages.

-

2

2

-

-

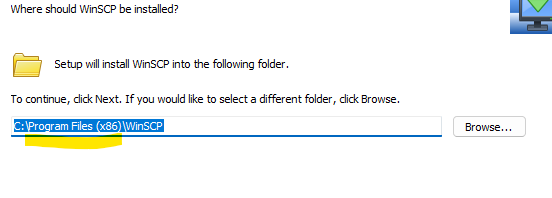

Unless (and it is rare), the software has no selection of installation, you can overtype or select a different folder other than the default. One exception is if you are installing something which is already installed, the dev may allow the setup to just "go" to the same location with no option to change.

What I am suggesting is to change the program file section to something else.

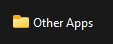

In this case, I had to select "custom" install to see/alter the installation location. Since the app is 32 bit, it defaults to the x86 program file folder. I replaced the section marked above the yellow with my own folder (Other Apps).

I am suggesting nothing be in the program file folders other than what the OS puts there when the OS is installed. This ISOLATES the apps from the OS better, which can pay off for cases where the OS is stuck, such as a failed upgrade, or user error, and the OS needs to be reinstalled or recovered.

-

1

1

-

-

I used to use zip drives, tapes (and glued many back in their spool, the light and the two little holes near the end failed when the drive was dusty), CD/DVD/Floppy, etc. I only tried imaging a few times, IIRC, is may have been Peter Norton's offering (pre Symmantec). I have done low level file recovery.

For me, I rarely have to "repair". My issues are like most, changing computers, or trying to undo/reverse human error (such as getting a file back I deleted or changed). I cannot think of any time I want to restore an entire image. If I were deploying setups, I would use images for certain. I cannot afford (too lazy) to redo more than an hour's work (sometimes 15 minutes) so I backup every hour during my work hours.

I also have a backup computer always ready to go, kept within a week current with my data. Likely an outlier as most do not, cannot, or don't think about such a system.

For me, I am too smart/experienced/lazy (and stupidly have had more than one self caused issue over the decades) to rely only on a local daily backup.

Don't backup the OS. System must be able to restore just one file, just one folder, or all of my data, quickly and easily. Must be able to have multiple backups, such as weekly, daily, and hourly. Also must allow manual trigger. I prefer 5 incremental, and then a full, for each group. Must be able to backup locally, as well as to send the result via SFTP. Must not use any secret or proprietary encoding, so something like 7 zip is free, reliable, and reasonably secure. I use my own encoding on the zip files for added security (since I have that ability). I locally backup onto a portable hard drive, SD, and USB. Also onto my spare computer. I send those results to two different secure servers, which are also backed up (imaged) regularly, and they have in place auto dups which come online if the main server fail.

In this case, my backups were fine, and my backup computer was fine. Had I installed my apps in a non OS controlled location, I would have been back within minutes. The problem is, I had to dig through many files (or manually recreate) some of my "preferences" for those apps, and reinstall them, which is annoying to me. Plus, if I had installed outside of the OS folders, there would have been NO ISSUE at all with letting the OS rebuild/recover, other than the few minutes for that process. I really don't like the OS wiping files outside of those it needs/creates. I understand, MS is trying to get the computer functioning and the user our of their support loop ASAP, but the means is not good - I would say it is destructive and costly to the user. It is the same as a well known fix it chain who has a policy of making some sort of proprietary backup/image on DVD's, wiping the computer, and letting their customer figure out how to restore. I have to deal with that company weekly (at least) as my customers contact me asking how to undo what they PAID someone else to "fix".

I should have known better, since this is related/similar to the original system restore issues created decades ago (why my app installs in a custom folder - with zero option for the user to select another location). But the result is fine, it is making me rework my backup/recover system again, and it will be improved yet again.

The point of the post was to suggest others consider taking more control over their computer, and not use either of the program file folders again.

-

1

1

-

-

Just now, Pacun said:

I guess you don't trust your 4 backups since you are installing in different folders instead of the ones suggested by Windows.

My backups were good (I did not count, but I have at least 4 sources, with multiple options withing each source, so likely 50+ backups I could try). The issue is the Windows "repair", which should have just repaired Windows, DELETES any not installed with Windows apps in the program file folders. This is a BAD thing. Why? Any problems in those folders can be handled via console mode, rather than just wiping them out. If MS was concerned a non windows app was the issue, they could just remove/clean the STARTUP items, so no non win app starts automatically...

Windows suggests what is best for MS, not what is best for the computer user. It is the reason I have been installing my app in a root folder, as there are things MS does which was wiping out my customer's data, which my customers expected me to fix. System restore was one of the problems, and now I see Windows recover is as well (had not looked since it was already solved for my app). It is nearing the time I will have to force customers to make backups, as their skill level is dropping as computers are now appliances, and it seems many assume all software is sending data to the "cloud" for them with no interaction. ("I paid for the software, it should protect me from me")

I am just old, or old school, I guess. Reinstalling or recovering the OS should NOT delete apps. Period. My fault, as it has been at least a decade since I had to repair from a fat finger error. I borked the registry, and could not boot. I was up and running in 30 minutes with major items, and the rest have been resolved within a day. My backup machine would have been fine to use as well.

My point is, unless apps are installed in a non MS controlled folder (NOT program file folders), those folders need to be backed up. This goes against the old advice of backing up data, and reinstalling software. Why? Because there is DATA (mostly configuration, INI type stuff, but not always) in those folders which MS wipes on recover!!!

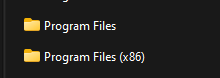

These are the two folders ("suggested for app installation by MS") which are wiped when using the Windows recovery tool in the advanced options. Nothing criminal, but there are better options for the user, but it must be MS decided to just wipe them, so Windows will boot, then they can say "we fixed Windows, you are on your own for the apps we deleted "for" you".

Instead of allowing installation into the above folders, I am using a folder I created.

In addition to the better recovery from non boot, I can backup the other apps folder in total, without backing up all the things Windows re installs on its own. Noe, if I have to reinstall Windows, I can leave existing data, with zero data loss via the recovery.

-

2

2

-

-

What is old is not always wrong...

Yet another in the long line of self caused problems had me using the advanced options to reinstall Windows (was unable to boot properly).

The Windows reinstall was fine, BUT one of the things it does "for you" is to remove everything and everything you have installed into one of the Program Files folders. (These are the folders Windows suggests apps install to, which many developers blindly follow. In my case, my own software does NOT do this, as we install into a folder of our own making in the root.)

While this can help some, who may have an issue caused by faulty outside software, it means a real time loss reinstalling software after an OS error. In my case, it was a bad key press while editing the registry, it was not something an update did!

So for me, and those who ask me, I am even more sticking with the old way of not letting Windows manage locations, and my apps are going into a folder of my own making, such as "Outside Apps", rather than one of the program file folders Windows defaults to. This will better isolate the OS from the non OS Apps, in case of a repair, since MS has elected to wipe things with no backup made during the windows repair process.

The other huge advantage is for backups, as one can backup their outside apps folder (not for the apps, but for their configuration and data!), rather than blindly backing up the program file folders, which contain a large amount of Windows apps which do not normally need to be backed up.

Granted, I am an outlier, as I test and use my backups at least a couple times of year, not only for safety, but for changing computers (main and a spare). I backup on 4 different local devices (in case one fails), and send copies to two different secure online locations I directly control (which means two servers/machines, plus auto backups of each server which resides on other servers).

Thank goodness my backup software (Cobian Reflector) allows multiple backup lists, so my usual is restoring from my special hand crafted list of ini, cfg, and data files for my day to day stuff. Funny thing, I had no backup of my Cobian backup sets, since I tend to make new sets after each restore/computer change.

-

1

1

-

-

They noticed the increased net and spent it. Employees always question a penny less than expected, and rarely question increased net until tax time.

In any case, the employer will eventually get dunned for their part of any underpayment and the employee is responsible for their underpayment (even if employer error or omission). If the person likes their job, file and pay and let the irs deal with the employer.

-

4

4

-

-

Coming to other states soon as well. Emboldened by the Wayfair (anti Quill) ruling, states are eager to "follow" the Multi state tax commission guidelines. For instance, the guidelines (not law, just suggested for member states) have clicking on an email or chat link, from within an adopting state, as triggering nexus in the state the customer or potential customer's machine is in.

-

1

1

-

FYI EXPLOSION

in General Chat

Posted

DC is probably cleaner and more stable for the devices, but that is beyond any recent knowledge for me.