-

Posts

662 -

Joined

-

Last visited

-

Days Won

1

Posts posted by Eli

-

-

8 minutes ago, kathyc2 said:

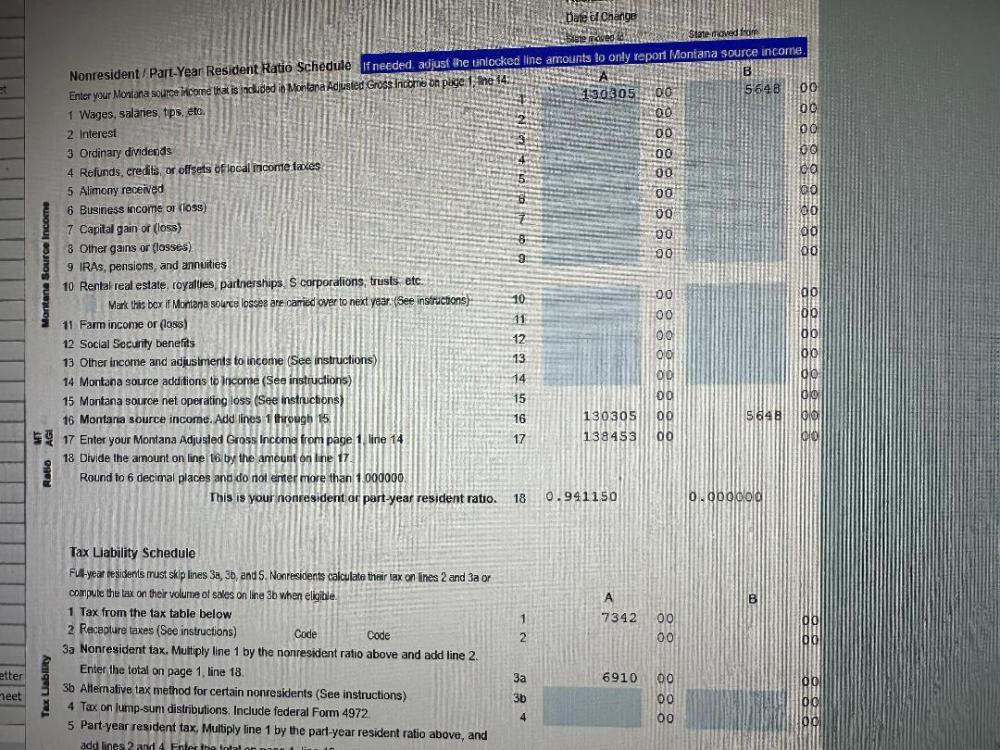

Page 8 is where you enter MT source income. You entered 130K as MT income. Column B is for spouse MT income, not the total of MT income. Put the 5648 in Column A.

Gosh!! Thank you!!!!!

-

1

1

-

-

I'm pretty certain there's a form missing or I'm missing a click somewhere

-

-

23 minutes ago, jklcpa said:

Have you included the nonresident/part-year ratio schedule in the return? That ratio from the schedule would be applied to the overall MT tax on all income so that the tax is reduced to the same ratio that the MT income represents of the total income.

Thank you for responding. I don't see any Non-resident nor part-year resident forms in the Mt state section in forms. I have 4 other states included & they all have those forms available.

-

Good evening. I am trying to file a Montana Non-Resident state return. Taxpayer earned $5648 of his 130K in Mt. It says he owes $6100+ in taxes. I have already specified he earned the 5648 & has WH of $319. Anyone familiar with MT taxes?

Thank you!

-

7 hours ago, Randall said:

I don't mess with this stuff. Too scared. It may work for some and some may be more knowledgeable about this. But I keep away from it. I'll just have to close program when I get the message and reopen. I don't like it but oh well.

It seems this year is worse & lots slower. I may try it this coming weekend. If it doesn't work after that I guess I'll have to contact tech support.

-

I don't see an ATX config file. Sorry a bit short on the tech savvy

-

Found it!

Thanks!

-

Good afternoon all! I have a return that includes Georgia & South Carolina. I cannot seem to find how to credit the SC tax on the Georgia return. I'm pretty sure I am missing a check mark somewhere. Any ideas?

Thank you!

Eli

-

I am having trouble with AZ 140 dependents field. The parents are automatically sent to page 3 & no deduction is being allowed for them.

Any ideas?

Thanks!!

Eli

-

Looking to go to the Dallas forum. It's a good 8 hr drive or a 90 min flight from where I live. Hopefully meet up with Bulldog Tom!

Eli

-

-

I have one from February 4 & one from February 14th,

I still have one client who has not gotten their refund from 1.30.13 accepted e-file. I am so frustrated. Called the IRS twice and still all they can tell me is it is in review and will be processed when they get to it.

Anyone got a magic bullet that gets the IRS off their A$$ on these things? Thinking about calling my congressman. Any other suggestions.

Tom

Hollister, CA

I have two that were accepted Feb 5 & have not issued refunds yet. I've called for both & all they will will tell me is that they are being checked. I ask why there hasn't been any correspondence with the taxpayer & their rely is that the don't need any further info. If that's the case, then why can't they just issue the refund?

Eli

-

I am taking a couple of hours off today to go shopping with my Granddaughter for Maternity Clothes. Yes!!!!

What is more important, tax returns or a new Great Grandbaby, the first? I am thankful that all of you will be helping me with my work while I am out. Have not been out of the house since Monday. They heard the nice, strong heartbeat yesterday and are so excited.

What is more important, tax returns or a new Great Grandbaby, the first? I am thankful that all of you will be helping me with my work while I am out. Have not been out of the house since Monday. They heard the nice, strong heartbeat yesterday and are so excited.

Congratulations!! At 83 years young, my mom has about 115 grand, great & great great grandchildren. She still gets excited each time she hears a new one is on the way

-

1

1

-

-

Well said, Terry!! Glad to hear you have had a great season.

Eli

-

Happy Birthday, KC!! God bless

-

Are any of you on a stand-alone XP machine? until I hear good reviews from people sharing my specific set-up, I will not update...just too risky.

I didn't notice any difference. At least it hasn't messed it up any either

Eli

-

Wow! Good to hear from you, Kerry!! Hope you & your family are doing well. It's been a while since we had seen you on here. I'm sure your kids are growing like weeds

Take care & don't be a stranger.

Eli

-

1

1

-

-

How much in FTC does your client have? If under $600, delete the 1116 and 1116 AMT and the error code will go away. If it is more than the $600, then you have to determine the foreign income and fill out the 1116. On that stupid 3b questions, put anything, anything at all, like "other itemized deductions", and move on.

Hth!

Thank you, Maribeth

Eli

-

Working on a couple's return. He has 5 K-1's. On one of them there is foreign income, but it says 'other countries'. When I do an error check, it says: If there is an amount on line 3b for other deductions, the line 3b 'Statement for Other Deductions related to Gross Foreign Income must be filled out.

Any help where I can find the info that goes on there?

Thanks!

Eli

-

I do not accept credit cards at my home business, but I offer to send a PayPal invoice, and it seems that everyone has a PayPal account.

If you ever want to take credit cards, Square is pretty simple & just charges a per transaction % fee. I've used it a few times this year.

Eli

-

look at page 12 of the handbook for e-file providers pub. 1345

Returns Not Eligible for IRS e-file

The following individual income tax returns and related return conditions cannot be processed using IRSe-file:

Other than current year tax returns;

Yes, some previous year returns can be e-filed. Update your previous year program.

Eli

-

I wish that what you say is true. In fact, it is NOT. The program becomes very unstable above 250 returns. This applies whether standalone or network. Network is WORSE by a factor of 10.

I've got 487 e-files with hardly any problems. I'm using a custom built computer utilizing Windows 7 Ultimate, an AMD Phenom II x4 940 3.00 Ghz processor, 8Gb ram, & 64 bit operating system.

Eli

-

1

1

-

-

She has Green Bay Packers license plates.

She was ALMOST a model client

Eli

So Grateful for this Board

in General Chat

Posted

Yes! I definitely agree. Especially for those of us who work solo. Thank you!!