NECPA in NEBRASKA

-

Posts

1,533 -

Joined

-

Last visited

-

Days Won

19

Posts posted by NECPA in NEBRASKA

-

-

6 hours ago, cbslee said:

I have read articles recommending an LLC as a excellent way to own family vacation property but not for tax reasons.

But for legal reasons like making it easier to transfer ownership between family members, sharing expenses erc.

The property would not be used for vacation, as it is local farm land. They were told that they could go to Florida or wherever and deduct the vacations as board meetings.

I only questioned this, because I was looking for a K-1 or the normal share of income from somewhere. The client believes that there is no income tax involved at all and no return needed. I am pretty sure that the attorney and the taxpayers are both confused about taxes.

I am only preparing my client's 1040 and will not be taking on the additional taxes.

Thank you,

Bonnie

-

I have seen LLCs taxed as S corporations or partnerships, but today I was told that an attorney told my client and siblings to put their family farm rental into an LLC that would pay all of the taxes and they would not have to pay anything. In fact, they can all go on family vacations and call it a board meeting! This guy is way more popular than I am, because I asked questions when I did not received the normal rental income and expenses from my client.

I have never seen a family farm rolled into a "C" Corp. It is only land and worth about $250K today. Does anyone know if this is something new and I am just slow? Be nice, I know that I'm a little slower to pick up new stuff.

Thanks!

-

2 hours ago, grandmabee said:

I had a client bring in a notebook today with the clear pages that each tax doc was inserted. So I have to pull them all out and copy and then yes he wants them back into the clear jackets and put back into the notebook. They think they are being helpful, helpful would be clients who open the enveloped and throw them away.

I have one of those, too. I love her, but it's such a freaking pain.

-

6

6

-

-

I have been trying to read up on this. I am on a FB group that says that we should be checking this method out for every married couple that meets the income requirements. MFS is rarely a great idea in Nebraska, so there are a lot of moving parts to check. It does not seem correct for each parent to get the credit, but apparently Congress didn't know exactly what they were passing. What a surprise!

-

1 minute ago, cbslee said:

It took me far less time to to the print and mail the W 2s to the SSA than the time I wasted trying log into the BSO.

Yea, I am totally done with all of my 4th Quarter and Year End Payroll Stuff, both Federal and State!

Please don't rub it in! I still have 8 more clients left. Nebraska changed their unemployent website and it's been a PITA. They have extended the payment and filing deadline to 2/28 because of the headaches.

-

13 hours ago, jklcpa said:

Agree to expensing also. With the mention of cost seg studies and upgrades, it originally sounded as though this was part of a larger project.

Judy, I was just doing research that included what had been done in other cost segregation studies. An ex board member thought that it was an improvement, so I wanted to cover all of my bases. He isn't in the business of doing accounting or construction, but I still wanted to listen and bounce it off of my back office. ( All of you wonderful people)

I would lose my mind without all of you.

I would lose my mind without all of you.

-

2

2

-

-

3 hours ago, cbslee said:

This really falls in a murky gray area.

It doesn't meet the requirements to be called"Qualified Improvement Property."

I would argue it's a repair and expense it.

1. It does not prolong the property's life, a fully depreciated building.

2. It doesn't really add value to a fully depreciated building, no one evaluates water shutoff valves, they either work or they don't work.

3. All it really does is keep the property in good operating condition.

Therefore it's an expense. Sometimes we get hung up on the details when we need take a step back and look at the bigger picture.

There was a board meeting last night and they decided that it may be a repair, because it was started with a leaky valve in the bathroom and then pipes started to fail out to the street. The whole place will be falling apart, because it is an over 60 year old swimming pool. I will still keep researching, but it does not prolong the property's life for sure.

-

1

1

-

-

The bill was $8k for two valves and the building is fully depreciated, so it looks like depreciating is the only way.

-

1

1

-

-

I'm going to try a local shredding truck for a bunch of old boxes of files from the days before I scanned almost everything. My current shredder that I use just for day to day shredding takes forever to shred old papers and files because it only shreds about 10 pages at a time without stopping. It is a micro shredder and then we compost or burn the shred when it's full.

-

1

1

-

-

I decided that it must be 39 years, because it was an improvement bringing utilities to the building.Thanks everyone!

-

9 hours ago, Medlin Software said:

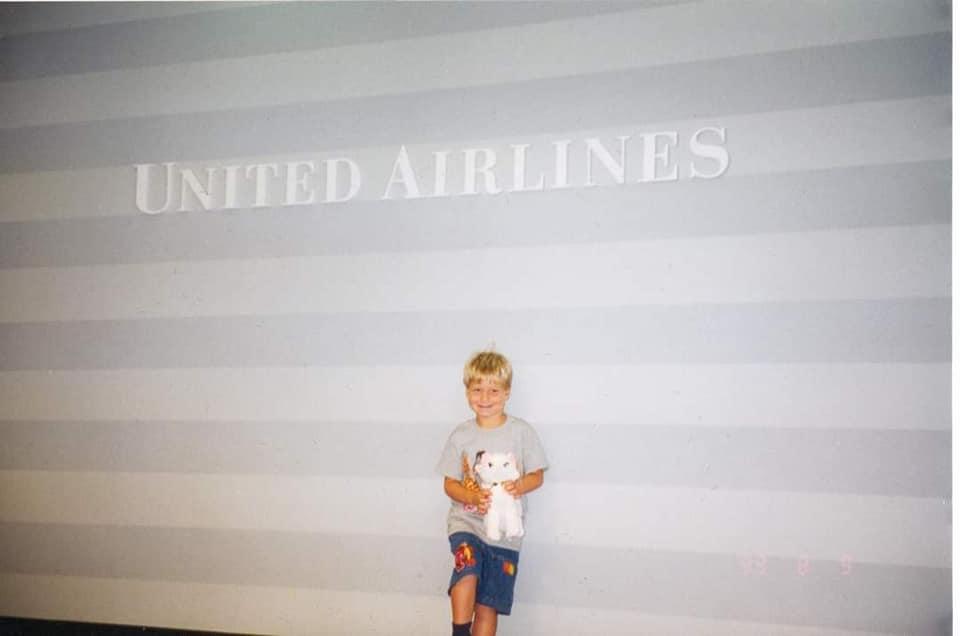

Terrific news. Have a good friend who recently retired from UA (flight attendant) after more than 40 years. She was not even in the top 50 of seniority... Several other friends are A/P at SFO.

One of our sons wanted to be a garbage man (we would not be allowed to ride with him!). Back then, there were no ready made garbage truck toys. Pilot was next, but at the time, his only route was through the regionals, and he prefers a different lifestyle. He then went into medical research for 5 years, and is now working towards trauma surgery. For us, we are most proud of his volunteer time at local free clinics, community based clinics, and at a VA facility. I fully expect him to take up flying again, once he chooses where to practice. (He is a strong believer in not being few times in the air per year private ticket guy. He wants to be up a couple times a month, at least, to keep current.)

That's great. It is very hard to stay current if you don't fly all of the time. Andrew is keeping his CFI current, because it's too hard to do it all over again. He does not fly private planes much anymore, but always has another good pilot with him. He says that it's way different than a jet and it's very easy to make mistakes.

-

1

1

-

-

13 hours ago, Randall said:

Congrats. Where did he get his flying training? Military? Air Force? or civilian?

Randall, his training was all civilian. He started flying very young and soloed on his 16th birthday, then got his certificates on his 17 and 18th birthdays. He received his Bachelors in Air Transport Administration from the Aviation Institute at UNO, because it was much cheaper to get his flight hours on his own, instead of through the University. I did not believe his first flight instructor when he had a plan to get him through, but it turns out that he was correct. He started instructing at 18, so he built a lot of hours over time.

-

Andrew was hired by United and started training January 4. It was hard for him to leave SkyWest, but this has been his dream job since he was little. He will be flying 737s out of LAX until a spot opens in Denver. We are super happy for him. I am looking forward to more fun trips to places that I have never seen.

-

15

15

-

1

1

-

-

I know that our meter is owned by the city, because they are coming to fix a gas leak outside my house before the meter on Thursday. They already replaced the meter. The gas and water company are the same utility here. I will have to check and find out who owns the pipes and shut offs at the street for my client. Thanks for the help.

-

Me too! I have been trying to stop taking new clients for a few years. I turned two down today that I knew, that's much harder than the random phone call. I just know that this tax season is not going to be much better than the last two. I had three more clients pass away this month and that always means more time needed for their returns and dealing with family. I will miss my clients when I retire, but I won't miss worrying about data security, the constant liability and new tax laws.

-

4

4

-

-

I was looking at a table for cost segregation studies and I an unsure if water line shutoffs at the street would be considered land improvements or building improvements, because it is carrying utilities to the building. It is definitely an upgrade and included having to cut the street.

Thanks for any ideas. I have not run across this one before and the difference between 39 years and 15 years is fairly sizeable.

Bonnie

-

Congratulations, Terry!

-

2

2

-

-

We plan on moving to Colorado in a few years to be close to our son and I swear that I will be done with my business by then. I don't plan to retire, just find a part-time job that is not tax related and somewhat enjoyable. I have moved my office location three times and have worked out of my house for 10 years. I had lovely clients that moved me twice and set up my office. It was a huge pain to move and I won't move my office again. Changing my information was easy. Unpacking was a huge pain. I receive my faxes over the Internet, but still have a landline. My cell service is not the best in our neighborhood and I want a real landline to stay on hold with the IRS.

I was not planning to retire for 6 years, but I'm thinking about three if that will work for us. My husband's health has gone downhill so much the past two years and I am spending so much time taking him to medical appontments and taking over the housework that he has done for the last ten years. Since we lost my mom this year and had to clean out and sell her house, our kids have been helping us (forcing us) to get rid of things that we don't really need. If has really been cathartic (and sad sometimes) to see that it has made a difference. It has taken a lot of time and many, many trips to donate and recycle stuff. It is a good thing, because if something happens to my husband, I won't stick around here long and will have to downsize alot to live in Littleton.

If you still love your business, downsize it until you are comfortable and keep working. I wish that I still loved this job, but after 45 years of tax seaon running my life and the constant tax changes, I am ready to take it easier. I will miss my clients, but I have lost a lot of them the past few years due to age and illness. I lost three (two from the same family) in 7 days this month. I need to buy sympathy cards by the box.

Just do what you think is best for you.

Bonnie

-

4

4

-

-

6 hours ago, Lion EA said:

Out here in the boonies, people steal out of mailboxes.

They steal out of them here, too. They are driving around in broad daylight getting caught on cameras. I'm glad to be home most of the time so I see when the mail gets here.

-

1

1

-

-

50 minutes ago, TexTaxToo said:

There is a difference between e-filing and direct deposit/pay. You can e-file and still pay by mail.

Of course, if you send them a check, they still have your account information. Ask them how they are paying. Maybe they want to take cash to a local IRS office??

He also told them that they were more apt to get audited by electronically filing and that it gives them too much information.

-

1

1

-

-

Is there something wrong with me? I just got put down for electronically filing tax returns by a client's daughter. Her tax person does not e-file and has all of his clients say that they refuse to efile so he files the 8958 (or whatever it is). His reasoning is that the IRS can get into your accounts too easily and take their money anytime that they feel like it and they know too much about you. I normally expect their neighbor,barber, etc. not a "really smart guy" that they love so much to say this crap. She just kept going on about why not mail it. I told her that I have to efile and it would be wrong of me to tell my clients not to efile, if that was my personal preference.

-

1

1

-

4

4

-

-

I second Lion's verdict. I'm not in the directory, because I don't wantnew customers. I do find their classes educational and their publications are great.

Bonnie

-

1

1

-

-

I have no control over payment for any of my clients. Heck, I still make them mail 941s. I have sent clients away when they decided to add employees, because I have been gradually getting rid of what I have. This client uses a payroll program and the reports that they give me are good.

-

1 hour ago, BulldogTom said:

Get the POA, then share your Covid concerns with the auditor. I am fairly certain they will want to do this via correspondence (they probably don't like going to offices where they don't know the people either). Follow the advice above. When I have done these in the past, I will try to know the results before the auditor sees anything. And if something was missed, I lead with that item and agree to that adjustment right off the bat. No sense trying to hide something. I find it buys some goodwill if you admit there was a mistake and it is corrected.

Tom

Modesto, CAI will do that. I don't expect there to be any payroll mistakes on my part. I don't prepare their payroll, just use their quarterly numbers. They give me the amounts for 1099s. I hope that seeing everything will not open problems for anyone, including me, on their income tax.

LLC taxed as corporation?

in General Chat

Posted

Cbslee, No I am not preparing the return until they get an answer from the attorney and I have proof that they are a C corporation or I get a K1. The sibling that is in charge of making these decisions is not my client.