-

Posts

8,008 -

Joined

-

Last visited

-

Days Won

293

Posts posted by Lion EA

-

-

I've been trying to convert my clients that insist upon mailing checks to use IRS's DirectPay instead so they get an immediate confirmation. CT has a similar system; although, not as user-friendly as DirectPay. Most states I prepare have something similar.

Of course, I strongly encourage Direct Debit with e-filing, but sometimes clients have to move funds around before they can pay, or we're dealing with ES during the year.

-

5

5

-

-

Maybe the SSA has the wrong spouse marked as deceased. Or, the IRS computers flagged the wrong spouse. I've seen other preparers say the IRS requested a 1310 when it was not needed in the situation (such as MFJ). Good luck.

-

2

2

-

-

I think it can get into how the property was held, also. But, I can't give you any details about the different ways a couple can title property might or might not make it community property in CA. You might need to talk with the family's lawyer about that specific legal title.

-

2

2

-

-

You're NOT filing an inaccurate return. You're reporting what the biz did last year. Not what it should've done, because it didn't do what it should've done. The BIZ was not accurately following the regulations for an S-corp if it wasn't paying reasonable compensation. Circ 230 tells us to explain to the client what they did wrong and the consequences. We do NOT have to repair their prior acts, unless they engage use to do so.

-

3

3

-

-

Sound like November clients to me, especially if they're getting a friends & family discount.

-

2

2

-

1

1

-

-

-

Form 2553, if you're going that way. But now you have the dissolution of a corporation for 2022, also.

-

1

1

-

-

So, the business dissolved at the end of 2022? Or, ceased any further business activity? First & last return?

-

2

2

-

-

I take a LOT of courses that do NOT earn me CEs to retain my EA. I take classes on CT, NY, MA, PA, CA, and other states, and also technology, and classes from instructors/topics I like that might give CPE but not CE. My NY/CT-ATP group includes an hour of NY tax updates and an hour of CT tax updates each year and two hours of non-federal tax law classes (we've done SS, Medicare, retirement planning, multi-state issues, financial aid/paying for college, and office security years before the IRS approved it for CEs).

-

1

1

-

-

Well, it has to be IRS-approved CE. EAs must look for the square IRS logo that IRS-approved CE providers use and the IRS-provided course number. Only federal tax law qualifies, including ethics and updates. No state tax topics and no tax-adjacent topics, such as SS, Medicare, office management, technology, (although, IRS has now approved security-related topics).

-

I've had classes from Bob Lickwar on other topics and like him. And, have heard good things about Surgent; but their constant emails have been about courses I don't need (specialized trusts, for instance) or CPE only and not CE, so I haven't stopped to check out their schedule. I should do so. NY/CT-ATP has a rental real estate track planned for October with Kathy Morgan that I'm signed up for (6 CEs + 2 CEs ethics).

-

I don't think anyone else is an idiot.

I do feel that I'm an idiot for not being thoroughly educated in tax-adjacent topics, such as SS, Medicare, retirement saving, investing, crypto, planning for like-kind exchanges, STR, vacation rentals, anything I haven't had to study in the past, etc.

I know I don't have the knowledge or the time to give my clients the consultation they need -- but that there are people who can.

I do talk a LOT about SS to my clients, but remind them I don't know any more than I'm telling them, that I gained my little bit of information by taking courses from experts in those fields, and suggest they consult experts in each field, that we can all work together to help them plan.

I thought I was agreeing with kathyc2 that we need to help our clients plan (in my case, with my limited knowledge, help by recommending consultants that I've learned from) for retirement -- using SS as just one of their resources.

Who do you all recommend that I take classes from to up my SS game? Any courses you recommend scheduled for November-December 2023?

-

1

1

-

-

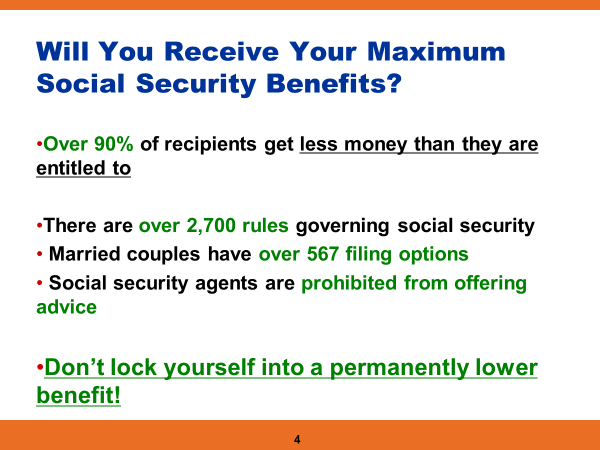

Until I can figure out how I copied a slide...

Waiting until 70 is only one way to increase SS benefits, but won't be successful unless you live to about 90, so NO, failing to wait was NOT how people left money on the table. Not working out what their goals are for retirement and being honest about their situations (health, for instance) and looking after their own finances via private investing &/or working and NOT relying on our inefficient government were topics he discussed.

-

Back in 2018, he charged those of us at his class and our clients $750. I think that may've been half price. At that time, he was one of a very, very few speakers on SS; and our NYCTATP group had looked hard for a couple years before finding a speaker. I would think more have joined that niche as we baby boomers have aged.

He spoke to us for only 2 hours, so we didn't cover more than 67 filing options! To keep working in his niche, he must have documented the options. He took us through many to show us how optimizing over a lifetime, taking into account more than just SS, was better than just looking at how much SS benefits could be received. Single? Divorced? Married? What if the older was ready to retire first? Younger? What if there were minor children? Are their living expenses already covered, so they can take advantage of investment opportunities? Do they need money sooner for other reasons, such as healthcare? Those types of questions to adjust each scenario beyond just ages: 62, FRA, 70, and everything in between. Way more than I have time to generate from scratch when it's not my core expertise.

After taking us through one set similar to the above, here are his summary slides: (can't figure out how I copied a slide above; I'll try on a new post below)

-

Ash took us through examples of maximizing benefits vs optimizing benefits. So many differences in a person's or couple's needs. Perhaps health/non-working requires more benefits sooner. Or health/ancestry + minor children suggest starting benefits sooner to preserve them for children/spouse. Or market rates are predicted to out perform the 8% from waiting. Or...

If you know when each spouse will die, the calculations get much easier!!

The SSA even offers a couple of Do-Over options. But, limited.

There are courses available that cover a multitude of scenarios. Or, a calculator/spreadsheet can help you sort out possibilities for a specific client situation. I send my clients to Ash Ahluwalia. Some clients already work with their financial advisor, so we work together to make sure the tax implications are taken into account before, not after, making financial decisions

-

Remember when the IRS said they were moving employees to opening the mail in a timely manner? Now we know where they came from! Of course, some other function will suffer.

-

1

1

-

-

Send your clients to an SS benefits expert. Here's just 1 of Ash's slides from his presentation to the NY/CT-ATP June 2018:

-

3

3

-

-

12 hours ago, Christian said:

...while in the degree program she was shown as a half time student...

If daughter was NOT at least a full-time student for any part of 5 months while in college, then she failed that qualification to be a dependent of her mother.

https://www.irs.gov/pub/irs-news/fs-05-07.pdf

"...under the age of 24 if a full-time student for at least five months of the year..."

The dependency requirement had to be met first, before the parents could take the AOC or LLC education benefits.

Review!

-

https://dor.mo.gov/taxation/individual/pay-online.html

https://dor.mo.gov/forms/MO-2210_2022.pdf

What software do you use? Maybe one of our members can help you with how to enter in your software. Or, contact your software technical support for how to include P&I in the MO-1040 e-filing.

-

I don't prepare MO returns, but can you calculate the MO P&I, via the MO version of Form 2210 or something similar, so it's part of the MO1040?

Otherwise, does MO have something like the IRS's DirectPay for you/your client to pay the P&I online?

-

You may have some amending to do if the daughter hasn't been a full-time student since high school.

-

-

Like Tom said, if NOT a FT student but over 18 and earning over the then-current amount ($4,700 for 2023, for example), daughter will NOT be a dependent of mother, and mother won't be eligible for education benefits. Daughter will take her own exemption and can take education benefits.

Sounds like mother already may have lost her tax dependent in a prior year.

-

2

2

-

-

And, if daughter makes under the $$ limit for that future year when she lives with mom, she might be a qualifying relative when she's too old to be a qualifying child. Must meet the requirements, but not hard to do while a student, so research her qualifications each year.

NT -need to change my avatar pic

in General Chat

Posted

I'm so very sorry. It's hard to lose a furry family member, and an office staffer, too. I'll miss seeing his pic. Hugs to you.