-

Posts

4,880 -

Joined

-

Last visited

-

Days Won

298

Posts posted by Abby Normal

-

-

Maryland hasn't had the unemployment rates ready for the first payroll of the new year, in many years. They used to get it out on time, but I guess the computers are slowing them down.

-

1

1

-

-

AnyDesk

-

1

1

-

-

It is well worth 20 minutes of my day to provide input to the IRS. I'm a big believer in data acquisition, and I still hang onto what little hope I have left, because being hopeless is not an option.

-

3

3

-

-

No trouble logging in for the past few years. Yes, they make you change your password sometimes, but that's been working smoothly for awhile. Although ATX blocks your browser from automatically saving the new password, so you have to go into your saved passwords and update it manually.

-

1

1

-

-

Yes, fiscal year returns and extensions are on the prior year form because 2023 forms are not ready yet. Just make sure you have the fiscal year dates correct in the return before efiling the extension.

-

2

2

-

-

Freddie was better.

-

ATX does not even have a MD Efile info form, and I doubt ATX will ever bother to add it.

-

1

1

-

-

Sounds like a candidate for uncollectible status. I've used this before in these situations.

https://www.taxpayeradvocate.irs.gov/get-help/paying-taxes/currently-not-collectible/

-

1

1

-

-

8 minutes ago, mircpa said:

I believe this shareholder who is resident of OK should file CA 540 NR with its share of CA K1 income & capital gain. Include CA 540 NR California adjustments.

But, in this case, it's not CA capital gain. If the cap gain was on the K1 as being incurred by the S corp, then yes, it would be taxable in CA. But this is the shareholder's personal capital gain.

It's hard to imagine the K1 not showing some income, loss or deductions for CA.

-

2

2

-

-

Probably about a month. They can keep checking the installment agreement IRS site and one day it will show a balance due.

-

4

4

-

-

34 minutes ago, kathyc2 said:

There has been talk of moving COLA to chained cpi, but it hasn't passed. SS COLA is change of CPI-W (wage and clerical workers) from 3rd quarter prior year to 3rd quarter current year. The main difference between CPI-U and CPI-W is the weighted importance given to each category. For example W weighs food and energy higher than U and services (including medical) less than U.

The CPI-U and CPI-W, on the other hand, are biennial chained price indexes where their expenditure weights are updated every two years, not monthly like C-CPI-U. So they are all chained, it's just a matter of frequency.

https://www.bls.gov/cpi/additional-resources/chained-cpi-questions-and-answers.htm

-

Both main CPI calculations (W & U) are "chained" which results in a lower percentage increase. So when consumers switch to cheaper products because they can no longer afford what they used to buy, this becomes part of the calculation by swapping in cheaper goods for what we used to be able to buy. It's a death spiral of poverty, brought to you by the millionaires in congress and their wealthy owners.

-

3

3

-

-

13 hours ago, Hahn1040 said:

my experience is that you create the federal efile but not transmit it. only transmit the state (after you have unlinked it as Abby instructed)

Creating the federal efile is not necessary and can't be done in many cases (red error).

-

On the state efile info form, there should be a box to disconnect the state return from the federal modernized efile (MeF) system.

-

2

2

-

-

Six months won't do it, it has to be all year, from what I'm reading.

https://www.irs.gov/publications/p501#en_US_2022_publink1000220954-

4

4

-

-

I see a paper copy of the notice is arriving today. That's probably for the best or even required by law, but I've already handled it, so I can just shred the notice.

-

1

1

-

-

1 hour ago, kathyc2 said:

I don't see how you can retroactively dissolve the S when presumably payments for services in 2023 when to corporate bank account.

Also, the bank account used in 2023 is in the corporation's name so all activity goes on the 1120S. We account for what happened, not what we wish had happened.

Shoot for dissolution on 12/31/23 to avoid short year calcs.

-

3

3

-

-

1 hour ago, cbslee said:

Several quick online searches suggest that this may be available to tax professionals only???

It was for me personally, but I think you might be right that it's because I'm also a pro.

https://www.irs.gov/payments/your-online-account

Access Tax Records

View key data from your most recently filed tax return, including your adjusted gross income, and access transcripts

View information about your Economic Impact Payments

View information about your advance Child Tax Credit payments

View digital copies of certain notices from the IRS

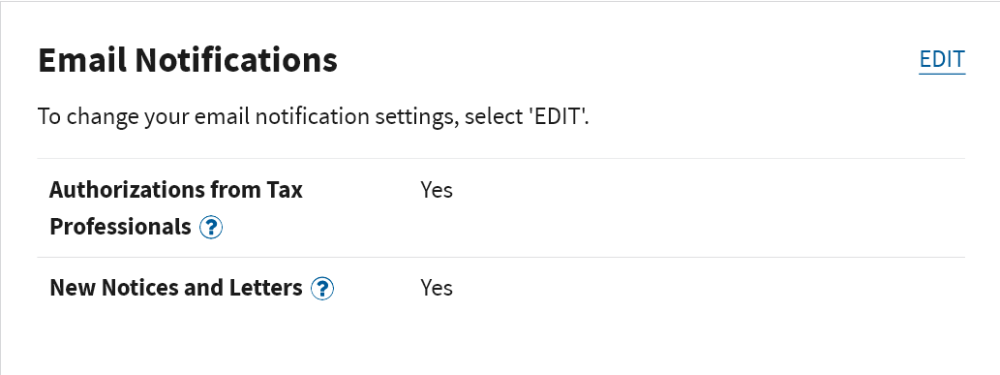

Here is the setting in my IRS account:

-

1

1

-

-

That's no longer true. It was a legit email and there was a notice for me to download. I may have opted for this on my account.

-

1

1

-

-

Just got an email from the IRS about a notice, that I can log into my account and download. I like it!

The Post Office is going to take a big hit if the IRS stops mailing many notices. Of course, I could still be getting a mailed notice. Or if I pay the notice quickly enough, they won't? Brave new world.

-

8 minutes ago, Patrick Michael said:

This is why I always tell clients to get, at a minimum, a certificate of mailing, certified mail with return receipt preferred.

We mailed something to MD at year end, a time when they get a ton of mail. It ended up going to an agent of the state to hold until MD was ready to handle it. Because of the 3rd party agent receiving it, it never showed as delivered on the USPS site and we never got back the green card proving delivery, but MD did eventually receive it.

-

3

3

-

-

I can't follow that. What did you add the depreciation back to?

If the depreciation was correct in ATX, then the gain should have calculated correctly, if you enter the sales proceeds and expenses of sale correctly.

-

-

21 hours ago, Max W said:

Shouldn't the CPA amend the K-1 and the 7203?

1120S doesn't include a 7203, only 1040. Unless the 7203 was prepared as part of the K1 for convenience or in lieu of a basis worksheet. And I agree with you that the loss is simply carried forward and does not create a capital gain. Distributions in excess of basis should be the only capital gain issue here.

And, being pedantic, basis can not be negative. It stops at zero.

-

1

1

-

Old old charitable organization

in General Chat

Posted

Often churches fall under the tax exemption of a regional group or diocese that has a TE status.

There is a Quaker (Religious Society of Friends) meeting in a nearby town that is part of the Philadelphia Quaker group (Philadelphia Yearly Meeting). An IRS agent drove by and ended up investigating the meeting, mostly because he'd never heard of Quakers. Ridiculously, it took the meeting more than a year to get the IRS off their case, even though the IRS is right there in Philadelphia and surely someone has heard of the Quakers.

The Quaker organizations are usually set up as monthly meetings, quarterly meetings and yearly meetings, but that's a carryover from early days.