M7047

Members-

Posts

72 -

Joined

-

Last visited

Everything posted by M7047

-

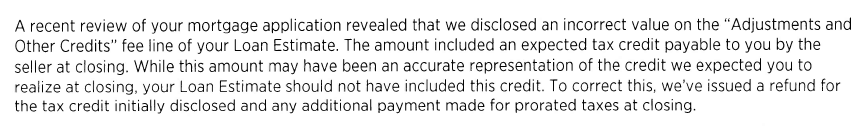

I was thinking that the 396 should be interest, just wasn't sure if it would flag anything since they never received a 1099. Thanks everyone.

-

It was from their mortgage Co. They issued them a check. This is the letter they received. Nothing was ever deducted, as they can't itemize. Thanks

-

Have a client that received money for "Lost use of funds" and being told it would be reported to the IRS as required by law. They never received anything other than the letter. Would I just place the amount like it was an interest payment or would that confuse things, since there was no 1099?

-

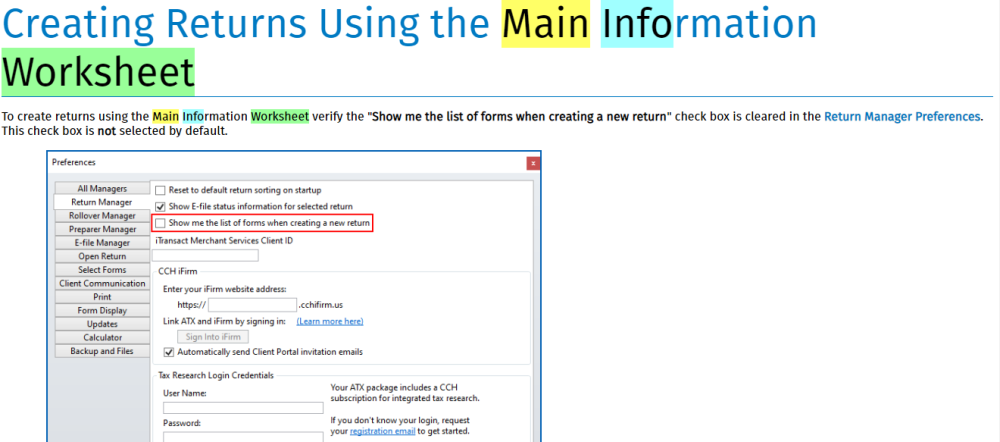

Spoke with ATX technical support today. She says this isn't an option this year, the removed it. I asked her to pass on to the powers that be that this was a really dumb move on their part and is wasting our time.

-

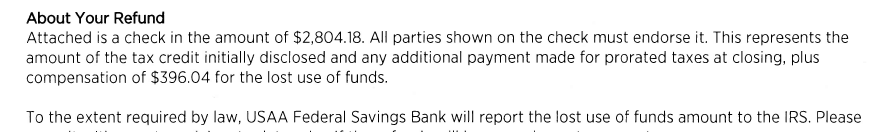

I found this and I get the Main Info worksheet when I open a return (new or rolled over), but not when I choose customize masters! I still can't figure out how to customize this, it's either greyed out or not just a form you cant customize.

-

Ugh...not yet. I know I did in the past and it was a real time saver. I thought I was missing something.

-

In the past I could customize items on the main info worksheet. This year I can't even select it, it's grayed out. Anyone have any ideas as to how to change that? It shows up as a generic form in my rolled over returns or if I try to create a new return. I just can't customize it.

-

How do you stop them. I'm going to get a newer version and don't want to fall into that trap either.

-

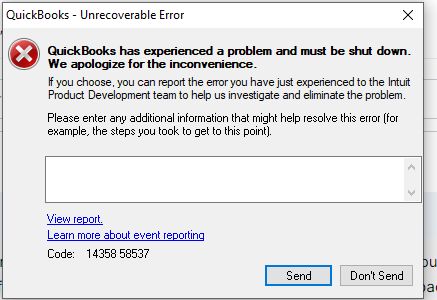

@Dennis. I truly appreciate you taking the time to give me input, but I can't open anything on this stupid program. It never gets to that point. I've tried to open backup files from a hard drive but it wont open those either. As soon as I try to open quickbooks, this is the message I get and it never goes beyond it to try anything else. UAC was down to never.

-

Ugh, I thought this was brilliant. I have a 2009 version with the license key. I tried doing what you suggested, but even with the internet off, I still get this message once I try to open it. I've even tried to run compatibility with windows 7 and still nothing. Tried looking up the code and it's just basically telling you it's not compatible with windows 10. Funny thing, I had this working on windows 10 but had to get a new hard drive, and now it wont cooperate...:(

-

Hello, I'm looking for software to enter "after the fact" receipts for a few clients. Need to also be able to get P/L statements. Don't need payroll. I've been using quickbooks and like their checkbook entry, but they're getting out of hand price wise. Also want a desktop version not online, as our internet can be out some days. Anyone have any recommendations?

-

I'm in very rural PA (as in I have no visible neighbors) and my pricing is similar to yours. Obviously I would love to get more for a basic return, but given where my office is and there are two other accountants in "town" with similar pricing, I just cant.

-

I was looking at the ProSeries Choice 200 as an alternative to ATX. I understand this is for new customers only. Could you tell me what are they telling you about renewal? I'm looking at alternatives as ATX is getting out of hand, but I don't want to be looking again next year.

-

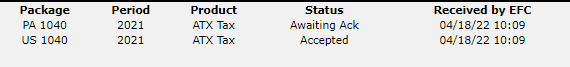

I've had multiple returns stuck at "transmitted to agency" for the state return. The federal are accepted. Are these considered filed on time?

-

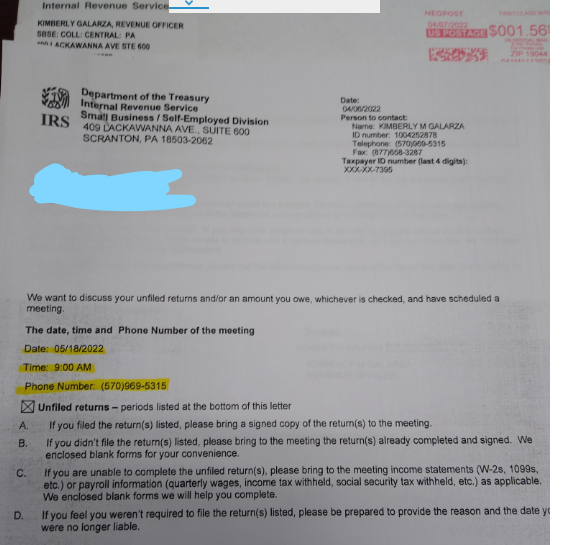

She claims she doesn't know whose number that is. I am an accountant, but not a CPA or an EA I thought this was fishy too. The weird thing is they want her to call them at that time. What happens if she doesn't call them....

-

New Client received this letter from the IRS. It has her name and address correct, but that's not the last four of her social security number. The second page has 2 years listed that had no filed returns(because she only had social security those years). Our concern is, is this legit when they don't even have the correct social on it. Does she call and say that's not my number and then scammers have her real number? I'm so leary of fraud anymore. Has anyone else seen where they set up a time for you to call them? Anything I've seen had everything done back and forth in writing. Advice?

-

Client received a letter from the IRS asking for proof of withholding.

M7047 replied to M7047's topic in General Chat

That makes sense. Thanks! -

Client received a letter from the IRS asking for proof of withholding.

M7047 replied to M7047's topic in General Chat

I can do that. I just thought it was weird they were asking for that when they would have received the federal copy of the 1099 and should also have social security on file. It seemed weird they would ask for info they should have already, when they are understaffed. -

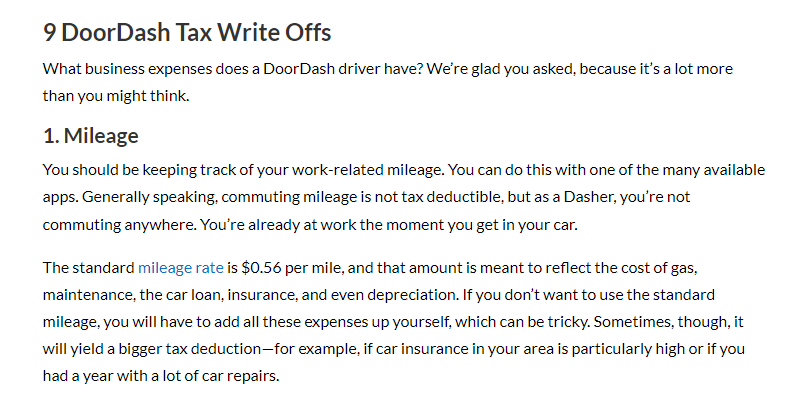

I can see what you're saying here. Makes you want to use the whole mileage, but I would still be inclined to forgo a home office deduction. I've been digging but there doesn't seem to be any case giving a definitive answer.

-

Thanks guys. I was inclined to ignore the commuting miles to first and from last pickup until I read this (attached) from a "tax advisor" and started second guessing myself. I had already told her no commuting mileage and I'm not venturing into a home office with her when all she's doing is answering her phone there.

-

This is her only job. It's a rural area so she doesn't go anywhere unless she gets a notification from the app. Once she accepts the job, she leaves home and goes to pickup/deliver whatever. She doesnt really have an office, she's just using her phone to get notices.

-

I understand that the client can use the standard mileage rate when working for these companies. My question is, does that start when they leave home or when they pick up the food/ passenger? I have read a lot and am getting both versions of this depending on who wrote the article. Some consider the mileage to the pickup as commuting others say the diver has no permanent place of work, so mileage to the pickup counts. Thoughts...

-

I've been thinking of switching software, the price for ATX Max is just getting out of hand for my business size and that 95.00 processing fee to download software is beyond ridiculous! . I have about 160 paid returns and a couple of partnerships. Does anyone have experience with other software and care to offer pros and cons? I have an email from Drake and I understand a lot of people like them once they get on to their system. Any others...

-

HELP PLEASE! Sale of Personal Residence turned into Rental

M7047 replied to M7047's topic in General Chat

Thank You so much! I was using Fixed assets to remove it from Dep Sch.