M7047

Members-

Posts

72 -

Joined

-

Last visited

Everything posted by M7047

-

HELP PLEASE! Sale of Personal Residence turned into Rental

M7047 replied to M7047's topic in General Chat

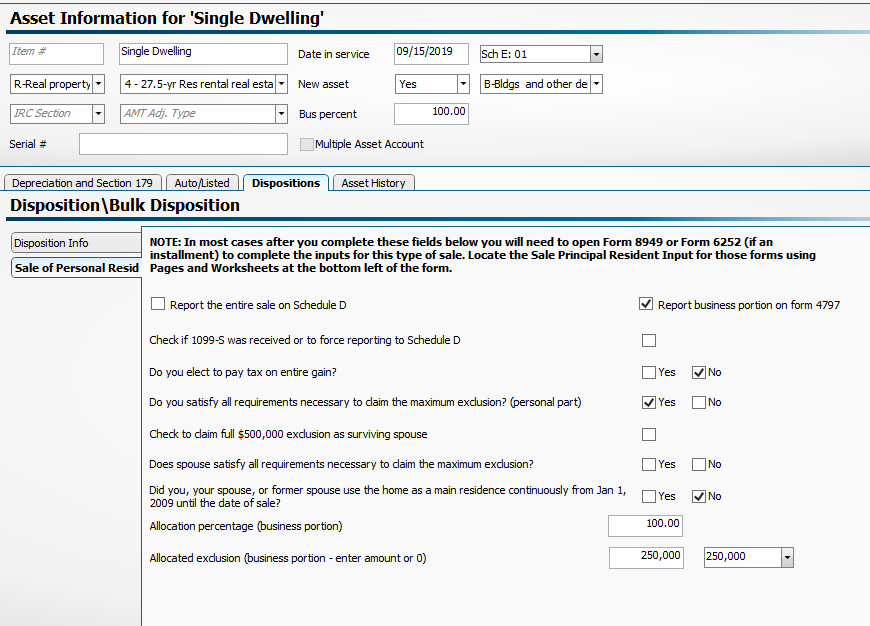

I filled out the sale of personal residence on the fixed asset tab. Why would I use 8949, wouldn't that put it on here twice? -

HELP PLEASE! Sale of Personal Residence turned into Rental

M7047 replied to M7047's topic in General Chat

That's the date it became a rental. She's owned it since 2011. -

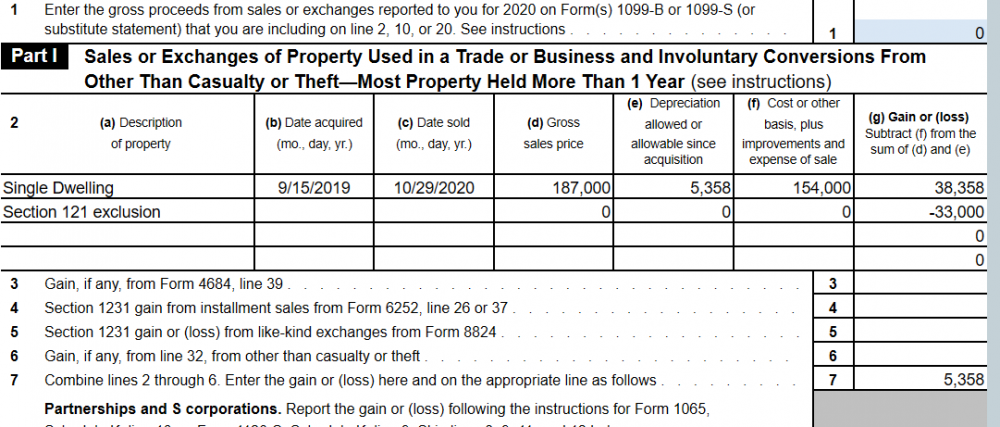

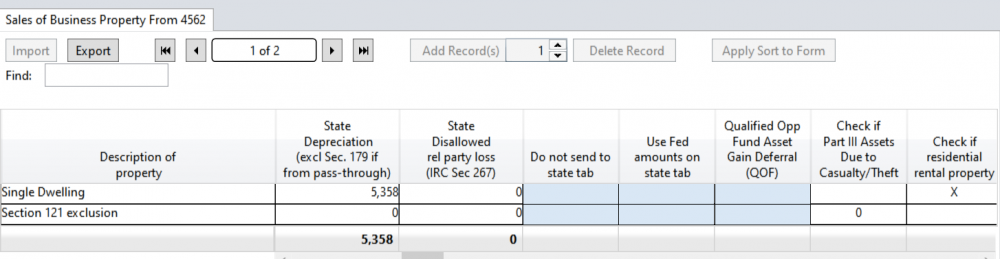

This is what I have for the 4797-it flows from here to the schedule D onto the 1040. They do qualify for the exclusion BTW. Even though the state info is there on the detail tab, I can't get the info to flow to the state return... My PA Sch D is blank and I cant get any of the info there. What am I missing? Thanks!!

-

Why, when the whole gain is under 250,000? Wouldn't you figure the gain/loss first and go from there . I mean, if you have to factor the depreciation into the basis aren't you already recapturing it...

-

This was part of another post that must be considered closed. If client has home that they turned into rental property, used it 2 out of the 5 and then sold it, does he have to recapture the depreciation if the total gain is under 250,000? In other words, if you reduce your basis by the amount of depreciation used and still have a gain, can you exclude it all if that gain was under 250,000?? Ex house value 150,000 used depreciation of 10,000 so basis is now 140,000. Sales price is 190,000 making a gain of 50,000. Can they just exclude all that gain and not report anything? https://www.irs.gov/faqs/capital-gains-losses-and-sale-of-home/property-basis-sale-of-home-etc/property-basis-sale-of-home-etc-5 "Generally, the law allows an annual depreciation deduction on your rental property and you must reduce the basis of the property by the amount of your depreciation deductions. If you don't claim some or all of the depreciation deductions allowable under the law, you must still reduce the basis of the property by the amount allowable before determining your gain on the sale of the property. The gain attributable to the depreciation may be subject to the 25% unrecaptured Section 1250 gain tax rate. Additionally, taxable gain on the sale may be subject to a 3.8% Net Investment Income Tax. For more information, see Questions and Answers on the Net Investment Income Tax. Refer to Publication 523, Selling Your Home and Form 4797, Sales of Business Property for specifics on how to calculate and report the amount of gain."

-

If he used it 2 out of the 5 and then sold it, does he have to recapture the depreciation if the total gain is under 250,000? https://www.irs.gov/faqs/capital-gains-losses-and-sale-of-home/property-basis-sale-of-home-etc/property-basis-sale-of-home-etc-5 "Generally, the law allows an annual depreciation deduction on your rental property and you must reduce the basis of the property by the amount of your depreciation deductions. If you don't claim some or all of the depreciation deductions allowable under the law, you must still reduce the basis of the property by the amount allowable before determining your gain on the sale of the property. The gain attributable to the depreciation may be subject to the 25% unrecaptured Section 1250 gain tax rate. Additionally, taxable gain on the sale may be subject to a 3.8% Net Investment Income Tax. For more information, see Questions and Answers on the Net Investment Income Tax. Refer to Publication 523, Selling Your Home and Form 4797, Sales of Business Property for specifics on how to calculate and report the amount of gain."

-

I have a client that their return was accepted 8 weeks ago and where's my refund still says it's being processed. They don't have any extra credits on it either, just a basic return.

-

Anyone from Virginia on here?

-

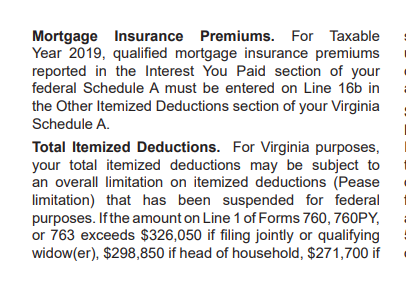

I have a client with mortgage insurance premiums. He is only allowed part of it on the federal because of income limitations. Does Virginia use the same amount as the federal or can he use the whole amount? I can't find anything on this, and the line through ATX is a blue box with no worksheet. I don't want to short him if he can use it all. Thanks

-

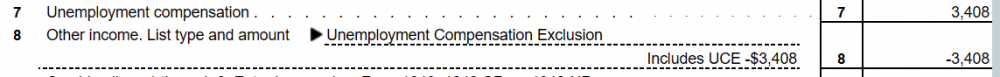

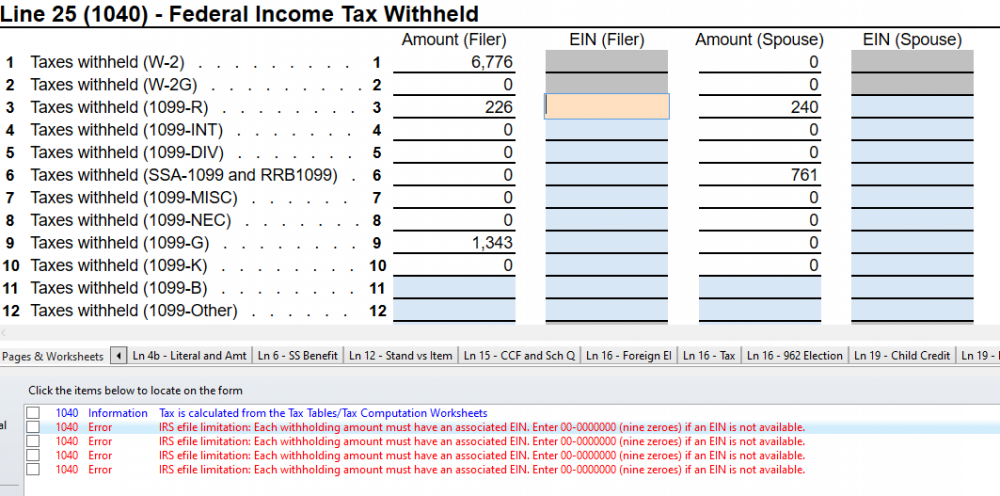

Ugh, I didn't even catch this on the first one I did. Why is this even an issue though? The worksheet (even in ATX) says the amounts from page one of the 1040 (not the amount from sch 1 line 7). This amount already has the 10,200 taken out.

-

-

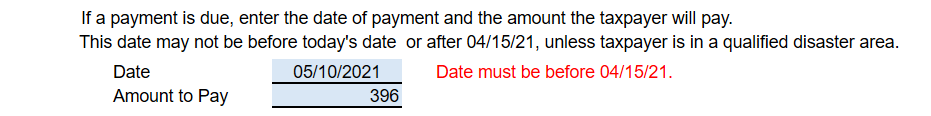

1040 EF Info and extended due date of returns with direct debit.

M7047 replied to M7047's topic in General Chat

I think you're right about waiting for the update. I was hoping there was a work around, but I don't see one for this form. Thanks! -

Where is the "Unemployment Compensation Exclusion Worksheet – Schedule 1, Line 8" my software is up to date, but I don't see this anywhere?

-

-

I did have it on the Fed for 2019, but it didn't go on the state. I'll check with him to see if he heard from VA and if not amend that. Thanks for the heads-up there! For 2018 it wasn't on either since it was expired at that time. Just wasn't sure where to put it on the return. Thank you both!

-

I don't normally have VA returns. I found this information for 2019, would I do the same for the 2018 that needs amended too? Thanks!

-

I don't normally have VA returns. I found this information for 2019, would I do the same for the 2018 that needs amended too? Thanks!

-

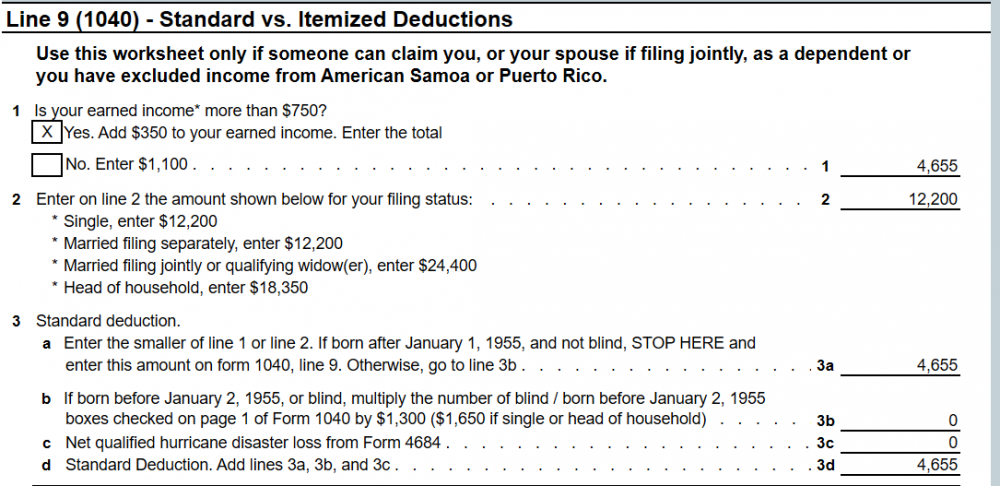

I understand that I can make part of the students scholarship taxable to maximize the AOC on the parents return. I keep seeing posts that say the student wont have to pay taxes on the scholarship unless its over 12,200. Putting the 4305.00 taxable part of the scholarship on the w2 worksheet line 4 (scholarship and fellowship grants not reported on w2) is making the standard deduction only 4655.00. Am I doing something wrong? Thanks.

-

The part 2 rolls over, the part 1 doesn't. It used to say that it was only needed in the first year, now they want it every year. Grandmabee-you cant efile without section 1 filled in.

-

Doing an installment sale. Previous years required you to fill out part 1 only in the initial year. Now they want part 1 filled out for every year. Where do I get the info from when no one has returns that old?