-

Posts

814 -

Joined

-

Last visited

-

Days Won

10

-

Hi all! Just wanted to let you all know if you are active on Facebook, we have a support group there as well. Come join the fun! https://www.facebook.com/groups/827167400659499

-

Please ATX - please rollover driver's license numbers

HV Ken replied to schirallicpa's topic in General Chat

My understanding is that it is the IRS does not allow this. -

Mine has been calculating the $330 just fine. I'd love to see a screen shot of one where it is not working properly. Is this because of the decoupling from the IRS calculations? NY only gives $100 when there is no earned income on the NY return.

-

NY IT-215 Earned Income Credit I have my first return with EIC. The NY form is not calculating. The Federal EIC amount is not feeding to line 10 of the IT-215. This is a HOH client with just a W-2 and 2 dependents. Anyone else having this problem with the IT-215? Am I missing something?

-

We use Daybreak Virtual to answer our phones - https://daybreakvirtual.com/ They cover our phones M-F 9a-5p, so everyone who calls talks to a human and does not go to voicemail. They schedule all appointments, confirm all appointments, make followup calls, etc. Their team communicates us via slack so we can authorize which calls to put through. Couldn't do this without them. Their billing is based on usage: "Combined productivity equivalent to one or more 6-9 hour per week clerical employees"

-

2021 Tax Organizers - Adding Additional Questions?

HV Ken replied to ETax847's topic in General Chat

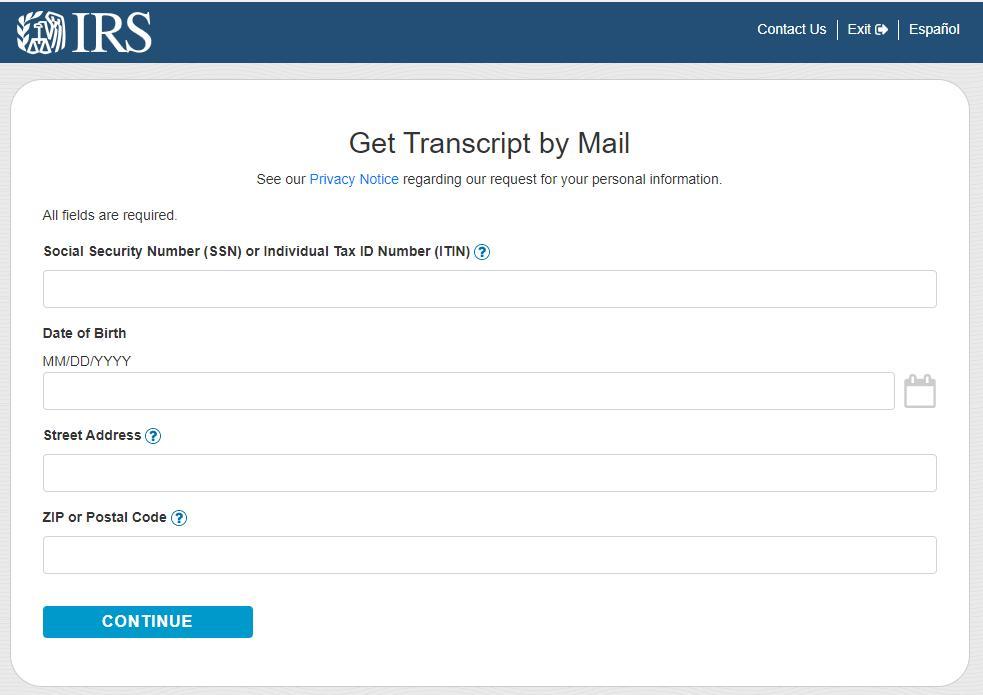

No IRS account required. Simply go to https://www.irs.gov/individuals/get-transcript. Can receive it in the mail within 5 to 10 calendar days by filing in 4 fields. -

2021 Tax Organizers - Adding Additional Questions?

HV Ken replied to ETax847's topic in General Chat

No account needed! Go to https://www.irs.gov/individuals/get-transcript and if the client can't get it online, it can be mailed and received within 5 to 10 calendar days. We utilized this approach during this current tax season for anyone who couldn't absolutely prove their amounts via other means (not merely relying on their memory) and as a result had ZERO math error notices once we adopted it. You can also request a transcript by mail by calling the automated phone transcript service at 800-908-9946. We also offer a transcript monitoring service as an add-on. For clients on this service we were easily able to get their information. -

2021 Tax Organizers - Adding Additional Questions?

HV Ken replied to ETax847's topic in General Chat

If you mean Ken (not Kev), no I am not kidding. The EIP3 information is already on the 2021 transcript (just as EIP1 and EIP2 were on the 2020 transcript as the start of last tax season), and I believe the ACTC is as well. It's easy peasy to obtain and will eliminate all the math errors and delays. I honestly can't understand why any taxpreparer won't require this. Sadly, the taxpreparer industry contributed greatly to the delays the taxpreparer industry suffered due to IRS manual processing caused by invalid amounts claimed for the RRC. We can do better and be better citizens to ourselves. -

I am hoping to begin evaluating TaxDome next week and have it in place for tax season. Based on customer reviews, I am not bothering with the comparison and just going right to TaxDome.

-

Have you guys gotten email about cloud based CCH Axcess?

HV Ken replied to schirallicpa's topic in General Chat

I decided to call ATX about this, and found out that this was sent by an internal salesperson and was NOT a company-wide marketing email. -

2021 Tax Organizers - Adding Additional Questions?

HV Ken replied to ETax847's topic in General Chat

Based on client's inability to accurately provide correct stimulus amounts during this past tax season, we started requiring, and will continue to require, every client to provide an IRS transcript as another piece of data for tax prep, just like a W-2. -

UPDATE: I decided to call ATX about this, and found out that this was sent by an internal salesperson and was NOT a company-wide marketing email.

-

I assume all ATX users received this email? This has nothing to do with ATX, but is an offer to get us to move to "CCH Axcess™ Tax"

-

Those are alternative facts!

-

Where did you get that date from? Haven't seen that announcement anywhere. The IRS date is 11/20 and ATX typically backs up 5 days from that. 11/11 seems excessive.