-

Posts

3,565 -

Joined

-

Last visited

-

Days Won

68

Posts posted by joanmcq

-

-

And the taxpayer is taxed as though the $45k is taxed. So if your client has 45k in wages (excluded), and $100k of other Taxable income, the 100k is taxed as though taxable income is $145k.

The way the foreign income exclusion works changed under Bush. Expats aren’t a big lobbying force.-

1

1

-

-

Done. I hope they know!

-

What they have in the Admin Console storage locations? It's under File Settings. Mine have been wiped out and Support is closed. I can't lose a day and ATX won't launch without the proper stuff in the Admin Console.

-

I just want to make sure I'm getting the new rules correct. Have married couple, the IRA account holder died and spouse inherited it. Spouse does NOT have to follow the 10-year rule and can take RMDs out based on his life expectancy. Or he can roll it to his own IRA and take out according to the IRA rules, once he turns 73.

-

I’ve read any older children (not an infant) are special needs.

-

2

2

-

-

It sounds like they are qualified non personal use vehicles. Any vehicle that is “not likely to use more than a de minimus amount for personal purposes.” Because of its design. They are exempt from substantiation requirements but can only use actual expenses for a deduction.

-

7

7

-

-

I picked up a client some years ago that had prepared his own returns in TT for years. He had an S-corp and three rental properties.

Some years, the rentals were reported in the S-corp. Some years on the 1040. One property was a historic building and had carryover business credits. Oh, and he was a real estate professional too. It was approximately 15 years of screwed up returns.

I prepared a disclosure with calculations showing for regular tax and AMT, what the NOLs, credit carryovers, etc. etc. what they should have been for each year and the correct figures for the year. And didn’t amend.

-

3

3

-

-

Well, he wasn't being as big a PITA as I supposed, but then got an email (right after the one where he said he wanted the return done right) and his ex hired a CPA and that CPA is going to do both returns. Clean my hands of him.

And sent a bill for $500. whether that gets paid or not, I really don't care.

-

9

9

-

-

New client with ‘easy’ return is becoming a PITA. Been using TurboTax and hired me because this year he bought out his partner on a duplex they owned. Lived in one half, rented the other.

So I’m inputting the depreciable assets, and I notice that the rental half is $368,000 with $100,000 for land. The duplex was bought for $930,000. It seems to me he is depreciating the entire rental unit and not just his half. When I asked him about it, he said “I just followed what TurboTax told me to do”. It seems the first two years The whole property was rented. I guess TurboTax didn’t ask about taking it out of use. Or he didn’t understand what they were asking. So there’s only 6 years of over depreciation.

He’s starting to push back on correcting the depreciation. He keeps insisting his return was ‘easy’.

So do I fire him? I just sent a stern email.

-

1

1

-

-

Yes my program is up to date. I’m talking to support now.

-

Thank you Judy. I hadn’t realized there were SSNs showing. I had a bitch of a time just getting the images attached. I used print screen.

-

Rejection error R0000-004-01 ReturnTypCd (specified in the Return Header) and the return version (specified by the 'returnVersion' attribute of the 'Return' element) of the return must match the return type & version supported by the Modernized e-file system.

So I go to the Knowledge base and do what they said and it is still rejected with the same error message.

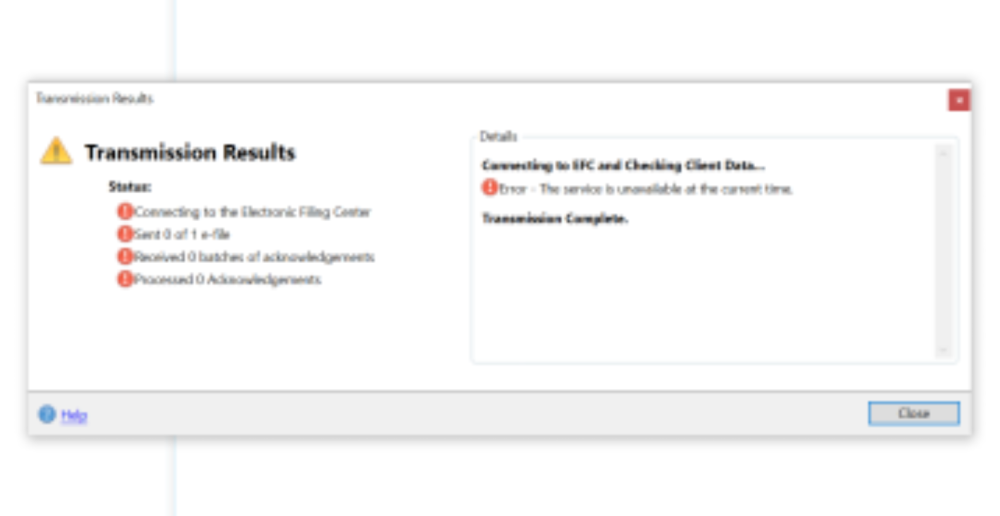

When I hit 'transmit', I get this:

If I keep hitting 'transmit' I will eventually get this:

If I keep on hitting 'transmit' I will finally get the all green and it will send. And then reject. Since I only have the one e-file, I don't know if it is something with the file or the program or both. Does anyone have any ideas?

-

It has something to do with schema. I’m getting very frustrated. So far haven’t gotten any files accepted.

-

I’ve never had the issues I’m having now with efiling. The first one I’ve had that’s ready to file has been rejected several times. I looked up the reject code, did what they said and it still rejected.

-

Went to get the acks for the federal filings and it wouldn’t hook up at first. Hit get acks immediately after and got the half green message. Hit it again and got acks.

-

Well as I was waiting for a chat representative to come on, I hit update for my program on 2022 and 2022 payroll. Both updated. So I tried to send the efiles again. Got a totally red can't do it at this time message and then tried again and the efiles went. How weird is that? And they said they had no problems at their end.

-

2

2

-

-

I took the credit in the year installed even though the electric company didn't hook it up until January.

-

3

3

-

-

How do I check that then?

-

I efiled fine until efiling closed. Haven't gotten anything new on the computer.

-

I'm trying to efile a 2021 return. I hit the efile federal button and get ! in all the Transmission results. In the details there is a green 'System Status: connected to the Electronic Filing Center successfully.' and 'Client Status: Customer info verified successfully'.

Then 'Transmission Complete'.

WTF? No transmission of the efile.

-

Happy New Year to everyone! May it be prosperous & healthy.

-

7

7

-

2

2

-

-

So I just finished the self study course. Got 78.57% so I passed. Nothing like doing it at the last minute!

-

7

7

-

1

1

-

-

Nevada has a rolling 2 year calendar year certification. I actually noticed it 2 days ago and have been working on the course I found. But I can only do so much before my brain explodes.

-

2

2

-

-

In early November, I figured how much CPE I needed for the year. And proceeded to get that much CPE. But when renewing my license…I’m 14 hours short. Can I no longer subtract? Should I be doing taxes?

so anyways, I’m working on completing a self study course by tomorrow. I hate self study because I’m a great procrastinator. Oh well, back to the grind…

-

1

1

-

4

4

-

Happy Pi Day

in General Chat

Posted

I’m having Apple streusel. Thank you for the reminder, I may have forgotten…