Leaderboard

Popular Content

Showing content with the highest reputation on 09/20/2023 in Posts

-

2 points

-

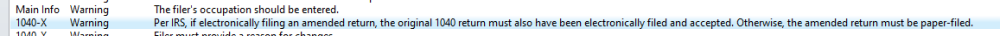

I'd call support. The only requirement should be met is by IRS, that the original was efiled. The program used to create the amendment shouldn't matter. I've done amended returns in my program for new clients, not ATX though.2 points

-

"You can't take an income tax charitable contribution deduction for an item of clothing unless it is in good used condition or better. An item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires a qualified appraisal and a completed Form 8283. See Deduction over $500 for certain clothing or household items, later."2 points

-

Another Random Thought....these fractional CFO companies may have to be included on the reports as CFO's are explicitly included in the section on persons having significant control over the company. And the "catch all" provision states that the work you do is determinative of the requirements for reporting, not the title. So a CFO cannot have their title changed to "Finance Manager" just to escape the reporting requirements. I wonder when FinCEN is going to start auditing the reports, if they ever do? Tom Longview, TX1 point

-

I agree that the plain reading of the guide seems to exclude C&Fs. It appears that the trigger for most of our clients is a formation document filed with the SOS of the state in which they are formed. Just a random thought, companies that form after 1/1/24 have to include the "applicant". Lawyers and Public Accounting Firms who set up these entities are going to have to be included on the report as the "applicant"? But Law Firms and Public Accounting Firms are exempted from the reporting requirements. I wonder how that is going to play out? Tom Longview, TX1 point

-

I downloaded the guide and it is pretty well written for a government document. Cleared a lot of my questions up. Notice that there is a "Catch All" for each class of reportable persons...very slippery when a $500 per day penalty is on the line. I sent a .pdf copy to all my clients who have LLCs, Corps & Partnerships. Told them I can't do the reporting for them but as a courtesy I was providing the guide to let them know about their requirements. Tom Longview, TX1 point

-

If FMV is over $5k, the client needs an appraisal. Is that what you meant by "approval"?1 point

-

Because they have a smart phone and they have plans for their refund1 point

-

"A “Reporting Company” is a domestic or foreign corporation, limited liability company, or similar entity that was either formed or registered to do business in any state or jurisdiction by filing a document with a secretary of state or other similar office and which does not qualify for an exemption. " (There are 23 exemptions) Depending on how this is interpreted, it could include any entity with an "Assumed Business Name" registration with any state. Including Schedule C, E and F without ABNs appears somewhat unlikely. "We will see what happens"1 point

-

He will definitely have basis of: original cost, settlement charges at purchase or paid outside of closing that are required to be capitalized, and any subsequent improvements Then ... The way the original post was worded, it seems that this property was never "put in service" as a rental, but it must have been entered on Sch E if PALs were reported. I agree with cbslee that we need to know if it was available and advertised for rent. If never put in service, he should have made an election to capitalize "otherwise deductible" expenses of the real estate taxes, mortgage interest, and other carrying charges that could have added to basis instead of incorrectly creating a PAL. For projects under development or unproductive real estate such as this one, the election must be made annually by attaching the election statement to the tax return by its due date including extensions. In other words, IF it was never put in service as a rental and IF no 266 election was made for those years, I don't believe that there should be valid PALs available to help offset the gain, and I don't believe he would now be able to now add those expenses to basis for which no 266 elections were made.1 point

-

Thank you everyone for creating this conversation. I was unaware of the new reporting. I was chastised by a local attorney for helping a client create a Corp a long time ago. So I leave that alone. But I did do the paperwork to create my husband's corporation several years ago. So I will have to keep up with this reporting requirement.1 point

-

I'm reviving this to say that I'm relieved not to have this responsibility or risk except for my own corporation. I'll still have to deal with the government portal, but only for myself and that's it. I spoke with an attorney from the firm that handles my remaining corps and LLCs that will be handling this reporting. He said it's all up in the air and sure to be a nightmare when people question the need, fail to respond, or notify them with changes. They're not sure what the charge will be but sure it will not be inexpensive.1 point

-

I once watched a squirrel burying nuts in my front garden. (Why not? Nice soft soil, no hard digging.) A chipmunk was hiding under a hydrangea in the other front garden. Every time the squirrel left to go get another nut, the chipmunk dashed across the walk and unburied the last nut, took it home, then returned to its hiding place.1 point

-

I can only speak about my state's requirements for formation, and corporations and LLCs incorporated here in DE must designate a registered agent, either themselves or hire an attorney or other agency that represents/handles the legal matters on behalf of these entities. These attorneys or agencies file the annual franchise tax with the state SOS here that keeps the companies in good standing and this new FinCen reporting seems to be similar to me and should be handled by either these corporate clients or their registered agents, not by me. I'm with Catherine, and I've submitted 8938s for several years for exactly one client in my entire career. He also needed FBAR filings that he did himself as I wasn't going to be responsible for that or having to sign up for yet another government agency's filing access for only one client. He moved recently and changed to a more local preparer, so I no longer have that worry anyway. There are the separate agencies that we deal with such as the SSA for filing W-2s that are still tax forms, or some of us utilizing the directly filing of 1099s through the IRS FIRE system, but those are all tax prep-related forms being filed. As I stated above, I think this is beyond the scope of tax preparation, and this is one more reason that I'm closer to the end of my career than the beginning of it.1 point

-

I agree about forming companies with the SOS. Not for me to do. I just ask for the proof of filing, articles, EIN, etc. However, since this is an IRS reporting requirement, and we do IRS STUFF with our clients, I think they are going to want us to do the reporting for them, very much like our clients wanted us to do the FINCEN reporting. Where do we draw the line in what we do for our clients? Tom Longview, TX1 point

-

Thanks @Lion EA. I can now see why this is being put into effect and that this may be put on tax preparers to file these reports. Not to derail this topic, but I will say though that as tax preparers, we should not be "forming companies with the Sec of State for [your] clients" as you said. At least in my state, that would be considered practicing law and also most likely would not be covered under tax preparers' typical malpractice policies. If anyone here is doing this, you may want to check with your insurance carrier about your current risk exposure.1 point