-

Posts

7,723 -

Joined

-

Last visited

-

Days Won

509

Posts posted by Catherine

-

-

I would also be lost without this board. Thank you to Eric for keeping us going, & to Judy for moderating.

You can make your donation automatic - annual, quarterly, monthly. Check the Donate link!

-

5

5

-

-

I've got personal stuff on QB 2021 on a W10 machine. If it won't work on W11, then that machine will get kept on W10 and I just won't use it online.

-

3

3

-

-

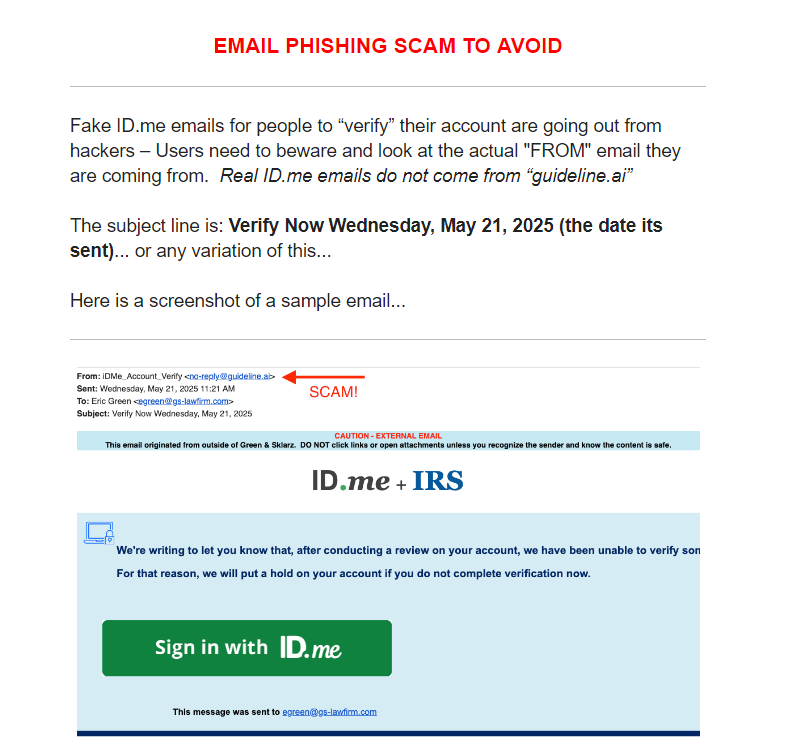

I have not seen it, but then again I've been away for a bit and have not opened my work email except on my phone just to dump spam. Anything that looked real has been ignored. I really oughtta go look at the real stuff, I guess. Got all the mail opened & dealt with, so I'm running out of good excuses.

-

2

2

-

-

-

TexTaxToo is correct, and you are correct, Corduroy Frog.

You do have until the later date. But Drake won't allow scheduling payment after the *current* date if that date is after 4/15. The only way to pay later, electronically, is by doing so online via Direct Pay or EFTPS. Or, your client can mail a check to arrive by the date they want to pay. The IRS is very quick about cashing checks; it's about the only thing left that they handle expeditiously.

-

2

2

-

-

On 6/2/2025 at 12:24 PM, mcb39 said:

I love the "red flag" quote.

On that theme, a favorite of mine is

"THE IRS" without the space, is "THEIRS" and that's how they see it!

-

4

4

-

1

1

-

-

3 hours ago, Lee B said:

How can you tell if the QR code you are using is legitimate or a scam?

GOOD question and one reason I detest those %^&Y* things.

-

5

5

-

-

3 hours ago, JohnH said:

That’s clearly the work of the devil.

But not the Mark of the Beast, as that is both voluntary and includes some level of worship.

-

There is a particular schedule they want ES payments made, with specific percentages by Date X. Miss that, and there are underpayment penalties. For one year, you could protest based on unequal income (large distributions in December due to investments), but after a year or two, they will expect the taxpayer to expect those distributions. You could try the 2210 with unequal income distribution. I've used that a time or two for clients and gotten penalties waived. But it's not guaranteed.

As for getting a refund, that's only dependent on the total paid. Think of it this way: client's total tax is $9,000, and as self-employed they make zero ES payments until January, at which time they pay in $10,000. They'll get a refund on tax, yes, but they will also have penalties for not having paid in anything the previous April, June, and September.

-

5

5

-

-

2 minutes ago, Abby Normal said:

And the state gain or loss is almost always different, so you'll need an adjustment on the state return, if there's a state income tax.

Yes, there is usually a separate chart of state adjustments (since these are sold all over). Forgot about that; thanks, @Abby Normal. Lucky me, as I haven't seen one of these in a while. I think everyone they got foisted off onto... umm, I mean sold to, yeah, sold to... either dumped them or was elderly and has passed on. I also pointed out how much more the tax prep bill was and compared that to the distributions they got (usually not particularly favorable). Not investment advice! Just cash flow analysis.

-

4

4

-

-

If the contribution can't be recharacterized to the next year (or even the year after), then he needs to withdraw it. Pronto.

Save for retirement. Don't save for your retirement if you make more than X. Save it this way. Make and honest mistake and we'll punish you while being cagey about how to fix the problem. You put your right foot in, you take your right foot out, you put your right foot in, and you shake it all about.

-

On 5/31/2025 at 10:25 PM, JohnH said:

By far my favorite satire site is The Babylon Bee.

For the most part, the articles there are superfluous; most of the giggles come from the headline. Love the barcode idea! (Wasn't it Heinlein who claimed that an "honest" politician is one who stays bought by the initial buyer?)

-

2

2

-

-

On 6/1/2025 at 9:18 AM, BulldogTom said:

"Everything is bigger in TEXAS!"

Except Alaska.

My contribution to the discussion here is in the sig area.

-

1

1

-

-

13 hours ago, Corduroy Frog said:

This is a PTP.

Upon sale, the partnership *usually* provides a worksheet for reporting the sale. This is separate from the K-1 (although sometimes appended) and also separate from any brokerage Schedule D-style reporting. In the worksheet, information is provided for determining LTCG, Ordinary Income, Form 4797 sale of business property items, and more. Look for that.

-

6

6

-

-

If we were going to commission a special, tax-accountant's version of the Magic 8-Ball, what should be the "answers" on the ball?

- It depends

- $500

- Answer hazy; Congress is in session

Suggestions for others? Let's have some fun with this; be outrageous!

-

4

4

-

3

3

-

Of course I can't find it now, but wasn't there an admission that the IRS computers are sending out erroneous balance due notices?

-

1

1

-

-

@mcb39 "I just got a letter saying that I owe them the amount that I had direct withdrawn the day that I filed."

The payment coupon that came with the letter you got. If it says you owe money, it should include a way to pay that - including a coupon to send in with a check. Or at least a "mail payment to" address.

Use that.

-

14 hours ago, mcb39 said:

Plus Penalty and Interest, no less

Mail a copy of the proof of payment to the address on the payment coupon sent (along with that payment coupon). Add in a note about expecting the penalties & interest to be reversed since they have had payment since the due date. Highlight the date of payment on that copy of the payment receipt.

Eventually, they'll catch up to it and fix it.

-

1

1

-

-

If you are not licensed, you cannot legally give investment advice. Series 6, 66, 63, and 7 licensures (or some combination of those).

However, as Judy says, the tax benefits (or detriments) of IRAs or other investments is something we can - and should discuss. Start out with "not investment advice; tax consequences only) and reiterate that at the end, too. Along with "talk to your investment advisor." Also remind the client that any tax advice from the investment advisor is suspect.

I do wish we could get the licenses of investment "advisors" who give tax advice yoinked the way ours can be for investment advice. I've heard - heck, we've all heard - preposterous and expensive and generally horrible "advice" our clients blithely followed from their "stock guy" that blew up in their faces come tax time. And far too often, we've been hit with the blame and/or the anger.

-

7

7

-

-

20 hours ago, JohnH said:

formaldehyde, benzene and toluene

Ahh, the good old scent of nasty volatile organics. We refer to them here collectively as "methyl ethyl death."

-

4

4

-

3

3

-

-

3 hours ago, mcb39 said:

Funny thing is that I still have a desktop calculator and do still have check tapes attached to the office copy on occasion (just in case). BTW, is my nearly perfect new electric Smith-Corona, slightly dusty, now considered an antique?

I still have two paper tape calculators, and paper, and save the check tapes in the client folder (don't save paper returns anymore).

Yes, your SC electric is now an antique. As are we all!

Anyone remember income averaging? Some good circular loops in those calculations.

-

3

3

-

1

1

-

-

3 hours ago, jklcpa said:

Yes, it did. Now it goes to the Senate.

After passing in the Senate, it then has to be signed into law. After that it can take effect.

-

-

Standard response to client inquiries: there is no sense in discussing anything until a bill has been passed and signed. Until then, all bets are off.

-

4

4

-

Windows 11 and older QuickBooks

in General Chat

Posted

But who knows - I may take this as impetus to update my probably 10 year old W10 laptop with the flaky "n" key and nearly-unusable space key! Hey, it works fine on vacation with the plug-in keyboard...