All Activity

- Past hour

-

Pat Dimmitt over at the NAEA site in February commented that the rules remain in proposed form and therefore sticks with a previous opinion:

-

Or, your client's Congressperson.

-

Working on an extension for a young couple, both self employed. I asked if they had health insurance and he said they were part of a Health Sharing Ministry. I did some research and appeared to get conflicting answers as to whether they could take this as the Self Employed Health Insurance deduction. I know it is not technically insurance although it did qualify as an alternative to Obamacare but saw various opinions and code section references on both sides of either yes of no on the deduction. One post I saw mentioned a proposed regulation which would definitely allow this but not sue it it ever became law. Any help would be appreciated. Thank you

-

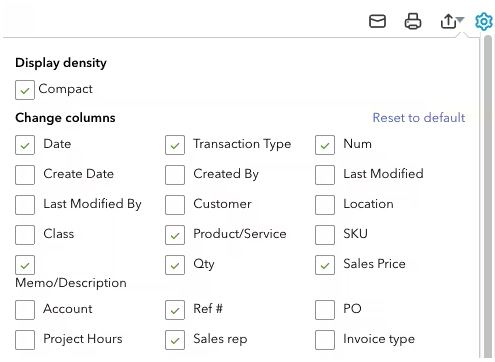

It appears that is only available on some reports, not all. This article lists the applicable ones: https://quickbooks.intuit.com/learn-support/en-us/help-article/report-management/use-custom-fields-reports-quickbooks-online/L9kOaeiC2_US_en_US#:~:text=Add custom fields as columns to a report&text=Select the gear icon at,right side of the report.

-

Perhaps you should try the Taxpayer Advocate Service https://www.irs.gov/advocate/the-taxpayer-advocate-service-is-your-voice-at-the-irs

-

That is not it. On every report, there is a gear icon on the report itself that allows you to customize the report. It is how you can add columns (in my case, a customized field that I created) that are not included in the standard report. That gear icon does not have the tools showing anymore. Just the display density This is what I see.... This is what I should see..... Tom Longview, TX

-

Medlin Software, Dennis started following Dependent Care Credit Question , IRS Frustration, Fraud and Alternative Software

-

I had an estate return (only filed to get refund for one of the pandemic credits) take more than two years to get processed and the funds received. There was no fraud or other issues and was timely filed. Even after about 4 years, still dealing with estate issues, such as trying to get native oil/gas dividends/settlements transferred (the folks who manage these have zero incentive to actually help).

- Today

-

I'm in the never ending merry-go-round with the IRS. Client had a fraudulant 2020 return filed mere days after she passed away. We didn't know at the time, but when we went to file the returns 2020 & 2021 rtn (yes, 2020 was late) in Sept 2022, obviously it was discovered a few months later when the refunds weren't issued. I have been through ID verification 7 times for the 2020 & 2021 returns. I finally got the 2021 refund, but 2020 (the return that actually had fraud) still, 1.5 years later is in limbo. Strangely I got another letter that they needed me to ID verify 2021 again and soon after a copy of the cleint's tax transcript for 2020 that said I requested it, but I didn't. Of course, I have called the ID verification number at least 50 times, and it says, you "due to high call volume, we cannot take your call at this time." Adding insult to injury, the main IRS reps cannot field any calls regarding the still outstanding 2020 refund until I ID verification, for the 8th time, has been completed. And the true cherry on top. They said processing after ID verification is taking upwards of 650 days!! (This is much worse than the 430 days number I got 6 months ago.) WTH. I don't even know who to go to for help. Can't the gov't be held accountable in some way for this nightmare of disorganization. It has got to be criminal the way the IRS is being managed these days.

-

None of the QB versions are great about customizing. Are you saying that if you start with one of the standard reports the customize bubble is not showing? You may need to scroll up from where the report loads to see it.

-

I can save a few hundred per year by changing charge card processors, but the work on my end would be weeks of time/$. I am facing porting code to a different compiler, and it will take a couple of years to complete, but it has to be done at some point to keep value in the company when I am gone (to something more people use, rather than a specialized compiler not many use). One should always be prepared for their tools of income to disappear at a moments notice, including a plan in place to recover. This also includes a threshold/plan/budget/timeline for changing tools.

-

Intuit's CEO has openly said that they plan to expand to take 25 % of the small business accounting/payroll/tax market. I wonder if cutting services to boost profits will help them

-

for Federal--from IRS tax topic no. 602: Facts and circumstances...

-

I cannot customize my reports anymore in QBO. I went to the little gear icon and the boxes that you need to customize the report are not there anymore. So I get on QBO chat support and after 30 minutes, the chat "expert" ended the session after only verifying my account. Who do you think has worse customer support? IRS or QBO? Any QBO experts out there who know what I am talking about and know how to fix it? Thanks Tom Longview, TX

-

Changing to Sigma Tax Pro to save $400 isn't worth it to me. I can make that up with one tax return.

-

Can be state specific. So much depends on how many hours in 24 the person is deemed to need care, and what activities are counted. If the family is not up to speed on the rules, then there is likely a state specific disability rights group of some sort which can give the family some tips, and likely you as well. I come at this as the person with the needs should have income, at least SSI, and to be able to pay for some of their care. For over and above, folks can give to an Able account, to avoid benefit issues.

-

Personally, I'm a very cheap person.

-

Taxpayer's 13 year old son has ADHD severe learning disability. He attends regular classes, but also has special classes to help with his ADHD. Anyone have experience on this? Specific qualifications and documentation? Thanks

-

I wonder if dentists and veterinarians have these kind of discussions? They don't hesitate to raise their prices--maybe they don't hear the kind of feedback we get from our clients?

-

If you are a Drake customer, can move to a reseller like that? I don't know how Drake does it but ATX flagged your EFIN and wouldn't allow it years ago. You could go from the reseller to working directly with ATX but you couldn't go the other way.

-

If price is your concern you might want to take a look at Sigma Tax Pro. They are a reseller of Drake as well as other major tax software providers. Current pricing for Drake for 2024 is $999. You may want to look at postings under the Drake Forum for more comments.

-

IMO, changing software should only be done as a necessity (i.e. the program being discontinued) unless you are prepared to put in a large amount of work. Drake just looked around and saw what others were charging for what they offered. A robust program is going to be fairly pricey but you'll need it for recreating returns and when you get into the weeds. Less expensive (like OLT) will work great for 85-90% of your clients but...the other 10-15% are probably your best paying clients. I also found when I tried them that they don't reproduce returns from other programs, just creates a basic framework with name, social, etc.

-

Amen; I hated cleaning up Turbotax returns with a passion. And I inherited one client who only wanted me to review his work in Turbotax for a nominal fee--I did it once (the 1116 was a total mess) and when he came back next year I doubled the price. Thankfully that was the last I saw of him. But funny how proud he was of his work, I think he just wanted me to congratulate him.

-

I have been with ATX MAX since its birth and will never change. That is a lot of years since 2005. It ofers everything I would ever need and then some.

-

Back in the day, I worked for an Accountant who used Turbo Tax big floppy disks. She had to pay extra for every single module. Efiling was barely heard of. We printed and printed and assembled and assembled. Once I started my own business and graduated (by force) to Sabre; I introduced her to the ATX products and she embraced the (Everything for the price of one). She happily continued with Max until she retired. We often question why people are willing to pay almost as much for Turbo Tax as we would charge them for a professional return. Sometimes we end up cleaning up the messes that they create. I have never gained a client by advertising. 276 returns for a small, in-home office isn't bad for "word of mouth" growth. Integrity and personal interest will win out every time and I sleep very well at night.

-

daiki78 joined the community

-

I have been with Drake for years and years, but a couple years ago, Phil Drake cashed in his chips and sold the business. Since then, there have been changes, most prodigious change is a whopping price increase. A recent post from another member advised simply to cover software increases with our fee structure next year, e. g. changing to an unknown product is risky. Good advice, but I am going to look around if their are other recommendations. I will need invidual returns, all entity returns, and all state returns that work. Years ago I had TaxSlayer, which had excellent, excellent customer services, but was weak on state returns once you left SCarolina and Georgia. If there is nothing better to look at, I might be best advised to take the gentleman's advise - don't risk changing and build the increase into next year's fee structure.