giogis245

Members-

Posts

79 -

Joined

-

Last visited

Profile Information

-

State

IL

Recent Profile Visitors

5,976 profile views

-

Can it be a business expense on their business return or must it go on personal? if it's on personal, can it go on adjustments to income line 17 or does it have to go on Schedule A?

-

Client bought 2 investment properties in 2022, they renovated them completely, between the 2 units they spent $50K in new furances, kitchens, floorings, lighting, paint, bathrooms in material and labor. Their contractor buys the materials and they just make a check out to the contractor for material and labor then send him a 1099. Just seems like such a big number, can they really write off all of it?

-

Client files 1040 and received a 1042-S, where do I enter?

giogis245 replied to giogis245's topic in General Chat

Thank you so much! -

She has a SSN and doesn't know why she received this, she withdrew her retirement money, payer is Empower Trust Company, withdrew $6k paid in $1,600 to federal. Where do I enter this on a 1040?

-

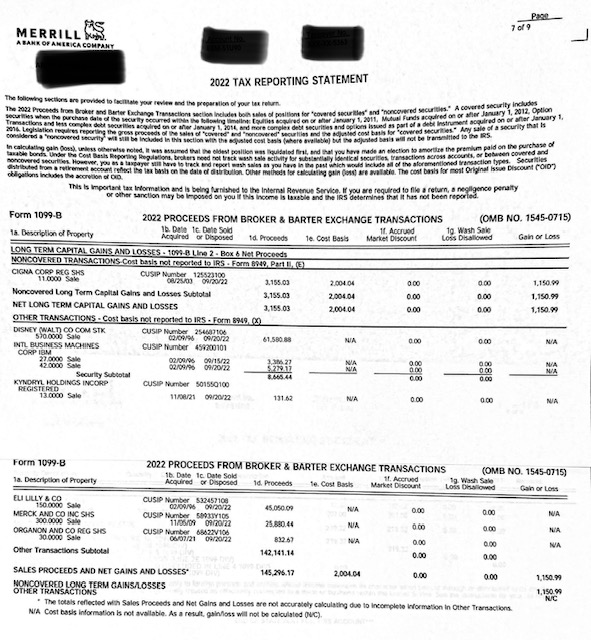

Thank you! Do I include form 8949 or nothing at all since based on this, client does not pay capital gain taxes.

-

Hello, we're on the final stretch! I have a client who came in with this form, she inherited stock from her grandpa. He passed in July of 2022, she withdrew the money in Aug 2022, her Merrill Lynch stock broker told her she would not have to pay taxes. I've never had a situation like this, so your help is greatly appreciated!

-

It's been a long week (and it's only Tuesday) and I cannot think straight. TP bought house 3/6/20 and sold it 11/15/21, do I have to report on 8949 and pay taxes on the proceeds? He bought a piece of land and thinks they can write off that purchase, which I have told them they have not as they plan to build a new house. Can you please shed some light.

-

Based on what I found, not but just want to make sure. Thank you so much for your help!

-

Client received 2 1099-A's for timeshares he had, do I enter the Balance/Fair Market Value (same amounts) as income on other income?

-

Ok looks like I have to do some reading tonight. Thanks much!

-

Basis $469,183 Cost: $505,785 Wash sale loss disallowed: $48,268 Net gain: $11,673 do these numbers make sense