Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

I appreciate the mention of succession (and I also include ending - voluntary of not, and possible sale). It is rare indeed for someone organizing or starting a business to look at the end game. Some decisions at startup can drastically alter the possible end, or at least make it costly to alter. Thus the earlier mention of completely separate entities is not to be ignored, depending on the long term plan. While some call it a game, it is a game, protect the interests. One may have employees, and suffer something costly (like UI claims or WC issues) and should be insulated from others. Not suggesting UI dumping or anything along those lines, just to be wise and think things through. There are plenty of experts in this specific topic to engage. It seems like it may be wise to avoid multiple entities which make little or no money as I suspect those may be looked at strongly going forward.

-

Agree, and make sure the person acting as the agent for the entities is a qualified attorney at an established firm. DIY is rarely a good option in these situations.

-

I have a customer claiming they entered their checks accurately but the irs is telling them they did not. Never ends, but ensures employment… I expect it is a data entry or setup issue, but I can’t be sure until I see their data. It is never productive to believe verbal information fully or to let it taint my thoughts prior to seeing the data.

-

Not a lawyer so just conjecture. Unless there are statutory damages, it would take some proof of damages to get a contingent lawyer to file.

-

From my perspective, payroll is easy compared to income tax reporting... There are some, to me, seriously broken parts of payroll, such as the increasing number of tax agencies profiting via required "retirement" or other "helpful" deductions (they contract out the back end processing and keep a cut as profit). The lack of common rules with items affecting all states, such as minimum time in local to trigger nexus. But, there are many families whose living depends on a tax agency having an office to set and monitor rules - process returns etc. - so the likelihood of a tax agency making thing easier is nil. I saw an article about a non US jurisdiction where the tax agency monitors income and adjusts withholding on the fly so there is no need for tax returns. How would that go over here, let alone across the US? I struggle with this issue whenever I think about it, as simplicity has merit, but will never happen because complication leads to jobs, and opportunity to believe one is paying less tax than required. (I often wonder if there was no opportunity to believe we beat the system, we would not care if the system was made simple.)

-

Many owners are also employees. Easy to use the ssa site to see if their personal earnings data is updated. Could be a way toonitor the data recording, or prove the data was actually recorded.

-

With phone or any other non written information, how to you handle they said/I heard issues? While we are in different industries, the issue is very relevant to both. In the current environment, many (including me) insist on having a trail for nearly everything, to reduce miscommunication, to provide backing, etc.

-

It has been a bit since I looked, but I remember finding a couple of services which handled scheduling and getting paid for phone/online/remote access support time with customers. Time is still money, offering one on one for free is costly, other than email and sms. In the case here, it is unlikely you can get paid for initial consultation, but once retained, all time should be compensated in some manner. At least for me, it has been a couple of decades since I could afford to chat on the phone, and a decade since I could take support calls on the phone without cutting into time I could have used to help others. I ponder paid support, but have so few complaints about written support, it is a non starter at present.

-

I have no insider knowledge. However, Adam bought a programming tool several years back, and as of at least mid 2022, was still occasionally participating in an online programmers forum (at least with a handle looking like his name). Unlikely this could have been done for anything other than self protection, to maintain a tool they used in house. Now, no idea after the sale/purchase, and a quick search did not find anything relevant in the programmer's forum.

-

I have no insider knowledge. What I do know is Drake bought a now dead programming tool which many used to use. IIRC, it was because they depended on it for their own software. Likely, whatever happens next (if it has not already), the odds are good they are or have been working furiously on rewriting their code to use whatever programming tools the buyer is comfortable with.

-

We keep a 40 year family number via a VOIP service. It forwards to a cell number. A few $ a month.

-

Understood. For breakage or failure, another physical phone on hand is nearly a must. One flaw with dual sim is one is usually an esim, which requires a little more (not much though) to move it to a different phone. I keep (I think) a Pixel 5 or 6 around just in case. I can use it for one line pretty easily. It is what we used for travel (to leave in the RV to keep the RV router connected) before we got starlink. I am pondering getting the i14 for the e sat function. We have a handheld sat device (text and e messages), but not having to drag it around when we are out would be nice. Would likely not trade in the i12 and keep it for the backup.

-

Uncommon sense prevails?

- 1 reply

-

- 4

-

-

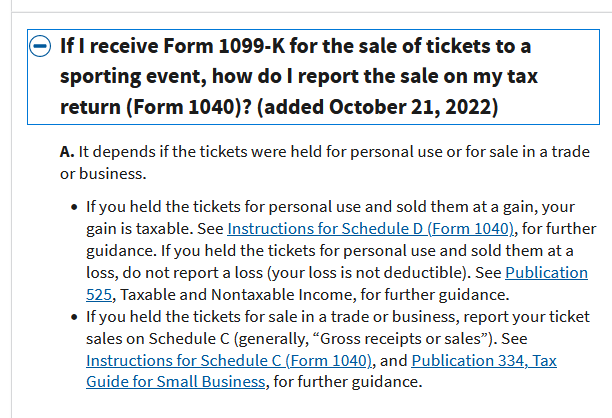

1099K from Stubhub for Selling Tickets

Medlin Software, Dennis replied to ETax847's topic in General Chat

Proof again of guaranteed lifetime employment in any accounting or tax field for anyone so inclined. Similar to the wayfair ruling, as it is a game changer. I read it as budgeting law. A way to show something is getting paid for. Like how the final Q of ERC was clawed back, after the fact, to pay for other grants, some of which were to private firms. -

I made the leap a couple of years ago... to an iphone. Apple has enough pull to stop carriers from locking functionality, like allowing dual sims. it is much easier carrying one device, with two major carrier lines, with auto switching to the strongest signal for actual connection. Now that we have starlink too, I don't carry a second phone when traveling (to leave connection in the RV to monitor dogs and temp while we visit something). When getting an iphone from a carrier, it gets unlocked within a few months. If bought directly from apple, it is unlocked right away. There are android phones which allow dual sim, but US carriers lock down the phones enough to make it nearly impossible, unless you buy a grey market phone from out of the US. Dual sim is a much more used function outside of the US, where folks get data sims separate from their phone sim.

-

I use remote access software so I can be at my computer from any device while my computer remains reasonably safe. Freedom through tech. Computer is not water resistant so phone connection makes it possible to work from hot tub. In my experience, the common flaw is not being prepared and practiced on managing loss of hardware issues (no backup and recover plan in use and tested).

-

I just got a complaint that we are masking SSN on the employee W2 forms... a financial service provider! I also got a complaint that I sent back an order, because the charge card was not a valid number. The complaint was I violated PCI. PCI only applies to valid cards and their data, and when I don't send the invalid number, inevitably I have to anyway, as the person says they entered it correctly and my system is the problem. Tech has certainly changed things. No more Abagnale skills are needed for check fraud, anyone you ever give a check to has all they need to access your account, such as printing their own checks. Actually had this discussion yesterday, as someone was trying to convince me check by phone was safer than a charge card.

-

1099K from Stubhub for Selling Tickets

Medlin Software, Dennis replied to ETax847's topic in General Chat

I think I saw a headline where there is talk of an amendment to raise the reporting limit to 10k, IIRC, it was to be stuffed into the budget bill. -

How much does it cost to have a living trust set up?

Medlin Software, Dennis replied to Pacun's topic in General Chat

From my perspective, my daily checking and savings do not need to be in the trust, since it is a relatively small amount (not even a month's expenses). The accounts will automatically transfer to the person who will be managing our estate, enough to keep things going for a couple of weeks in case other access gets held up. Same for a life policy, it is a small one, and will go directly to two desired people, outside of anything else. Our main cash holding accounts are in the trust, as is our home. We monitor to make sure anything not in the trust will be probate proof (small estate exception). A trust is not an end all/catch all, it is part of an overall plan (to me). -

1099K from Stubhub for Selling Tickets

Medlin Software, Dennis replied to ETax847's topic in General Chat

Watch/ask for any additional costs, such as bank or charge card fees between time of purchase and time of payment. Make sure the 1099 is accurate, and shows the amount actually paid out. IOW, watch for the broker fees. Candidly I bought as many tix as I could for a certain performer's LV shows. Sold all but 2 right away, at a multiple profit (which more than paid for our personal tix, flights, and hotel), but lower than what most were asking. Those we held for personal use, we let go right after the "cancellation/postponement". The entire process turned us off so much, I did not try the same for another recent performer whose online sales process failed, even though it absolutely would have been profitable, and we have a few family members who would have wanted to go... Team tix may be slightly different as many/most will have a controlled resale portal which may have been used. -

1099K from Stubhub for Selling Tickets

Medlin Software, Dennis replied to ETax847's topic in General Chat

Caught my eye. Assuming no more delays, I will soon be getting paid for selling tickets for a certain performer who is a year late in completing their residency in LV. IIRC, it has always been taxable income (if a profit is made). The lower 1099 threshold will make it profitable to the IRS since many/most? individual's sales were unlikely to have been reported. -

Us boomers have not done a great job of raising those who follow. Also, we are just getting farther and farther from the greatest generation... There is hope, like always, at least if we try to make a difference in our own circles and trust that those folks will build their own positive circle. Politics aside, folks like Mike Rowe, and creating more trades people, and showing the pride in being in the trades, may turn things around. I am a product of shop classes in MIDDLE school, and actual job training in high school. I was a paid mechanic at age 14, and GED'd out of HS to work full time at 16. I eventually taught myself computer programming so I did not have to rely on what I could produce, every hour, spinning wrenches, or how/if I could shortcut book time. (It was great when I was contracted for a specific race team though, since it was not hourly rate.) If we can make trades strong and proud again, the the white collar jobs will follow. Not everyone can work at home in their PJ's.

-

I believe it. They are backlogged, period. It was not always great pre pandemic, but pandemic will take years to get past. Personally "waiting" on a deceased filer's 2020 return to be processed... --- So many entities struggle to get caught up, and are still falling behind. Even if there were enough skilled workers who returned, there is not yet enough (maybe not for a long time) ready to step in to replace those who moved on, or to actually add to the number of folks processing/working.

-

Receiving a non needed 1099 is not a new issue. Been happening for decades. The issue remains being prepared to show why it was not taxable, or where the taxable amount was reported. Sounds like the k version of the form may be something the IRS plans on reconciling?

-

These things are a reason why I have pondered (here I believe too) why more do not ask things such as what OS is being used, what security measures are in place, etc., of those I need to trust my data to. I absolutely have customers, who prepare payroll for others, who are most definitely not keeping their OS/system up to date. Sometimes, those customers even complain that I warn about using an outdated OS. Or, like one a few minutes ago, they had a computer issue, no backups, payroll due out today, and no options other than to rebuild all data from scratch.