Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

thank you for the clarification. I get the reasons, but it is fairly unworkable, for something many access only during January. No point in having a Pwd at all for that short of a time, better to rely on some sort of other method, SMS code (with a less often expiring PWD), token, etc. Just one person's opinion, and darn glad I do not have to handle their lost/forgotten PWD requests.

-

1099K from Stubhub for Selling Tickets

Medlin Software, Dennis replied to ETax847's topic in General Chat

Succinct, sensible, and direct information from the IRS! We did well on ridding a certain performer's LV concert tix, after deciding not to wait the year for the reschedule. I am fine with paying the tax, and appreciate clear direction. Will be interesting to see 2023's direction, as we will get one more payment in a few weeks, and likely a 1099-K. -

Not sure what their current policy is, but at least for a time, it had to be changed in some frequency that those who log in only to file W2 data would have to first go through the lost password (forgotten since the prior year), and those who remembered, would have to come up with a new one every year. For me, I have a calendar reminder to log in first Tue of Dec, just to make sure I am ready for EOY.

-

Catherine. I hope I am getting better (more forceful?) at catching issues up front, such as those who expect the software to teach them accounting/payroll processing, rather than use the software as a tool. My self explanation is computers have become appliances to many, expected to do it all "for" the user. Last century, all who used computers/software were already experts, now a growing majority believe the ads stating anyone can Q by using B software. I find myself working on perfecting a stock reply, that software is a tool to help someone do something they can already do without said software. If there is no existing training/experience to rely on, then hiring out is the best bet - maybe a small local person/firm who is willing to patiently answer questions (not for free) if the person wants to learn the process. I also mention all business owners should have at least a modest idea of the process, so they can spot trends/issues, but they should defer to the people they pay for advice (and their E&O coverage!). There are endless options to gain knowledge, free and paid, in person and remote, so lack of desire to gain knowledge is a red flag.

-

Some of Mrs. Kravitz' habits have leaked in as well... Not so much being a busy body, but watching what goes on, or more specifically, having visible working cameras so the baddies move along. We get asked, from time to time, if we caught something. One of our cams records every thing entering our cul-de-sac. Helped catch someone who as checking for unlocked vehicles and homes. The person who was caught skipped by our place and vehicles, looking straight at the cameras... but did not realize how wide the field of view is. Just got four new ones today, to replace some outdated ones. They not only are clear enough to get a real face image and license plate image night or day, they are supposed to pan with the moving subject.

-

Just finances/taxation. One cannot call it sensible in any manner <smile>. If puzzling, consider refraining from offering the client any advice until it becomes more clear. With a plan, the plan manager can answer their contribution questions, and you can just do what the client wants (unless it is objectionable to you). Keeps you from being liable for giving the advice or numbers to go on.

-

As we have chatted about before, it can be freeing, and many will say necessary, to fire a few clients each year/season. In my case, I don't really have to prepare, I can just issue a refund, and send a "thank you for past usage, make sure to print needed records" type of message. Happened again today. Someone asked a relatively simple question, with the proper answer being no. The now former customer did not like the answer (the item was something it is not proper to do), so the refund was initiated. For me, most fire themselves, such as making the "threat" along the lines of do what I want or I will find other software/post negative reviews, etc. These are becoming sadly routine as attempted blackmail seems to be some sort of way people think they can get what they want. The other usual is someone asking me (interestingly, the person who wrote the software) for help, then claiming my suggestion is wrong, unable to be done, etc. Today's example was a customer who believed their "IT" person (or was just being dishonest about having an "IT" person), sent a nasty reply, then sent another rely that the software was not the issue as proved by installing in a different location (it was a firewall issue on their end, not broken software on my part). As I get ready to try to train my eventual replacement, I have been making notes of things to help them deal with customers. One of them is to never assume the customer is telling the truth. This is a huge change from 30 years ago when I started... It simply is not wise to take all information at face value. I actually often ask for "proof", such as a screen capture, and a fair amount of the time the customer was wrong, mistaken, or just untruthful. So for here, I wonder if you are ready to fire at all times, meaning ready to give working papers or copies on short notice, and send them to the next person/firm? I ask, because I know we chatted here, years ago, about even terrible customers having money to "get" (meaning to get/earn for services), and sometimes, they have more to spend than easy customers. In my case, I have one price, so I cannot charge more for tough customers... Plus, as I get older, and relatively stable financially, I have little need to deal with certain things. (Maybe I am getting to be more Mr. Wilson than Dennis!)

-

Bingo! Given a one person entity, the odds are good there is no formal plan.

-

Document Scanning Software Recommendation

Medlin Software, Dennis replied to Chowdahead's topic in General Chat

If true (I have no idea at all) makes what some old timers told me seem real. The IRS has some, in decision power, who know they are leaving for private, and realize keeping things complicated benefits them. I am still a bit surprised the paper 1099's are now multi year, but it may have been done in tie in with the supposed upcoming easy efile portal, despite what forms suppliers and paid portals likely lobbied against. -

YES. There are many who say/claim/have proof the IRS accepts self printed copy A, the "specifications" do not permit it, and thus, the IRS can elect to charge a fairly hefty fine per form (not page, but for each item reported). This is different than the SSA, which embraced self printed Copy A forms starting with TY 2021. If the PR is correct, and the IRS does come up with an easier/free efile for 1099's, I suspect I (in my software) will not even try to fill in the red dropout ink 1099 forms any longer, even though it appears the IRS has settled on non year specific forms...

-

An S Corp shareholder/employee IS considered an employee and a self employed person, depending on who is asking... I am no expert on this, but taking the OP at face, if the amount beyond the allowed amount is given, it would itself become taxable wages.

-

Opinion only. They expect employers to be timely, not wait until day of filing to sign in, or to realize they don't have a current password. Security, email is not secure. We are talking about what would be thousands of pieces of PID, so they have to take all reasonable steps to keep it secure, including not sending a password via email. Mail, mail is no longer a few day affair, not even across town using the same local distribution center.

-

I had no trouble just before EOY. I have not heard any complaints from my customers, other than those who wonder why they have to sign up with SSA (such as ask me what an SSA ID is). If you do mail, I always suggest using something which offers proof of delivery. Personally, I would mail, first class, but I need to do what my customers might do, so I efile. Mailing is less time consuming (I know many will argue, but print, stuff, and mail takes what, a few minutes, versus sign up, login, password reset, etc.), so less costly, assuming you keep copies, have proof of delivery, and monitor for receipt (as mentioned in a different thread).

-

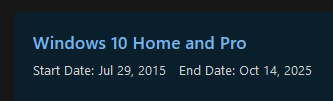

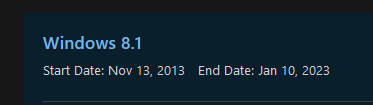

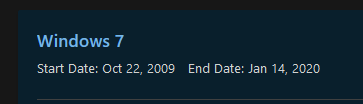

Microsoft is very transparent about their end of support dates. Any search engine will return a list. Most use such a list not so much for planning, but to see how far behind they are <smile>.

-

For the hold outs, the last time I checked, Microsoft will support Windows 10 until (at least) October of 2025. If getting a new box, there is zero reason to get anything other than a current OS. If software does not run on the current OS, it is time to get new/different software! It has been many years since MS released a new OS which was not reasonably backwards compatible. Yes, there is still a command prompt, and things like CD and MKDIR still work. What you might run into, is a program (programmers) who use undocumented API's, or elect to use some function or feature which is known to be deprecated, and tell their customers not to use a NEW OS because of "compatibility" (rather than a decision they made) issues. Or, a software dev may say something like "hold on", we have not done any testing with the new OS (even through devs have access early on to relatively close to release versions of the new OS). Just free thoughts, from a long time developer, worth what you paid for them. (I do not miss trying to stuff data into 300-400k of available memory, or having to come up with special code to hook keys into to do what they should have done within the OS.)

-

Document Scanning Software Recommendation

Medlin Software, Dennis replied to Chowdahead's topic in General Chat

Filing cabinets and first line enforcers... That is the "rub" of my part of this thread, many are doing things which put them, and the clients, at risk, via the e records rules. I have some awful first hand experience in this area, as I have shared before. Person had my software on their computer. (Convicted tax fraudster, preparing returns for others and taking fake refunds for them.) Feds searched/inspected the computers, found my software, and asked what part I had in the situation. The convicted party, while they could, made death threats against me and mine if I even spoke to the officials investigating. I think I already asked here, and most clients do not ask things about how secure their data is kept (IIRC, it was a topic which should now be for anyone not using at least Windows 10). I ask those questions (now). -

Document Scanning Software Recommendation

Medlin Software, Dennis replied to Chowdahead's topic in General Chat

Does WISP supersede 97-22 (and the like)? The ones where e record POTENTIAL or actual loss requires notification to the IRS? (Potential is the issue as it can easily be argued a computer change means there is potential for data loss, so a letter to the IRS is mandated. Same for a power outage. This is, unless the holder checks all required data, one by one, after a computer move or power loss.) How about the requirement to agree to "inspection" at any time? (The one no one should ever agree to IMO!) That is what I am always hoping to hear, that 97-22 (etc.) has been updated/replaced by something less onerous. My suspicion is there is no reason for the IRS to make the rule less impactful, so they haven't. -- While maybe not for tax data, there are localities (Local PTB) who have delved into data retention, such as requiring data to be kept under the liable person's control, and IIRC, WITHIN their jurisdiction (no commercial online backup likely would meet this). -

Converting a disregarded LLC to an S corp

Medlin Software, Dennis replied to michaelmars's topic in General Chat

I self handled creating a corp (mostly) in my naive 20's. I would never do so again, since I am not a lawyer (or more specifically, do not have insurance to cover those types of attempts). Just one person';s experience... -

Document Scanning Software Recommendation

Medlin Software, Dennis replied to Chowdahead's topic in General Chat

Lion. Thank you for the above. It appears nothing has changed since I dug into it heavily a decade or two ago. If the references, like the one above, included all of the relevant information (I shared above), I doubt anyone would stop keeping paper. I did not (then) find any issues where something like a fire, theft, or accidental loss required anything of the keeper of paper records as far as proactive notification of loss. I say all of this as I am on the lookout for a good looking enough (SWMBO vetoed metal) tall 4 drawer file cabinet for my office/grandaughter room... 4 years is my data cycle. Current is in a drawer next to me, the 4 prior are in the dedicated cabinet. The drawers get labeled for shred date, then the empty one is used for the data no longer current. -

Document Scanning Software Recommendation

Medlin Software, Dennis replied to Chowdahead's topic in General Chat

One part is from '97. What gets me is how anyone would agree to this, because of the requirement to proactively notify if there is any chance data is not available (such as even a computer change, or upgrading software - and not taking the item to recreate every required item), and the essentially giving rights to a search at any time for ANY reason (what those on parole must give up!) . Imagine one of these (random, or not so random) searches during your busy time and your computer(s) are either occupied, or more likely, taken away for search. I know, they state is is not a "search", but items found during any allowed examination are not likely to be prohibited from being evidence. Imagine having to explain that to your clients, E&O provider, your BOP provider, and your debtors. Personally, I don't consider PDF's to be a specific issue, unless the PDF readers ever abandon an old format. But, I have multiple local backups and multiple secure online backups, so anything where I could not get to something would have far worse consequences than a data review. But, the eltter of the rulings, even PDF's are considered e records, so the onerous allowance of not keeping paper records still applies. Paper - while I have not ruin across it, if there is no corresponding rule for paper, then paper remains king. A file cabinet or drawer by year, labeled with the first allowable shred date remains a safe way to comply, and to not retain any data which (being not required) could be used against you/client). I guess for me, a "sum it up" for the original topic, I would not be comfortable using some sort of data retention service UNLESS they warranted they meet the IRS data retention rules. -

Document Scanning Software Recommendation

Medlin Software, Dennis replied to Chowdahead's topic in General Chat

I am sure I have brought this up before, but how do you comply with https://www.irs.gov/businesses/automated-records, or if you are not subject, what allows you to go paperless and still maintain compliance? I have NOT reread all the rules, but the last time I did, I could not find a way any reasonable person would elect to have only e records. I know, the odds of a review are slim, but I suspect those with certification, degrees, or other things causing them to have to meet extra standards, could be in a bad position if they knowing or unknowingly are not meeting the e records rules (such as no E&O to cover the expense of lost data). --- (1) The District Director may conduct a records evaluation at any time the District Director deems it appropriate to review the taxpayer's record retention practices, including the taxpayer's relevant data processing and accounting systems. 1) The District Director may periodically initiate tests to establish the authenticity, readability, completeness, and integrity of a taxpayer's machine-sensible records retained in conformity with this revenue procedure. -

To maybe add some prevention, there is merit to using a PMB service for all important mail. For PMB services, many will have scanning ability, and all will have forwarding ability (sometimes only forwarding what you select via their images). For USPS, their informed delivery ability is pretty good for letters, postcards, and packages, to be able to see what is on the way. The flaw is things like a 9x12 don't create an image, just a notice that "something" is being delivered. Similar for important email messages. Use an email service which offers NO filtering before delivery (which is not going to be any of the free services!) You can then manually, over time, select addresses, subjects, whatever, to be put in spam on your local machine(s). That is the ONLY way to be sure to get all important messages.

-

Well written. All the group can do is offer advice and experience, and the reader gets to ignore if they elect to. I do this daily with my customers. I stick my advice to areas which fall within the scope of what they pay me for, but I will often, with disclaimer, add stuff from the college of hard earned experience. The former, I expect then to heed, since they are paying for the reply, the latter, it is up to them to do what they wish with the information from my experiences. With the OP's handle including the word "tax" and not including JD, Esq, or anything similar, it would be tough to believe the OP should not be farming out whatever the client has asked which prompted the post. I presume there are professional referral options available everywhere, some which may even come with a referral fee?

-

Sorry, missed this earlier. Unless there is a wonderfully in place and funded self retirement plan, I am personally not fond of not paying into SS. It does require belief the government will never let SS wither, which is not a crazy belief. Examples. Disabled child/adult child able to get SSDI from SSA retired parent earnings. Non working spouse benefits. Survivor benefits. etc. Let alone the worker's personal benes. Could be, like we elected years ago, that one gets a W2 and earns as close as possible to the SS limit (or enough so the SS calculator shows the desired benefit level when planning to take SS retirement). In the case of wanting to leave the best for the non working spouse, and any now or potential before age 18 disabled children, maxing out SS earnings could be a long term win (among other possible wins). So much to consider, likely way more than a tax/payroll pro should even consider delving into. Makes the case of having some sort of overall advisor, with specialists available (a bigger accounting/attorney/estate/succession firm).

-

Pay for the expertise, but try to understand what you are signing too. Said as I had to get to page 73 of my BOP document (past exclusions for E&O) to get to the E&O rider! When I first reread the policy documents, I reached out to the agent because the disclaimer was, 70 pages before the rider.