-

Posts

7,718 -

Joined

-

Last visited

-

Days Won

509

Everything posted by Catherine

-

TexTaxToo is correct, and you are correct, Corduroy Frog. You do have until the later date. But Drake won't allow scheduling payment after the *current* date if that date is after 4/15. The only way to pay later, electronically, is by doing so online via Direct Pay or EFTPS. Or, your client can mail a check to arrive by the date they want to pay. The IRS is very quick about cashing checks; it's about the only thing left that they handle expeditiously.

-

On that theme, a favorite of mine is "THE IRS" without the space, is "THEIRS" and that's how they see it!

-

GOOD question and one reason I detest those %^&Y* things.

-

But not the Mark of the Beast, as that is both voluntary and includes some level of worship.

-

There is a particular schedule they want ES payments made, with specific percentages by Date X. Miss that, and there are underpayment penalties. For one year, you could protest based on unequal income (large distributions in December due to investments), but after a year or two, they will expect the taxpayer to expect those distributions. You could try the 2210 with unequal income distribution. I've used that a time or two for clients and gotten penalties waived. But it's not guaranteed. As for getting a refund, that's only dependent on the total paid. Think of it this way: client's total tax is $9,000, and as self-employed they make zero ES payments until January, at which time they pay in $10,000. They'll get a refund on tax, yes, but they will also have penalties for not having paid in anything the previous April, June, and September.

-

Yes, there is usually a separate chart of state adjustments (since these are sold all over). Forgot about that; thanks, @Abby Normal. Lucky me, as I haven't seen one of these in a while. I think everyone they got foisted off onto... umm, I mean sold to, yeah, sold to... either dumped them or was elderly and has passed on. I also pointed out how much more the tax prep bill was and compared that to the distributions they got (usually not particularly favorable). Not investment advice! Just cash flow analysis.

-

Never had penalized ira contributions before...

Catherine replied to schirallicpa's topic in General Chat

If the contribution can't be recharacterized to the next year (or even the year after), then he needs to withdraw it. Pronto. Save for retirement. Don't save for your retirement if you make more than X. Save it this way. Make and honest mistake and we'll punish you while being cagey about how to fix the problem. You put your right foot in, you take your right foot out, you put your right foot in, and you shake it all about. -

For the most part, the articles there are superfluous; most of the giggles come from the headline. Love the barcode idea! (Wasn't it Heinlein who claimed that an "honest" politician is one who stays bought by the initial buyer?)

-

Except Alaska. My contribution to the discussion here is in the sig area.

-

Upon sale, the partnership *usually* provides a worksheet for reporting the sale. This is separate from the K-1 (although sometimes appended) and also separate from any brokerage Schedule D-style reporting. In the worksheet, information is provided for determining LTCG, Ordinary Income, Form 4797 sale of business property items, and more. Look for that.

-

If we were going to commission a special, tax-accountant's version of the Magic 8-Ball, what should be the "answers" on the ball? It depends $500 Answer hazy; Congress is in session Suggestions for others? Let's have some fun with this; be outrageous!

-

Of course I can't find it now, but wasn't there an admission that the IRS computers are sending out erroneous balance due notices?

-

@mcb39 "I just got a letter saying that I owe them the amount that I had direct withdrawn the day that I filed." The payment coupon that came with the letter you got. If it says you owe money, it should include a way to pay that - including a coupon to send in with a check. Or at least a "mail payment to" address. Use that.

-

Mail a copy of the proof of payment to the address on the payment coupon sent (along with that payment coupon). Add in a note about expecting the penalties & interest to be reversed since they have had payment since the due date. Highlight the date of payment on that copy of the payment receipt. Eventually, they'll catch up to it and fix it.

-

If you are not licensed, you cannot legally give investment advice. Series 6, 66, 63, and 7 licensures (or some combination of those). However, as Judy says, the tax benefits (or detriments) of IRAs or other investments is something we can - and should discuss. Start out with "not investment advice; tax consequences only) and reiterate that at the end, too. Along with "talk to your investment advisor." Also remind the client that any tax advice from the investment advisor is suspect. I do wish we could get the licenses of investment "advisors" who give tax advice yoinked the way ours can be for investment advice. I've heard - heck, we've all heard - preposterous and expensive and generally horrible "advice" our clients blithely followed from their "stock guy" that blew up in their faces come tax time. And far too often, we've been hit with the blame and/or the anger.

-

Ahh, the good old scent of nasty volatile organics. We refer to them here collectively as "methyl ethyl death."

-

I still have two paper tape calculators, and paper, and save the check tapes in the client folder (don't save paper returns anymore). Yes, your SC electric is now an antique. As are we all! Anyone remember income averaging? Some good circular loops in those calculations.

-

After passing in the Senate, it then has to be signed into law. After that it can take effect.

-

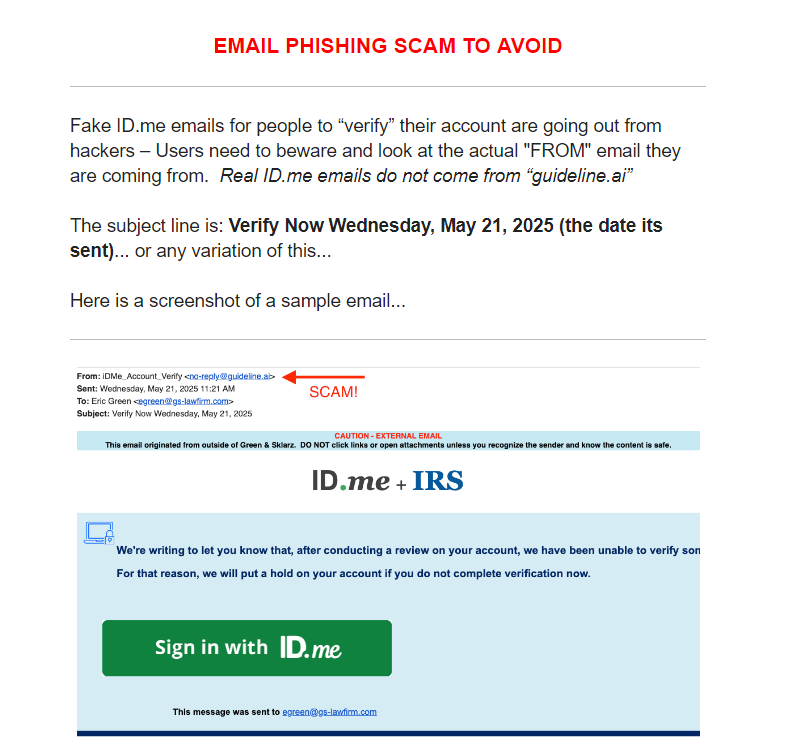

Eric Green of Tax Rep Network sent out a warning today about this. He got one yesterday, as did a local colleague. Here's what he sent out:

-

Standard response to client inquiries: there is no sense in discussing anything until a bill has been passed and signed. Until then, all bets are off.

-

I also charge $25 - $50 for dependent returns, with the option I keep for myself to give them a courtesy discount down to $5 or $10 or even $0 (say if the kid had one W-2 and $27 in withheld tax). But I want to see it before I price-quote, and anything that involves credits, kiddie tax, and multi-state issues is not done for a measley $50.

-

It looks like the "Windy" format.

-

I use an ancient version of 1Passwrod that is still 100% local (on my machine). I know others who use the cloud-based version and like it. It's very easy to use, but I wish they still offered a local-only version.

-

I had to have "the talk" with two elderly couples this year. (Well, one couple and the adult son POA for the other couple.) Huge capital losses in "investments" that are utterly inappropriate for people in their late 80s and early 90s - and no, they did not have those investments the prior year. General warning to ask LOTS of questions before buying anything, and not to accept gobbledygook as answers.

-

Rita is one of the best. Hope she comes back to post more often. That summer get-together is one of my very fond memories.