-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

I like Right Networks but yes, they are expensive. I have been thinking about Right Networks hosting Pro-Series and QB but I am pretty sure that is the $200.00 per month. I know that is the charge through Drake. This is a year of change for me and a ton to consider. I don't have time to evaluate anything yet so just asking questions for now.

-

Client had rental property that I began depreciating back in 2011. The property was rented until he got divorced in 2016 and moved into the property. Client is now remarried and began renting the same property in 2022. Numerous capital improvements. Is my thinking correct. Start the depreciation for TY 2022 using the original cost plus capital improvements, minus accumulated depreciation to arrive at the now depreciable basis. Is this correct or am I missing something? Start with 27.5 years or use the remaining years left? Thanks!

-

Well see, there you go. I don't do too many returns like this and was not aware the SD differs based on earned income. Thanks!!!

-

Has anyone been using the premiere desktop version for QB and changed to the subscription based cloud version? I'm looking at doing this very thing and want to know about the functionality of the cloud version. Intuit folks are not very helpful with this. I want to know if the cloud version will allow me as an accountant to serve multiple companies under one subscription or does each company have to have their own subscription. If the latter is true, then this need version will be awfully expensive for folks. Wondering what others are doing with this.

-

Just wondering but that sounds a bit bizarre to me. Was the program using the dependent standard deduction and then recalculated with the non-dependent standard deduction? Is this maybe what happened? I would check to see if dependency changed in the returns. Normally the excess scholarship funds to go on line 8 or 7 of the 1040. Different line for different years. Adding to or taking away from earned income shouldn't have any affect on the standard deduction or itemized deduction for that matter.

-

Sad, but you have to do what you have to do. CYA at all costs. Not sure it is needed in this case but a conflict of interest waiver comes to mind.

-

IRS Statement about State Special Tax Payments/Refunds

Terry D EA replied to Lee B's topic in General Chat

Exactly!!! -

A blurb from the IRS notice issued on Friday 2/10. I am still of the opinion the red statement is useless based on what I said above. 'In addition, many people in Georgia, Massachusetts, South Carolina and Virginia also will not include state payments in income for federal tax purposes if they meet certain requirements. For these individuals, state payments will not be included for federal tax purposes if the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit."

-

When I read the IRS ruling, GA, MA, SC and VA are not included in taxable income. The language states unless people in those states received a benefit from the rebate. How could anyone receive a benefit from something they had no previous idea they were getting? No one could report an itemized deduction in 2021 for any amount they received in 2022. For me to include in taxable income an amount as such just because the person itemized deductions is unconscionable. I agree to avoid a matching issue to enter the 1099 and then back it out. I believe ignoring it has the potential to raise some unnecessary questions.

-

I think you need to remove this post. You are displaying SS# If you can't maybe have Judy look at it to be sure. Not being picky or a pain just trying to protect you. I'm not sure if there is a name column either.

-

Just curious, and I do have a couple of state returns for more than one state coming up. Are you taking the amount of the 1099 MISC as a negative on other income on the 1040?

-

Thanks Judy, I apologize, I knew you were in Delaware but thought you filed some returns for MD. I have found that MD has not approved the forms for printing and they can still be filed electronically. Also, support stated the update should fix the wrong line entry on the form I mentioned. I can provide a digital copy but hate to give anything that is not populating correctly. Unprofessional and sloppy in my opinion.

-

I'd be careful here and don't agree with the 50/50 split. The instructions do say to NOT include any EIC on line 17 which is part of the refundable credits. The non-refundable portion of the CTC would be allocated to each spouse. Question, and not being a smart #%# here, but how do you allocate 1/2 a kid for the refundable credits on line 16? The instructions for the allocation does state you to allocate the items the same way you would a MFS return. A link to the instructions is below. I don't know if this helps you or not. Instructions for Form 8379 (Rev. November 2021) (irs.gov)

-

Working in a MD partnership return. Form MD EL101B is the electronic filing form. The form is showing the company name on the line for the fiduciary name and title. I can't see anywhere within the input screens that is causing this. Drake support said they would report it that the info isn't flowing right. Anyone else seeing this? If so, how did you fix it.

-

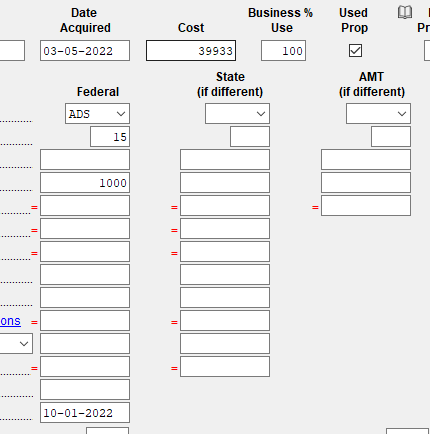

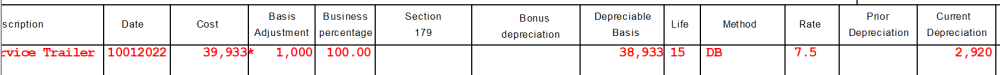

Thanks Judy, I'm right there with you on the calculation. Drake is correct, I checked the reports for future years and it matches my calcs as well. With the asset in-service date of 10/1/2022, the MQ is correct as well. Sorry for the confusion. Most of it was frustration on my part and not taking a break.

-

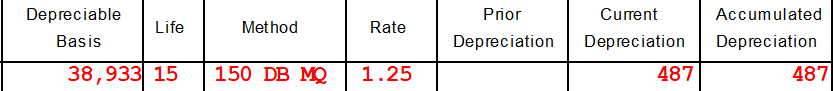

Ok I guess I need to walk away from this for a while. My math is definitely not right. First mistake, 150DB to determine the percentage the 150 is divided by the years of useful life. In my case 150/15 = 10% and not 15% 38,932.97 x .010 = 3893.30, 3893.30/12*1.5 (months) = 486.66. Using this method, everything matches. My brain hurts. Something so simple and I made a major catastrophe out of it. Too early in the season for this type of brain fart.

-

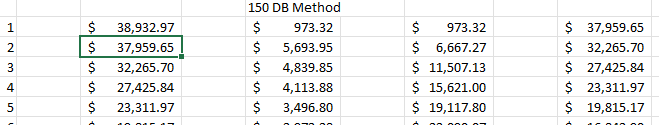

Now I'm questioning my math. Isn't this correct? 150 DB is 15% for the period. So, 38,932.32 x .15 divided by 12 times 2 = 973.32 for the first year. The following years are off as well in Drake. If I use SL, then everything matches perfectly. Sorry to e such a PITA with this.

-

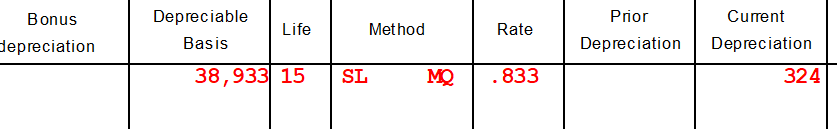

Crap. My stupid mistake, I chose the ADS instead of ALT. Now that I chose ALT, the amount of current depreciation is somewhat close to my spreadsheet but not good enough. I tried changing the date of in-service and still cannot get it right. Where is the program getting the "rate" at? Using the same data and change the in-service date to 9/1/2022, the rate changes to 5. This is driving me nuts.

-

Judy, I switched to the ADS on the input and this is what I got. I don't see why it switched to SL. I might try deleting the asset as it is the only one that I have entered so far, and do a repair index files. Based on the date in service, MQ convention is correct but not SL.

-

I'm wanting to use the 150 DB method of depreciation for an asset placed in service 10/1/2022. The snip below shows Drake current depreciation. It automatically comes up with the rate of 7.5. My calculations are: 38,933 x .15 divided by 12 x 2 equaling 973.32 for the first year. What am I doing wrong here. 150DB is 15% correct? I also noticed I cannot choose the 150DDB method in Drake either. How are you handling this?

-

Try this. Go to tools, repair index files. Be sure to click on all files. You can uncheck the test or sample returns. This tool runs very quickly and usually aligns everything back up.

-

John, By your original post and the reference Lion gave "KPMG NOTE: Beginning September 15, 2021, employees working remotely outside of Massachusetts should have wages reported and taxes withheld to the state where they are physically performing services. Employers will want to make sure they are registered for payroll in the states their employees are working remotely, and able to handle the complexity of compliance for a mobile workforce." the MA company is reporting correctly. To add another wrinkle, you stated he travels to MA for meetings. Is he performing any services while in MA? I would indeed check with the MA DOR and if a non-resident return is required, then file it with the credit to NC for taxes paid to MA. It would appear to be small amounts here.

-

Already e-filed a couple easy partnerships and individuals without any problems at all. I think everyone using Drake Accounting had the 940 issue. But, it was quickly resolved without any extra effort from me.

-

Even at 12,000.00 there had to be some SS deducted, paid somewhere. if he was self-employed, It seems like the EITC and CTC would have eliminated any SE tax. With that said, the SE tax generated is the SS portion still credited to his SS account? Never thought about this before.

-

Answering the phone quicker is a plus. Getting an Agent that knows what they're doing is another thing. I got through the other day and very quickly I could tell the agent wasn't going to be able to handle my issue. Then referred me to the phone number on the notice. This was a CP2000 they could have handled. The number on the CP2000 is far less helpful than the PPL.