-

Posts

5,207 -

Joined

-

Last visited

-

Days Won

325

Everything posted by Abby Normal

-

Promoted fraudulent tax schemes and sponsored legislation to eliminate the IRS. https://www.msn.com/en-us/news/politics/ex-congressman-billy-long-confirmed-as-commissioner-of-the-irs-an-agency-he-once-sought-to-abolish/ar-AA1GBkal

-

Why do you think you can't have multiple LLCs in one 1040. I've had two Sch C LLCs and even multiple Sch E LLCs? Is it because you're trying to use 1099 input forms? Or are you talking about some state level problem?

-

Clarification on time line to file an amended return

Abby Normal replied to GraceNY's topic in General Chat

There is no mailbox rule for amended returns. The return must be received by the IRS by 10/13/2025. Fortunately, efiling makes that easier. -

I assume they did this so they could have an EIN and not have to give out their Social Security numbers to all of these contests. In my state, you don't say how many members are in the LLC you're forming, but when they applied for the EIN, I'm guessing they did tell the IRS that they had multiple members, and the EIN letter says the IRS is expecting a 1065. Cheapest solution is to dissolve the LLC, form a new LLC and get a new EIN for a SMLLC that will be disregarded for tax purposes.

-

You can't which is why it's advised to never scan one out in public.

-

When these K1s are sold, either partially or completely, the broker will normally show the initial investment cost, but the K1 will have attachments showing both a basis adjustment and an ordinary income component of the gain or loss. The basis adjustment increases the gain and the ordinary income component will decrease the gain on the Sch D and also be reported on the 4797 (as Catherine already noted). On 8949, you will use adjustment codes BO to net the two adjustments so the Sch D gain is correct. You can do this even if you're reporting totals from the 1099-B. And the state gain or loss is almost always different, so you'll need an adjustment on the state return, if there's a state income tax. When I see these investments by a client, I always warn them that their tax prep bill will be higher every year that they own them and a lot higher when the sell them.

-

If this is a PTP (Publicly Traded Partnership), you don't need to track basis. But if this a regular limited partnership, yes, basis is increased by taxable and nontaxable income and decreased by deductible and nondeductible expenses/losses. So basically everything in and out. If you didn't allocate basis to passive losses, there'd be no basis for deducting those losses later.

-

How much is reasonable? What do most people take?

-

Someone calculated that only 15% of the Social Security collect is the dollars that you paid in, with another 15% from your employers and the rest is earnings. Hopefully they adjusted for inflation, but that's how we got to 85% taxable. And the tax on Social Security helps keep the fund solvent, which means that the IRS must forward the tax paid on Social Security to the Social Security fund.

-

Crypto is a pyramid scam that will come crashing down someday, and it's also very bad for the environment because of the huge amount of electricity it consumes. When summers get really hot and you have to cut back on cooling or even have a blackout, remember the strain that crypto puts on our electric grids. And IRAs only earn pennies in interest if you have them in cash investments. Although these days, interest rates are providing better returns on safe investments. I have some CDs in my IRAs, but stocks should eventually give better returns.

-

This bill is an abomination and needs to die in the Senate.

-

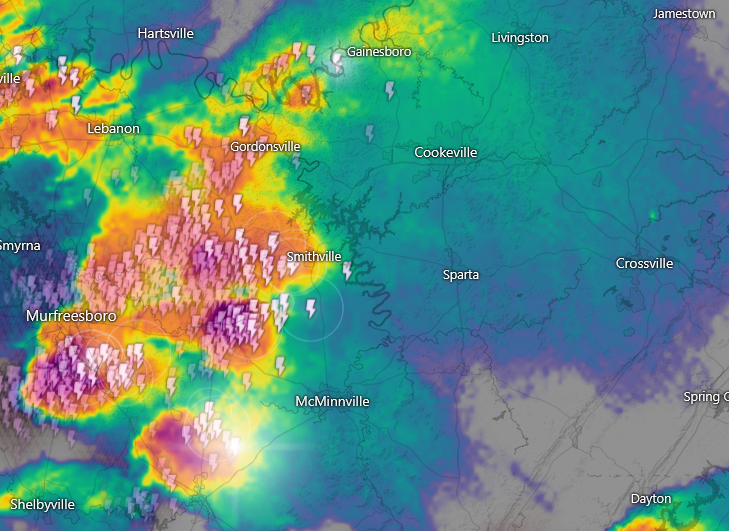

Correct! I have 4 weather apps on my phone: Windy One Weather Google Weather Weather Wise I use mostly the Windy site on the computer. Also fond of https://www.lightningmaps.org You can add weather radar to lightning maps, too. It's a setting.

-

-

You just hang onto the letter and wait for the dust to settle. If they send a 2nd letter, then mail them proof of payment.

-

Yeah, you need last year's server running. You probably haven't lost anything, ATX just can't find it.

-

I started using Bitwarden, because it was so highly recommended. It's ok but I prefer the one built into Firefox.

-

'Keep me authenticated' check box added to ATX Tax!

Abby Normal replied to Abby Normal's topic in General Chat

I heard that it would only be for 3 months, but as long as we can check the box for another 3 months, it's all good. -

I had one client who had 30k in phantom income when she sold these because a large portion was currently taxable ordinary income, and the big capital losses had to be carried forward because she already had plenty of capital loss carryforwards.

-

I think the only factor that matters is the big commission stream earned by the broker. They have a huge conflict of interest. I explain to my clients that these partnerships were created because borrowing money from the banks is expensive and the operators didn't want to risk their own money, so they went public to get unsuspecting investors to buy in, and they pay brokers big fees to foist these investments on you.

-

I'll never forget the look on my clients' faces when they bought 10 of these K1 investments, and I told them each K1 adds $75 to their tax prep bill, every year, and $150 when the each K1 is sold, so I hope they make a lot of money on these. They went back and told their broker who then called me. Of course these are prices from about 10 years ago.

-

Is your computer on a battery backup surge suppressor?

- 1 reply

-

- 2

-

-

A K1 inside a retirement account is not entered. And you have to be careful with K1 investments inside retirement accounts because they can result in taxable income, although it's rare.

-

I had a form of Sciatica called Piriformis Syndrome, but I was able to cure it with both massages and some exercises I found on YouTube.