-

Posts

5,223 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

It's always a good idea to have your computer running with as few other things in the background as possible. Programmers love to start crap you don't need running in the background. It's a constant struggle. This is the main reason I don't buy brand name computers. I still use the old StartupMonitor program to alert me anytime some software wants to add an automatically started program, but you can also go into Services and look at the update programs and other things you don't need or want running 24/7.

-

Wierd - 1041 payment voucher not printing to PDF?

Abby Normal replied to BulldogTom's topic in General Chat

I learned last year that if you do a print preview and print from the preview, it fixes the problem with 1120S & 1065 basis worksheets not printing. I'd try that first, whenever you have a printing issue. -

I prefer it all in one place, and I don't want to risk making a data entry error. Also, it's a lot more work to have a separate, non-integrated fixed assets system.

-

The 600/300 rule is just for not including the 1116. You still have to prepare the 1116 to do the calculations, then check a box to say you're just using the 1116 for the calculations.

-

ATX largely automates the 1116. If the taxes are on long-term capital gains, there are entries you need to make on a worksheet, but if it's just dividends, then ATX should get it right.

-

They weren't disposed of. He still owns them. Nothing until a final disposition happens. You can use the ATX disposition code, 'removed for personal use,' to get the 2022 depreciation correct, BUT that will remove the asset from the fixed assets system and you'll lose track of the assets and the accumulated depreciation. What I like to do is, use that code 'removed for personal use' and note the depreciation amount. Then clear out the disposition tab, override the current depreciation, and leave myself a note for next year to set the business use % to zero, by entering 0.001 in the business use percentage screen. I do this because I want to keep the assets in the tax software. It's way too easy to forget about that old depreciation many years down the road. If only ATX had a 'removed from service' date field so this could be more easily handled.

-

Decedent SS# on Trust transaction - how to report

Abby Normal replied to BulldogTom's topic in General Chat

You don't have to, but you are supposed to. Over the years I've nomineed plenty of things off of one return onto another return and never had a problem. I think this is because the IRS matched the one 1099 they had, and the IRS won't normally question income on your return, for which they don't have a 1099. -

So , Wells Fargo is correct and the IRS will not be expecting a 1099R. Good. One less form for them to deal with.

-

Update: All of the members of the LLC refuse to sign the amended 1065, but this is putting a strain on relationships with the widow (who married into the family, later in life). Fortunately, most of the estate is settled, except for a stein collection, that supposedly contains some valuable items, but no one really knows the best way to sell or split them.

-

Widow in my extended family, received IRS matching notice on a 1040 for a K1 supposedly showing 9,020 of dividends. The original 1065 (family LLC) was paper prepared and filed, with cents (?! ) on the amounts. The K1 showed 90.20 of dividends, but was apparently keypunched as 9,020 to the member's 1040 account. No other members have received matching notices. CPA advised widow to file an amended 1065, even though the original 1065 was correct. And the bill to date is about $500 for just talking about this. Who knows how much the unnecessary 1065 would cost. And at this point, it's getting close to being more expensive to pay this CPA, than to pay the IRS. I advised to send a copy of the K1 showing the 90.20 in response to the IRS notice, explaining that it was entered wrong by the IRS. All of this could have been avoided by efiling that 1065.

-

Meh. No 1099R, no IRS matching notices. I would never have called.

-

IRS Statement about State Special Tax Payments/Refunds

Abby Normal replied to Lee B's topic in General Chat

Both SNAP and TANF are nontaxable. Perhaps they used that exception. -

Do they have other money he could put into an IRA? This is why IRA transfers should always be trustee-to-trustee.

-

If they are repairs in nature, they could be considered start up costs. If capital, then depreciation starts when the business is operating.

-

I always create a Group called Admin2 that I give all of the privileges to, so more than one user can be an admin. Ooops! Sorry! I wandered in the Drake forum. I'll see myself out.

-

It seems I forgot everything I knew about ATX

Abby Normal replied to BulldogTom's topic in General Chat

This was one of my main impetuses (impeti?) for retiring. -

It seems I forgot everything I knew about ATX

Abby Normal replied to BulldogTom's topic in General Chat

Think of it as closing distributions to retained earnings. That's the entry I make. Zero out distributions, and put it to RE. I do the same with partnerships, but each partner has their own equity account, instead of an RE for the business. -

It worked when I tried it. I was able to open an 1120S and a 1040 at the same time. Unknown if there are any downsides to this hack.

-

This is a new (to me) solution, though.

-

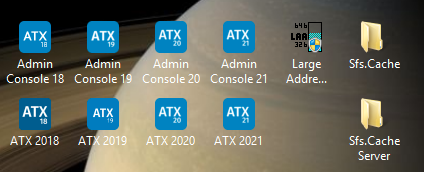

Program is in Program Files(x86)\Wolters Kluwer. Data is in ProgramData\Wolters Kluwer You can see the program location by right clicking the ATX icon on your desktop and choosing properties. You can see the data location by running ATX's Admin Console, which should be in your Windows menu, but I always put a shortcut to it on my desktop for easy access, as well as the Sfs.Cache folder. The cache folder contains temporary files that should be deleted if you're having trouble with ATX. I wish they'd delete every time you close ATX.

-

Are we sure it was not reported on a 1099 and didn't end up on the 1040?

-

You have to open the return and use the E-file menu to Display Rejection Errors, even though it wasn't rejected. ATX needs to rethink this mess. Alternately, in E-file Manager, select the return and press Ctrl+R.

-

And that makes messages useless because we'll all stop looking at them. 'Accepted' is really the only part I care about.

-

This should be standard procedure for everyone. Computers simply run better after a restart.

-

I just tried this and it would not let me save. It says access denied. I checked and the file is not read only. I right clicked the file and had an option called "Take Ownership." After choosing that, it did let me edit.