-

Posts

233 -

Joined

-

Last visited

-

Days Won

3

Profile Information

-

State

FL

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

I am one of the cases. We originally filed the return September 2022 -- In January 2023 after still not receiving the refund, we learned there was ID theft. Elderly client who unfortunately passed away during all this. The fraudulant return was flagged, and luckily, not paid out. When the legitimate return was filed, the process of ID verification begin. We had to go through ID verification 7 times before it finally stuck. (well hopefully, the refund has still not produced) Originally in June 2023 we were told it could take up to 430 days. In August 2024, we were then told maybe 640 days. Called last week (you know, 2 years and 9 months after filing the original return we filed) and were told ID verification is confirmed, but it has yet to be assigned to a case worker. So, about 1,000 days later ... we are hoping the National TP Assistance will help us.

-

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

Trust was setup years ago. LLC was just setup last year and owns the rental. I got the EIN letter from the client, they state 1065 as the expected form filing. -

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

I learn something new everyday. Thanks! -

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

Great point. They are still looking for it. The did all this last year, and did not mention it to me till Tuesday. The LLC has one owner, the revoc trust. The revoc trust's grantors are a married couple. This is where my uncertainty stemmed from. If I look at the LLC ownership 1st (and only), there's a single owner (the rev trust) so ... it's a SMLLC. But as @Lee B pointed out, drilling down deeper, the trust is disregarded bc it's revocable, so then the grantors of the trust are LLC owners. Married couple, thus two people, common law state so MMLLC. Thank you everyone for your input. -

As the title says Married Couple's Revocable Trust Owns "Rental Property LLC" in a Common Law State. (So, No Community Property State, No QJV) Ignoring the trust part for a second, couple is then required to file 1165 partnership rtn because they are a multi member LLC. But there's always a monkey wrench that makes me go . Is the TRUST considered a single entity, so then the LLC is considered a disregarded entity and can forego the 1165, filing Schedule E direcly on the married couple's 1040? My gut says no, but maybe there's a legal element in play that someone's seen before?

-

Exactly why I wish ATX would create a one-stop-shop location for all CF/CO -- Wolters Kluwer, if you're listening, this would be a really great addition and help alittle in justifying the large increase in software costs we get every year!

-

Did you complete a IT 360.1? Also, be sure on page one of IT-201, question E & F correctly with days and months.

-

Just in case the developers at ATX monitor this forum.... Is there a reason the Tax Summary Carryover Summary doesn't detail QBI Carryforwards? I routinely check the 8995 for any QBI CF, but I can see how this is easily missed if it's a new client and/or if the data isn't rolled over the next year (new tax software). Or if there's a netting of QBI CF, then at least have a *** note on the CF summary that says, "QBI CF present." Something of an alert for this and the other CF info that was present in a previous year. Just my two cents.

- 1 reply

-

- 1

-

-

'Keep me authenticated' check box added to ATX Tax!

G2R replied to Abby Normal's topic in General Chat

This was a GLORIOUS discovery. Thank you!! -

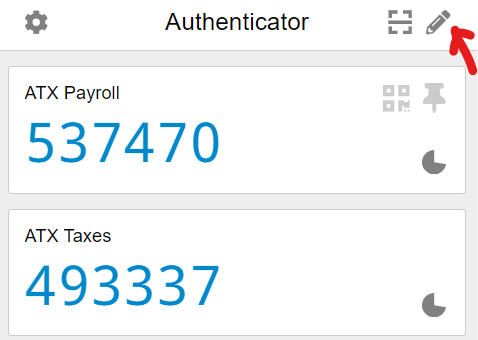

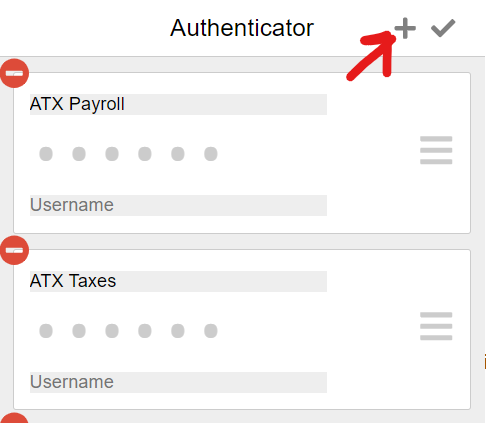

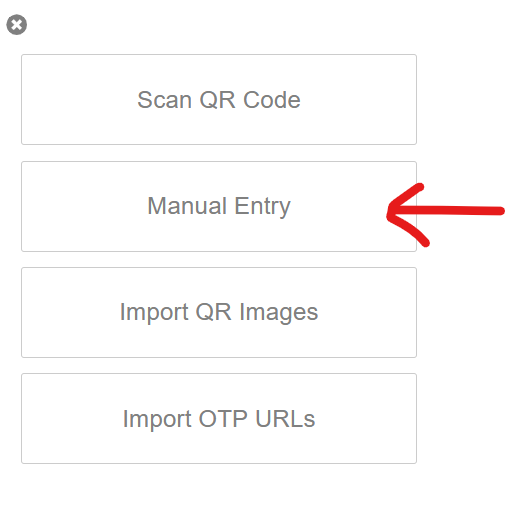

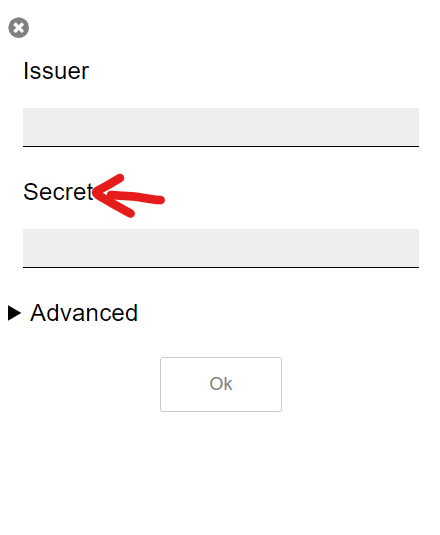

I reached out to ATX. The guy said 95% of his calls since October were complaints about this. Nothing they can do at this point unless rules change. He did advise of a browser based authenticator if cell phone wasn't an option. I tried it and it worked so it'll be a bit easier to explain to my low-tech/no-tech dad. I downloaded the Authenticator.cc browser extension in Chrome. Hope this helps.

-

Not sure how much this might help, but Google being the unasked-for big brother they are often tracks people's location history. If he has a smartphone, he might be able to track each time he went to a rental property to address an issue inside his Google Maps timeline. In addition, email and phone records are also usually stored in the phone and or via the cell phone/telephone records. It's a labor intensive process for the client, but if it's req to avoid a major tax implication, it is what it is.

-

I got a reply from ATX regarding this issue. In case this comes up for anyone in the future. ATX resolution: Additional Note: Not only did the Line 3 instructions throw me off as ATX reports in the resolution, but it was the ABOVE 2 questions being NO, and the highlighted above stmt that said "If you answered YES to Questions 1 AND Question 2, continue below, entering ONLY the information pertaining to the taxpayer born on or before 07/01/1957." Personally, I don't think interpretation of the worksheet instructions are the problem, I think ATX instructions are just flat wrong. Had I followed them, the client would have owed $4500 more in RI taxes. ATX gets alot right federally and catches things I've missed time to time, but on a state taxation level, I find I have to be much more digilent about the return's accuracy on specialty items.

- 1 reply

-

- 3

-

-

@jklcpa You're a genius! Yes there is! For anyone looking for this in the future, the rabbit hole map is: 1120S, pg 4, 17d (yes the greyed out field) and JUMP to Linked Field which takes you to: Line 17d, Sch K (1120S) - Other Items & Amts. Scroll to AC, and click the JUMP to Linked Field which takes you to: Line 13 (1120S) - Interest Expense. Depending on how you answer the schedule B question, the "IRS Sec 448 Gross Receipts Test equation is explained. For the record, it's the preceeding three year average fo gross receipts OR the CY gross receipts. Thank you @jklcpa !!