-

Posts

7,731 -

Joined

-

Last visited

-

Days Won

510

Everything posted by Catherine

-

@mcb39 "I just got a letter saying that I owe them the amount that I had direct withdrawn the day that I filed." The payment coupon that came with the letter you got. If it says you owe money, it should include a way to pay that - including a coupon to send in with a check. Or at least a "mail payment to" address. Use that.

-

Mail a copy of the proof of payment to the address on the payment coupon sent (along with that payment coupon). Add in a note about expecting the penalties & interest to be reversed since they have had payment since the due date. Highlight the date of payment on that copy of the payment receipt. Eventually, they'll catch up to it and fix it.

-

If you are not licensed, you cannot legally give investment advice. Series 6, 66, 63, and 7 licensures (or some combination of those). However, as Judy says, the tax benefits (or detriments) of IRAs or other investments is something we can - and should discuss. Start out with "not investment advice; tax consequences only) and reiterate that at the end, too. Along with "talk to your investment advisor." Also remind the client that any tax advice from the investment advisor is suspect. I do wish we could get the licenses of investment "advisors" who give tax advice yoinked the way ours can be for investment advice. I've heard - heck, we've all heard - preposterous and expensive and generally horrible "advice" our clients blithely followed from their "stock guy" that blew up in their faces come tax time. And far too often, we've been hit with the blame and/or the anger.

-

Ahh, the good old scent of nasty volatile organics. We refer to them here collectively as "methyl ethyl death."

-

I still have two paper tape calculators, and paper, and save the check tapes in the client folder (don't save paper returns anymore). Yes, your SC electric is now an antique. As are we all! Anyone remember income averaging? Some good circular loops in those calculations.

-

After passing in the Senate, it then has to be signed into law. After that it can take effect.

-

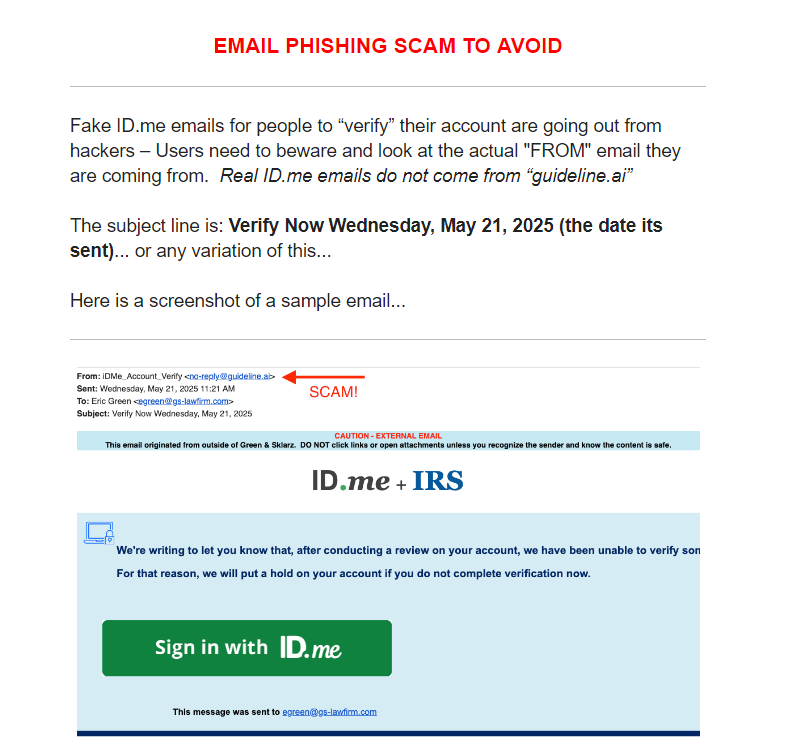

Eric Green of Tax Rep Network sent out a warning today about this. He got one yesterday, as did a local colleague. Here's what he sent out:

-

Standard response to client inquiries: there is no sense in discussing anything until a bill has been passed and signed. Until then, all bets are off.

-

I also charge $25 - $50 for dependent returns, with the option I keep for myself to give them a courtesy discount down to $5 or $10 or even $0 (say if the kid had one W-2 and $27 in withheld tax). But I want to see it before I price-quote, and anything that involves credits, kiddie tax, and multi-state issues is not done for a measley $50.

-

It looks like the "Windy" format.

-

I use an ancient version of 1Passwrod that is still 100% local (on my machine). I know others who use the cloud-based version and like it. It's very easy to use, but I wish they still offered a local-only version.

-

I had to have "the talk" with two elderly couples this year. (Well, one couple and the adult son POA for the other couple.) Huge capital losses in "investments" that are utterly inappropriate for people in their late 80s and early 90s - and no, they did not have those investments the prior year. General warning to ask LOTS of questions before buying anything, and not to accept gobbledygook as answers.

-

Rita is one of the best. Hope she comes back to post more often. That summer get-together is one of my very fond memories.

-

Don't need answers today - next week would be nice

Catherine replied to Catherine's topic in General Chat

In case anyone was wondering about the outcome of this. I dredged up old documents (that had not yet been shredded somehow) and discovered they got the one that did not need repayment. Plus after some more research in other old files, I recalled the IRS was rejecting e-files for anyone who did not include the annual $500 repayment amount on their 1040. Since that did not affect these folks, that is confirmation of the non-repayable version of the credit. -

That makes a twisted kind of sense, @Gail in Virginia. Got another one a little while ago, about documents for tax consulting (yeah, right) and when I hovered my mouse over the sender name the originating email was from -- just guess now -- an onlyfans account!

-

-

It's the computers sending all the letters. No people involved - especially with the more stupid letters.

-

I'm not going to it, but it's only about 4 hours west of me. It's not impossible to have an early snowstorm in late October, but not likely. It will be chilly, though.

-

Just write them backwards; then they'll be completely safe!

-

We have a friend who had a matrix for passwords, that depended on the company name and a couple of other items. Once you knew the algorithm, new passwords were super easy to generate and recall - and even if you got his cheatsheet, it was utterly meaningless without knowing the algorithm. Multiple pieces had to be put together, in the right order, which varied. I wish I remembered better how it worked. Simple, elegant, inscrutable.

-

Just about the only reason I bother to go in is that when my mother in law got sick (in her 90s), she had been so healthy for so long and skipping any annual exams (too busy!), they no longer had any record of her. She might as well have been a Martian who showed up, sick as a dog, to be treated.

-

Are you / have you used "My Tax Prep Office" tax software?

Catherine replied to TAG's topic in General Chat

Never even heard of it, but I'd be interested in hearing other's opinions too. Information is always helpful. Is it supposed to be similar to Ignition, or Liscio? -

Like Margaret, it's just me here. Anyone trying to access my stuff would need to get into my house - past locks and alarms - then into my computer (password protected) then into my secure drive (a different password) or my online portal (yet another password). WiFi is totally locked down, hidden, inaccessible. How is adding more "authentication" crap going to help keep anyone's stuff more secure? Answer: it won't. What makes good sense in a multi-person office, or large corporation, is simply stupid in a one-person operation and leads to the idiocy of passwords on post-it notes stuck to the side of the monitor.

-

I got a phone message left just today, reminding me of an appointment for something or other. Let's just ignore that I already got, and responded to, the email notice. And went online and filled in all the #$%^&^%$#$%^ forms they now require (where you have to click all the &*@#$%& checkboxes; it was ridiculous). My guess is the text message comes next. Message was annoying but at least funny. Recorded, not even a real person, and it sounded like the "play" speed had been mis-set to make the recording sound like the "person" was either drunk or tranquilized.

-

It becomes more and more important to plant a medicinal herb garden...