-

Posts

814 -

Joined

-

Last visited

-

Days Won

10

Everything posted by HV Ken

-

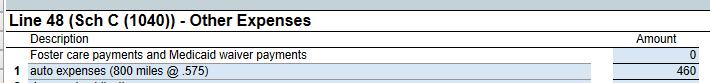

Schedule C client. Has assets. Uses vehicle and takes the standard mileage rate. New in ATX 2020, ATX is throwing an ERROR that the vehicle information must be entered on the 4562. More changes that impact efficiency! I am seriously thinking of this screenshot as a workaround

-

And wait a year for it to process? No thanks!

-

Funny that you are quoting me - something I know I wrote - but I don't see what I wrote in the thread.

-

I remember doing this before, but I don't see it anymore! Yes it's the only W2. How does filing without the W2 handle the federal and state withholding?

-

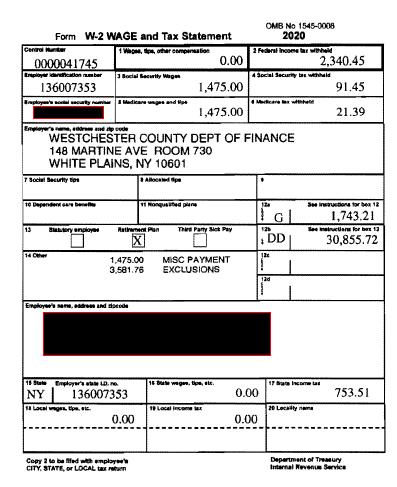

Here is the client's explanation: "I've been out injured all of 2020 on 207C disability which is a disability for police that I continue to get full pay that is tax free. taxes were taken out of my pay for the first few paychecks until human resources corrected it. Some of the tax is also for uniform allowance that comes in two checks of 737.50 and is taxed 289.61. Only thing taken out of paycheck is my healthcare contributions and union fees."

-

Client's W2. ATX will not allow efile for IRS or NYS IRS: W-2 cannot be transmitted. Withholding amount is present but IRS requires a corresponding wage amount greater than zero when e-filing or return will be rejected. NY: State withholding can not be greater than or equal to state wage. Not sure how to get past this. My thought was to put the NY withholding amount (+1) as wages and then back it out as a Schedule 1 adjustment. But this just seems like a hack approach to me. Anyone have any other thoughts?

-

Yes. Actually the whole thing only added a couple of minutes to the processing. Not as bad as I was expecting.

-

OK - I'll answer my own post! I went into 1099MISC Detail tab. Export. Over to 1099NEC Detail tab. Import. Have to select the fields to match on the Import. Overall, pretty easy.

-

I tried searching but didn't see any hits. If this has been addressed, please point me to the right location. So it appears none of the 1099-MISC information is being migrated to the 1099-NEC, which means: We have to enter all the information all over again. There is a process described to help make this easier than entering the information all over again. Does anyone know of a procedure to do this easier than from scratch?

-

How did you get this info? I am guessing their is an update coming to correct this?

-

Because the EIN for RRB is different than SSA, I do NOT think the idea of changing the master form (proposed by @Abby Normal) is a good one.

-

Is the EIN for RRB1099 the same or different? I think I will just code it in for the small number of SSA1099s I have that also have withholding. I bet it is less than 5% of my client base.

-

Has anyone ever taken the time to clean up their "Payer Manager"? I have ~4,800 entries in there, with a lot of duplicates. It would be some effort to go through and clean all of these up. And I wonder if it is even worth it?

-

-

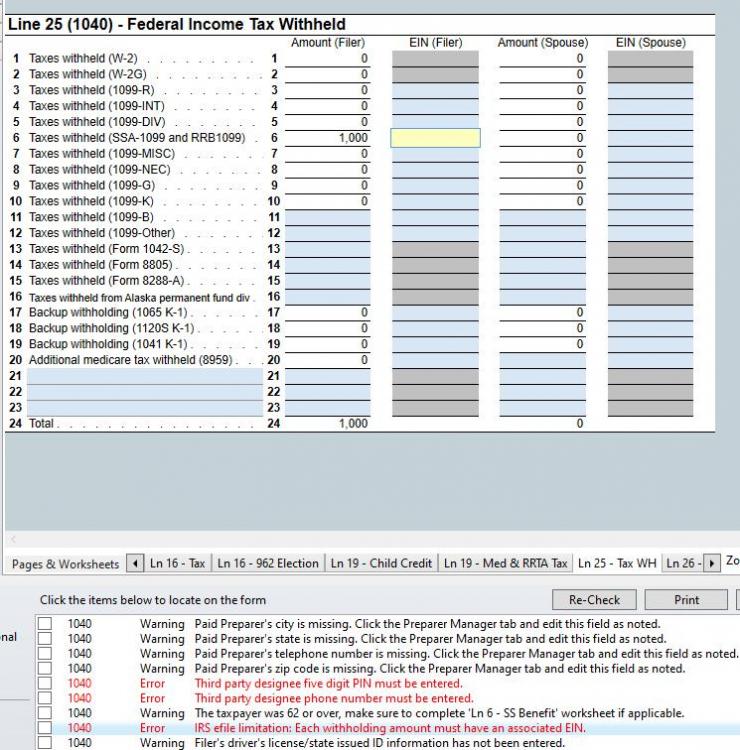

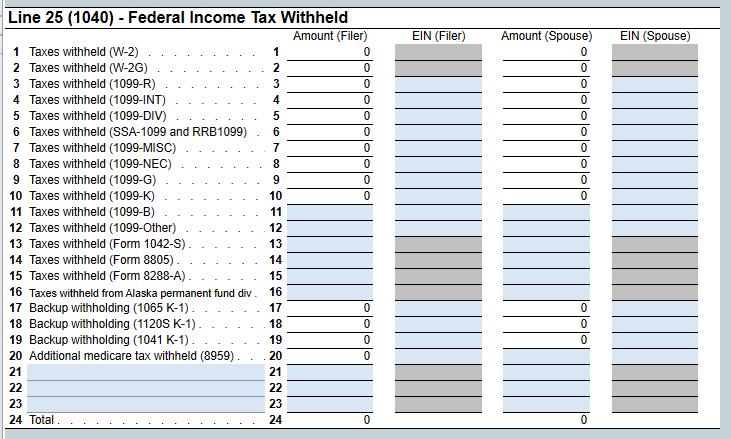

That part I get. It's the requirement for the EIN that I am asking about.

-

If a taxpayer has withholding on their SSA-1099, ATX is requiring the EIN on the line 25 worksheet, number 6. There is no EIN provided on the SSA-1099. What are people doing to get past this?

-

This has to be one of the most annoying errors to deal with: Form IT-204: a copy of the other deductions statement is required to be attached to the return; create the PDF, then attach PDF (before generating the efile). Why can't this just be automagically handled by the software?

-

What a strange workaround. This works. Otherwise, I get the same errors as everyone else on multiple computers and all browsers. Kinda hard when you cannot login to their support site!

-

Does anyone know of a way to find all returns that contain a certain form? For example, I want to find all returns that contain Form 8962. If you can't do it in ATX directly, can you do it using Windows File Explorer?

-

With the Taxpayer Certainty and Disaster Tax Relief Act of 2019, there are things that expired that have been added back retroactive. I guess we are stuck waiting for ATX (among other things) to provide updates to ATX 2019 and ATX 2018 for: * 1040 Schedule 1 line 21 for Tuition and Fees Deduction * Form 8917 Tuition and Fees Deduction * Schedule A line 8d Mortgage Insurance Premiums * Form 5695 Residential Energy Credits Is anyone aware of when we should expect to see any of these?

-

Anyone attending the 7th Annual 2015 New York Accounting Show & CPE Conference on either April 29-30 at the Pennsylvania Hotel? I will be there on Wed (4/29) - it is always great to meet other professionals face to face!

-

Cash and check always first choice! For people with a refund, Fee Collect works great. For people who owe and can't pay cash/check, we also take credit cards. Our engagement letter requires payment and signed papers before e-file. We have offered credit under extenuating circumstances. We have also added a finance charge notice to our invoice this year for those few clients whose hardship credit request is approved. We will never file a return in a second year when there is still an open balance from the previous year, or if there is an open balance from other services (bookkeeping, payroll, etc.).

-

@Hahn1040 - I include a cover letter and scan and attach the supporting documents into a PDF file and attach it to the efile when the 1099-Q vs. 1098-T gives the impression that the earnings may be taxable. Have never gotten a letter from the IRS once I started doing this. Previously, we would wait for the letter and then send the stuff in.

-

Client returned to us this year. Two years ago they had a NOL which we filed the election to carry forward. Last year they went to one of the box stores (won't mention any names but you might think of them if you think of a famous landmark in NYC) due to a promotion to get a discount on their tax prep fee. Guess what the box store preparer left off their return (among other mistakes)? You get what you pay for.

-

Poughkeepsie? That's my stomping grounds!!